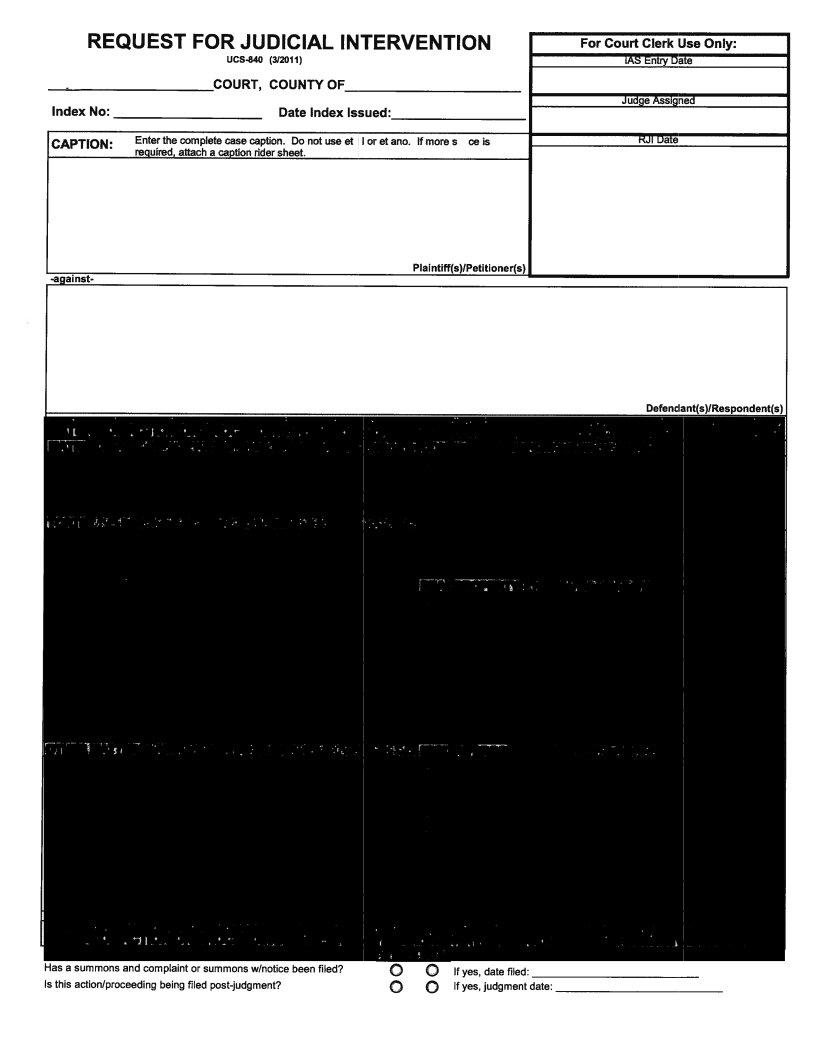

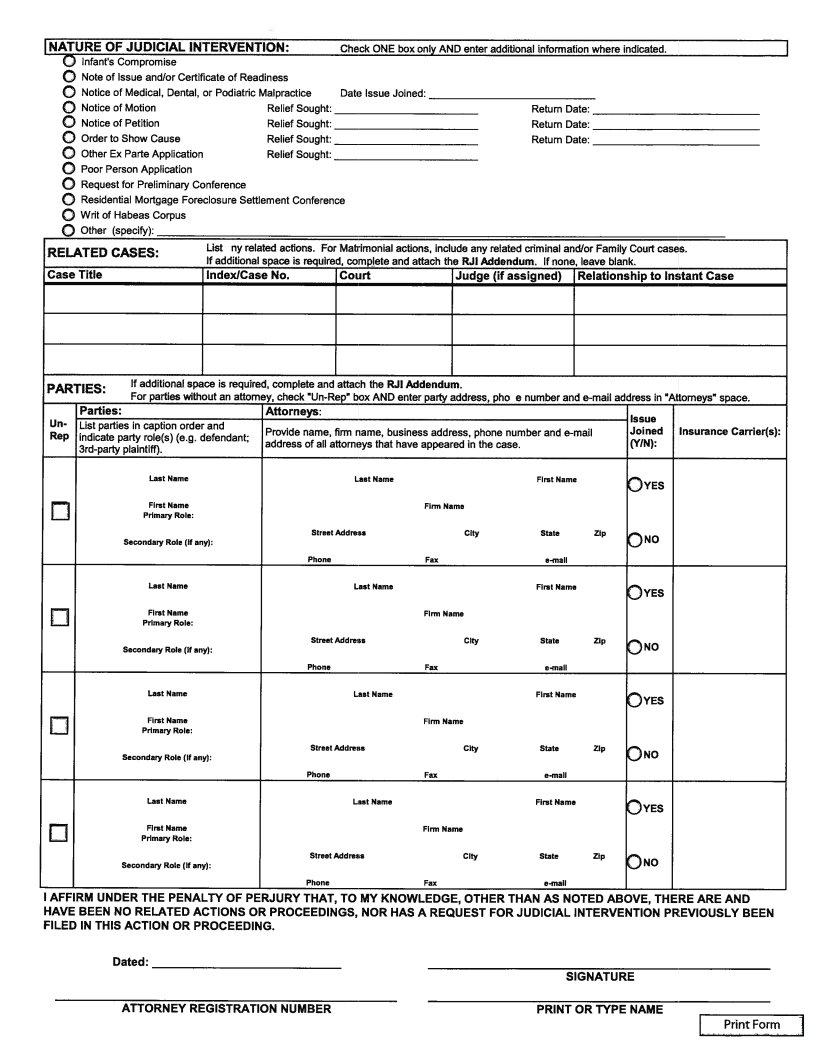

UCS 840 is a form that is used to report certain types of payments made to corporations. The form is used to report the amount of the payment, and the reason for the payment. The form must be filed by the corporation that received the payment, and must be filed on or before the due date for the income tax return for the year in which the payment was made. The use of UCS 840 will help ensure that all payments made to corporations are reported, and will allow for an accurate portrayal of a company's financial health. The form should be filled out carefully, and any questions should be directed to a qualified accountant or attorney.

| Question | Answer |

|---|---|

| Form Name | Form Ucs 840 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Alabama, IAS, UCS-840, NYCRR |