Form Pgh 40 is a form that allows the City of Pittsburgh to assess and levy real estate taxes. The form must be completed by the owner of the property, or their authorized representative, and must be filed with the Tax Assessor's Office on or before March 31st of each year. The assessed value of the property is used to calculate the tax bill for that year. In order to complete Form Pgh 40, you will need to know the legal description of the property, as well as its assessed value and taxable status. You can find this information on your recent tax bill or from your local Tax Assessor.

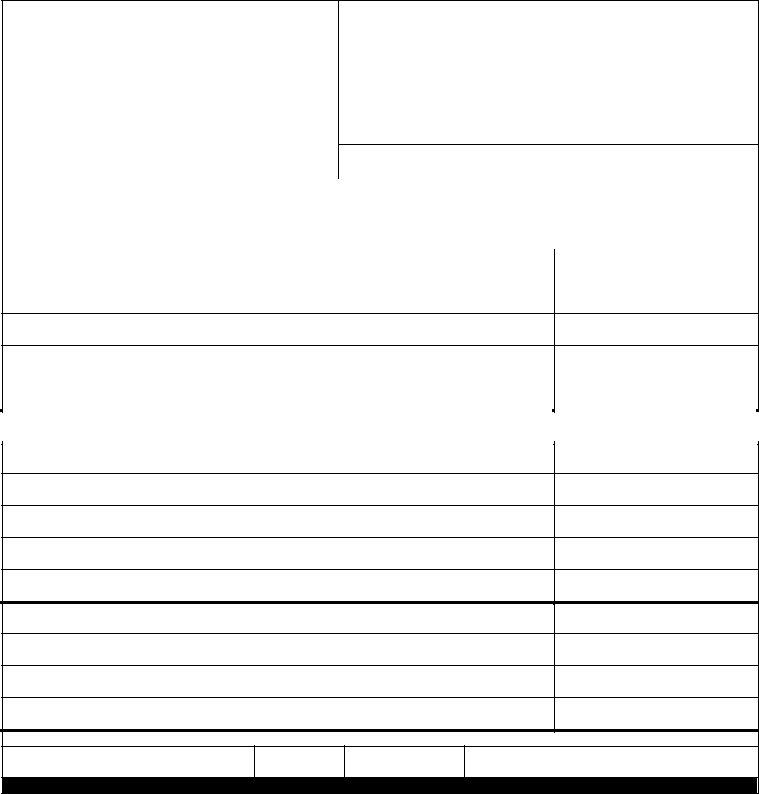

| Question | Answer |

|---|---|

| Form Name | Form Pgh 40 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 10_PGH 40_tax_form pgh 40 2012 form |

CFD

CITY AND SCHOOL DISTRICT |

|

OF PITTSBURGH |

|

Individual Earned Income For Calendar |

|

Year and/or Fiscal Year Ended _______ |

PRINT NEATLY in CAPITAL LETTERS, and use BLACK INK |

Check if Amended Return |

Check if you do not need a |

__________________________ |

___________________________ |

Taxpayer’s Occupation |

Spouse’s Occupation |

You MUST enter your complete

If married, include your Spouse’s Name, Social Security No. and Occupation even if filing separately

