Any time you would like to fill out Maryland Frorm 510 Form, you won't have to download any kind of programs - simply give a try to our online tool. Our tool is consistently evolving to provide the best user experience possible, and that is because of our resolve for continuous development and listening closely to customer feedback. To begin your journey, go through these basic steps:

Step 1: Just click the "Get Form Button" in the top section of this site to launch our pdf file editor. Here you'll find everything that is needed to work with your document.

Step 2: This tool allows you to work with your PDF file in a range of ways. Change it with your own text, adjust existing content, and put in a signature - all possible in no time!

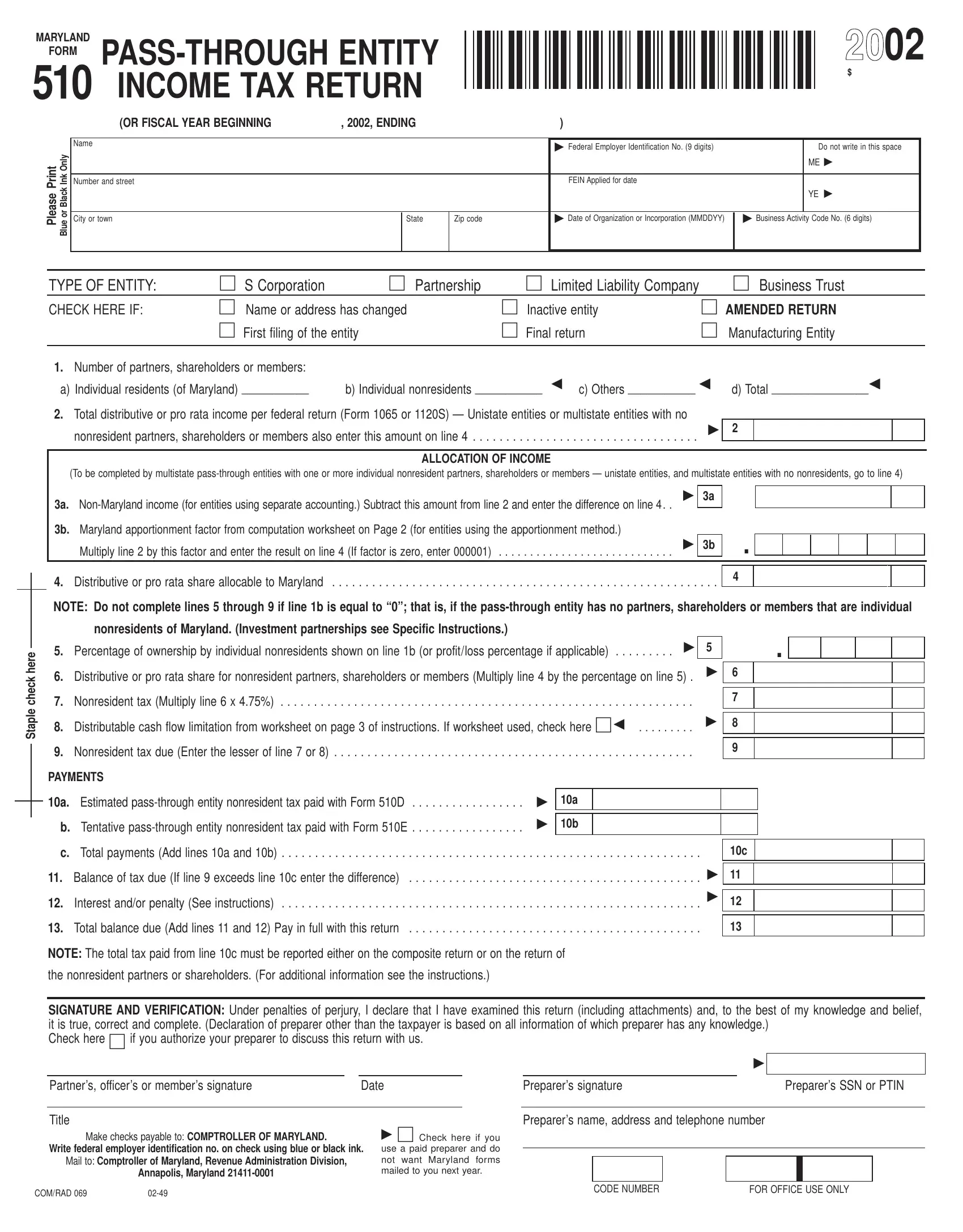

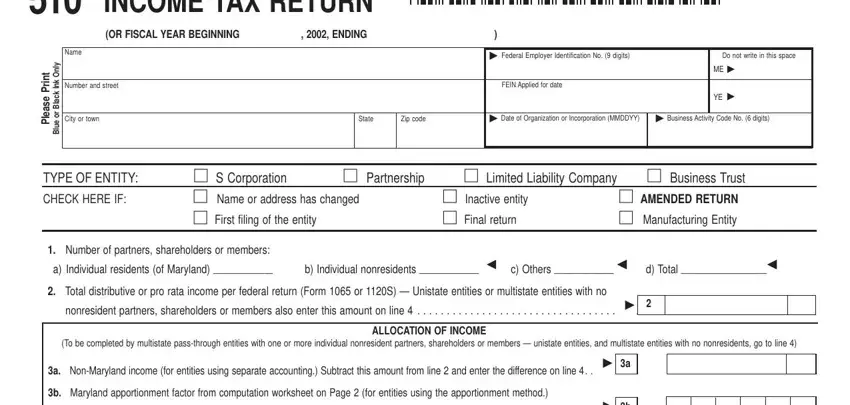

When it comes to fields of this specific form, here's what you need to know:

1. The Maryland Frorm 510 Form necessitates specific information to be inserted. Ensure the subsequent blank fields are filled out:

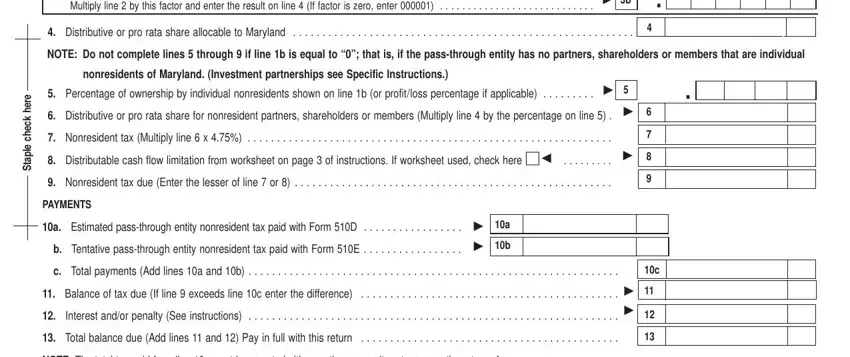

