Dealing with PDF documents online is certainly super easy with this PDF tool. Anyone can fill in Michigan Form 514 here without trouble. Our development team is constantly endeavoring to expand the tool and enable it to be even better for clients with its cutting-edge functions. Make use of the current revolutionary possibilities, and discover a heap of new experiences! If you're seeking to start, this is what it takes:

Step 1: Click on the orange "Get Form" button above. It is going to open up our editor so you could begin filling in your form.

Step 2: The editor gives you the opportunity to change PDF forms in many different ways. Enhance it by including personalized text, correct existing content, and add a signature - all within several clicks!

It will be simple to finish the pdf with our detailed guide! Here is what you need to do:

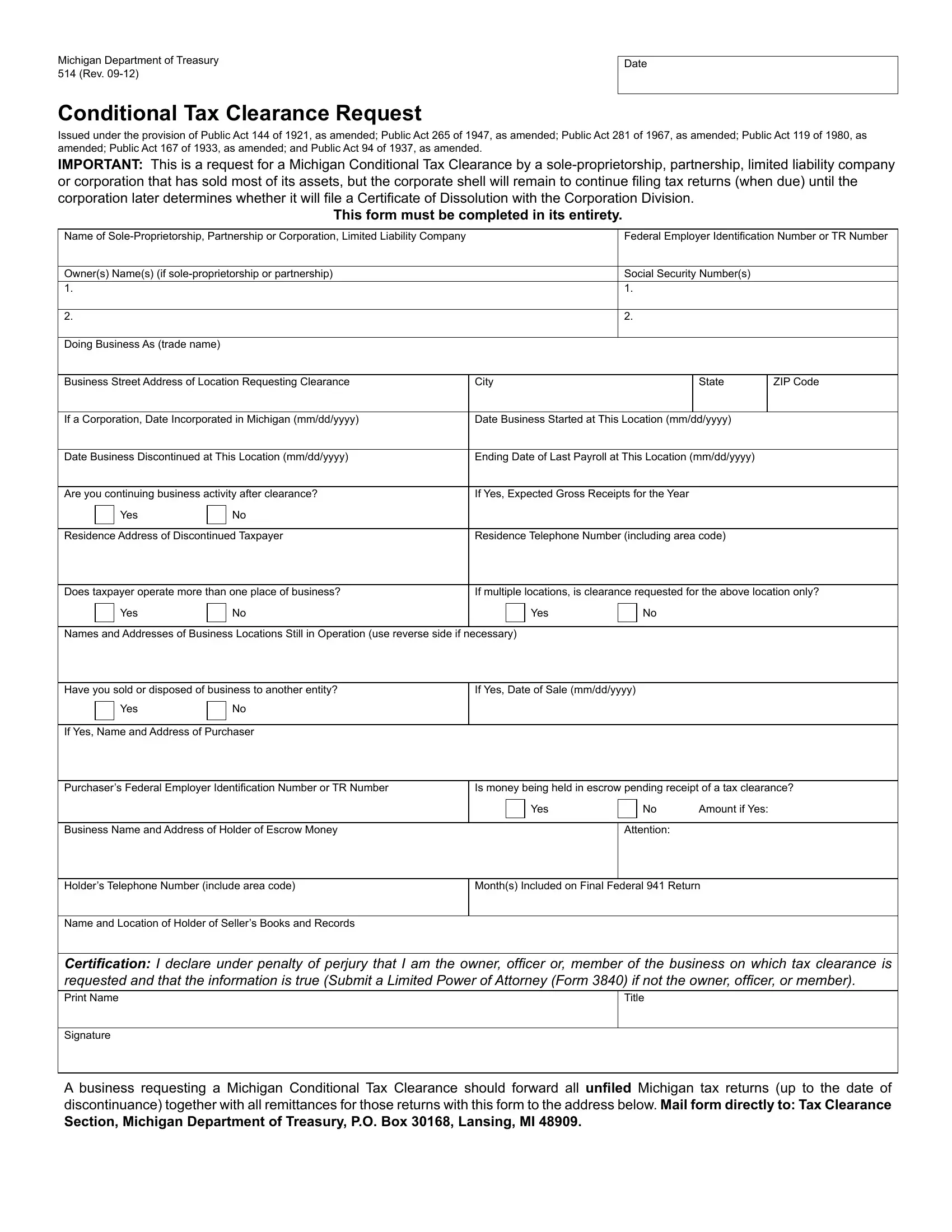

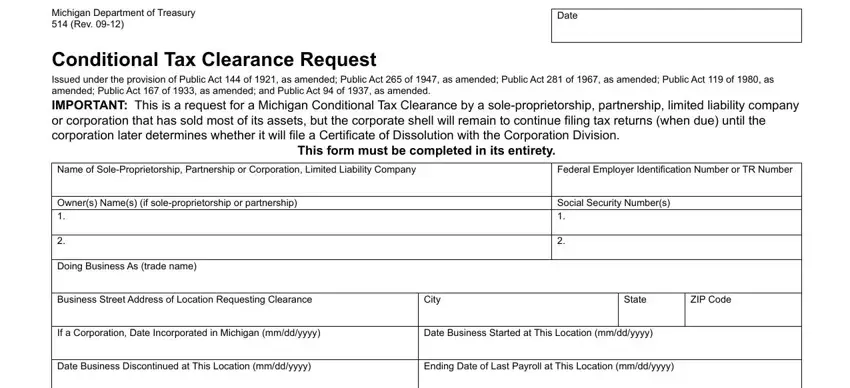

1. Whenever completing the Michigan Form 514, make sure to complete all of the important blanks within the corresponding form section. It will help facilitate the process, allowing your details to be processed fast and properly.

