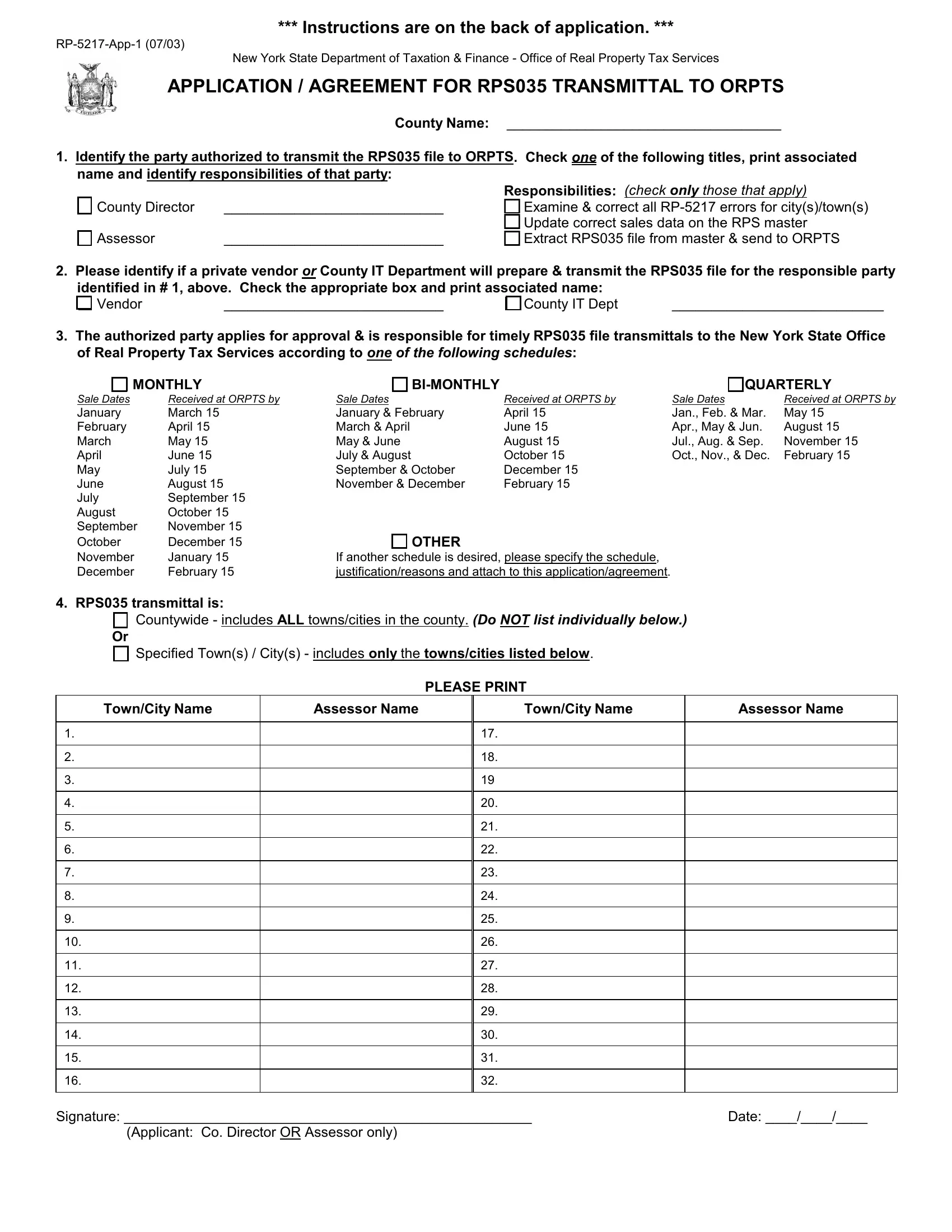

*** Instructions are on the back of application. ***

RP-5217-App-1 (07/03)

New York State Department of Taxation & Finance - Office of Real Property Tax Services

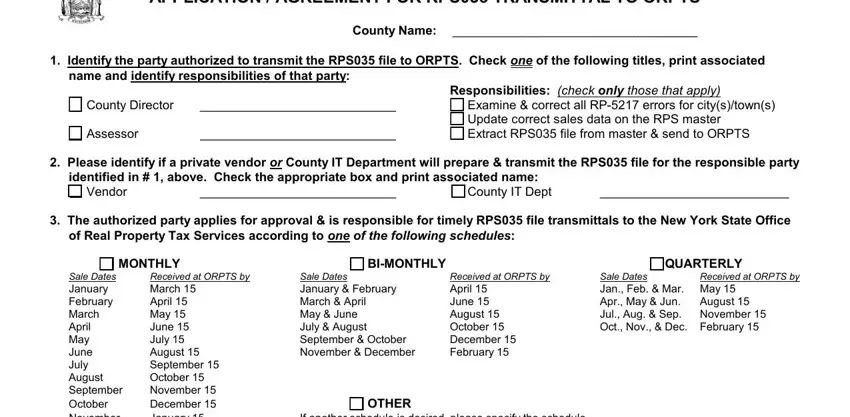

APPLICATION / AGREEMENT FOR RPS035 TRANSMITTAL TO ORPTS

County Name: ___________________________________

1.Identify the party authorized to transmit the RPS035 file to ORPTS. Check one of the following titles, print associated name and identify responsibilities of that party:

