If you want to fill out city of tiffin income tax department, you don't need to download any programs - just try using our PDF tool. Our editor is constantly evolving to present the very best user experience attainable, and that's because of our dedication to continual development and listening closely to testimonials. Here is what you would want to do to start:

Step 1: Click on the "Get Form" button in the top area of this page to get into our PDF editor.

Step 2: With the help of this handy PDF file editor, you could do more than just complete forms. Edit away and make your docs seem perfect with custom text put in, or modify the file's original content to perfection - all comes with the capability to incorporate your personal pictures and sign the file off.

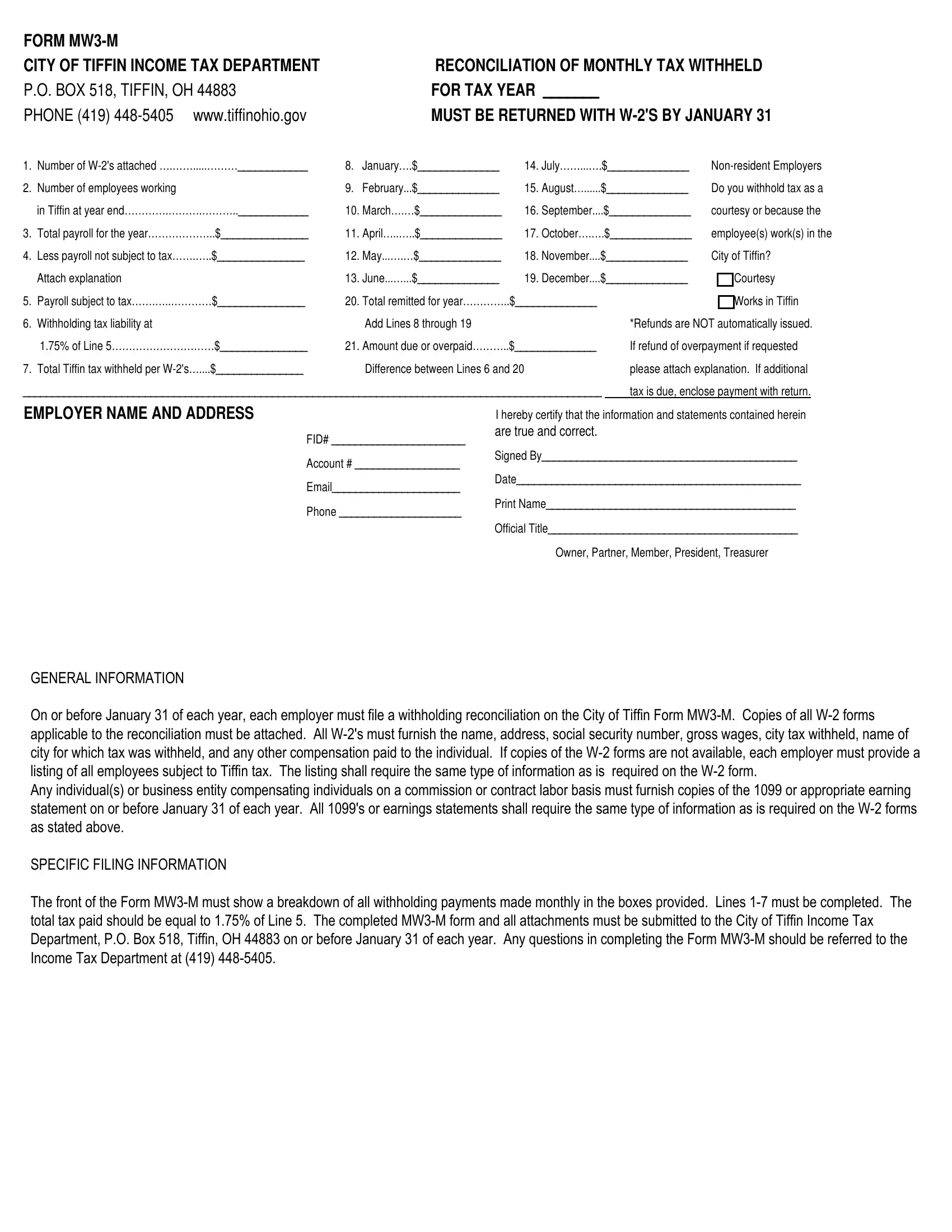

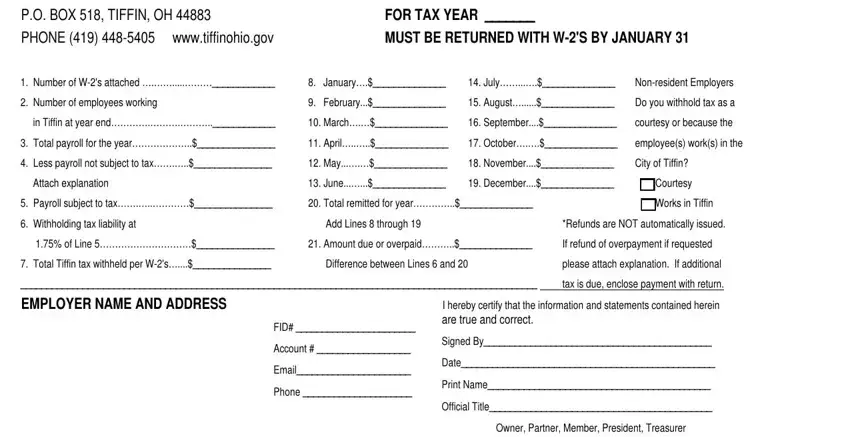

When it comes to blank fields of this particular document, here's what you should consider:

1. The city of tiffin income tax department will require certain details to be typed in. Be sure the next blanks are filled out:

Step 3: Spell-check the details you have entered into the form fields and hit the "Done" button. Make a free trial subscription at FormsPal and acquire instant access to city of tiffin income tax department - downloadable, emailable, and editable inside your personal cabinet. FormsPal provides safe document completion without data record-keeping or distributing. Be assured that your details are secure here!