If you wish to fill out Form Pa 1000, it's not necessary to download any applications - simply try our PDF tool. Our team is relentlessly endeavoring to improve the editor and insure that it is even better for people with its cutting-edge features. Discover an endlessly revolutionary experience today - check out and find out new opportunities as you go! With just several simple steps, you can begin your PDF editing:

Step 1: Simply press the "Get Form Button" at the top of this site to access our pdf form editor. There you will find all that is required to fill out your file.

Step 2: When you open the online editor, you'll see the form ready to be filled in. Apart from filling out different blank fields, it's also possible to perform some other things with the PDF, specifically writing any text, modifying the initial text, inserting images, signing the form, and a lot more.

This PDF doc will require you to enter specific details; to guarantee consistency, be sure to heed the guidelines further on:

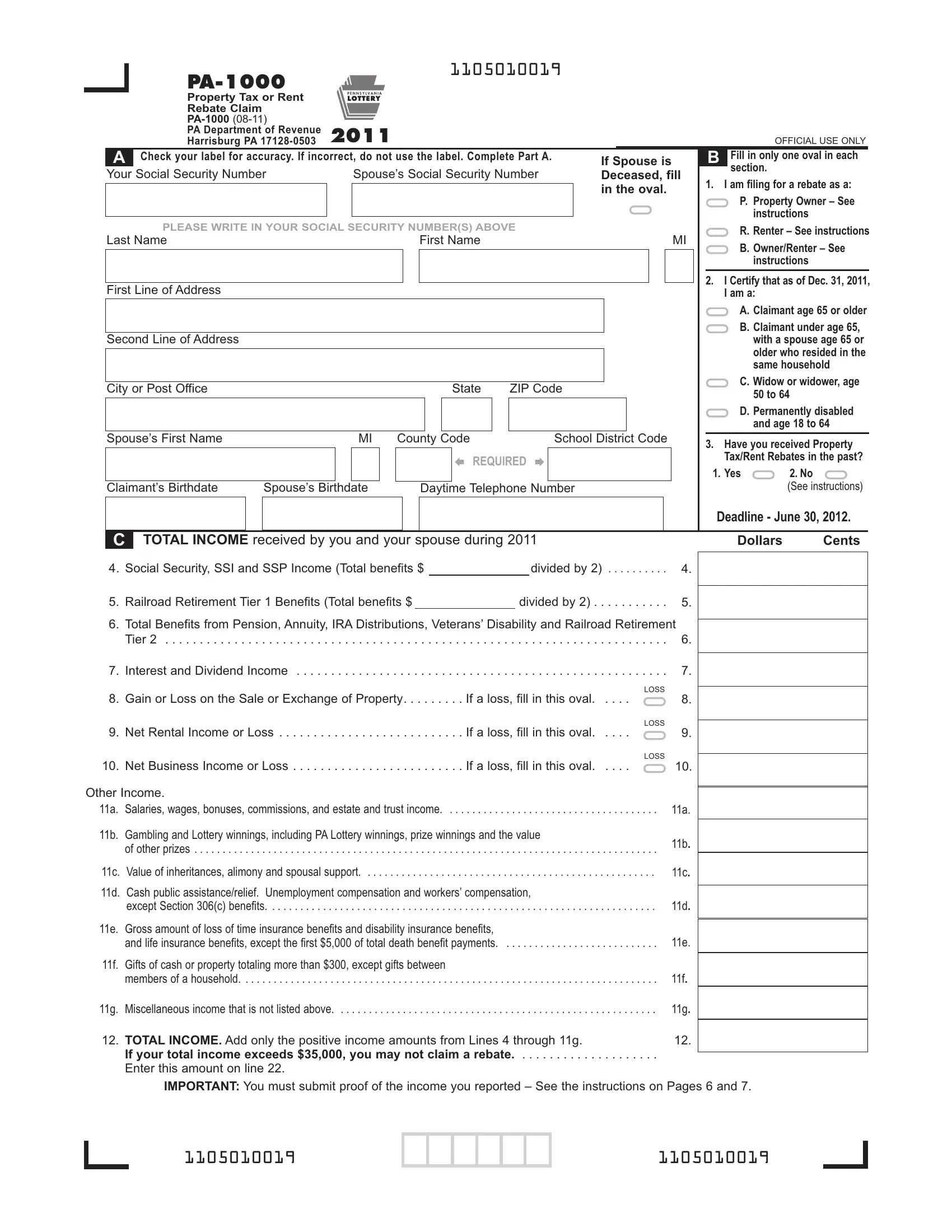

1. For starters, when filling out the Form Pa 1000, start with the page that features the next blanks:

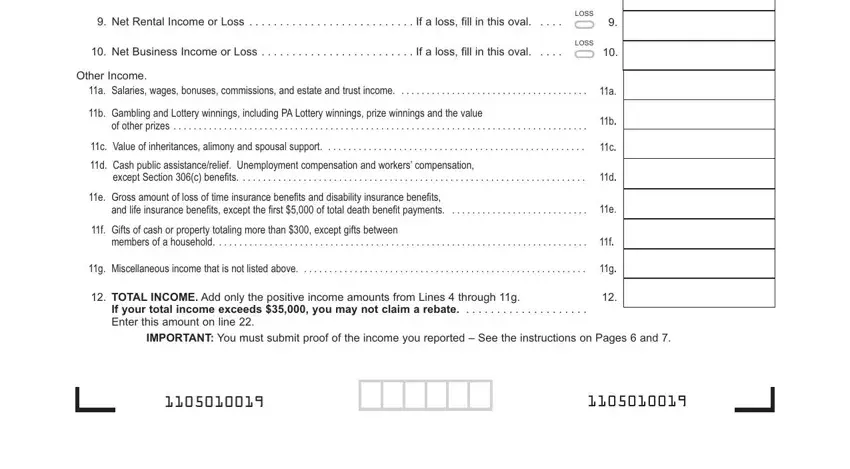

2. Once this segment is done, it's time to insert the needed details in Net Rental Income or Loss, Net Business Income or Loss, LOSS, LOSS, Other Income, a Salaries wages bonuses, b Gambling and Lottery winnings, of other prizes, c Value of inheritances alimony, d Cash public assistancerelief, except Section c benefits, e Gross amount of loss of time, and life insurance benefits except, f Gifts of cash or property, and members of a household allowing you to go to the next stage.

