Michigan Form 1028 can be completed in no time. Just make use of FormsPal PDF editor to do the job in a timely fashion. In order to make our editor better and more convenient to use, we consistently implement new features, with our users' feedback in mind. Here's what you'll want to do to get going:

Step 1: Press the "Get Form" button above on this webpage to get into our PDF tool.

Step 2: As you access the file editor, you'll see the form made ready to be filled out. Aside from filling in different blank fields, you may also perform some other actions with the PDF, particularly writing your own text, changing the initial textual content, inserting illustrations or photos, affixing your signature to the PDF, and a lot more.

This PDF form will require particular information to be typed in, hence make sure you take the time to provide what is required:

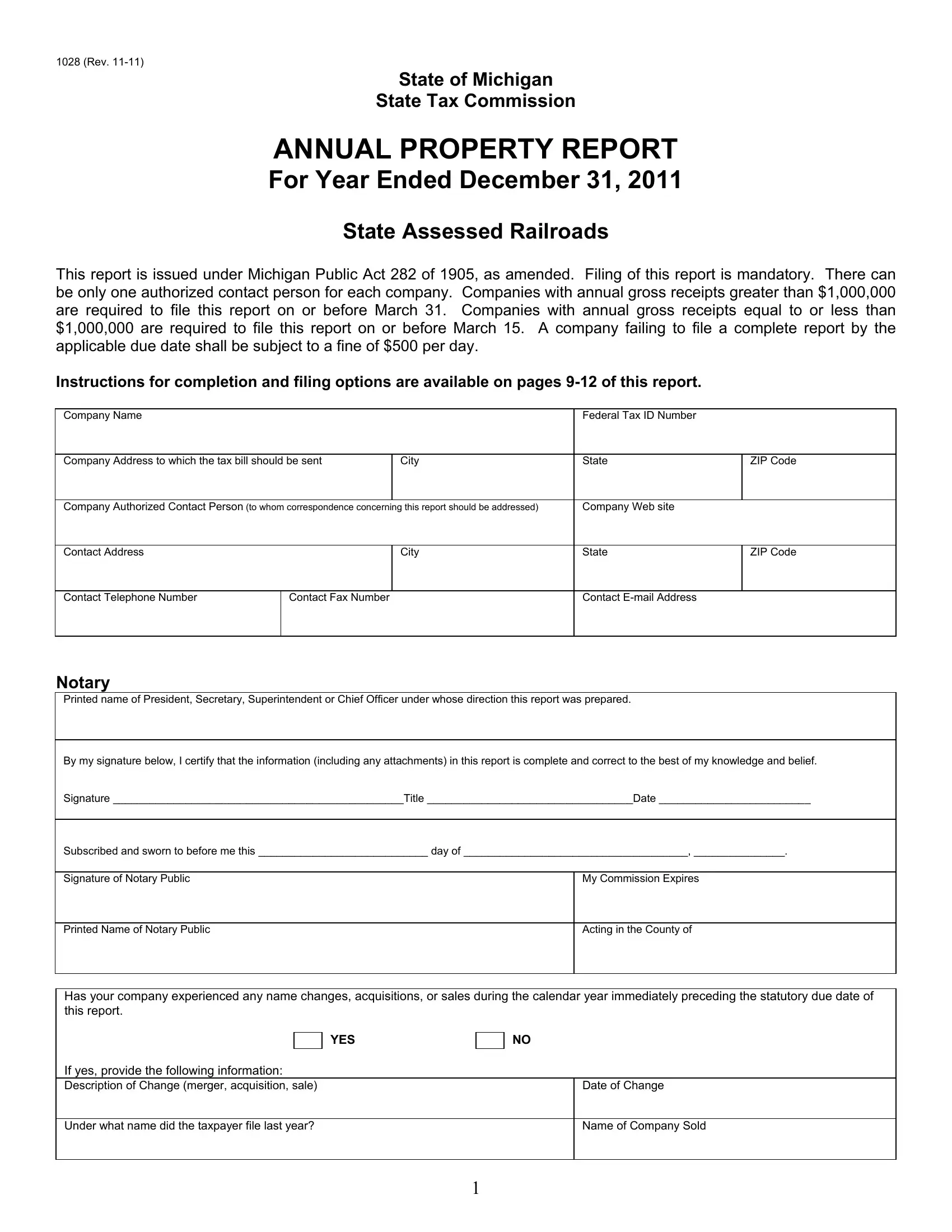

1. When completing the Michigan Form 1028, be sure to complete all of the necessary blank fields in its relevant part. This will help speed up the work, making it possible for your information to be handled swiftly and accurately.

