Using PDF documents online is actually surprisingly easy with this PDF tool. You can fill in kra application form pdf here within minutes. FormsPal is committed to providing you the perfect experience with our tool by consistently adding new capabilities and improvements. Our editor has become much more intuitive with the newest updates! Now, editing PDF files is easier and faster than before. With some basic steps, you are able to start your PDF journey:

Step 1: Click on the "Get Form" button above. It is going to open up our tool so that you can begin filling out your form.

Step 2: With our advanced PDF editor, you are able to accomplish more than merely complete blank fields. Edit away and make your documents appear faultless with custom text put in, or adjust the original input to excellence - all comes with the capability to incorporate any type of graphics and sign the document off.

It really is straightforward to complete the pdf following this practical guide! Here is what you need to do:

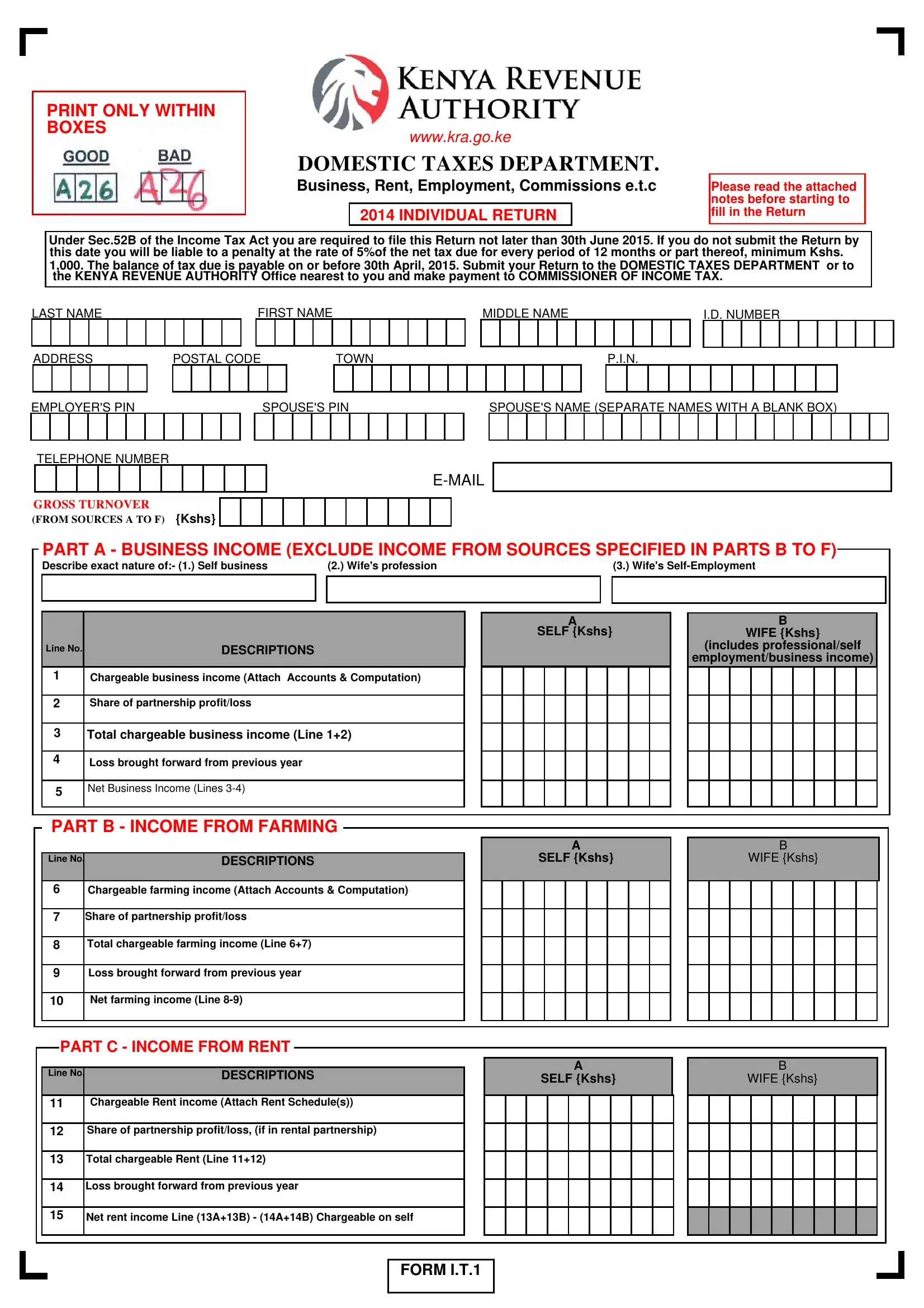

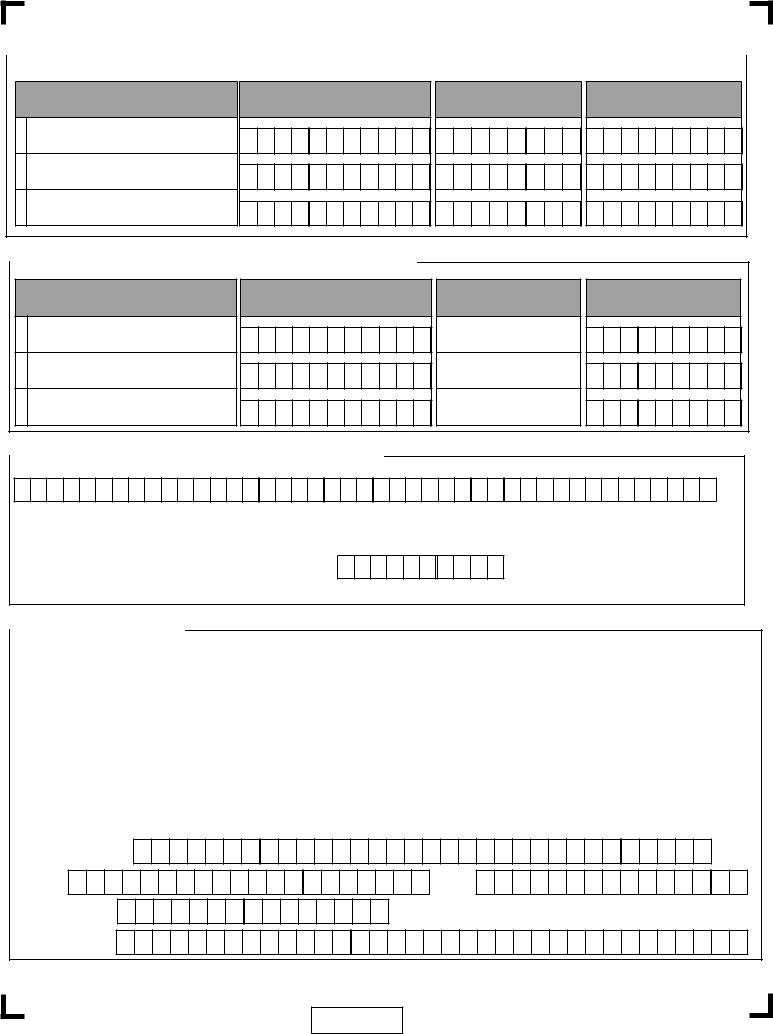

1. To start with, while filling out the kra application form pdf, start with the area that includes the following fields:

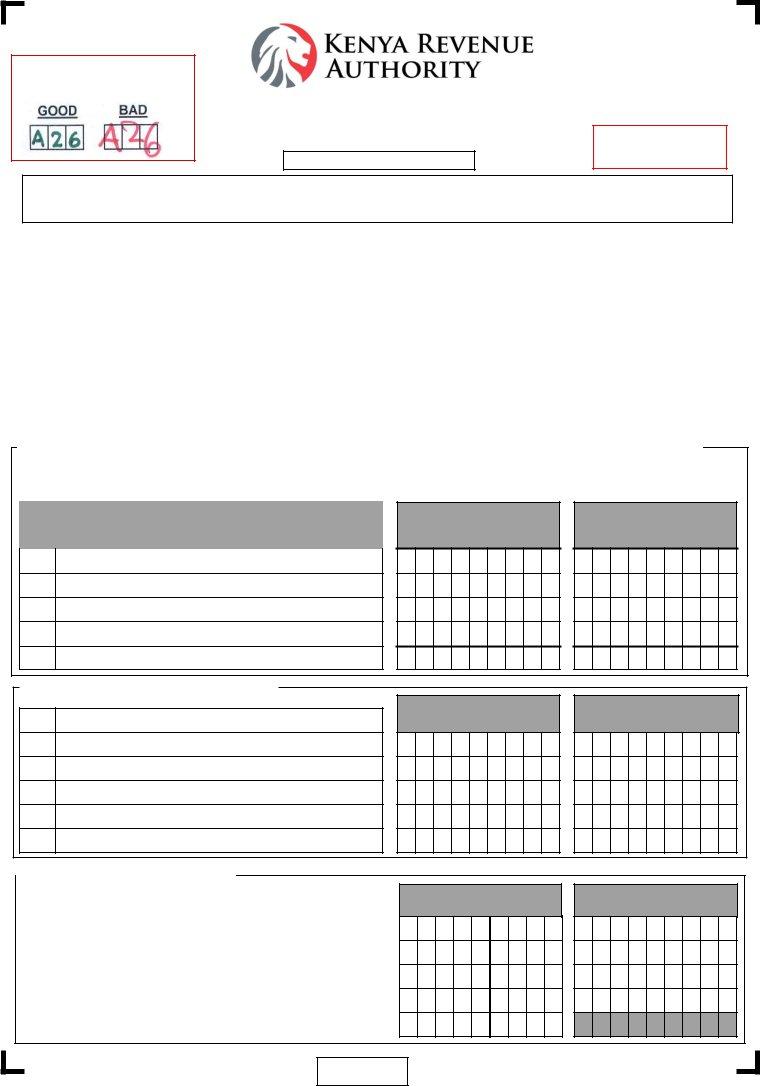

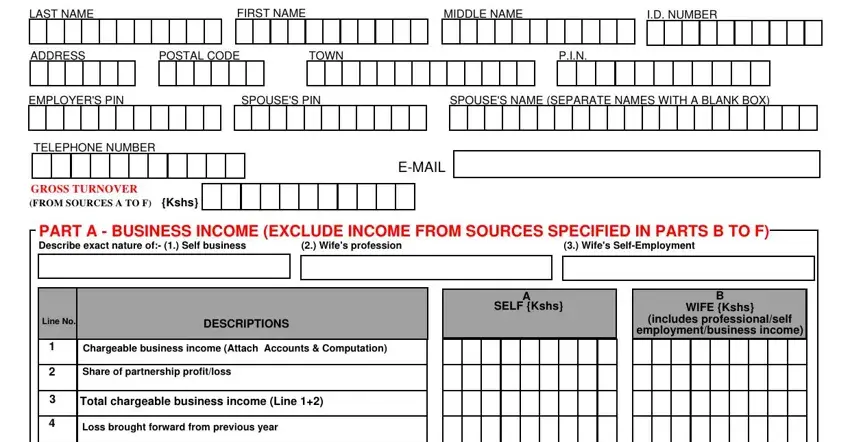

2. The next step would be to fill out the next few fields: SELF Kshs, WIFE Kshs, SELF Kshs, WIFE Kshs, Net Business Income Lines, PART B INCOME FROM FARMING, Line No, DESCRIPTIONS, Chargeable farming income Attach, Share of partnership profitloss, Total chargeable farming income, Loss brought forward from previous, Net farming income Line, PART C INCOME FROM RENT, and Line No.

