When you would like to fill out form 3552 ftb, you won't need to install any programs - just try using our PDF editor. To maintain our tool on the cutting edge of practicality, we aim to put into action user-driven capabilities and enhancements regularly. We're routinely grateful for any suggestions - play a pivotal role in revampimg how you work with PDF files. All it takes is just a few basic steps:

Step 1: First of all, open the pdf tool by clicking the "Get Form Button" in the top section of this webpage.

Step 2: This tool will allow you to customize your PDF document in various ways. Improve it with your own text, adjust what's originally in the file, and add a signature - all readily available!

Be mindful while filling out this form. Make certain every single field is filled in properly.

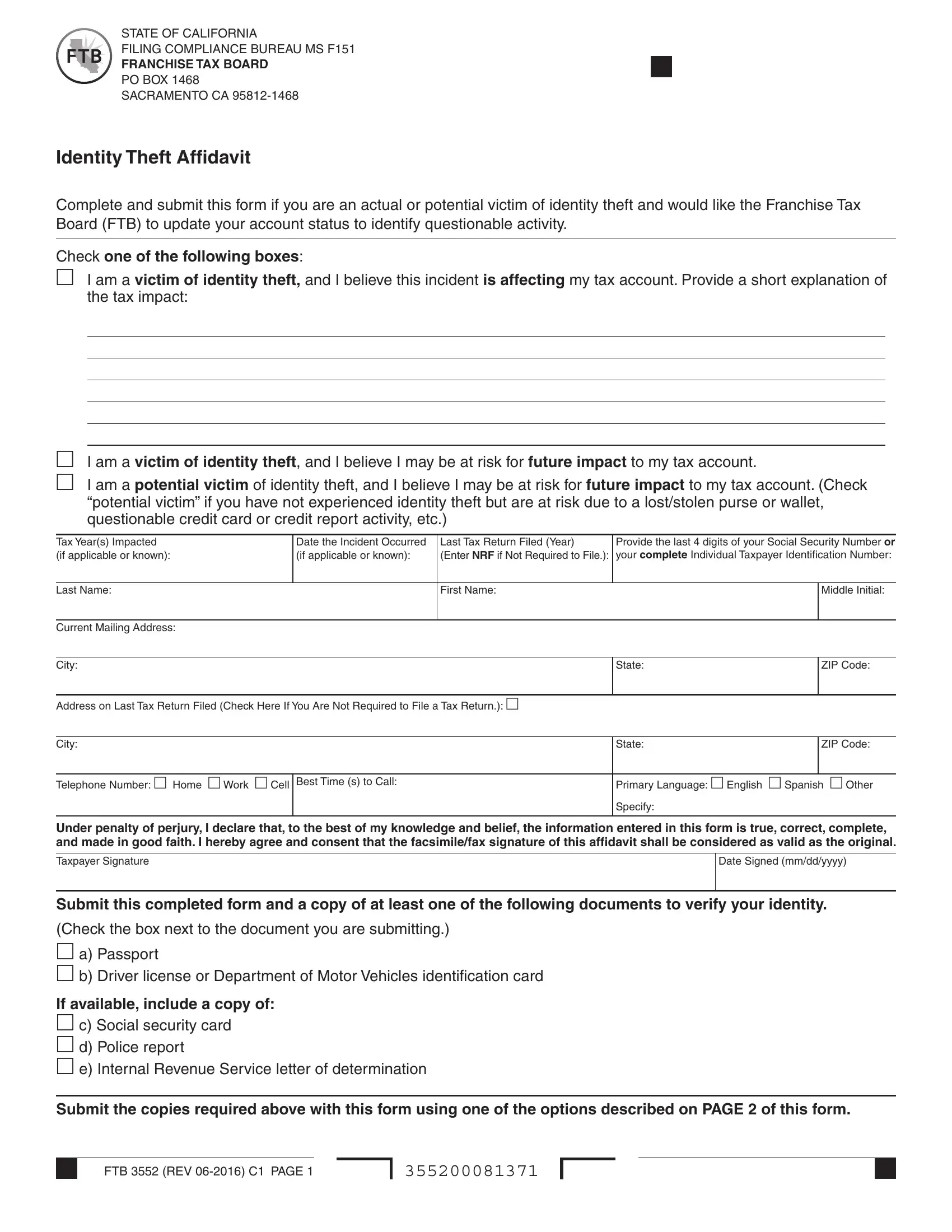

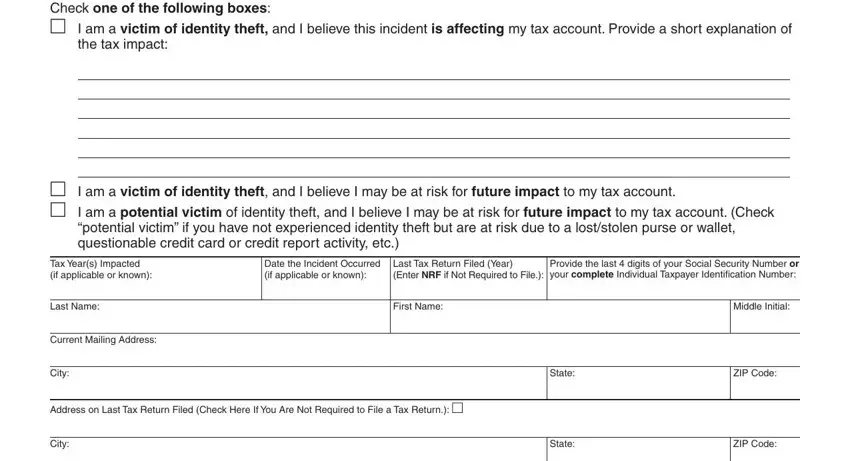

1. The form 3552 ftb will require specific details to be typed in. Be sure that the following fields are complete:

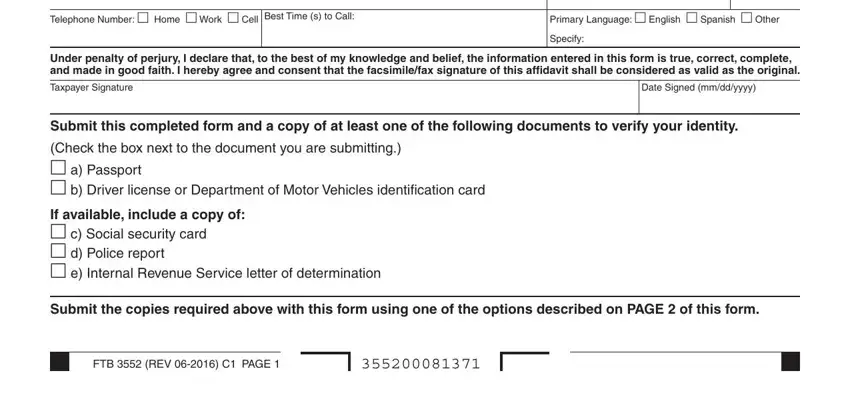

2. Soon after this selection of blanks is done, go to enter the suitable information in all these: Telephone Number Home Work Cell, Primary Language English Spanish, Under penalty of perjury I declare, Taxpayer Signature, Date Signed mmddyyyy, Specify, Submit this completed form and a, Check the box next to the document, If available include a copy of c, Submit the copies required above, and FTB REV C PAGE.

Concerning Under penalty of perjury I declare and Specify, make certain you double-check them in this current part. Those two are thought to be the most significant ones in this form.

Step 3: After you've looked once again at the details in the file's blank fields, click on "Done" to finalize your document creation. Try a free trial subscription with us and acquire instant access to form 3552 ftb - downloadable, emailable, and editable inside your FormsPal cabinet. FormsPal is invested in the personal privacy of all our users; we make sure that all personal information processed by our editor is secure.