md form 433a can be filled in online effortlessly. Simply try FormsPal PDF tool to finish the job in a timely fashion. FormsPal development team is always working to expand the tool and make it much better for users with its multiple functions. Enjoy an ever-improving experience now! With a few easy steps, you'll be able to start your PDF journey:

Step 1: Hit the "Get Form" button above on this page to access our PDF tool.

Step 2: As soon as you open the file editor, you will notice the form prepared to be filled in. Besides filling out different fields, you may also do some other actions with the PDF, including writing your own textual content, editing the original text, inserting graphics, signing the PDF, and much more.

This PDF doc will involve specific details; to guarantee accuracy, make sure you consider the guidelines further down:

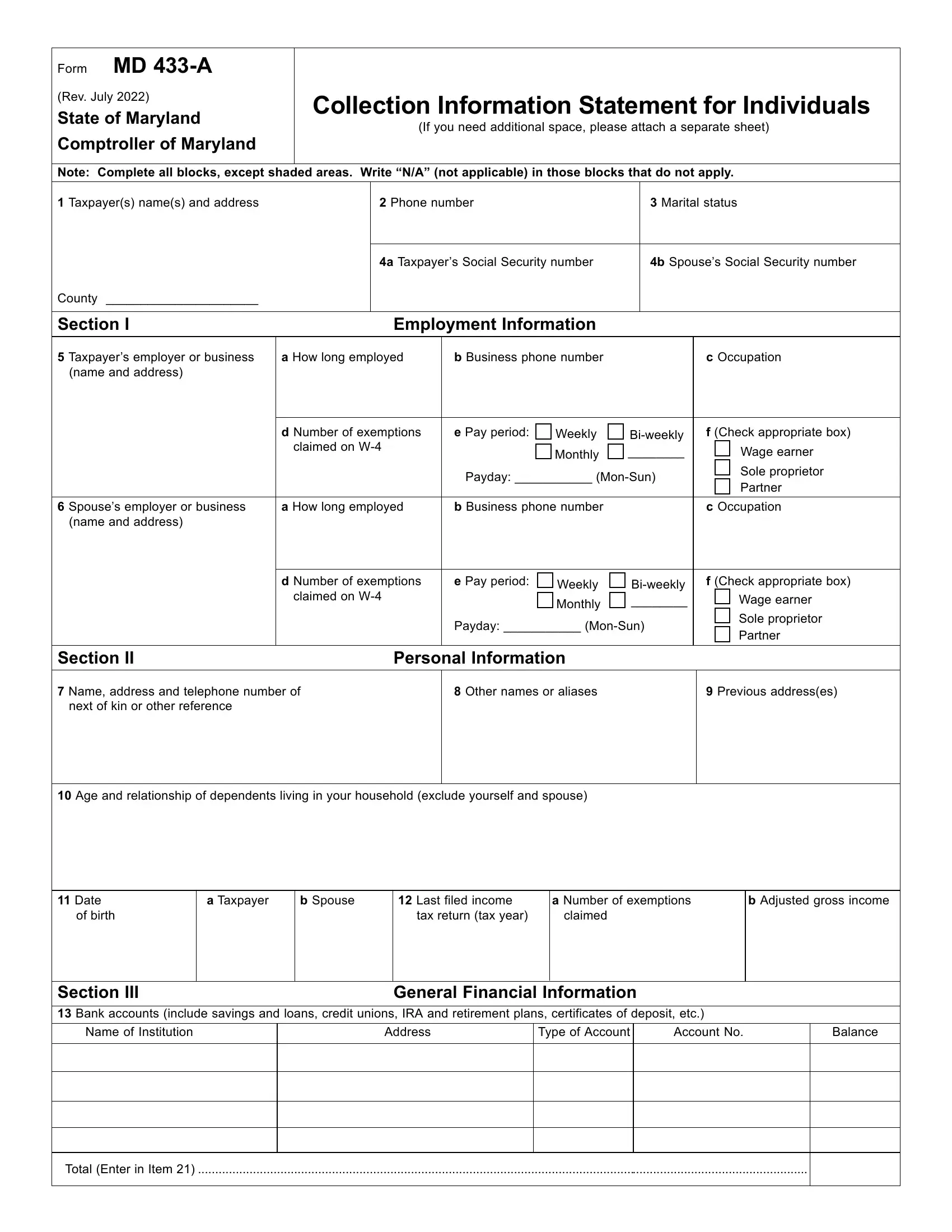

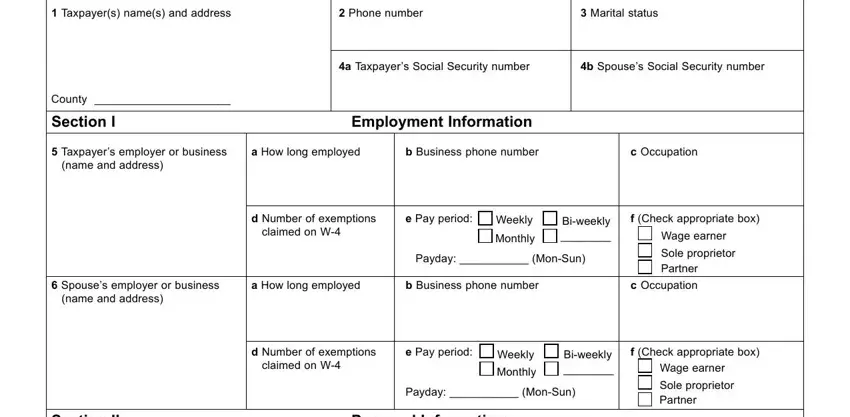

1. To start off, when filling in the md form 433a, start in the form section containing next blanks:

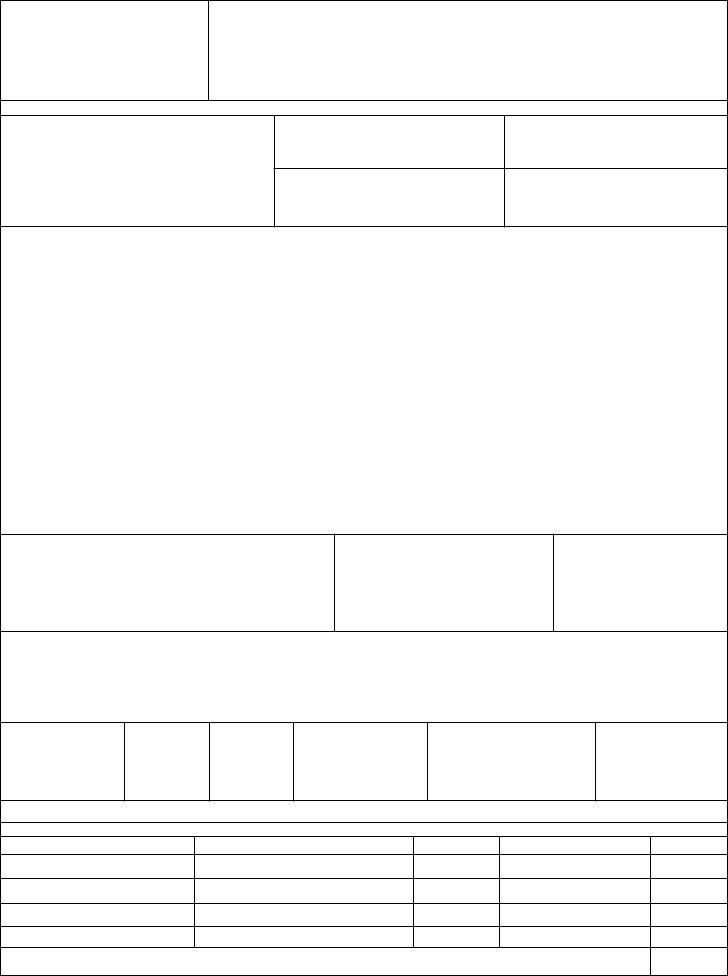

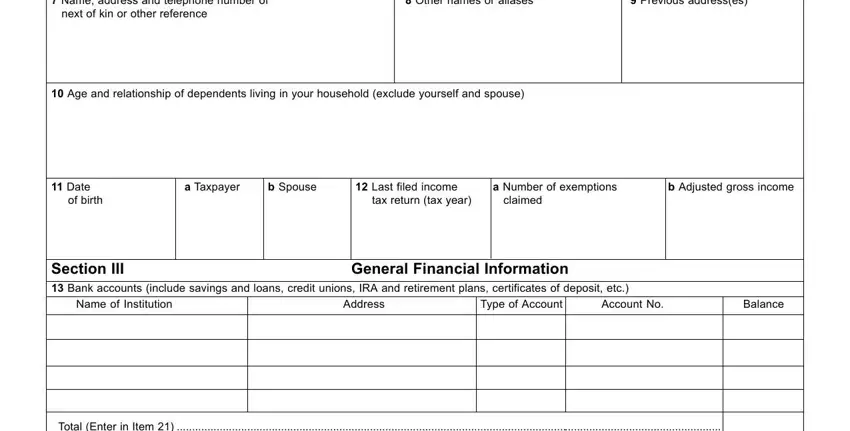

2. After this part is completed, you'll want to put in the essential particulars in Name address and telephone number, Other names or aliases, Previous addresses, Age and relationship of, Date, htrib fo, a Taxpayer, b Spouse, Last filed income, a Number of exemptions, b Adjusted gross income, raey xat nruter xat, demialc, III noitceS Bank accounts include, and noitamrofnI laicnaniF lareneG allowing you to move on further.