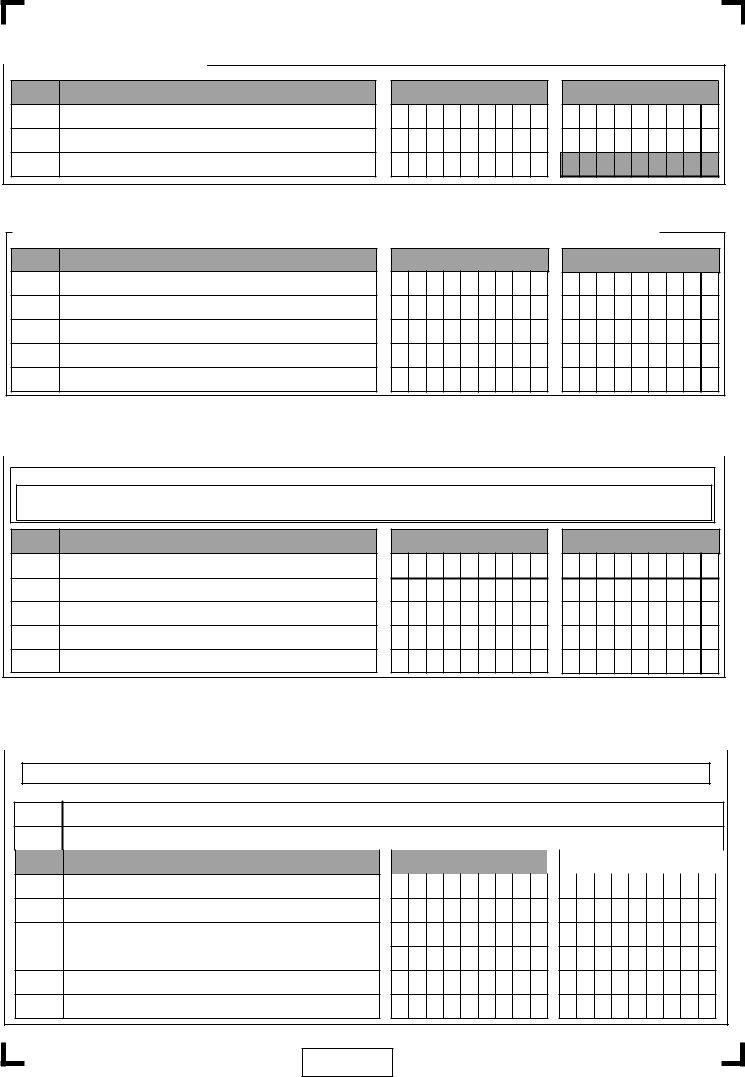

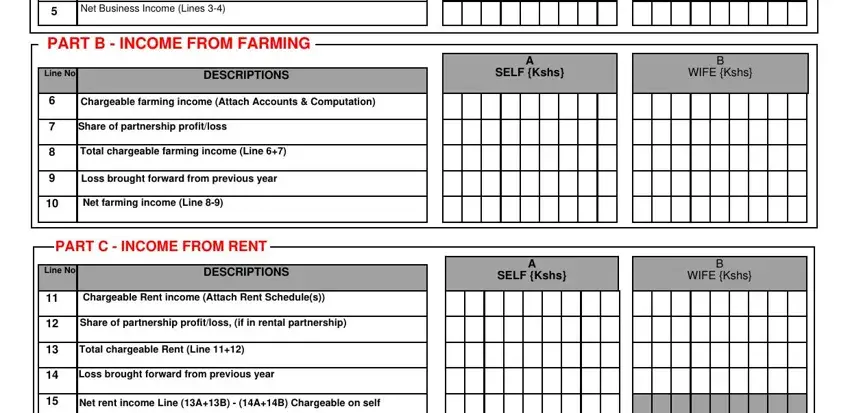

3. The following section is typically fairly simple, Line No, DESCRIPTIONS, A Self Kshs, B Wife Kshs, Nonqualifying Interest income see, Share of partnership interest if, Total chargeable Interest Self, PART E INCOME FROM INSURANCE, Line No, DESCRIPTIONS, A Self Kshs, B Wife Kshs, Chargeable income Attach Accounts, Share of partnership profitloss, and Total chargeable commission Line - every one of these fields has to be filled out here.