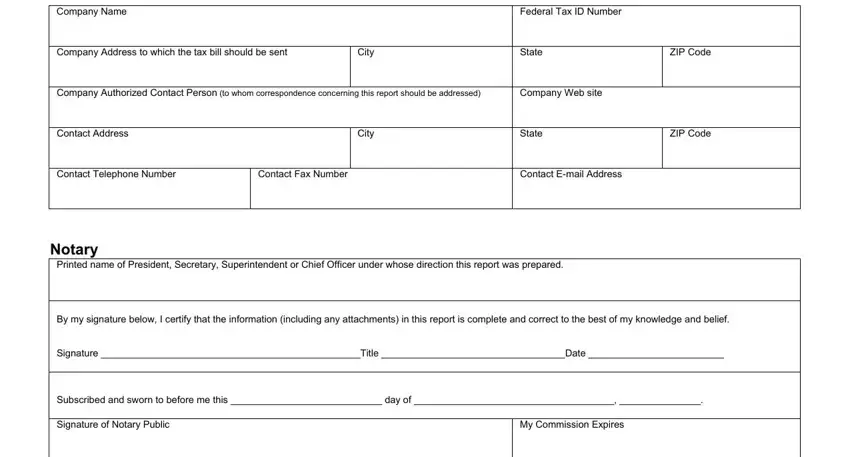

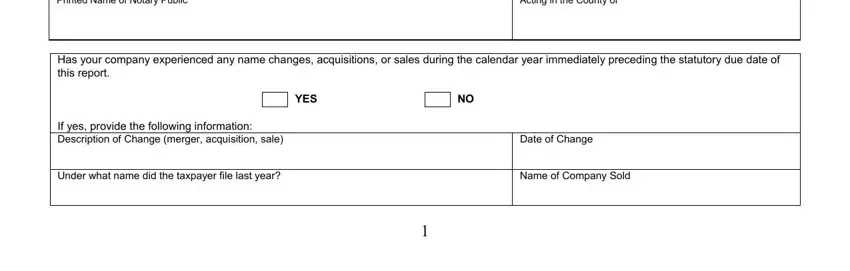

2. Once the last section is done, you'll want to put in the necessary particulars in Notary Printed name of President, Acting in the County of, Date of Change, YES, Under what name did the taxpayer, and Name of Company Sold so you can go further.

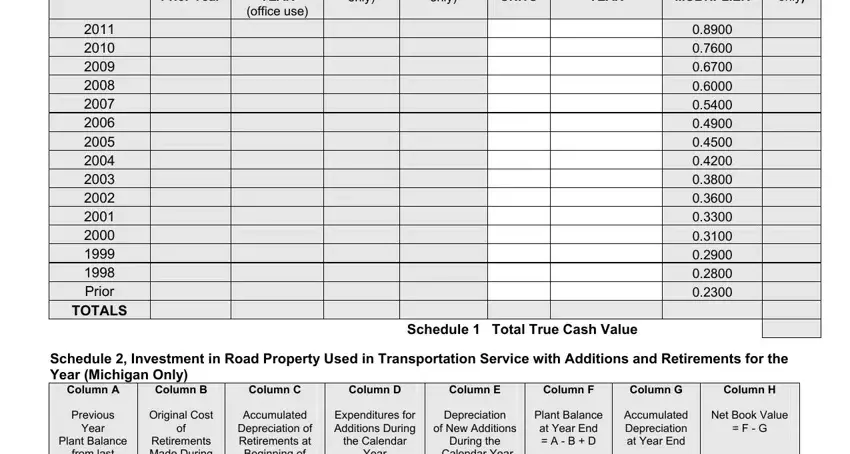

3. This part will be hassle-free - fill out all of the form fields in Reported Prior Year, PRIOR YEAR, office use, only, only, NO OF UNITS, YEAR, Schedule Total True Cash Value, use only, MULTIPLIER, Prior, TOTALS, Schedule Investment in Road, Column A, and Column B to complete this segment.