Taxpayer’s Social Security No. |

|

Spouse’s Social Security No. |

|

|

|

|

|

Taxpayer’s Last Name |

|

Taxpayer’s First Name |

|

|

|

|

|

Spouse’s Last Name |

|

Spouse’s First Name |

|

|

|

|

|

Address |

City |

State |

Zip Code |

SIGNATURE & PHONE OF

X ___________________________________ Phone: _____________________

FILING |

Single Married filing Jointly |

Married filing Separately |

Deceased |

|

Retired – No taxable income |

|||

STATUS |

|

|

|

|

Date Deceased ___ / ___ / ___ |

Date retired___ / ___ / ___ |

||

|

|

|

|

|

|

|||

RESIDENCY |

|

|

|

|

||||

STATUS |

Pittsburgh Resident |

Mt. Oliver Resident |

Residing in (State/Country) _____________ |

from ____ / ____ to ____ / ____ |

Residing within State of PA |

|||

|

(Complete WTEX on back) |

(Include visa or |

|

(Complete WTEX on back) |

|

(Complete WTEX on back) |

||

|

|

|

|

|||||

|

|

|

|

|

|

|

||

1. EARNED INCOME - Gross wages, tips, salaries, commissions etc. |

|

|

|

|

|

|||

Enclose photocopy of IRS Forms |

Instructions on pages 5 & 6 |

1 |

|

|||||

|

|

|

|

|

|

|

|

|

2. DEDUCTION FOR UNREIMBURSED EMPLOYEE BUSINESS EXPENSES |

|

|

|

|

||||

Must include copies of State of PA Schedule UE and specify occupation above. |

|

Instructions page 6 |

2 |

|

||||

|

|

|

|

|

|

|

|

|

3.TAXABLE EARNINGS

Line 1 minus Line 2 |

3 |

|

4. |

NET PROFIT - From business, profession, partnerships etc. |

|

|

|

Include copies of PA Schedules C, |

See Instructions page 6 |

4 |

|

|

|

|

5. |

TOTAL GROSS COMPENSATION/NET PROFIT |

|

|

|

Line 3 plus Line 4 - If the result is a negative number enter 0 |

|

5 |

|

|

|

|

6. |

TAX – Multiply Line 5 by the tax rate; DO NOT ROUND TO THE NEAREST DOLLAR |

|

|

|

Pittsburgh Resident 3.0% (0.03) – Mt. Oliver Resident 2.0% (0.02) – |

|

6 |

|

|

|

7.TOTAL LOCAL TAX WITHHELD PER

|

DO NOT INCLUDE THE $52.00 LST TAX. Enclose photocopy of IRS Form |

|

|

|||

|

|

|

|

|

|

7 |

8. TOTAL ESTIMATED TAX PAYMENTS ON |

UNDER Social Security No: ___________ - ________ - ___________ |

|

||||

|

|

|

|

|

|

8 |

9. |

TOTAL PAYMENTS ON |

UNDER Social Security No: ___________ - ________ - ___________ |

|

|||

|

|

|

|

|

|

9 |

10. |

OTHER CREDITS |

|

|

|

|

|

|

Include a copy State Tax Return |

See instructions on page 7 |

|

|||

|

|

|

|

|

|

10 |

11. |

TOTAL TAX CREDITS |

|

|

|

|

|

|

Add Lines 7, 8, 9 and 10 |

|

|

|

|

|

|

|

|

|

|

|

11 |

12. |

IF LINE 11 IS MORE THAN LINE 6 - - - - - - - - - - - |

- - - - - - - - - - - - - - - - - - - |

- - - - - - - - - - - - - |

|

||

|

CHECK ONE - REFUND CREDIT TOWARD 2011 TAXES. Amounts of $2.00 or less will not be refunded or credited |

|

||||

|

|

|

|

|

|

12 |

13. |

IF LINE 6 IS MORE THAN LINE 11 - - - - - - - - - - - |

- - - - - - - - - - - - - - - - - - - |

- - - - - - - - - - - - - |

- - - - |

ENTER AMOUNT OWED |

|

|

Amounts of $2.00 or less are not due |

|

|

|

|

|

|

|

|

|

|

|

13 |

14. |

PENALTY AND INTEREST |

|

|

|

|

|

|

If filed after APRIL 15, 2011, 1% per month of LINE 13 |

|

See instructions on page 7 |

|

||

|

|

|

|

|

|

14 |

15. |

TOTAL Add Line 13 and Line 14 - - - - - - - - - - - - - |

- - - - - - - - - - - - - - - - - - - |

- - - - - - - - - - - - |

TOTAL AMOUNT REMITTED |

|

|

|

Make check payable to: TREASURER, CITY OF PITTSBURGH – DO NOT SEND CASH – SEE REVERSE SIDE FOR MAILING ADDRESS |

|

||||

|

A $30.00 service fee will be charged for any check returned from the bank for any reason. |

|

|

|

15 |

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements. To the best of my knowledge and belief it is true, correct and complete. |