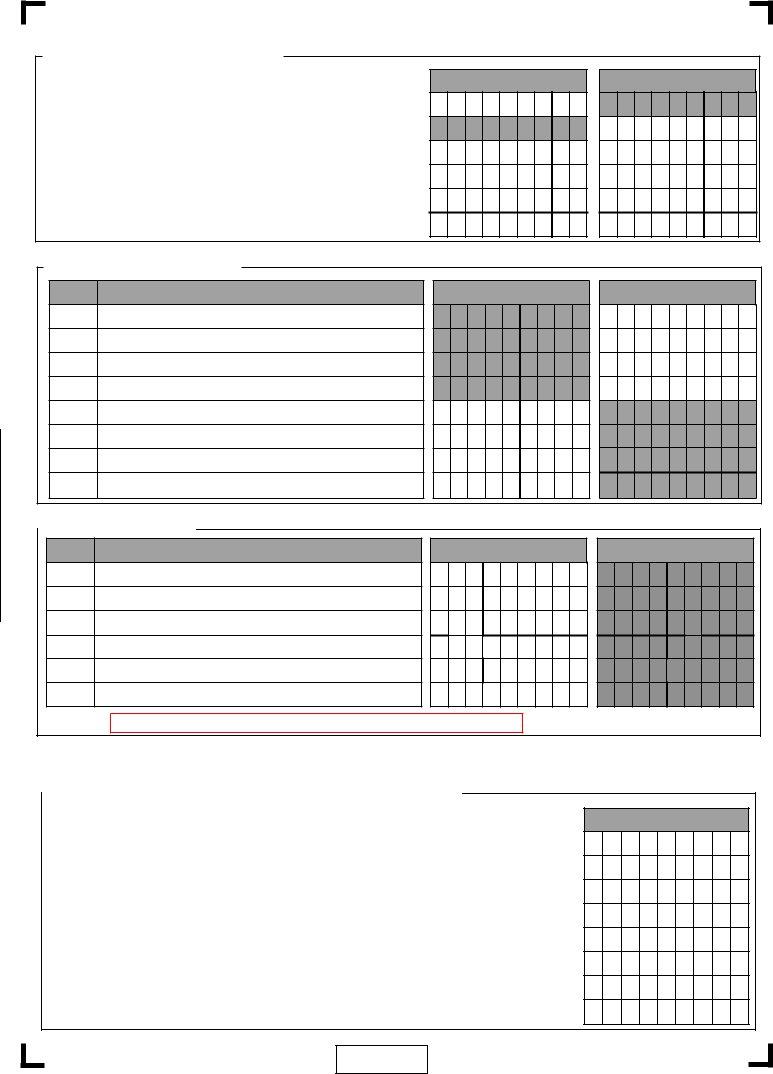

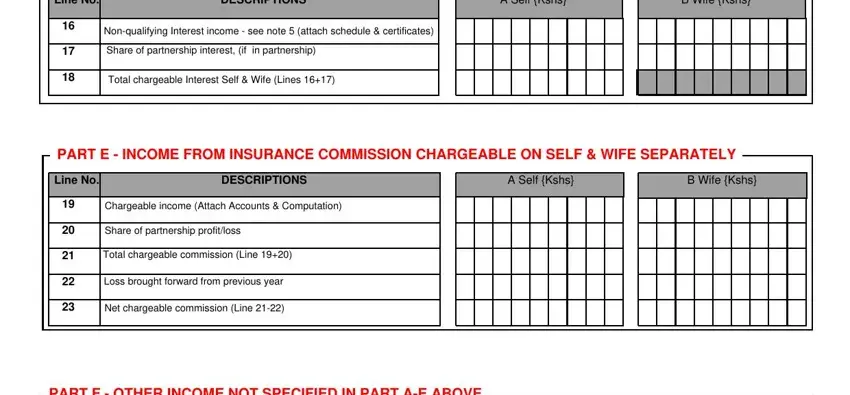

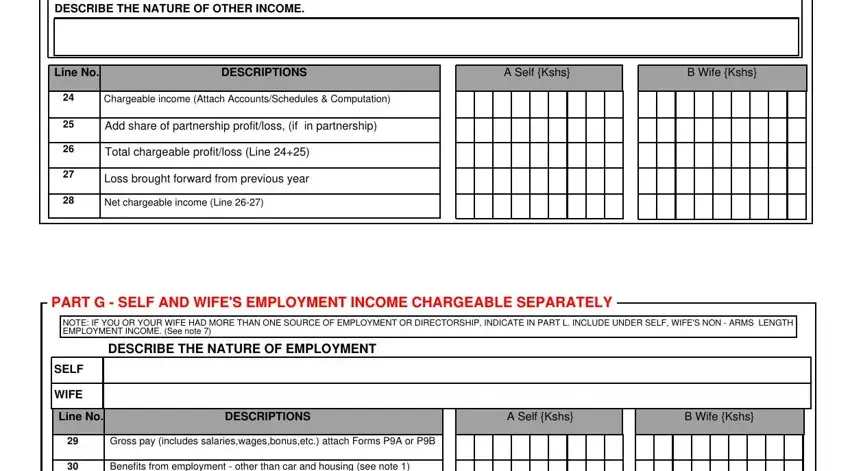

4. This specific part comes with the following empty form fields to complete: DESCRIBE THE NATURE OF OTHER INCOME, Line No, DESCRIPTIONS, A Self Kshs, B Wife Kshs, Chargeable income Attach, Add share of partnership, Total chargeable profitloss Line, Loss brought forward from previous, Net chargeable income Line, PART G SELF AND WIFES EMPLOYMENT, NOTE IF YOU OR YOUR WIFE HAD MORE, DESCRIBE THE NATURE OF EMPLOYMENT, SELF, and WIFE.

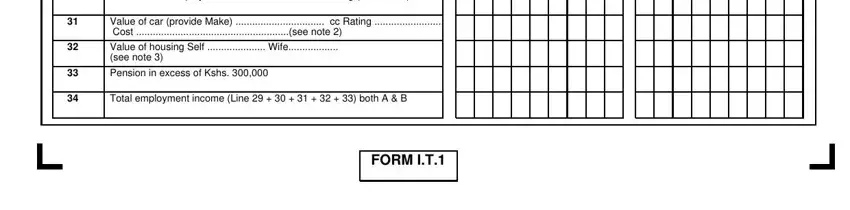

5. To wrap up your document, the particular area features a number of extra fields. Filling in Benefits from employment other, Value of car provide Make cc, Value of housing Self Wife see, Pension in excess of Kshs, Total employment income Line, and FORM IT should conclude everything and you'll be done in no time at all!

People frequently make errors when filling in Value of car provide Make cc in this section. Ensure you read again everything you enter right here.

Step 3: Glance through the information you have typed into the blank fields and press the "Done" button. Right after creating a7-day free trial account here, it will be possible to download kra application form pdf or send it via email right off. The PDF file will also be readily available through your personal account page with all your adjustments. FormsPal is devoted to the personal privacy of all our users; we make certain that all personal information used in our system remains secure.