Making use of the online PDF editor by FormsPal, you may fill out or change Form Ssa 10 Bk right here. To make our tool better and more convenient to use, we continuously develop new features, with our users' feedback in mind. It merely requires a few easy steps:

Step 1: Hit the "Get Form" button above. It is going to open up our pdf editor so that you can begin completing your form.

Step 2: This tool provides you with the opportunity to modify PDF files in a range of ways. Improve it by including any text, adjust what's originally in the file, and add a signature - all readily available!

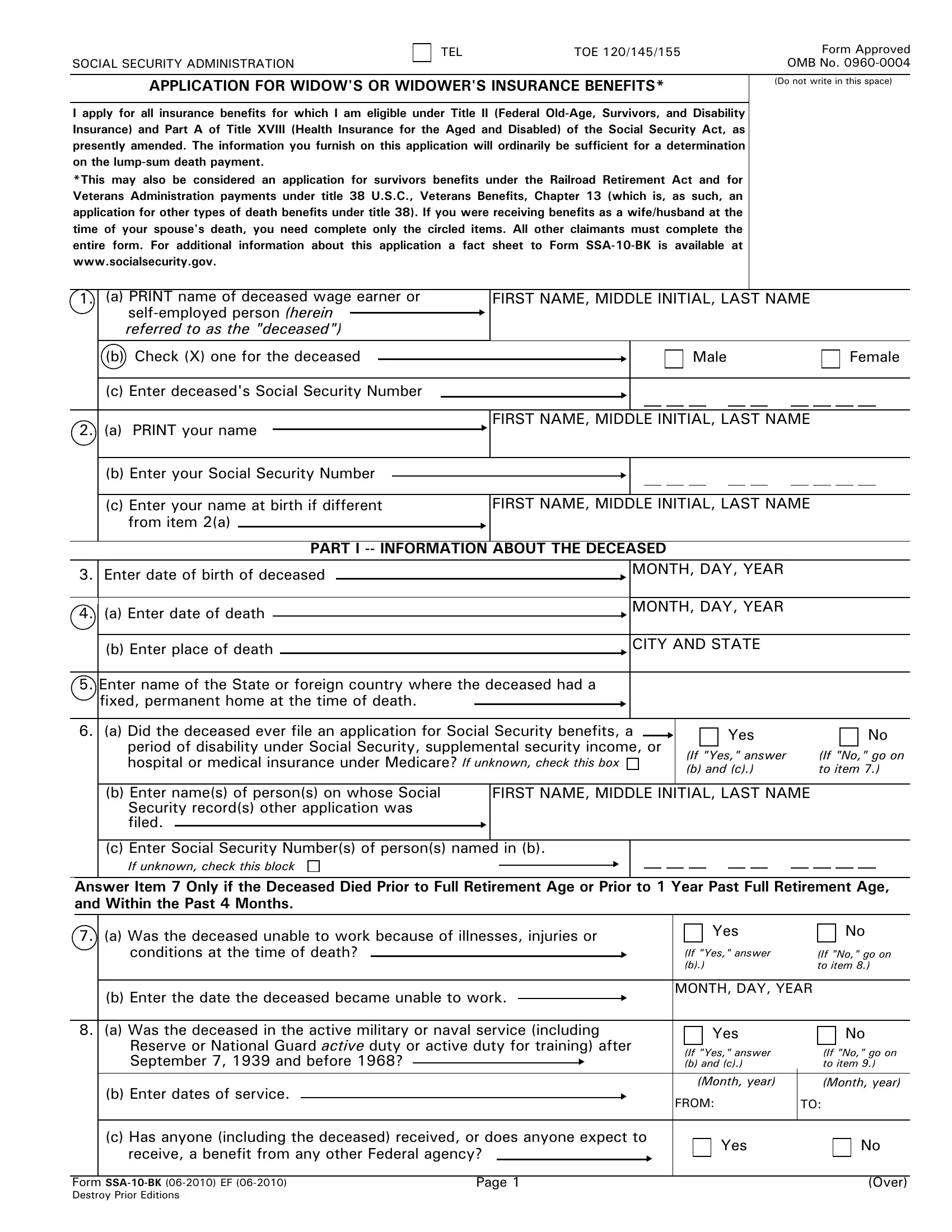

This document needs some specific information; to ensure accuracy, please make sure to pay attention to the suggestions listed below:

