The 1040 form is the standard form for U.S. tax returns filed with the Internal Revenue Service (IRS). All individuals and businesses must file a 1040 form, unless they qualify for an exemption. The 1040 form is used to report income, calculate taxes, and claim deductions and credits. In this blog post, we will provide an overview of the 1040 form and its various sections. We will also provide tips on how to complete the form correctly. Stay tuned for our next blog post, which will feature a detailed walk-through of the 1040 form.

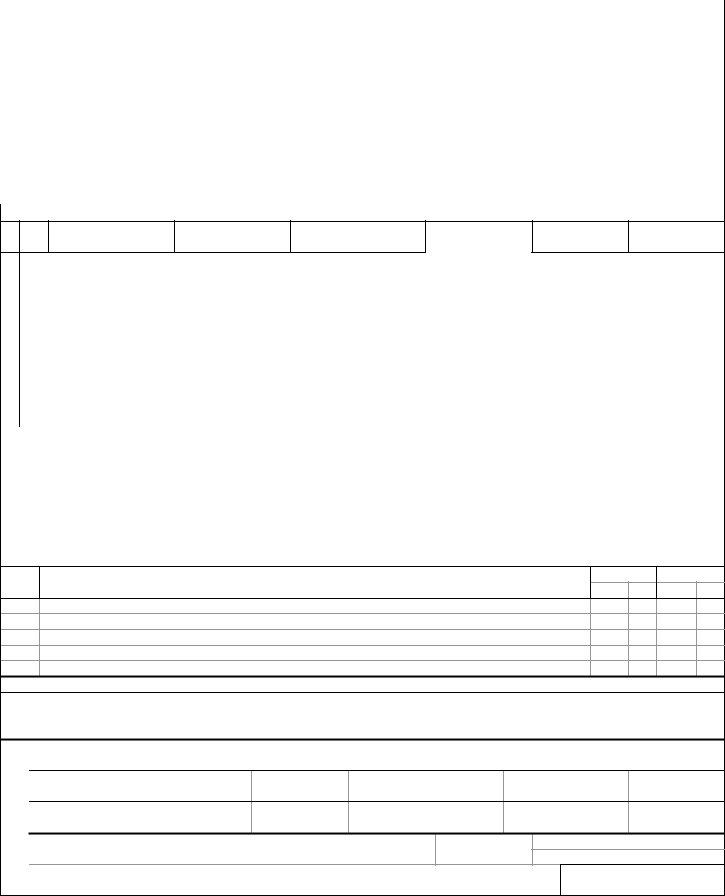

| Question | Answer |

|---|---|

| Form Name | Gr 1040 Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | grand rapids locat tax form, 2019 grand rapids city tax forms, grand rapids city tax forms, grand rapids income tax forms |

|

|

GRAND RAPIDS |

|

2019 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

INDIVIDUAL RETURN DUE APRIL 30, 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Taxpayer's SSN |

|

|

|

|

|

|

Taxpayer's first name |

|

|

|

Initial |

Last name |

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Spouse's SSN |

|

|

|

|

|

|

If joint return spouse's first name |

Initial |

Last name |

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To |

|

|

|

|

|

|

|

|

|||||

Mark (X) box if deceased |

|

|

|

Present home address (Number and street) |

|

|

|

|

|

|

|

Apt. no. |

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Taxpayer |

|

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FILING STATUS |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Enter date of death on page 2, right |

|

Address line 2 (P.O. Box address for mailing use only) |

|

|

|

|

|

|

|

|

|

Single |

|

|

|

Married filing jointly |

||||||||||||||||||||||

side of the signature area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Married filing separately. Enter spouse's |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Mark box (X) below if form attached |

|

City, town or post office |

|

|

|

|

|

|

State |

Zip code |

|

|

|

|

SSN in Spouse's SSN box and Spouse's full |

|||||||||||||||||||||||

|

Federal Form 1310 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

name here. |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Foreign country name |

|

|

Foreign province/county |

|

Foreign postal code |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Supporting Notes and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Statements (Attachment 22) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse's full name if married filing separately |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

ROUND ALL FIGURES TO NEAREST DOLLAR |

|

|

Column A |

|

|

|

|

Column B |

|

|

|

Column C |

||||||||||||||||||||

|

|

INCOME |

|

|

(Drop amounts under $0.50 and increase |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

