Any time you desire to fill out 1694 entity taxpayer form, you don't have to install any sort of programs - simply give a try to our online PDF editor. FormsPal development team is constantly working to expand the editor and ensure it is even faster for users with its cutting-edge functions. Uncover an endlessly revolutionary experience now - take a look at and discover new opportunities along the way! By taking several simple steps, you may start your PDF editing:

Step 1: Click the "Get Form" button at the top of this page to access our tool.

Step 2: As soon as you start the editor, you will see the form made ready to be filled out. Other than filling out various blank fields, you may as well do various other actions with the form, namely putting on any words, modifying the original text, inserting illustrations or photos, putting your signature on the document, and more.

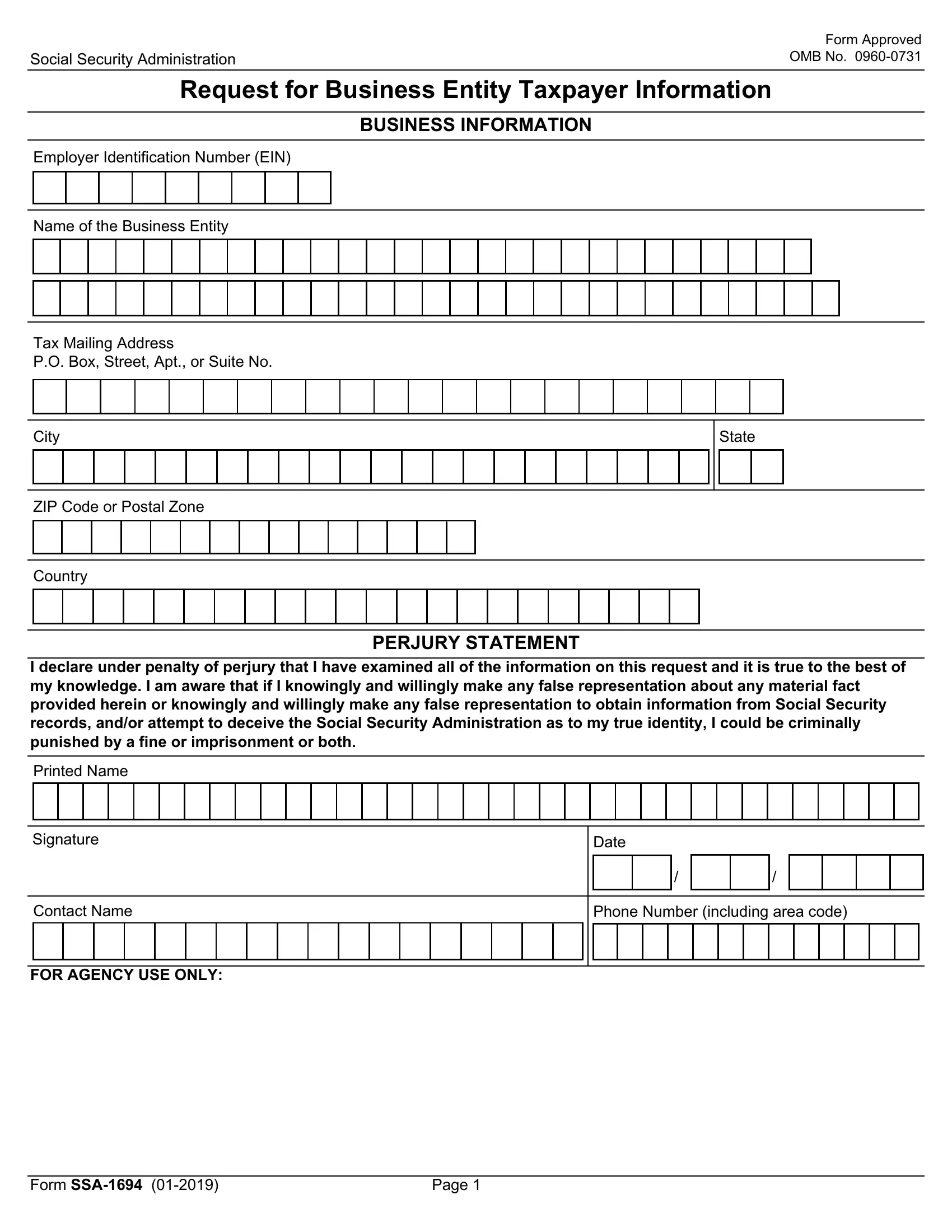

This PDF will require specific data to be entered, so be certain to take some time to enter precisely what is expected:

