If you wish to fill out form it 2658, you don't have to download and install any kind of software - simply use our PDF editor. We at FormsPal are aimed at providing you the best possible experience with our tool by regularly introducing new capabilities and improvements. With these updates, using our editor gets better than ever! Here is what you'll need to do to start:

Step 1: Simply press the "Get Form Button" at the top of this webpage to see our pdf form editor. This way, you'll find all that is necessary to fill out your document.

Step 2: With this handy PDF file editor, you're able to do more than just fill in forms. Express yourself and make your documents appear professional with customized text added, or modify the original content to excellence - all that supported by the capability to incorporate any type of graphics and sign it off.

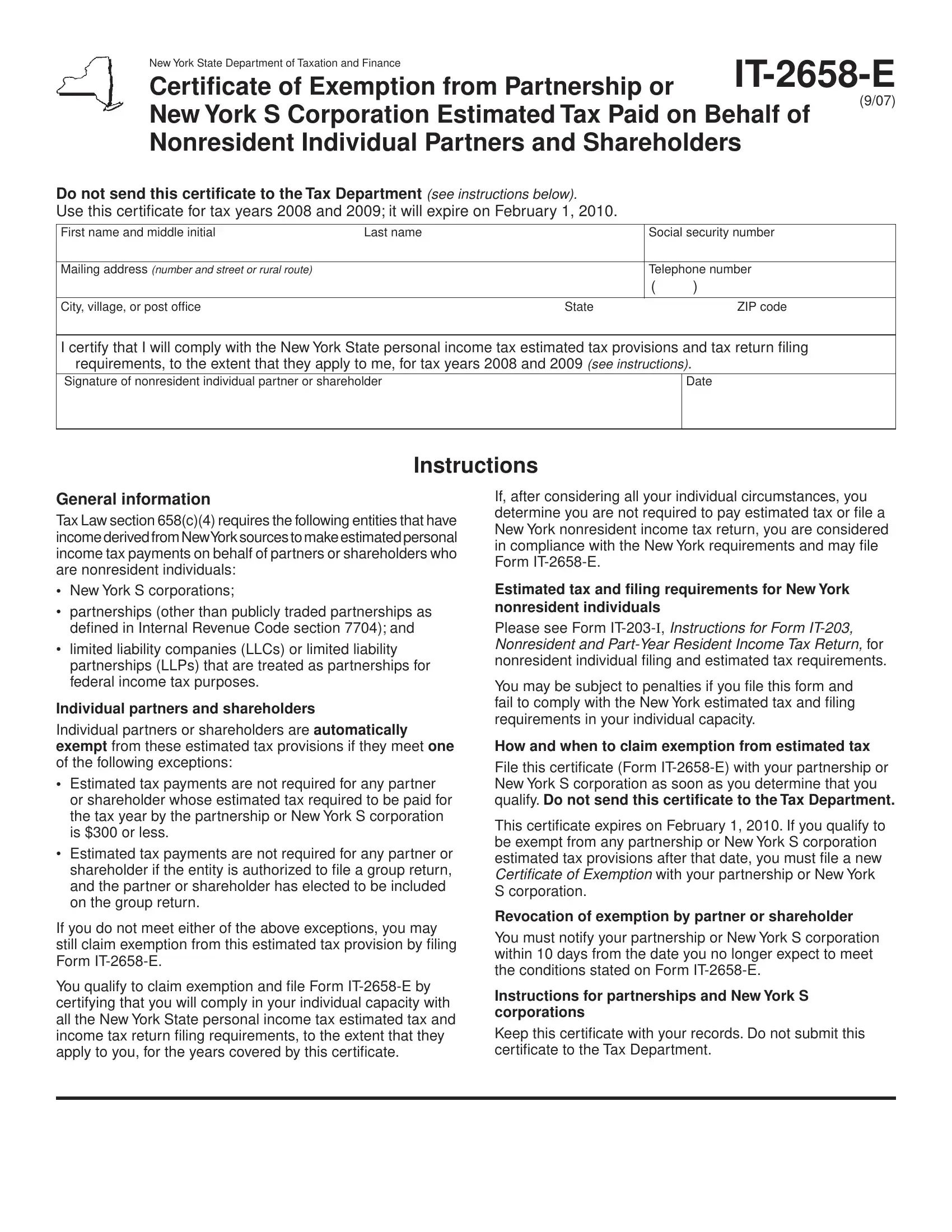

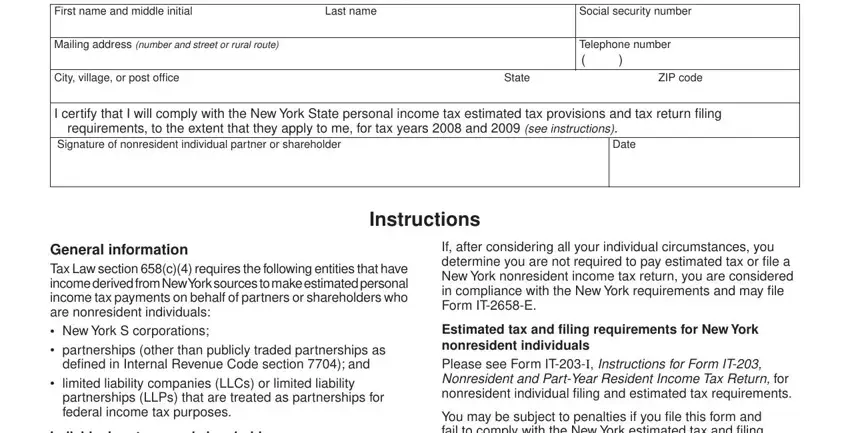

For you to fill out this PDF form, be certain to enter the information you need in every single area:

1. When completing the form it 2658, be sure to incorporate all of the essential blanks in their associated part. It will help to hasten the process, allowing your details to be handled efficiently and accurately.

Step 3: Just after proofreading your fields and details, press "Done" and you're good to go! Try a free trial subscription at FormsPal and acquire direct access to form it 2658 - with all transformations preserved and available inside your FormsPal account. FormsPal ensures your information privacy with a protected system that never records or shares any kind of private information used. Rest assured knowing your files are kept confidential any time you use our editor!