Federal Return Data |

|

Exclusions/Adjustments |

|

Taxable Income |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

amounts from $.50 to $0.99 to next dollar) |

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

ATTACH |

1. |

Wages, salaries, tips, etc. ( |

1 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

.00 |

|||||||||||||||||||

2. |

Taxable interest |

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

.00 |

|||||||||||

COPY OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAGE 1 OF |

3. |

Ordinary dividends |

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

.00 |

||||||||||

FEDERAL |

4. |

Taxable refunds, credits or offsets of state and local income taxes 4 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

|

NOT TAXABLE |

|||||||||||||||||||

RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Alimony received |

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

.00 |

|||||||||

|

|

6. |

Business income or (loss) (Attach copy of federal Schedule C) |

6 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

.00 |

||||||||||||||||||

|

|

7. |

Capital gain or (loss) |

|

|

Mark if federal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

(Attach copy of fed. Sch. D) |

7a. |

|

Sch. D not required |

7 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

.00 |

|||||||||||||||

|

|

8. |

Other gains or (losses) (Attach copy of federal Form 4797) |

8 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

.00 |

||||||||||||||||||

|

|

9. |

Taxable IRA distributions (Attach copy of Form(s) |

9 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

.00 |

||||||||||||||||||

|

|

10. |

Taxable pensions and annuities (Attach copy of Form(s) |

10 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

.00 |

||||||||||||||||||

|

|

11. |

Rental real estate, royalties, partnerships, S corporations, trusts, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

etc. (Attach copy of federal Schedule E) |

|

|

|

|

|

11 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

.00 |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

12. |

Reserved |

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

ATTACH |

13. |

Farm income or (loss) (Attach copy of federal Schedule F) |

13 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

.00 |

|||||||||||||||||||

14. |

Unemployment compensation |

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

|

NOT TAXABLE |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

FORMS |

15. |

Social security benefits |

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

|

NOT TAXABLE |

|||||||||||

HERE |

16. |

Other income (Attach statement listing type and amount) |

16 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

.00 |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

17. |

|

Total additions (Add lines 2 through 16) |

|

|

|

17 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

.00 |

||||||||||||||

|

|

18. |

|

Total income (Add lines 1 through 16) |

|

|

|

18 |

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

.00 |

.00 |

||||||||||||||

|

|

19. |

|

Total deductions (Subtractions) (Total from page 2, Deductions schedule, line 7) |

|

|

|

|

|

|

|

|

|

|

|

19 |

|

.00 |

||||||||||||||||||||

|

|

20. |

|

Total income after deductions (Subtract line 19 from line 18) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

.00 |

||||||||||||||||

|

|

21. |

Exemptions |

|

|

(Enter the total exemptions, from Form |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

number by $600 and enter on line 21b) |

|

|

|

|

|

|

|

|

|

|

|

21a |

|

|

|

21b |

.00 |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

22. |

|

Total income subject to tax (Subtract line 21b from line 20) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

.00 |

||||||||||||||||

|

|

|

|

|

|

|

|

(Multiply line 22 by Grand Rapids resident tax rate of 1.5% (0.015) or nonresident tax rate of |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

23. |

Tax at {tax rate} |

0.75% (0.0075) and enter tax on line 23b, or if using Schedule TC to compute tax, mark (X) box |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

23a and enter tax from Schedule TC, line 23c) |

|

|

|

|

|

|

|

|

|

|

23a |

|

|

23b |

.00 |

|||||||||||||||

|

|

|

Payments |

|

|

Grand Rapids tax withheld |

Other tax payments (est, extension, |

|

|

Credit for tax paid |

|

Total |

|

|

|

|

|

|

||||||||||||||||||||

|

|

24. |

and |

|

|

|

|

|

|

|

|

cr fwd, partnership & tax option corp) |

|

to another city |

|

payment |

|

|

|

|

|

|

||||||||||||||||

|

|

|

24a |

|

|

|

|

.00 |

|

24b |

|

|

|

.00 |

|

24c |

|

|

|

|

.00 |

|

24d |

.00 |

||||||||||||||

|

|

|

credits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

s & |

|||||||||||||||||||

|

|

25. |

Interest and penalty for: failure to make |

|

|

|

|

|

Interest |

|

|

|

Penalty |

|

Total |

|

|

|

|

|

|

|||||||||||||||||

|

|

|

estimated tax payments; underpayment of |

|

|

25a |

|

|

|

.00 |

|

25b |

|

|

|

|

.00 |

|

interest & |

25c |

.00 |

|||||||||||||||||

|

|

|

estimated tax; or late payment of tax |

|

|

|

|

|

|

|

|

|

|

|

penalty |

|||||||||||||||||||||||

ENCLOSE |

TAX |

|

Amount you owe (Add lines 23b and 25c, and subtract line 24d) MAKE CHECK OR MONEY ORDER |