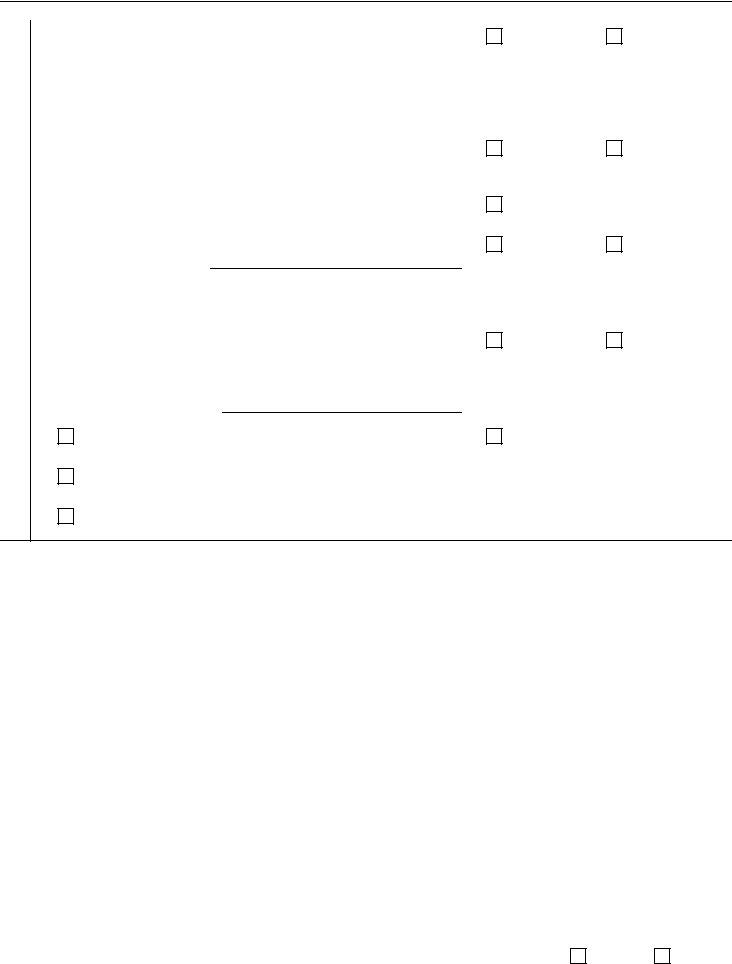

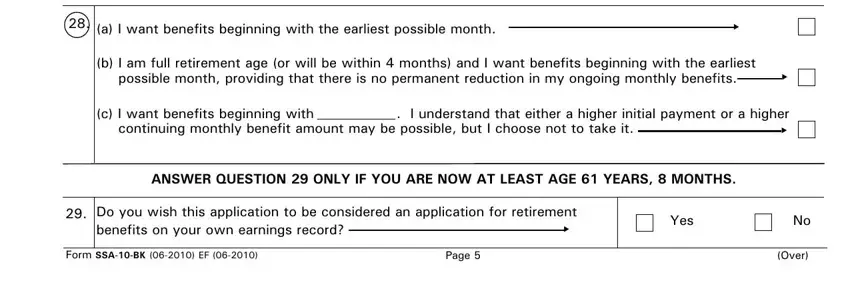

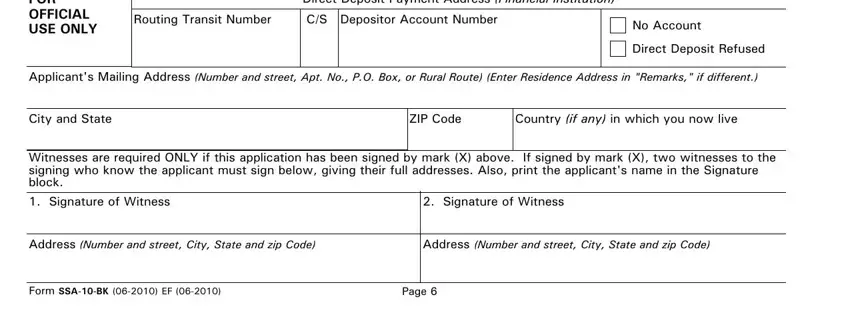

1. It's important to complete the Form Ssa 10 Bk correctly, thus be careful when filling in the areas that contain all of these fields:

