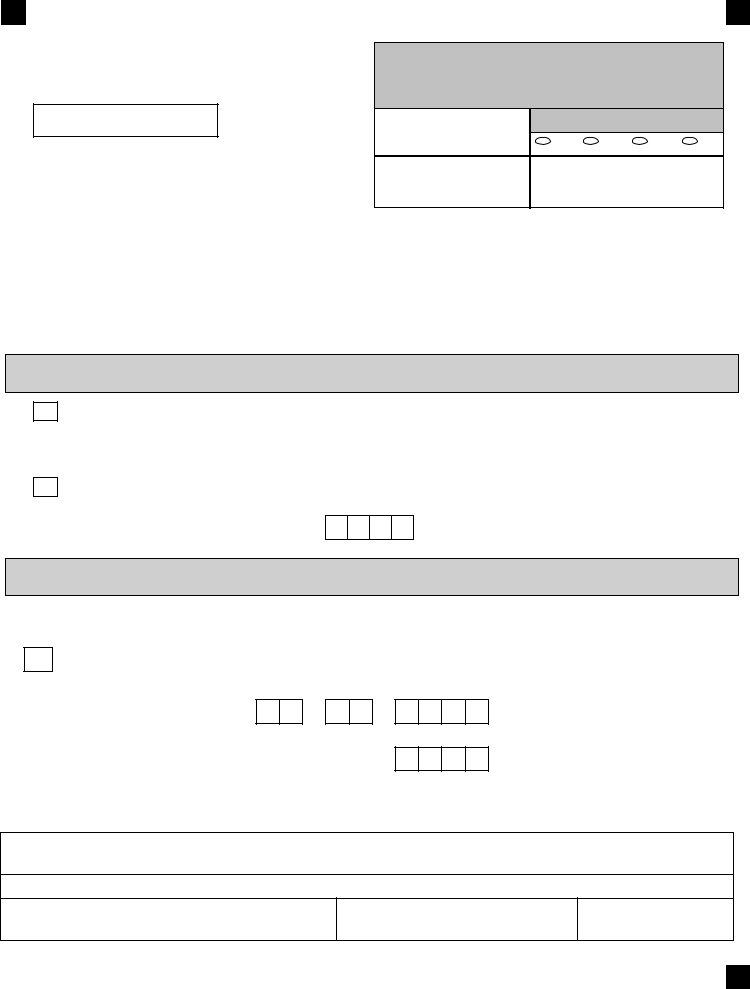

Form Ri 25 7 is a Rhode Island tax form used to declare casino winnings. This form is required to be filed by any individual who has won $600 or more in casino winnings during the year. The form must be filed by April 15th of the following year. Failure to file this form may result in penalties and interest charges. For more information, please consult the instructions for Form Ri 25 7. Thank you for your time.

| Question | Answer |

|---|---|

| Form Name | Form Ri 25 7 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | curently, OPM, 2003, NW |

Show any address change next to your address below.

Form A pproved

O M B N o . 3206

United States Office of Personnel Management

Retirement Surveys and Students Branch

1900 E St., NW

Washington, DC

Claim Number |

|

|

||

|

|

|

||

|

I |

II |

III |

IV |

Date |

Case Name |

|

|

|

You DO NOT need to send this form back if you have never remarried.

Please read the back of this form before completing your answers below. ONLY check the items that apply to you. Please enter the month, day, and year in the boxes provided. Enter a leading zero for months and days with only one number, for example, March 7, 2001, would be 03/07/2001.

Section A: Remarriage before Age 55

I remarried before I reached age 55 and this is my first time notifying OPM. The date of my

remarriage is: |

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

|

m m |

|

d d |

|

y y y y |

|||||

Although I remarried before I reached age 55, I was married to the person named above for at least 30 years. We were married on the following date:

|

|

/ |

|

|

m m |

|

d d |

||

/

y y y y

Section B: Remarriage before Age 55 (ONLY complete for unreported remarriages which have ended.)

Answer only if you have NEVER reported your remarriage to OPM. DO NOT SEND THIS FORM BACK IF WE ALREADY HAVE THIS INFORMATION AND THE PROOFS WE NEED.

I remarried before I reached age 55 and this is my first time notifying OPM. This marriage has since ended. The date of my remarriage is indicated below.

Date of Remarriage

This marriage ended

/

m m d d

|

|

/ |

|

|

m m |

|

d d |

||

/

y y y y

/

y y y y

(Please attach a copy of the document showing the date the marriage ended by death, divorce, or annulment.)

WARNING: We may verify your marital status through a computer match with other Federal agencies. Any intentionally false or misleading statement, certification, or response you provide is a violation of the law punishable by a fine of not more than $10,000 or imprisonment of not more than 5 years, or both (18 USC 1001).

I certify that all information I gave on this form is true and correct to the best of my knowledge and belief.

Signature

Daytime Telephone Number

( )

Date

|

RI |

21329 |

|||||||

|

Revised May 2003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31723

WHO NEEDS TO COMPLETE THIS FORM

If you are a surviving spouse who married before you w ere age 55, even if that marriage has ended, you must report your remarriage to OPM. If you have already notified OPM of the change in your marital status, please DO NOT return this form.

We contact you periodically to remind you of the eligibility requirements for you to continue receiving a survivor annuity. By law, you may continue receiving this annuity ONLY as long as you do not remarry before your 55th birthday unless you were married to the decedent for at least 30 years prior to his or her death. You are responsible for notifying us immediately of remarriage. Failure to notify us immediately will result in an overpayment of annuity. You will be held liable for full repayment of any and all annuity paid to you after the remarriage.

SHOULD YOU RESPOND TO THIS SURVEY FORM?

If you remarried before reaching age 55 and you have not already notified us of that remarriage, you need to complete and return this form within 30 days after the date on the front. Otherwise, do not return this form.

Example: You remarried in 1986 and notified us. We terminated your survivor benefits. This remarriage ended in 1993. Again, you notified us and we reinstated your survivor benefits. You do NOT need to complete and return this form.

INFORMATION ON COMMON LAW (MUTUAL CONSENT) MARRIAGE

If you live in a state that recognizes a common law (mutual consent) marriage, we must treat it the same as a marriage by a civil or church ceremony. To prove common law marriage, you must have presented yourselves as man and wife, supply two affidavits swearing you are married from persons who are in a position to know, and send us at least two of the following: copies of taxes filed jointly, joint bank account, joint contract for purchase of a home, joint lease for rental of an apartment or house.

NEED HELP?

If you need help, please contact our office at (202)

Privacy Act and Public Burden Statement

Information you furnish will be used to determine your eligibility to continue receiving survivor annuity payments. Information may be shared and is subject to verification, via paper, electronic media, or through the use of computer matching programs, with national, state, local, or other benefit paying agencies in order to determine and issue benefits under their programs, to obtain information necessary for continuation of benefits under this program, or to report income for tax purposes. It may also be shared and verified, as noted above, with law enforcement agencies when they are investigating a violation or potential violation of civil or criminal law. Solicitation of this information is authorized by the Civil Service Retirement Law (Chapter 83, title 5 U.S. Code) and the Federal Employees' Retirement Law (Chapter 84, title 5 U.S. Code). Failure to furnish the requested information may cause an overpayment of annuity. We will have to collect any overpayment from you .

We think providing this information takes an average 15 minutes per response, including the time for reviewing instructions, getting the needed data, and reviewing the requested information. Send comments regarding our estimate or any other aspect of this form, including suggestions for reducing completion time, to the United States Office of Personnel Management (OPM), OPM Forms Officer

Reverse of RI

Revised May 2003