When working in the online PDF tool by FormsPal, you'll be able to complete or alter Form Nj 1040 O right here. We at FormsPal are committed to making sure you have the ideal experience with our editor by regularly introducing new functions and enhancements. Our tool has become even more user-friendly with the newest updates! So now, filling out documents is simpler and faster than before. All it requires is a couple of simple steps:

Step 1: Just click on the "Get Form Button" in the top section of this page to access our form editing tool. Here you'll find everything that is required to fill out your file.

Step 2: With the help of this advanced PDF file editor, you can do more than just complete blank form fields. Try all the features and make your forms appear faultless with customized textual content put in, or fine-tune the file's original input to perfection - all comes along with an ability to incorporate any graphics and sign the file off.

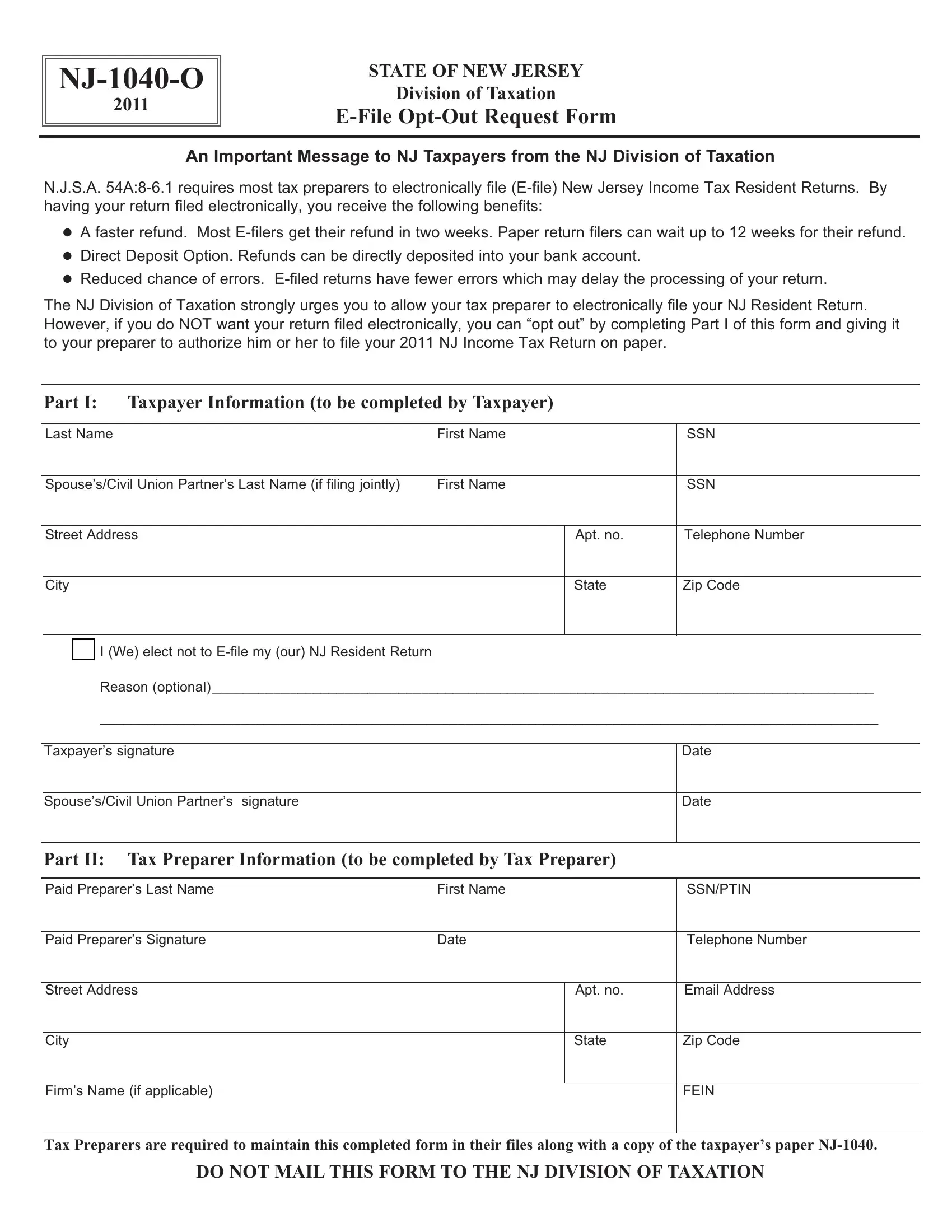

So as to fill out this PDF form, make sure you enter the information you need in each field:

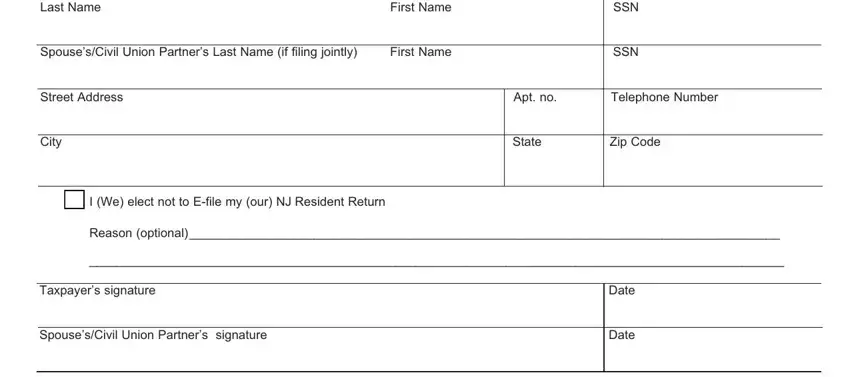

1. It's essential to fill out the Form Nj 1040 O correctly, thus take care while filling in the sections comprising all of these blanks:

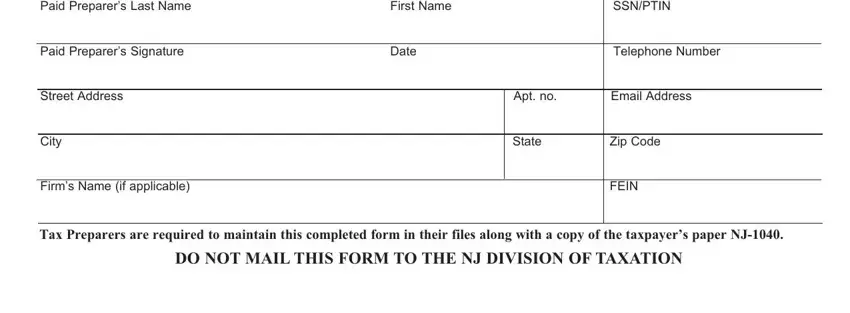

2. Right after completing this step, go on to the next stage and complete all required particulars in all these fields - Paid Preparers Last Name, First Name, SSNPTIN, Paid Preparers Signature, Date, Telephone Number, Street Address, City, Apt no, Email Address, State, Zip Code, Firms Name if applicable, FEIN, and Tax Preparers are required to.

People frequently make errors when filling out Date in this area. Be sure to reread everything you enter right here.

Step 3: Go through everything you've entered into the blanks and click the "Done" button. Right after registering a7-day free trial account at FormsPal, it will be possible to download Form Nj 1040 O or email it promptly. The PDF will also be readily available through your personal cabinet with your every edit. We do not share the details you provide whenever dealing with documents at FormsPal.