You may prepare SCA effectively in our online tool for PDF editing. FormsPal development team is relentlessly working to develop the editor and insure that it is even better for users with its extensive functions. Take your experience to the next level with continuously growing and amazing options we provide! Getting underway is effortless! All you need to do is follow the following basic steps below:

Step 1: Open the PDF file inside our editor by pressing the "Get Form Button" above on this page.

Step 2: The editor will give you the ability to work with the majority of PDF documents in various ways. Modify it by including your own text, adjust what's already in the file, and put in a signature - all at your fingertips!

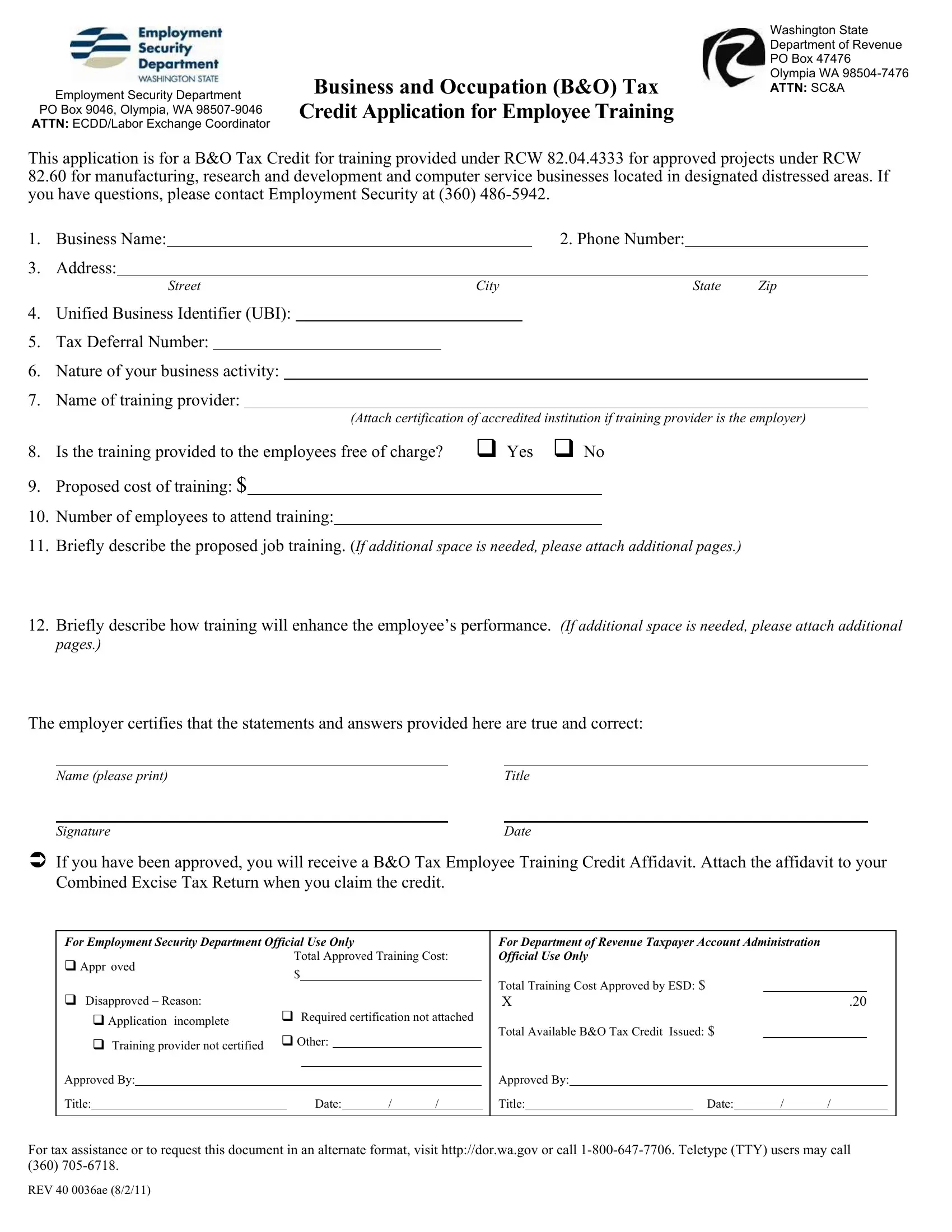

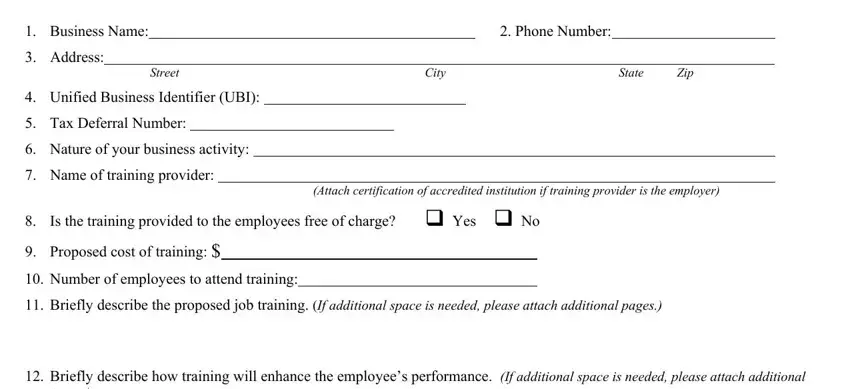

For you to fill out this PDF form, make sure you type in the necessary information in every field:

1. It is advisable to complete the SCA correctly, therefore take care while filling in the segments including these specific fields:

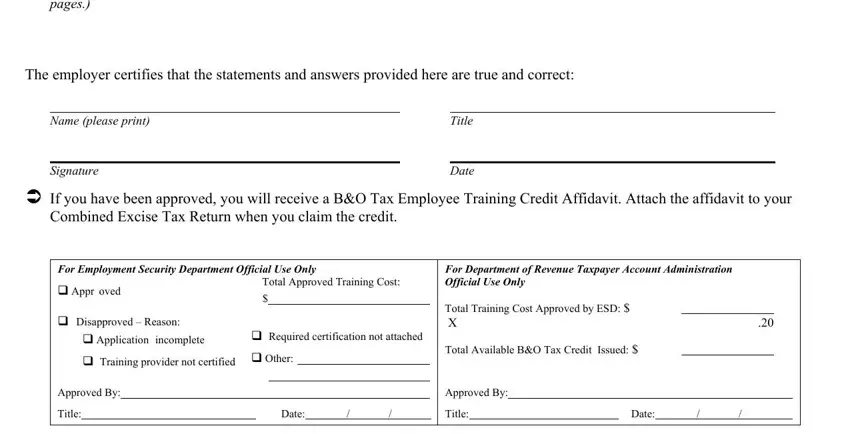

2. The subsequent stage is to submit these fields: pages, The employer certifies that the, Name please print, Signature, Title, Date, If you have been approved you, Combined Excise Tax Return when, For Employment Security Department, Appr oved, Disapproved Reason, Application incomplete, Training provider not certified, Approved By Title, and Total Approved Training Cost.

As to For Employment Security Department and Signature, be sure you don't make any mistakes in this current part. Both of these are the key ones in the file.

Step 3: Immediately after going through your fields, click "Done" and you're all set! Join us right now and easily get SCA, ready for downloading. Each and every edit you make is handily kept , making it possible to change the pdf later when necessary. We do not share the details that you type in when completing forms at FormsPal.