Did you know that, as a taxpayer, you're required to file an Income Tax return every year? Even if you don't earn any income? Sounds scary, but it's actually not that bad. In fact, the Canada Revenue Agency (CRA) has put together a pretty simple process for completing your tax return. And, believe it or not, there are even some benefits to filing! So if you haven't already started preparing your 2016 tax return, now is the time to get started. The first step is gather all of the relevant information. This includes things like your T4 and T5 slips, receipts for deductible expenses, and banking information for any RRSP contributions you made over the year. Once you have all of this information together, it's time to start filling out your return! The CRA has provided a number of helpful resources on their website to make the process as easy as possible. You can choose to complete your return online using NETFILE or by printing out the paper form and mailing it in. No matter which op

| Question | Answer |

|---|---|

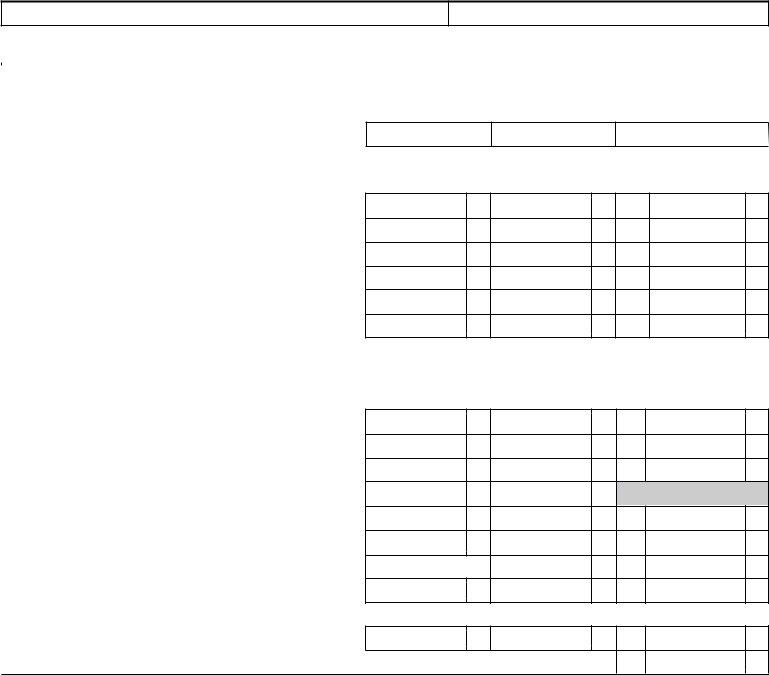

| Form Name | Form T 204A Annual |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | Alcoholic Beverage Annual Rec and Instr 2013 alcohal beverage reconciliation form |

TRTT

TTRU

TT

TLLL

R

TR

UU

UTRURTLLLQURR

RL§

UU

a

Taxpayer

dress

itytwrpstffice |

ate |

Zde |

Telepheuer

iladdress

de

aveyusldrclsedyurbusiess

Yes fyeswhatdate

fouflonsoltls turnlstlllo |

tonsoslnntftonnumr |

|

||

nlungtgtlotonnumrftrrmor |

tnlotonsplsttsprtlstng |

|

||

foumultpllotonsutflnulls |

turnsoumustflnnulforlo |

ton |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

forompltnglnstrougompltulsnonpg

TtaletTaxablelesfrtheperidec |

(nmustqultllsfrompgl |

n |

utftaxltiplylieby |

|

|

|

|

|

|

|

|

|

Ttaltaxduerettedfrtheperiduarythruheceer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

