Once you open the online PDF editor by FormsPal, you're able to complete or edit Form Mo 1041 right here and now. To make our tool better and more convenient to utilize, we constantly implement new features, taking into consideration feedback coming from our users. To get the process started, go through these basic steps:

Step 1: Simply click the "Get Form Button" above on this site to start up our form editing tool. There you will find all that is required to fill out your file.

Step 2: After you launch the PDF editor, there'll be the form made ready to be filled out. Aside from filling in various blanks, you may as well do various other things with the PDF, namely adding custom text, editing the initial text, adding illustrations or photos, putting your signature on the document, and more.

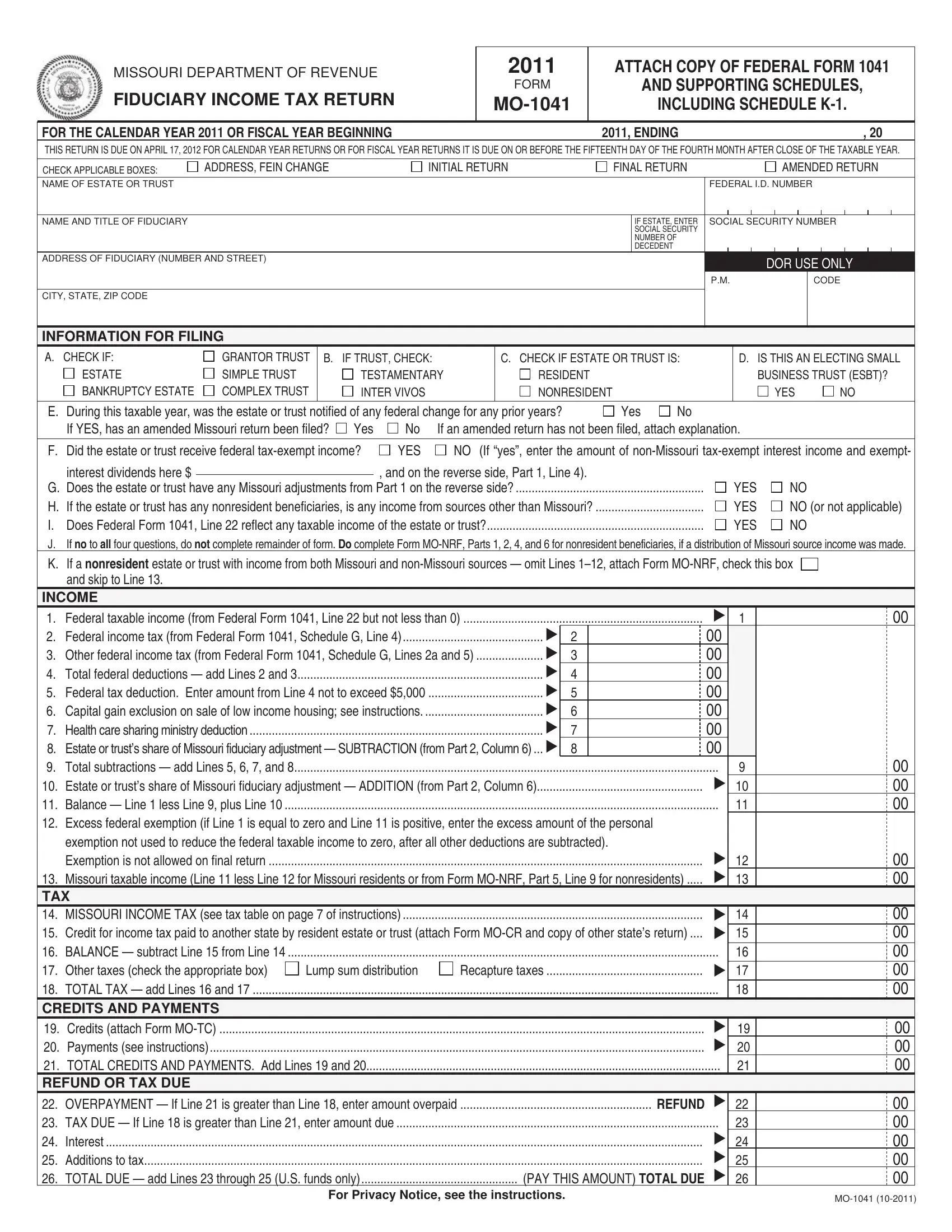