PAY WITH |

|

|

|

|

|

|

||||||||||||||||||||||||||||

26. PAYABLE TO: CITY OF GRAND RAPIDS, OR TO PAY WITH A DIRECT WITHDRAWAL, mark (X) pay |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

CHECK OR |

DUE |

RETURN |

26 |

|

.00 |

|||||||||||||||||||||||||||||||||

|

tax due, line 31b, and complete lines 31c, d & e) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

MONEY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

ORDER |

OVERPAYMENT 27. |

Tax overpayment (Subtract lines 23b and 25c from line 24d; choose overpayment options on lines 28 - 30) |

27 |

|

.00 |

|||||||||||||||||||||||||||||||||

|

|

28. |

Amount of |

|

Flags for Veterans graves in GR |

|

Grand Rapids Childrens Fund |

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

||||||||||||||||

|

|

overpayment |

|

|

|

|

.00 |

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

donation |

|

|

.00 |

||||||||||||

|

|

|

donated |

|

28a |

|

|

|

|

|

28b |

|

|

|

28c |

|

|

|

|

|

|

|

s |

28d |

||||||||||||||

|

|

29. |

Amount of overpayment credited forward to 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

Amount of credit to 2020 >> |

29 |

|

.00 |

|||||||||||||||||||

|

|

30. |

Amount of overpayment refunded (Line 27 less lines 28d and 29) (For refund to be directly deposited to |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

your bank account, mark refund box, line 31a, and complete line 31 c, d & e) |

|

|

|

|

|

Refund amount >> |

30 |

|

.00 |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

31a |

|

Refund |

|

|

|

31c |

Routing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Direct deposit refund |

|

(direct deposit) |

number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

31. |

(Mark (X) box 31a and |

31b |

|

Pay tax due |

31d |

Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

complete lines 31c, 31d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

and 31e) |

|

|

|

|

|

|

(direct withdrawal) |

|

number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31e |

Account Type: |

|

|

Checking |

|

Savings |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAIL REFUND & CREDIT FORWARD RETURNS TO: GRAND RAPIDS INCOME TAX DEPT, PO BOX 106, GRAND RAPIDS, MI

MAIL TAX DUE & OTHER RETURNS TO: GRAND RAPIDS INCOME TAX DEPARTMENT, PO BOX 107, GRAND RAPIDS, MI

|

Taxpayer's name |

|

|

|

|

|

Taxpayer's SSN |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXEMPTIONS |

|

|

|

|

|

Date of birth (mm/dd/yyyy) |

|

|

Regular |

65 or over |

Blind |

|

|

|

|

|

|

|

|||||||

SCHEDULE |

1a. You |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1e. |

Enter the number of |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

boxes checked on |

|

|||||||

|

|

|

1b. Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

lines 1a and 1b |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1d. |

List Dependents |

1c. |

|

|

|

Check box if you can be claimed as a dependent on another person's tax return |

|

|

|

|

|

|

|

|

|||||||||||

# |

|

First Name |

|

|

|

|

|

Last Name |

|

Social Security Number |

|

Relationship |

|

Date of Birth |

|

1f. |

Enter number of |

|

|||||||

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

dependent children |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

listed on line 1d |

|

|

2. |

|

|

|

|

|

|

` |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1g. |

Enter number of other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

dependents listed on |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

line 1d |

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1h. |

Total exemptions (Add |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

lines 1e, 1f and 1g; |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

enter here and also on |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

page 1, line 21a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXCLUDED WAGES AND TAX WITHHELD SCHEDULE (See instructions. Resident wages generally not excluded)

Col. A

T or S

COLUMN B

SOCIAL SECURITY NUMBER

(Form

COLUMN C

EMPLOYER'S ID NUMBER

(Form

COLUMN D

EXCLUDED WAGES

(Attach Excluded Wages Sch)

COLUMN E

GRR TAX WITHHELD

(Form

COLUMN F

LOCALITY NAME (Form

1. |

|

|

.00 |

|

.00 |

|

|

|

2. |

|

|

.00 |

|

.00 |

|

|

|

3. |

|

|

.00 |

|

.00 |

|

|

|

4. |

|

|

.00 |

|

.00 |

|

|

|

5. |

|

|

.00 |

|

.00 |

|

|

|

6. |

|

|

.00 |

|

.00 |

|

|

|

7. |

|

|

.00 |

|

.00 |

|

|

|

8. |

|

|

.00 |

|

.00 |

|

|

|

9. |

|

|

.00 |

|

.00 |

|

|

|

10. |

|

|

.00 |

|

.00 |

|

|

|

|

11. Totals (Enter here and on page 1; |

.00 |

<< Enter on pg 1,ln 1, col B |

.00 |

<< Enter on pg 1, ln 24a |

|

||

DEDUCTIONS SCHEDULE (See instructions; deductions allocated on the same basis as related income) |