paidsalestaxciarettesfrtheperiduarythruhe |

|

ceer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

reditbalacefayperlieftheualRec |

|

ciliatireturrT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

lestaxdueadpaidtatherstateiteicludedi |

|

edulelie |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

TtalTaxiddliesthruh |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

Lieshuldeuallieflieisrethalie |

thereisa |

lnu |

easeretpaytttheRhde |

|

|

||||

sladivisifTaxatiadsediwiththisualR |

ecciliatieistructisfradditialifrti |

|

|

||||||

flieisrethaliethereisa |

rtu |

Thisautwillbecreditedtthe |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

salestaxpayts |

otprmustsumt“lmforfunformtts |

|

|

|

|

|

|

|

|

ronltonnorrtorrfunoftorp |

mnt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

herebycertifythathavepersalkwledeftheifr |

|

ticstitutithisreturthatallstatetsctaied |

hereiaretrue |

||||||

crrectadcletetthebestfkwledeadbelief |

|

adthatthisreturisdeuderpealtyfperjury |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

affir |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

aturefwerparterrauthrizedfficer |

|

|

|

|

ate |

|

|

||

Titlefauthrizedfficerraetsiiretur

rTual Revd

a

Taxpayer

ttnton tflrsounfltsformonln Vstttpsrgotton

V

U

lstgor

aieadspiritssales

beradltbeveraesales

cthersaleslsalestlistedliearb

rossslslnsn

U stfpersalprpertyperRL

TTdliesdad

U

glutonsls

adadfdiredietsfrhucsuti

bResale

cterstate

dtraizatis

ederaladate

therexetraizatis& rfitsRL

e ieadspiritseceerly |

xxxxx |

fthereductistseparatelylistedabve

ecify____________________________________

Ttaleductisdliesathruhf

tllstrtlngfromlnrrtopgln

a

b

c

d

a

b

c

d

d

e

f

prepareeliragesRernnal

Renliainsarielelineanpageenmpleeall

linesnpageiningeleaneableles

liberagesalesneall salesfrearinanarelaeReslanbsiness esiningansalesempfrma

aWineanspirissales

beranmalberagesales

erallersales

rsssaleslinesabananeneralnisline

ersfangiblepersnalprperprase siefReslanafreefrsesragernsmp inbinissaeringearrsfpersnal prperprasefrresaleansbseqenlsern smebringearraeranbeingsls

inenislineeamnfanerransainsring

earsbjeesalesansea(egelerigas

esefreaingrliginganpraseipan fea

Rlinesananener alnisline

neallsalesaareempfrm

salesa

afereamnfeinsneapprpriaelines

faalegaleinaesnaisnline

enereamnnlinefanpreaespinfe ein

ineenlineanspirisalesfremnf emberareempanallableasaeinfr

gR linesarg fanenereamnnisline

R bralinegfrmlinean

enereamnnislineannlinenpage fe liragesRernnalRenliain

ttt btrs,ctsr

stttpsrtt

|

|

ereamnfrmlinefebafel |

i |

ragesRernnalRenliain |

|

Rlipl |

|

lineimes(anenereamnnisline |

|

R ereamnfsalesanse |

|

apaifreperinarrgember |

|

ereamnf |

|

prepaisalesangareespraseringeperi |

|

narrgember |

|

R R R RR |

|

ereamnfeibalan(ifanperlinef |

r |

nalRenliainRernrm |

|

ere |

|

amnfsalesapaianersaeniemsine |

in |

eleline |

|

linesrganener |

e |

amnere |

|

inesleqallineflineisgreaer |

anline |

ereisabalaneRemipaneisinf |

|

ainalngienalRenliainfrm |

|

flineislessanlineisiseamn |

rpai |

rpanssallbeappliesbseqenfilingperis |

f |

isreiarefninseafilea“laimfrRefn |

” |

frmierenliain |

|

ffilerliragesRernnal |

|

Renliainaillneesbmiaseparae |

|

paper“laimfrRefn”frm |

|

enebmfpage |

isse |

inmsbempleeansignebanarizener |

|

parnerrffir |

|

lfrmsnbefnneisinfain’sebsie |

|

ttptrtrssscs |

|

ilrmpleeliragesRernnal |

|

Renliainfrm |

|

R isinfain |

|

neapilill |

|

enR |

|

nassing |

|

rfaeassingina( |

|