Many people often make some mistakes when completing noitamrofnI laicnaniF lareneG in this part. Make sure you double-check whatever you enter right here.

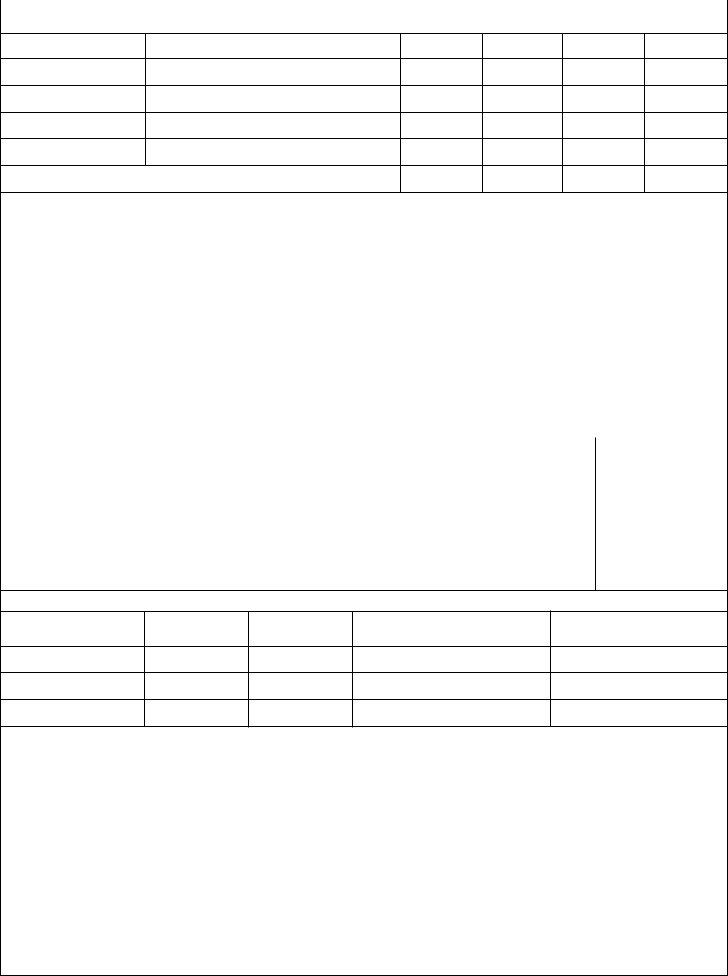

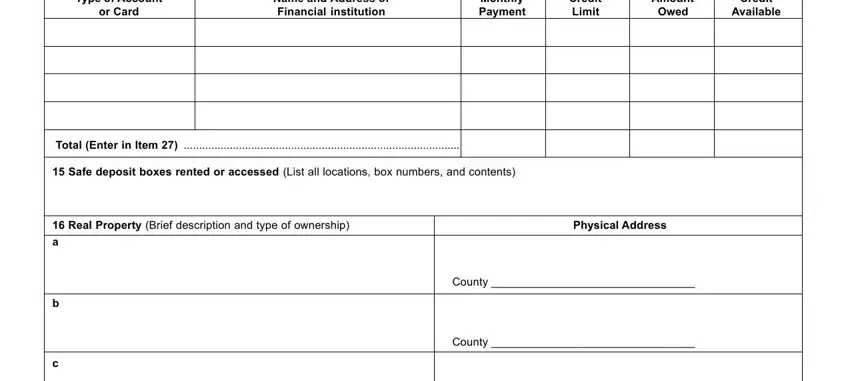

3. Throughout this step, check out Type of Account, draC ro, Name and Address of noitutitsni, Monthly tnemyaP, Credit timiL, Amount, Owed, Credit, Available, Total Enter in Item, Safe deposit boxes rented or, Real Property Brief description, Physical Address, County, and County. Each one of these will need to be completed with greatest accuracy.