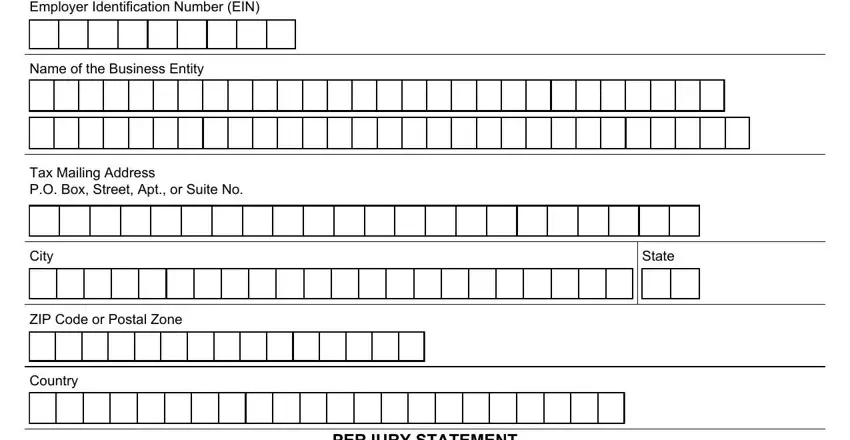

1. To start off, while filling out the 1694 entity taxpayer form, start with the area that features the next blanks:

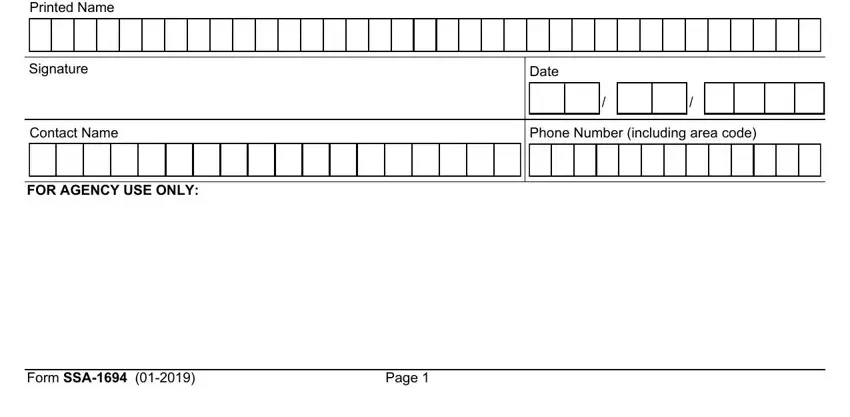

2. The next part would be to submit all of the following blanks: Printed Name, Signature, Contact Name, FOR AGENCY USE ONLY, Date, Phone Number including area code, Form SSA, and Page.

Always be extremely mindful while filling in Date and Page, as this is where many people make mistakes.

3. The following part focuses on IMPORTANT INFORMATION, Purpose of Form, The Social Security Administration, Instructions for Completing the, Employer Identification Number, Please enter your EIN If you do, Name of Business Entity, Enter your business name as shown, Tax Mailing Address, Please enter your tax mailing, Privacy Act Statement Collection, and Sections a and d of the Social - type in each of these blanks.

4. To go forward, this section involves filling out a handful of fields. Included in these are Paperwork Reduction Act Statement, This information collection meets, Form SSA, and Page, which are vital to carrying on with this particular form.

Step 3: After proofreading the entries, press "Done" and you're done and dusted! After getting afree trial account with us, you will be able to download 1694 entity taxpayer form or email it without delay. The document will also be at your disposal through your personal account menu with your every single change. FormsPal is focused on the privacy of all our users; we always make sure that all information processed by our system continues to be secure.