Using the online tool for PDF editing by FormsPal, you're able to complete or alter NYS right here and now. The editor is continually maintained by our team, acquiring additional functions and growing to be a lot more versatile. Starting is easy! All you have to do is adhere to these simple steps directly below:

Step 1: Open the PDF file inside our editor by clicking on the "Get Form Button" above on this webpage.

Step 2: The tool grants the capability to customize PDF documents in a range of ways. Change it by adding customized text, adjust original content, and include a signature - all manageable in minutes!

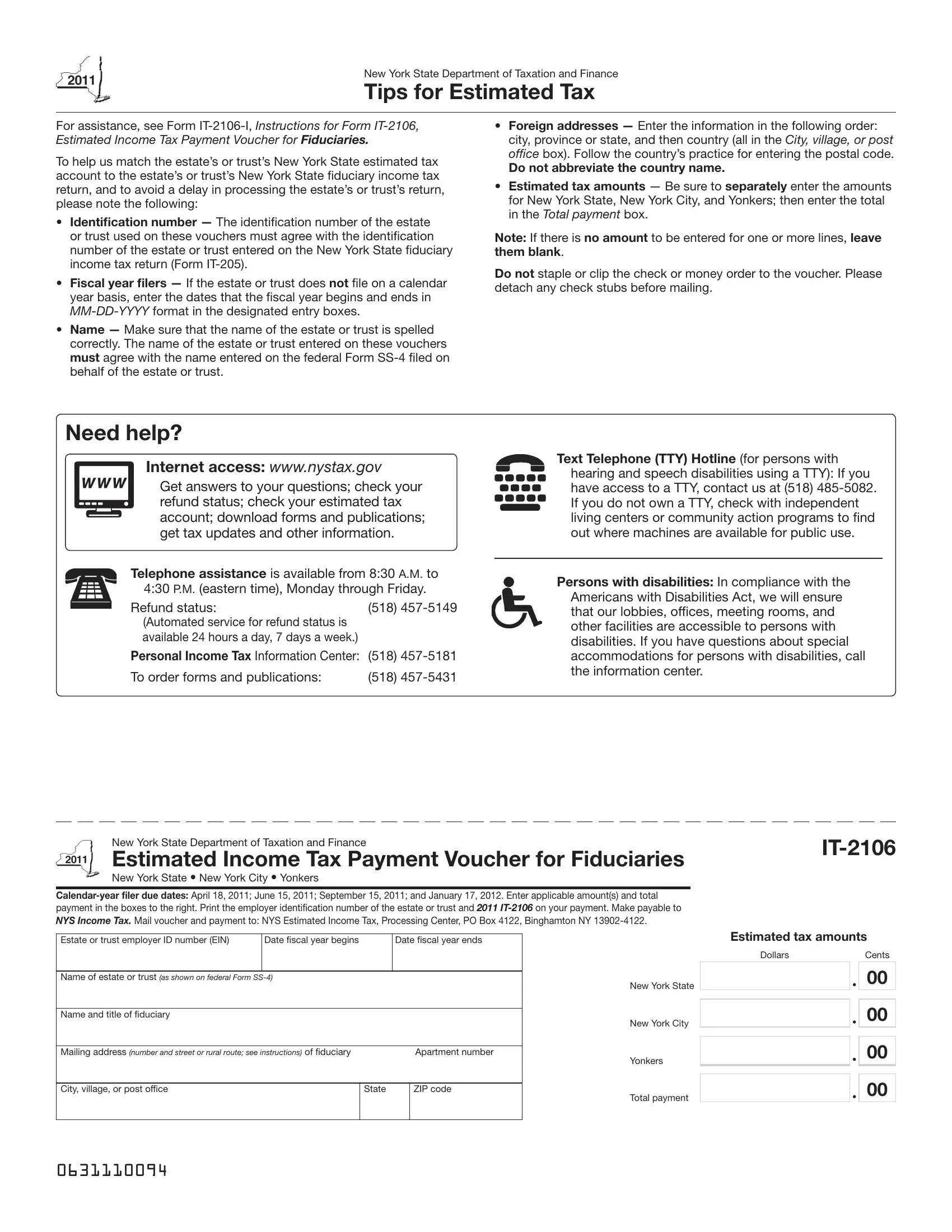

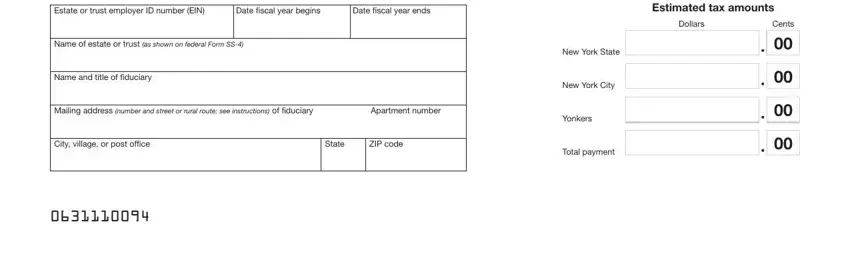

This document requires particular data to be filled out, thus you should definitely take the time to provide what's required:

1. The NYS usually requires particular details to be entered. Make certain the following fields are completed:

Step 3: Prior to submitting your file, check that blank fields were filled in as intended. When you’re satisfied with it, click “Done." Sign up with FormsPal today and immediately get access to NYS, prepared for download. All changes made by you are preserved , helping you to change the pdf at a later point anytime. At FormsPal.com, we aim to ensure that all of your information is kept secure.