|

|

Responsibilities: (check only those that apply) |

County Director |

____________________________ |

|

|

Examine & correct all RP-5217 errors for city(s)/town(s) |

|

|

|

|

Update correct sales data on the RPS master |

Assessor |

____________________________ |

|

|

Extract RPS035 file from master & send to ORPTS |

2. Please identify if a private vendor or County IT Department will prepare & transmit the RPS035 file for the responsible party

identified in # 1, above. Check the appropriate box and print associated name: |

|

Vendor |

____________________________ |

County IT Dept |

___________________________ |

3.The authorized party applies for approval & is responsible for timely RPS035 file transmittals to the New York State Office of Real Property Tax Services according to one of the following schedules:

MONTHLY

Sale Dates |

Received at ORPTS by |

Sale Dates |

BI-MONTHLY

Received at ORPTS by |

Sale Dates |

QUARTERLY

Received at ORPTS by

January |

March 15 |

January & February |

April 15 |

Jan., Feb. & Mar. |

May 15 |

February |

April 15 |

March & April |

June 15 |

Apr., May & Jun. |

August 15 |

March |

May 15 |

May & June |

August 15 |

Jul., Aug. & Sep. |

November 15 |

April |

June 15 |

July & August |

October 15 |

Oct., Nov., & Dec. |

February 15 |

May |

July 15 |

September & October |

December 15 |

|

|

|

June |

August 15 |

November & December |

February 15 |

|

|

|

July |

September 15 |

|

|

|

|

|

August |

October 15 |

|

|

|

|

|

September |

November 15 |

|

|

|

|

|

October |

December 15 |

OTHER |

|

|

|

|

November |

January 15 |

If another schedule is desired, please specify the schedule, |

|

|

|

December |

February 15 |

justification/reasons and attach to this application/agreement. |

|

|

|

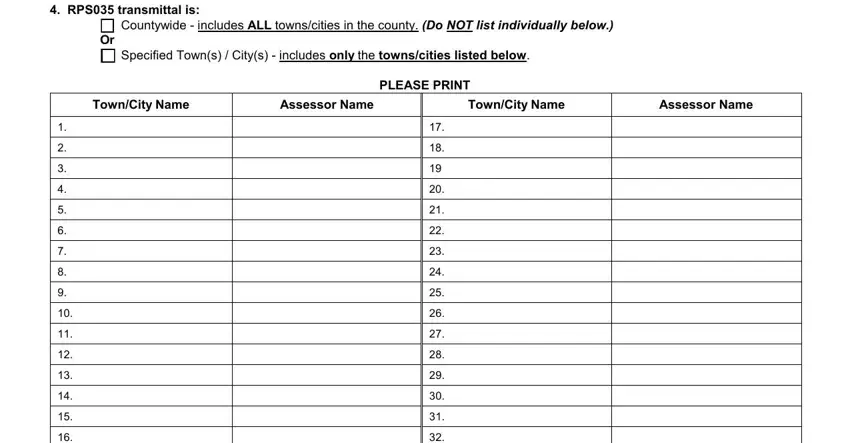

4. RPS035 transmittal is: |

|

|

|

|

|

Countywide - includes ALL towns/cities in the county. (Do NOT list individually below.) |