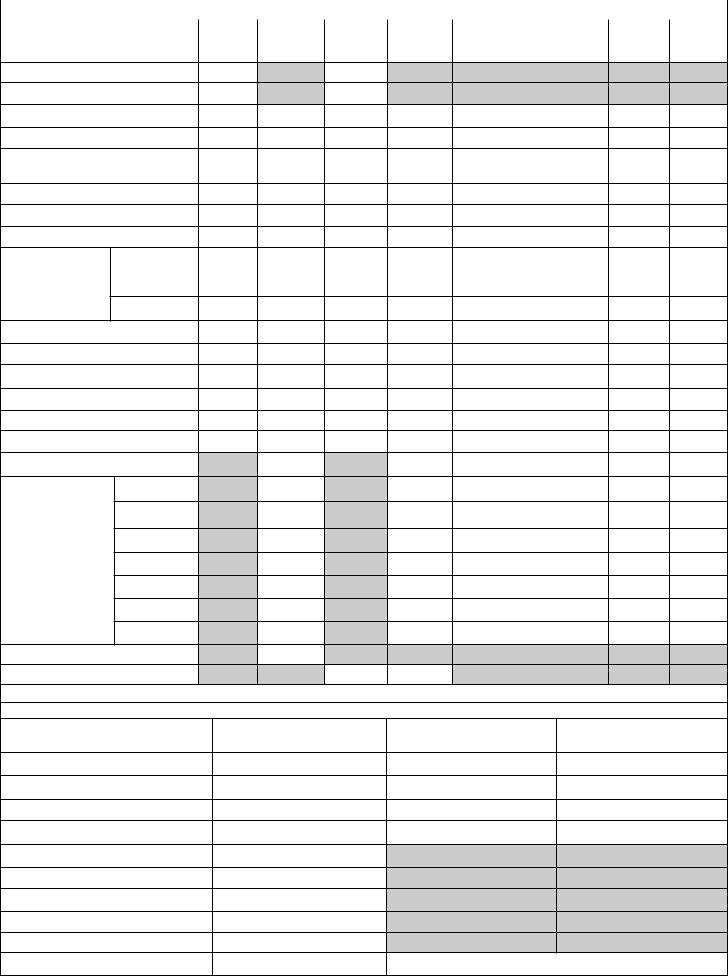

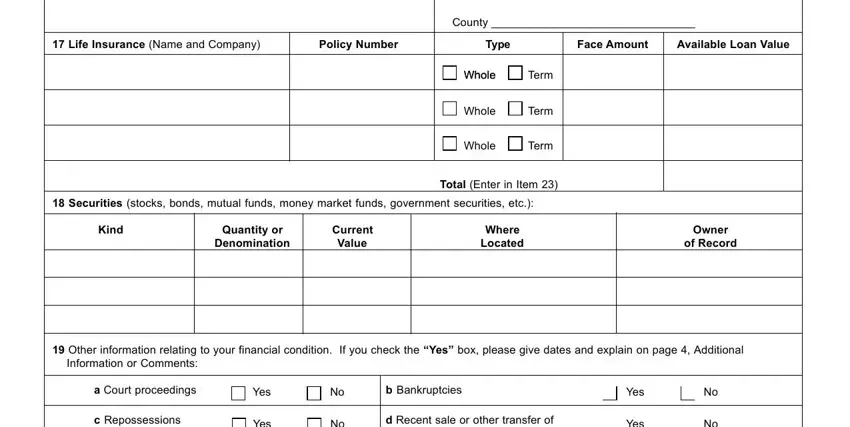

4. Filling in County, Life Insurance Name and Company, Policy Number, Type, Face Amount, Available Loan Value, Whole Whole, Term, Whole, Term, Whole, Term, Total Enter in Item, Securities stocks bonds mutual, and dniK is paramount in this step - make sure to take your time and take a close look at each field!

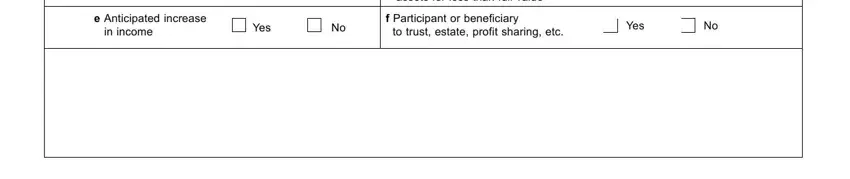

5. The final point to submit this document is pivotal. Be sure to fill in the displayed form fields, and this includes e Anticipated increase, emocni ni, Yes, d Recent sale or other transfer of, f Participant or beneficiary cte, and Yes, prior to finalizing. Failing to accomplish that might generate an incomplete and probably invalid document!

Step 3: You should make sure your information is correct and just click "Done" to progress further. Make a free trial subscription at FormsPal and get direct access to md form 433a - which you are able to then make use of as you want from your personal account page. Whenever you work with FormsPal, you can complete forms without stressing about database incidents or entries being distributed. Our secure software ensures that your private information is stored safe.