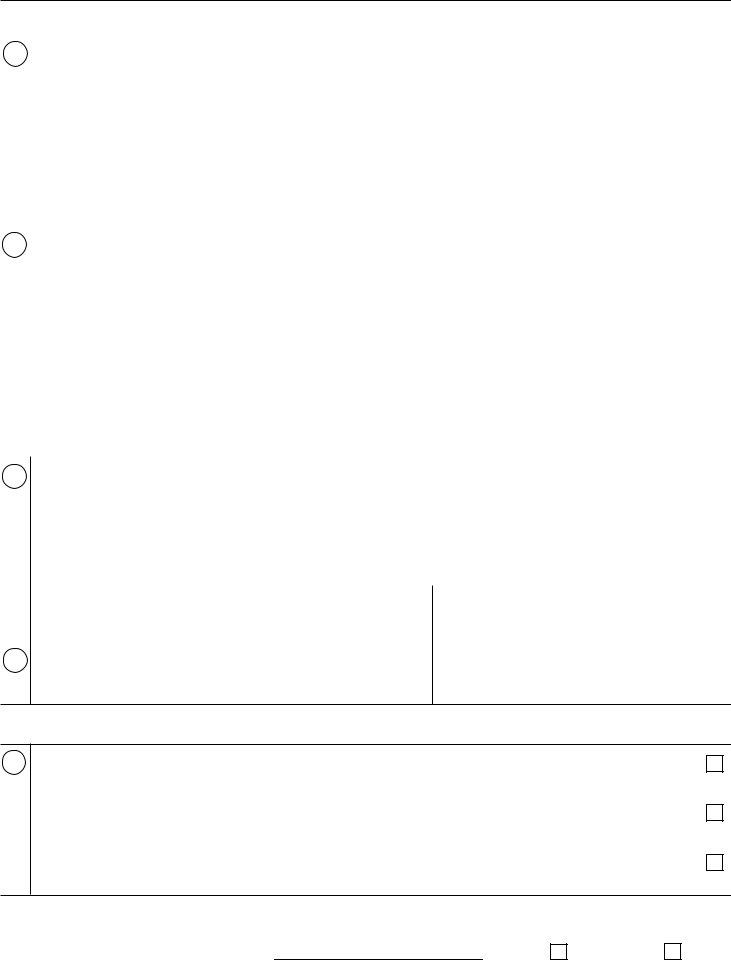

2. Once this array of fields is completed, you're ready to add the required particulars in No Account Direct Deposit Refused, Signature First name middle, Routing Transit Number, Direct Deposit Payment Address, Applicants Mailing Address Number, City and State, ZIP Code, Country if any in which you now, Witnesses are required ONLY if, Signature of Witness, Address Number and street City, Address Number and street City, Form SSABK EF, and Page allowing you to go further.