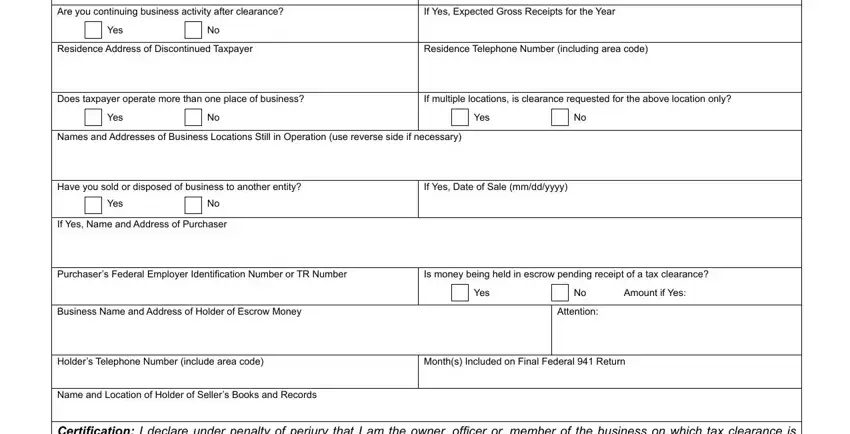

2. Once your current task is complete, take the next step – fill out all of these fields - Are you continuing business, If Yes Expected Gross Receipts for, Yes, Residence Address of Discontinued, Residence Telephone Number, Does taxpayer operate more than, If multiple locations is clearance, Yes, Yes, Names and Addresses of Business, Have you sold or disposed of, If Yes Date of Sale mmddyyyy, Yes, If Yes Name and Address of, and Purchasers Federal Employer with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be extremely attentive while completing If multiple locations is clearance and Residence Telephone Number, because this is the section in which most users make errors.

Step 3: When you have looked over the details in the blanks, click on "Done" to conclude your form at FormsPal. Get hold of your Michigan Form 514 when you subscribe to a 7-day free trial. Readily use the form within your personal account, with any edits and adjustments being automatically kept! Here at FormsPal.com, we endeavor to make sure your details are maintained private.