|

Or |

|

|

|

|

|

|

Specified Town(s) / City(s) - includes only the towns/cities listed below. |

|

|

|

|

|

PLEASE PRINT |

|

|

|

Town/City Name |

Assessor Name |

Town/City Name |

|

Assessor Name |

|

|

|

|

|

|

|

1. |

|

|

17. |

|

|

|

|

|

|

|

|

|

|

2. |

|

|

18. |

|

|

|

|

|

|

|

|

|

|

3. |

|

|

19 |

|

|

|

|

|

|

|

|

|

|

4. |

|

|

20. |

|

|

|

|

|

|

|

|

|

|

5. |

|

|

21. |

|

|

|

|

|

|

|

|

|

|

6. |

|

|

22. |

|

|

|

|

|

|

|

|

|

|

7. |

|

|

23. |

|

|

|

|

|

|

|

|

|

|

8. |

|

|

24. |

|

|

|

|

|

|

|

|

|

|

9. |

|

|

25. |

|

|

|

|

|

|

|

|

|

|

10. |

|

|

26. |

|

|

|

|

|

|

|

|

|

|

11. |

|

|

27. |

|

|

|

|

|

|

|

|

|

|

12. |

|

|

28. |

|

|

|

|

|

|

|

|

|

|

13. |

|

|

29. |

|

|

|

|

|

|

|

|

|

|

14. |

|

|

30. |

|

|

|

|

|

|

|

|

|

|

15. |

|

|

31. |

|

|

|

|

|

|

|

|

|

|

16. |

|

|

32. |

|

|

|

|

|

|

|

|

|

|

Signature: ____________________________________________________ |

Date: ____/____/____ |

(Applicant: Co. Director OR Assessor only) |

|

Instructions for Application/Agreement for RPS035 Sales Transmittals

Send the completed RP-5217-App-1 application form to:

New York State Department of Taxation & Finance

Office of Real Property Tax Services – Data Management Unit

WA Harriman State Campus – Bldg. 8A

Albany, NY 12227

This form is to be completed by the following: |

|

• |

County Director |

- where the County will be responsible for a RPS035 transmittal to ORPTS. |

• |

Assessor |

- where the municipality will be responsible for a RPS035 transmittal to ORPTS. |

|

|

|

|

IF |

|

|

THEN |

County will transmit the RPS035 file for ALL municipalities |

ONLY County Director will submit an application |

County will transmit the RPS035 file for ONLY some municipalities |

County Director will submit an application for the |

|

|

|

municipalities that County will transmit |

|

|

|

AND |

|

|

|

Assessor who transmits independently will submit a separate |

|

|

|

application for their municipality(s). |

County is NOT involved with RPS035 transmittals and: |

|

Assessor will transmit the RPS035 file for their municipality(s) |

Assessor will submit an application for their transmittal(s). |

within a single County |

|

|

Assessor will transmit the RPS035 file for their municipalities that |

Assessor will submit an application for each County involved, |

cross County lines |

|

listing the municipalities within each County that will be |

|

|

|

included. |

The RP-5217 App-1 is used as an application/agreement form to identify the:

•RPS035 transmittal schedule to the ORPTS Data Management Unit for the correction & update of RP-5217 sales data

•towns/cities to be transmitted on the RPS035 file

•authorized agent (party responsible for transmitting the RPS035 file to ORPTS – either the County Director or the assessor)

Upon receipt of this application, Data Management staff will review for accuracy & completeness, process and send confirmation letters of the RPS035 transmittal agreement to the County Director, assessors in individual towns/cities and the ORPTS Customer Relationship Manager (CRM). If you have any questions regarding this application, contact your CRM in the regional office.

The information required on the application is as follows:

Header: |

Enter the County name. |

|

|

Item 1: |

Check the title of the applicant authorized to transmit RPS035 file and enter the associated name. |

|

Check the responsibilities agreed to. |

|

|

Item 2: |

Check and identify when vendor or County IT Dept. prepares and transmits the RPS035 file. |

|

|

Item 3: |

Check one of the following RPS035 transmittal schedules requested: |

|

- Monthly, Bi-monthly, Quarterly or Other (if ‘Other’ attach the desired schedule & reasons). |

|

|

Item 4: |

Check the box indicating what municipalities will be transmitted: |

|

- ‘Countywide’ OR ‘Specified Towns/Cities’ with list of individual towns/cities included. |

|

|

Signature & Date: |

Application is to be signed and dated by applicant (County Director or Assessor only). |

|

|

RPS035 Transmittal Checklist

1.Run the Accumulated Sales Report (RPS035P3) before extracting any RPS035 transmittal file.

2.Compare the number of sales on the RPS035P3 report to the totals on the RPS035P1 report after the extract has been run to ensure that all sales are being transmitted.

3.Open the file before transmitting. Empty files containing no data are occasionally received.

4.In addition to the file, the transmittal should include the Sales Transmittal Report (RPS035P1) and the Corrected Sales Report (RPS035P4).

5.Keep one copy of the RPS035P1 report for your files.

6.Transmit to ORPTS via email: saleint@orps.state.ny.us

If e-mail is not available, mail to: NYS Department of Taxation & Finance

Office of Real Property Tax Services – Data Management Unit

WA Harriman State Campus – Bldg. 8A

Albany, NY 12227

Within 2 weeks of transmitting the RPS035 file to ORPTS, you will be notified that your file has been processed. Contact ORPTS if you do not receive notification that your file was processed. If you do NOT receive a note (for those using US mail) or an email message (for those sending via e-mail), please contact us at (518) 473-9791.