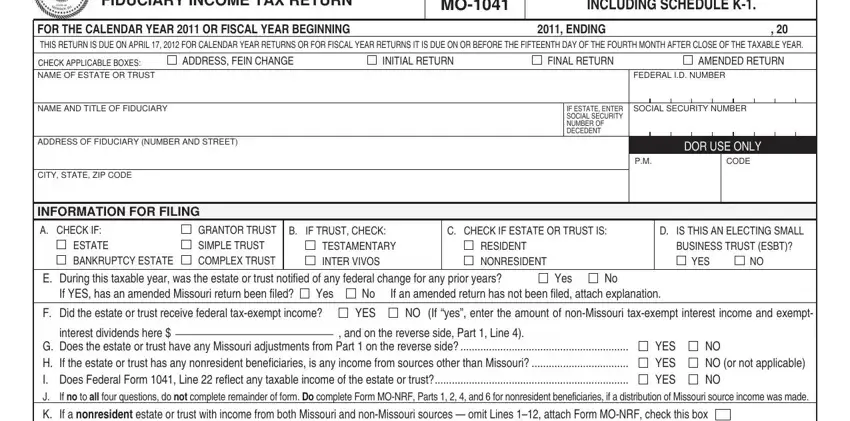

As for the fields of this particular form, this is what you want to do:

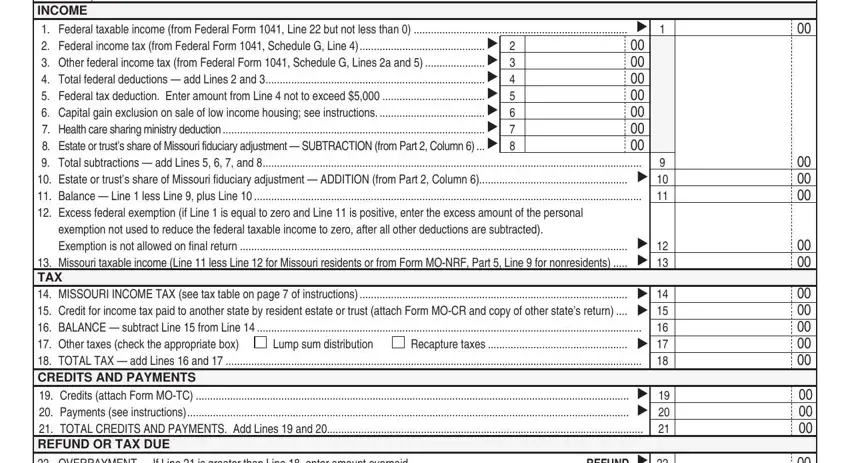

1. It is crucial to fill out the Form Mo 1041 correctly, thus take care when filling in the segments that contain these blank fields:

2. Right after finishing this section, go to the next part and fill in all required particulars in all these fields - and skip to Line, t t t t t t t, INCOME t Federal taxable income, Recapture taxes, Lump sum distribution, t t, t t, and OVERPAYMENT If Line is greater.

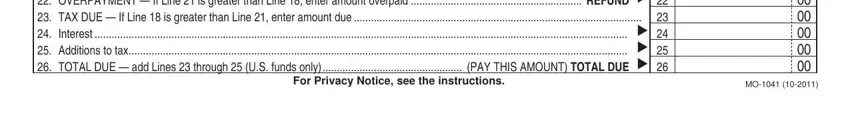

3. Completing OVERPAYMENT If Line is greater, and For Privacy Notice see the is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Be really mindful when filling in OVERPAYMENT If Line is greater and OVERPAYMENT If Line is greater, since this is where a lot of people make mistakes.

