If you wish to fill out calpers estimate request form, you don't have to download and install any sort of software - just use our online PDF editor. To keep our tool on the cutting edge of efficiency, we aim to put into operation user-oriented features and improvements on a regular basis. We're routinely thankful for any suggestions - assist us with reshaping PDF editing. Starting is easy! All you have to do is adhere to these simple steps directly below:

Step 1: Access the PDF form in our editor by clicking on the "Get Form Button" in the top section of this webpage.

Step 2: Once you launch the PDF editor, you will notice the document ready to be completed. Besides filling out different blank fields, you could also do various other actions with the Document, such as putting on any textual content, changing the initial textual content, adding illustrations or photos, signing the document, and much more.

Filling out this document requires thoroughness. Make sure that every blank field is done properly.

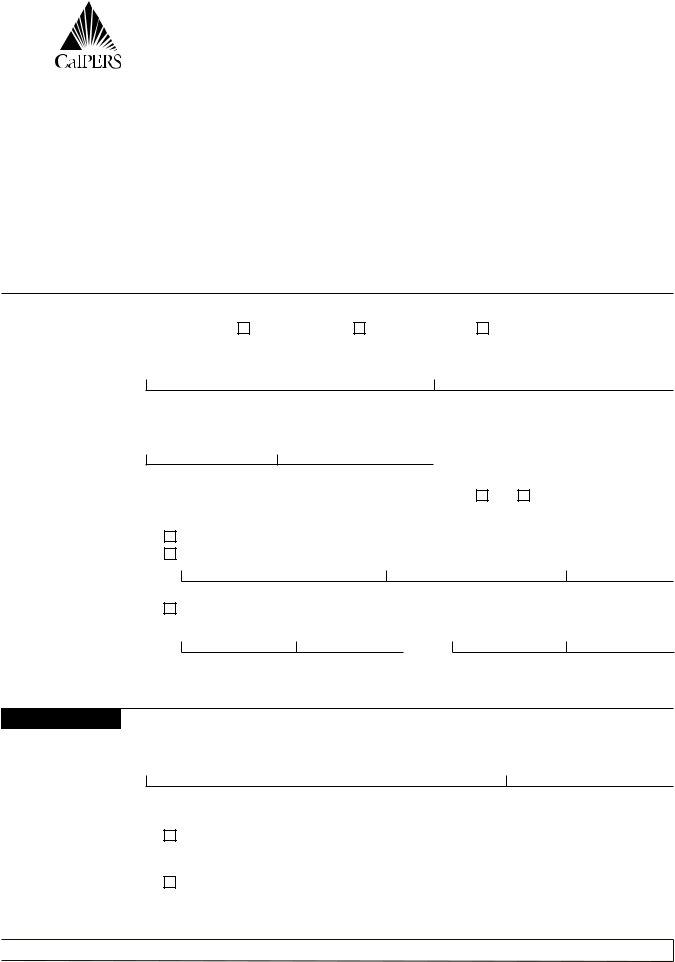

1. You should fill out the calpers estimate request form properly, thus be careful when filling in the sections containing these particular blanks:

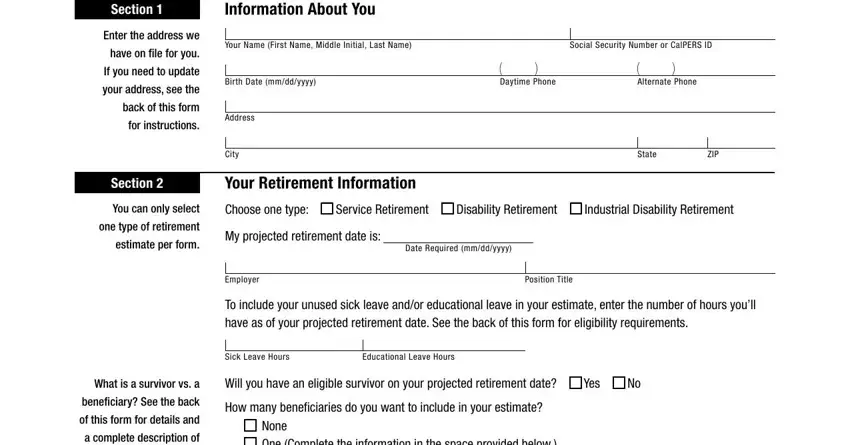

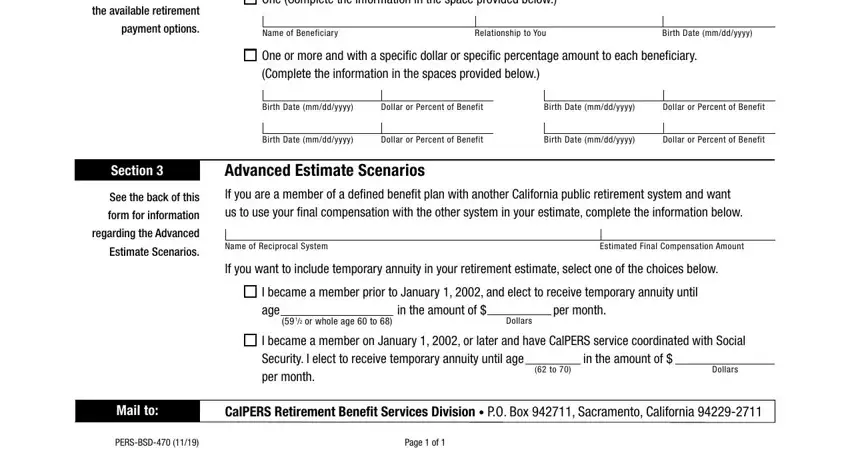

2. Once your current task is complete, take the next step – fill out all of these fields - the available retirement, payment options, c None c One Complete the, Name of Beneficiary, Relationship to You, Birth Date mmddyyyy, c One or more and with a specific, Complete the information in the, Birth Date mmddyyyy, Dollar or Percent of Benefit, Birth Date mmddyyyy, Dollar or Percent of Benefit, Birth Date mmddyyyy, Dollar or Percent of Benefit, and Birth Date mmddyyyy with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be extremely careful when completing Complete the information in the and Dollar or Percent of Benefit, because this is the section where a lot of people make some mistakes.

Step 3: After you've glanced through the details you given, click on "Done" to complete your form. Join FormsPal right now and immediately obtain calpers estimate request form, available for download. Every change you make is conveniently kept , making it possible to change the form at a later time anytime. If you use FormsPal, you're able to fill out documents without having to get worried about database leaks or data entries getting shared. Our secure platform makes sure that your private information is kept safe.