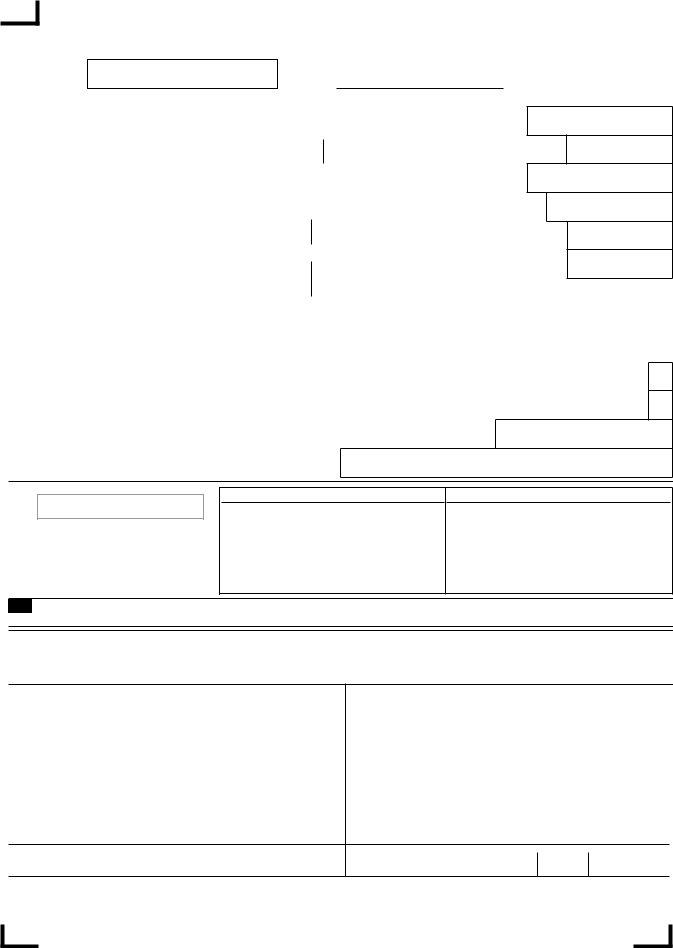

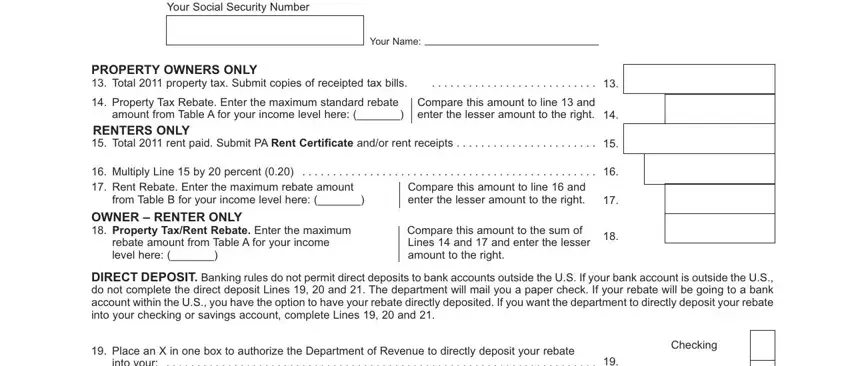

3. This third part is generally simple - fill in every one of the empty fields in Your Social Security Number, Your Name, PROPERTY OWNERS ONLY Total, Property Tax Rebate Enter the, Compare this amount to line and, RENTERS ONLY Total rent paid, Multiply Line by percent, Compare this amount to line and, from Table B for your income level, OWNER RENTER ONLY Property, rebate amount from Table A for, Compare this amount to the sum of, DIRECT DEPOSIT Banking rules do, Place an X in one box to, and into your to conclude the current step.

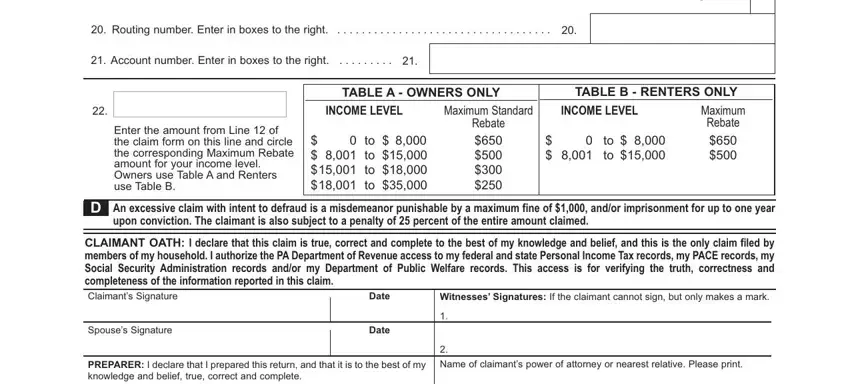

4. The form's fourth paragraph comes with these blank fields to fill out: Savings, Routing number Enter in boxes to, Account number Enter in boxes to, TABLE A OWNERS ONLY, TABLE B RENTERS ONLY, INCOME LEVEL, Maximum Standard, INCOME LEVEL, Enter the amount from Line of the, to to to to, Rebate, to to, Maximum, Rebate, and An excessive claim with intent to.