|

DEDUCTIONS |

|

1. |

IRA deduction (Attach copy of page 1 of federal return & evidence of payment) |

1 |

.00 |

2. |

2 |

.00 |

|

3. |

Employee business expenses (See instructions and attach deduction worksheet) |

3 |

.00 |

4. |

Moving expenses (Into Grand Rapids area only) (Attach copy of federal Form 3903) |

4 |

.00 |

5. |

Alimony paid (DO NOT INCLUDE CHILD SUPPORT. Attach copy of page 1 of federal return) |

5 |

.00 |

6. |

Renaissance Zone deduction (Attach Schedule RZ OF 1040) |

6 |

.00 |

7. |

Total deductions (Add line 1 through line 6, enter total here and on page 1, line 19) |

7 |

.00 |

ADDRESS SCHEDULE (Where taxpayer (T), spouse (S) or both (B) resided during year and dates of residency)

MARK

T, S, B

List all residence (domicile) addresses (Include city, state & zip code). Start with address used on last year's return. If the address on page 1 of this return is the same as listed on last year's return, print "Same." If no return filed last year, list reason. Continue listing this tax year's residence addresses. If address listed on page 1 of this return is in care of another person, enter current residence (domicile) address.

FROM

MONTH DAY

TO

MONTH DAY

THIRD PARTY DESIGNEE

Do you want to allow another person to discuss this return with the Income Tax Office? |

|

Yes, complete the following |

|

No |

|||

|

|

|

|

|

|

|

|

Designee's |

|

|

Phone |

|

|

Personal identification |

|

name |

|

|

No. |

|

|

number (PIN) |

|

|

|

|

|

|

|

|

|

Under the penalty of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct and complete. If prepared by a person other than taxpayer, the preparer's declaration is based on all information of which preparer has any knowledge.

SIGN TAXPAYER'S SIGNATURE - If joint return, both spouses must sign

HERE

===>

Date (MM/DD/YY)

Taxpayer's occupation

Daytime phone number

If deceased, date of death

SPOUSE'S SIGNATURE

Date (MM/DD/YY)

Spouse's occupation

Daytime phone number

If deceased, date of death

PREPARER'S |

SIGNATURE |

SIGNATURE OF PREPARER OTHER THAN TAXPAYER

FIRM'S NAME (or yours if

Date (MM/DD/YY)

PTIN, EIN or SSN

Preparer's phone no.

NACTP |

GRR19 |

software |

|

number |

|

Revised: 09/19/2016

Taxpayer's name

Taxpayer's SSN

2019 GRAND RAPIDS

SCHEDULE TC, |

ATTACHMENT 1 |

A |

Revised 09/30/2019 |

1.Box A to report dates of residency of the taxpayer and spouse during the tax year

2.Box B to report the former address of the taxpayer and spouse

3.Column A to report all income from their federal income tax return

4.Column B to report all income taxable on their federal return that is not taxable to Grand Rapids

5.Column C to report income taxable as a resident and compute tax due on this income at the resident tax rate

6.Column D to report income taxable as a nonresident and compute tax due on this income at the nonresident tax rate

A. |

From |

|

To |

|

|

B. |

||||||||||||||

Taxpayer |

|

|

|

|

|

|

|

|

|

|

Taxpayer |

|

|

|

|

|

||||

Spouse |

|

|

|

|

|

|

|

|

|

|

Spouse |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

Column A |

|

|

Column B |

|

Column C |

|

Column D |

||||

INCOME |

|

|

|

|

|

|

Federal Return Data |

|

Exclusions and Adjustments |

Taxable |

|

Taxable |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Resident Income |

|

Nonresident Income |

|

1. |

Wages, salaries, tips, etc. (Attach Form(s) |

1 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

|||||

2. |

Taxable interest |

|

|

|

2 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

NOT TAXABLE |

|||

3. |

Ordinary dividends |

|

|

|

3 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

NOT TAXABLE |

|||

4. |

Taxable refunds, credits or offsets |

|

4 |

|

|

|

.00 |

|

|

|

|

.00 |

NOT APPLICABLE |

|

NOT TAXABLE |

|||||

5. |

Alimony received |

|

|

|

5 |

|

|

|

|

|

|

|

|

.00 |

|

.00 |

.00 |

|

||

6. |

Business income or (loss) (Att. copy of fed. Sch. C) |

6 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

|||||

|

Capital gain or (loss) |

|

|

Mark if Sch. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7. |

7a |

|

D not |

7b |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

|||

|

(Att. copy of Sch. D) |

|

|

required |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Other gains or (losses) |