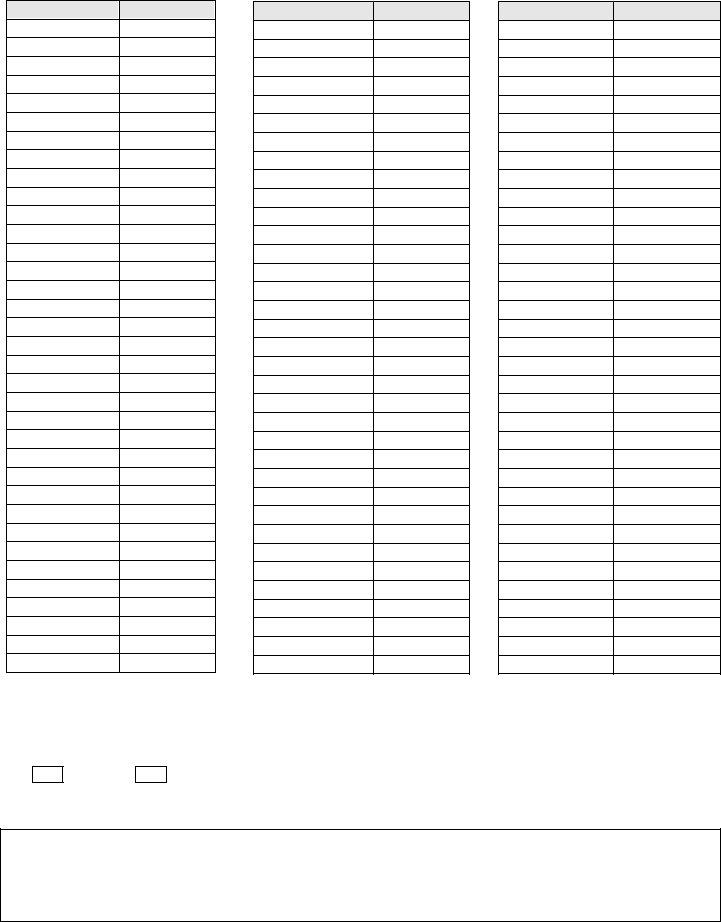

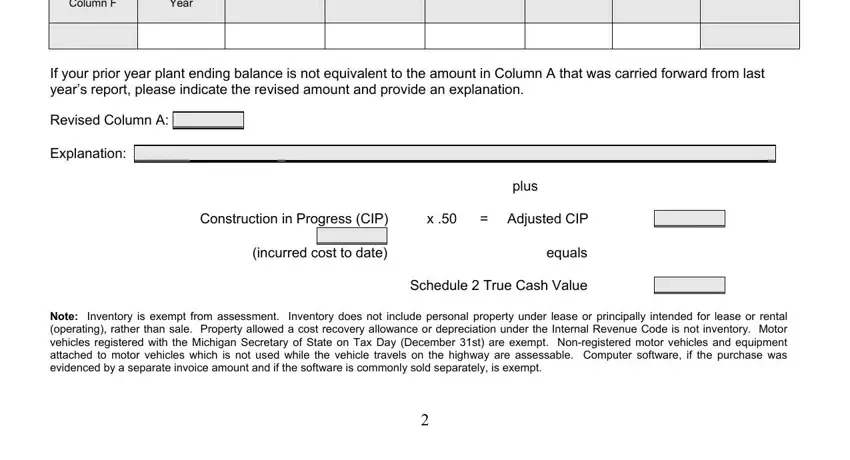

4. The next subsection needs your attention in the following places: Column F, Year, If your prior year plant ending, Revised Column A Explanation, plus, Construction in Progress CIP x, incurred cost to date, equals, Note Inventory is exempt from, and Schedule True Cash Value. Remember to type in all requested information to go further.

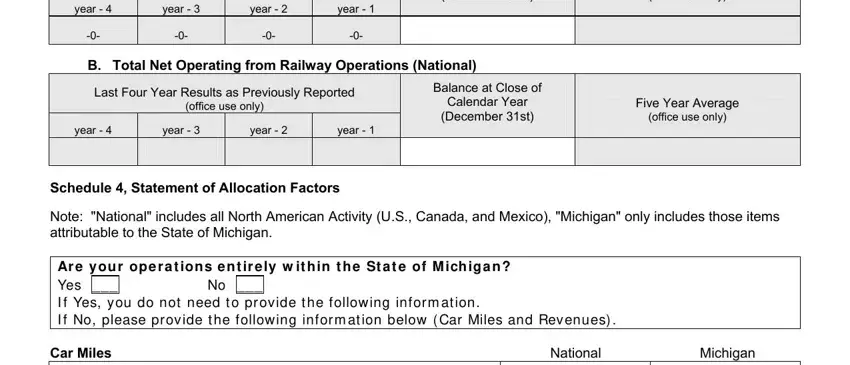

5. To finish your document, the final segment incorporates a few additional blanks. Filling out year, year, year, year, B Total Net Operating from, December st, Last Four Year Results as, office use only, Balance at Close of, Calendar Year, December st, year, year, year, and year will certainly conclude the process and you'll be done in the blink of an eye!

Be really careful while completing office use only and year, as this is where many people make errors.

Step 3: Once you have reviewed the information provided, press "Done" to complete your form. Right after registering a7-day free trial account at FormsPal, you will be able to download Michigan Form 1028 or send it via email without delay. The PDF file will also be easily accessible from your personal account menu with your every single modification. If you use FormsPal, you can fill out forms without stressing about personal data breaches or records getting shared. Our secure system helps to ensure that your private data is maintained safely.