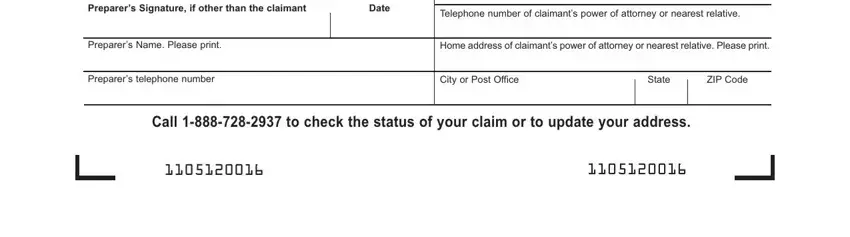

5. To conclude your document, the particular part features a number of additional blanks. Completing Preparers Signature if other than, Date, Telephone number of claimants, Preparers Name Please print, Home address of claimants power of, Preparers telephone number, City or Post Office, State, ZIP Code, and Call to check the status of your will conclude everything and you will be done very quickly!

People frequently make errors while filling out Telephone number of claimants in this section. Remember to re-examine whatever you enter here.

Step 3: Before submitting your form, double-check that all form fields are filled out properly. When you determine that it is good, press “Done." Create a free trial subscription at FormsPal and acquire direct access to Form Pa 1000 - which you'll be able to then begin to use as you wish inside your personal account. FormsPal provides protected document tools with no personal data recording or distributing. Feel comfortable knowing that your data is secure with us!