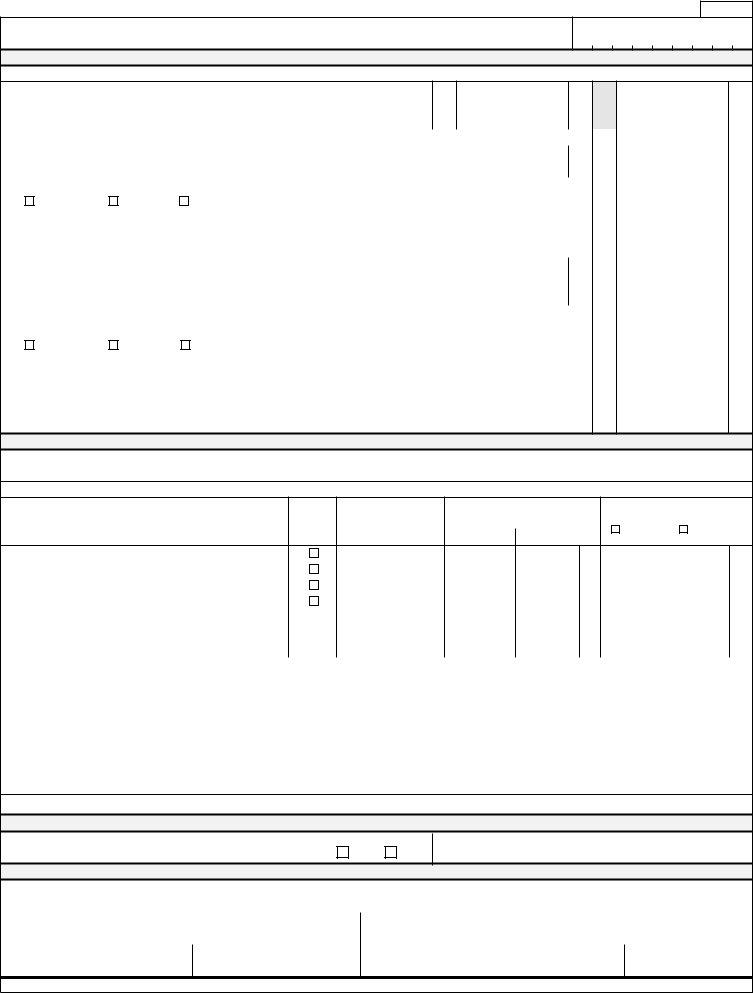

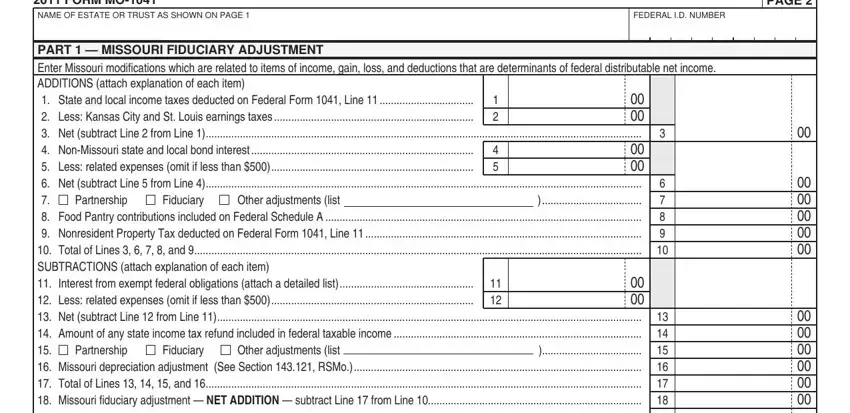

4. The subsequent subsection will require your attention in the subsequent parts: FORM MO NAME OF ESTATE OR TRUST, FEDERAL ID NUMBER, PAGE, Partnership, Fiduciary, PART MISSOURI FIDUCIARY, Other adjustments list, Other adjustments list, Partnership, and Fiduciary. Make sure that you enter all of the needed information to move forward.

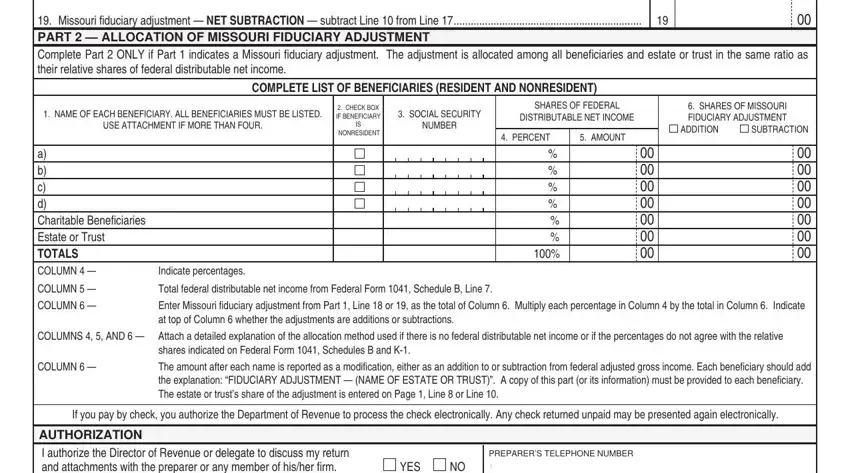

5. Because you near the conclusion of this document, you'll notice several extra things to complete. Specifically, Missouri fiduciary adjustment, NAME OF EACH BENEFICIARY ALL, USE ATTACHMENT IF MORE THAN FOUR, CHECK BOX IF BENEFICIARY, NONRESIDENT, SOCIAL SECURITY, NUMBER, SHARES OF FEDERAL, DISTRIBUTABLE NET INCOME, SHARES OF MISSOURI FIDUCIARY, PERCENT, AMOUNT, ADDITION, SUBTRACTION, and COMPLETE LIST OF BENEFICIARIES must all be filled out.

Step 3: After you've looked again at the details entered, click "Done" to conclude your form. Download the Form Mo 1041 the instant you join for a 7-day free trial. Quickly view the pdf form from your personal account, with any modifications and adjustments conveniently preserved! At FormsPal.com, we aim to make sure all of your details are stored private.