(Att. copy of Form 4797) |

8 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

||||

9. |

Taxable IRA distributions |

|

9 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

||||

10. |

Taxable pensions and annuities (Att. Form |

10 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

|||||

11. |

Rental real estate, royalties, partnerships, S corps., |

11 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

|||||

|

trusts, etc. (Attach copy of fed. Sch. E) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Reserved |

|

|

|

|

12 |

|

|

|

|

|

|

|

|

.00 |

|

.00 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

13. |

Farm income or (loss) |

(Att. copy of fed. Sch. F) |

13 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

||||

14. |

Unemployment compensation |

|

14 |

|

|

|

.00 |

|

|

|

|

.00 |

NOT APPLICABLE |

|

NOT TAXABLE |

|||||

15. |

Social security benefits |

|

15 |

|

|

|

.00 |

|

|

|

|

.00 |

NOT APPLICABLE |

|

NOT TAXABLE |

|||||

16. |

Other income (Att. statement listing type and amt) |

16 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

|||||

17. |

|

Total additions |

(Add lines 2 through 16) |

17 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

|||

18. |

|

Total income (Add lines 1 through 16) |

18 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

||||

DEDUCTIONS SCHEDULE See instructions. Deductions must be allocated on the same basis as related income. |

|

|

|

|

||||||||||||||||

|

1. |

IRA deduction (Attach copy of page 1 of |

1 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

||||

|

|

federal return & evidence of payment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

2. |

2 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

|||||

|

|

plans (Attach copy of page 1 of fed. return) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

3. |

Employee business expenses (See |

3 |

|

|

|

|

|

|

|

|

|

|

.00 |

.00 |

|

||||

|

|

instructions & att. deduction worksheet) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

4. |

Moving expenses (Into Grand Rapids area |

4 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

||||

|

|

only) |

(Attach copy of federal Form 3903) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

5. |

Alimony paid (DO NOT INCLUDE CHILD |

5 |

|

|

|

.00 |

|

|

|

|

.00 |

|

.00 |

.00 |

|

||||

|

|

SUPPORT. (Att. copy of page 1 of fed. return) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

6. Renaissance Zone deduction (Att. Sch. RZ) |

6 |

|

|

|

|

|

|

|

|

|

|

.00 |

.00 |

|

|||||

19. |

|

Total deductions (Add lines 1 through 6) |

|

|

|

|

|

|

|

|

|

19 |

|

.00 |

.00 |

|

||||

20a. |

Total income after deductions (Subtract line 19 from line 18) |

|

|

|

|

|

20a |

|

.00 |

.00 |

|

|||||||||

20b. Losses transferred between columns C and D (If line 20a is a loss in either column C or D, see instructions) |

20b |

|

.00 |

.00 |

|

|||||||||||||||

20c. Total income after adjustment (Line 20a less line 20b) |

|

|

|

|

|

|

|

20c |

|

.00 |

.00 |

|

||||||||

21. |

Exemptions |

(Enter the number of exemptions from Form |

21a |

|

21b |

|

.00 |

|

|

|||||||||||

|

|

|

multiply line 21a by $600; and enter on line 21b) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

(If the amount on line 21b exceeds the amount of resident income on line 20c, enter |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

21c |

|

|

.00 |

|

||||||||||

|

|

|

unused portion on line 21c) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

22a. |

Total income subject to tax as a resident (Subtract line 21b from line 20c; if zero or less,enter zero) |

22a |

|

.00 |

|

|

||||||||||||||

22b. |

Total income subject to tax as a nonresident (Subtract line 21c from line 20c; if zero or less,enter zero) |

22b |

|

|

.00 |

|

||||||||||||||

23a. Tax at resident rate |

|

|

(MULTIPLY LINE 22A BY 1.5% (0.015) THE RESIDENT TAX RATE) |

23a |

|

.00 |

|

|

||||||||||||

23b. Tax at nonresident rate |

(MULTIPLY LINE 22B BY 0.75% (0.0075), THE NONRESIDENT TAX RATE) |

23b |

|

|

.00 |

|

||||||||||||||

23c. Total tax (Add lines 23a and 23b) |

(ENTER HERE AND ON FORM |

|

|

|

23c |

|

.00 |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|