2. Right after performing this step, go on to the subsequent stage and complete all required particulars in all these blank fields - Multiply line by this factor and, Distributive or pro rata share, NOTE Do not complete lines, e r e h, k c e h c e l p a t S, nonresidents of Maryland, Percentage of ownership by, Distributive or pro rata share, Nonresident tax Multiply line x, Nonresident tax due Enter the, PAYMENTS, a Estimated passthrough entity, b Tentative passthrough entity, c Total payments Add lines a and b, and Balance of tax due If line.

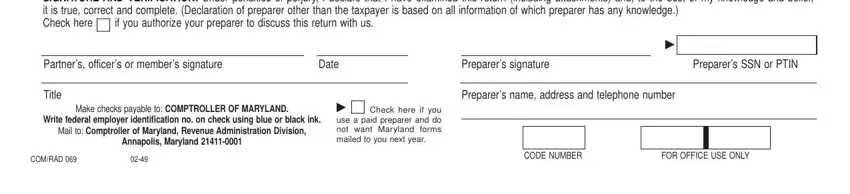

3. The next step should be rather uncomplicated, SIGNATURE AND VERIFICATION Under, Partners officers or members, Date, Preparers signature, Preparers SSN or PTIN, Title, Make checks payable to COMPTROLLER, Write federal employer, Mail to Comptroller of Maryland, Annapolis Maryland, Check here if you, use a paid preparer and do not, Preparers name address and, COMRAD, and CODE NUMBER - all of these empty fields is required to be filled in here.