||||||

SIGNATURE |

DATE (MM/DD/YY) |

DAYTIME PHONE NO. |

SPOUSE’S SIGNATURE – IF FILING JOINTLY, BOTH MUST SIGN |

|||

X |

|

|

|

|

X |

|

|

SEE REVERSE SIDE FOR FORM WTEX, PLUS IMPORTANT INSTRUCTIONS ABOUT FILING YOUR RETURN |

|||||

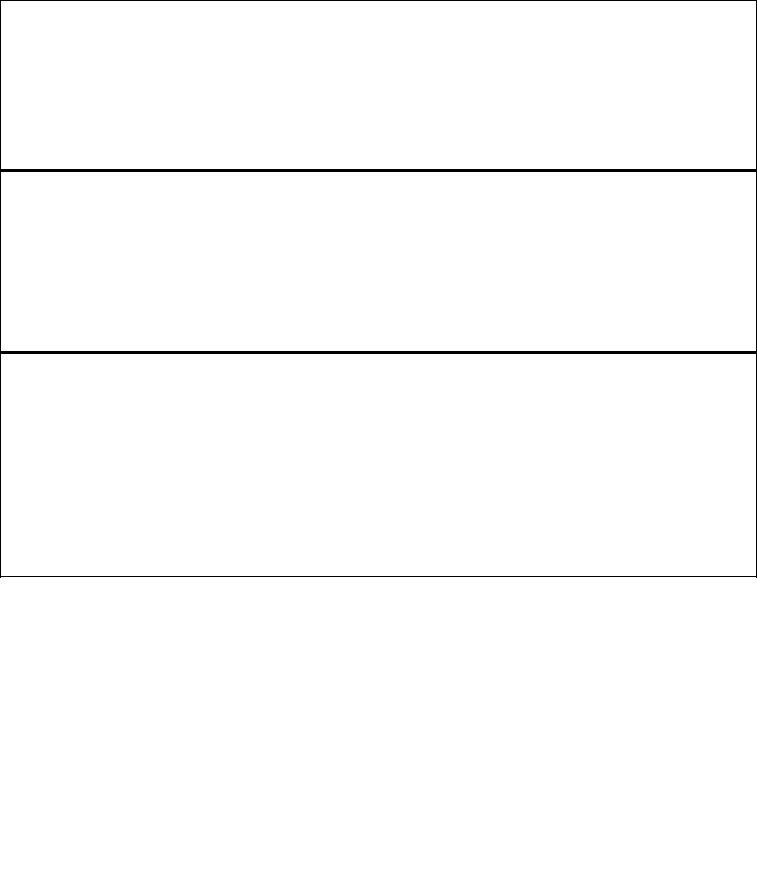

Form WTEX -

CLAIM FOR EXEMPTION FROM CITY OF PITTSBURGH AND/OR SCHOOL DISTRICT EARNED INCOME TAX

FOR

COMPLETE THIS FORM IF YOUR RESIDENCY STATUS IS ONE OF THE FOLLOWING:

2 - |

4 – |

|

residing within the State of PA |

|

during all or part of 2010 |

5 -

If you lived in another state during any part of the year, include copies of your PA and out of state returns.

Taxpayer Name___________________________________Social Security No.___________________Daytime Phone________________

Current

Address__________________________________________City______________________State_________Zip_________________

I was a resident of (Boro or Township)_______________________________________________________for all or part of year 2010.

I lived in the above municipality from ___________/____________/_____________ to __________/______________/_______________

As a resident of this municipality I earned $_______________________and I owe/paid $_______________________in earned income tax.

Therefore I was not liable for City of Pittsburgh and/or School District of Pittsburgh Earned Income Tax.

MUST BE VERIFIED AND SIGNED BY YOUR LOCAL TAX COLLECTOR FROM A PENNSYLVANIA MUNICIPALITY

I certify that the person above was registered as a taxpayer in my jurisdiction for the tax year 2010 and owes or has paid the Earned Income Tax to his/her place of residence in the amount stated above.

____________________________________________________________ |

SEAL |

||

Tax Collector’s Signature |

Date |

Phone |

|

A completed

The balance of tax due on Form

“TREASURER, CITY OF PITTSBURGH” and mail it with your return. Please write your Account Number (found in the upper left corner of the Taxpayer Information Box on Form

DO NOT STAPLE ANY PAPERS TO THE RETURN

IF ALL APPLICABLE INFORMATION IS NOT PROVIDED, YOUR

Please mail your completed

the correct

|

REFUNDREQUESTED |

|

|

|

CREDIITREQUESTED |

|

|

|

||||

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ATTENTION - REFUND |

|

|

ATTENTION - CREDIT |

|

|

ATTENTION – NO TAX DUE |

|

||||

|

TREASURER – CITY OF PITTSBURGH |

|

|

TREASURER – CITY OF PITTSBURGH |

|

|

TREASURER – CITY OF PITTSBURGH |

|||||

|

414 GRANT ST |

|

|

414 GRANT ST |

|

|

|

|

PO BOX 2701 |

|

|

|

|

PITTSBURGH PA |

|

|

PITTSBURGH PA |

|

|

PITTSBURGH PA |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- artial |

ay e t |

|

|

|

|

|

|

|

|

|

|

|

- artial |

ay e t |

|

|

|

|

|

|

|

|

|

|

|

TAXDUE |

|

|

|

- |

ll ay e t |

cl se |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

- |

ll ay e t |

cl se |

|

|

|

|

|

cl |

se |

|

|

|

TAXDUE |

||

|

|

|

|

|

cl |

se |

|

|

|

|

|

|

|

|

|

|

|

Enclosed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Returns sent to the incorrect address will |

|

|

|

ATTENTION – PARTIAL or NO PAYMENT |

|

|

ATTENTION – FULL PAYMENT |

||||

|

|

|

|

TREASURER – CITY OF PITTSBURGH |

|

|

TREASURER – CITY OF PITTSBURGH |

|||||

|

be delayed |

|

|

|

|

|

||||||

|

|

|

|

414 GRANT ST |

|

|

|

|

PO BOX 642583 |

|

||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

PITTSBURGH PA |

|

|

PITTSBURGH PA |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|