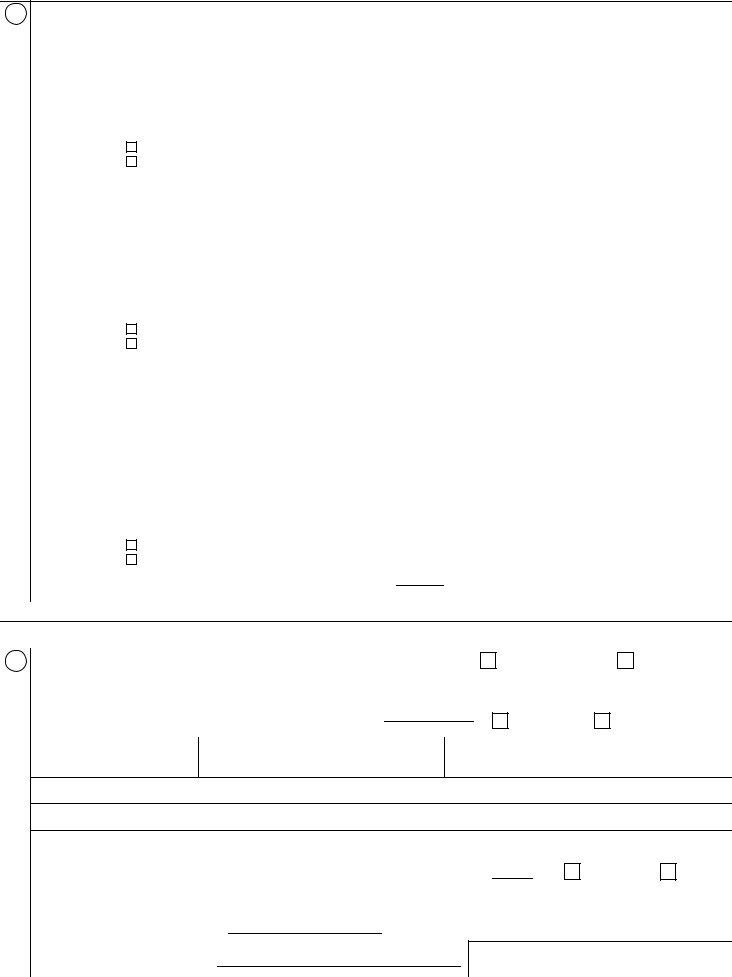

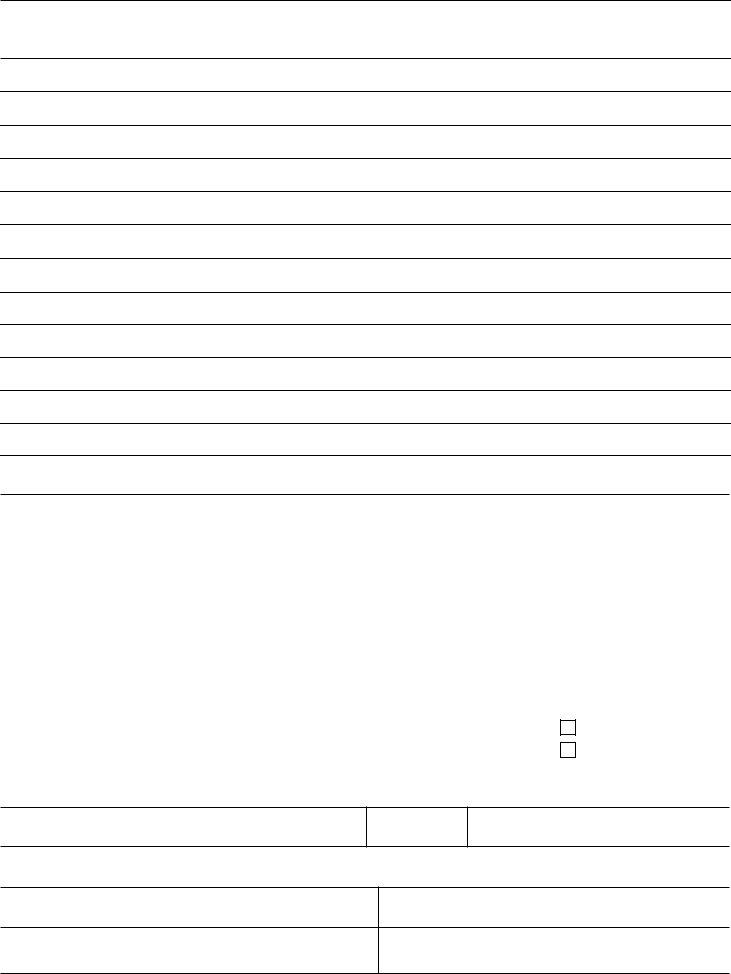

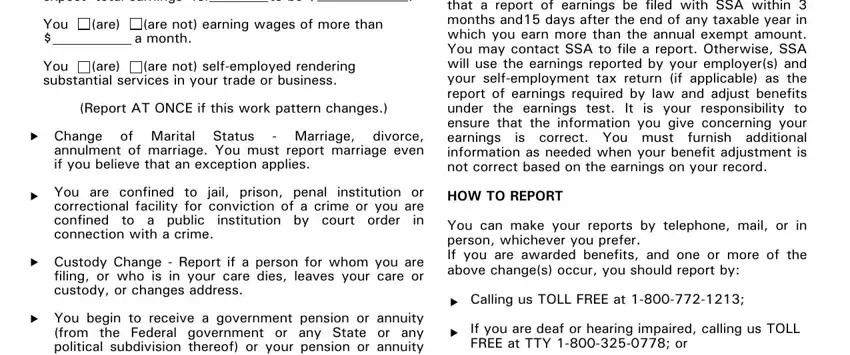

3. Within this stage, have a look at FAILURE TO REPORT MAY RESULT IN, are not earning wages of more than, are not selfemployed rendering, a month, Report AT ONCE if this work, Change of Marital Status Marriage, and You have an unsatisfied warrant. These need to be completed with greatest focus on detail.

People who work with this PDF often get some points incorrect while completing Change of Marital Status Marriage in this part. Ensure that you re-examine whatever you type in right here.

Step 3: Right after you have glanced through the information you filled in, click "Done" to conclude your FormsPal process. After starting a7-day free trial account at FormsPal, you'll be able to download Form Ssa 10 Bk or email it directly. The file will also be readily accessible via your personal account page with your every change. FormsPal ensures your information confidentiality with a secure method that in no way records or distributes any kind of sensitive information typed in. Be assured knowing your paperwork are kept confidential when you work with our editor!