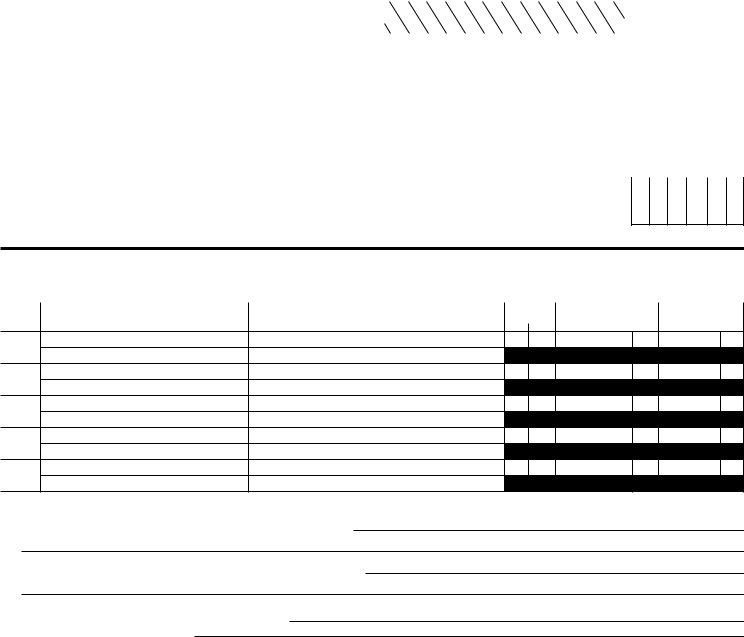

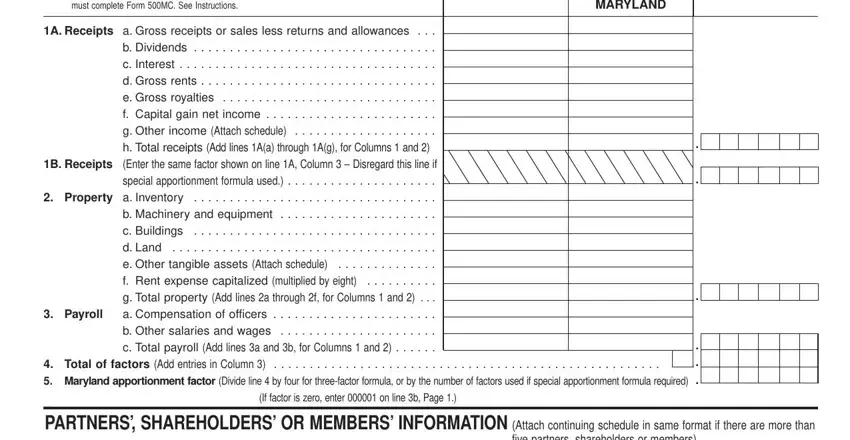

4. The form's fourth paragraph comes with all of the following form blanks to consider: COMPUTATION OF APPORTIONMENT, A Receipts a Gross receipts or, B Receipts Enter the same factor, Payroll, Total of factors Add entries in, If factor is zero enter on line b, MARYLAND, PARTNERS SHAREHOLDERS OR MEMBERS, and five partners shareholders or.

Always be very mindful while filling in Payroll and Total of factors Add entries in, because this is the section in which most people make errors.

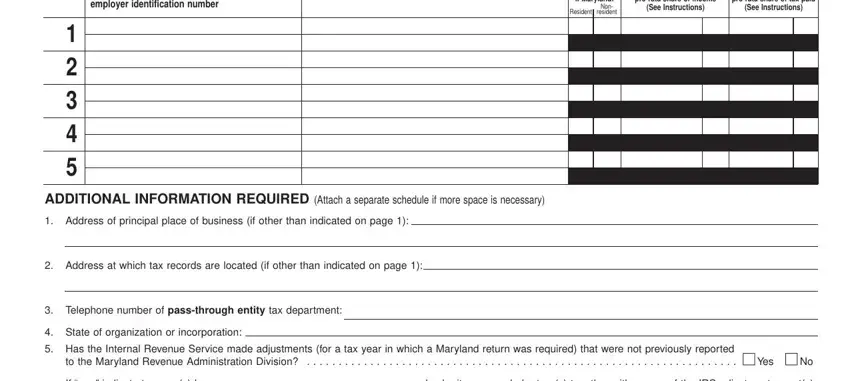

5. As a final point, the following last segment is what you should wrap up before closing the document. The blank fields in this case are the following: Name and social security number or, Check here if Maryland Non, Resident, resident, pro rata share of income, pro rata share of tax paid, See Instructions, See Instructions, ADDITIONAL INFORMATION REQUIRED, Address of principal place of, Address at which tax records are, Telephone number of passthrough, State of organization or, Has the Internal Revenue Service, and to the Maryland Revenue.

Step 3: When you've glanced through the information in the fields, click on "Done" to complete your document creation. Join us now and immediately get access to Maryland Frorm 510 Form, available for download. All modifications you make are saved , allowing you to change the form at a later stage as required. Here at FormsPal.com, we strive to make certain that all of your details are maintained secure.