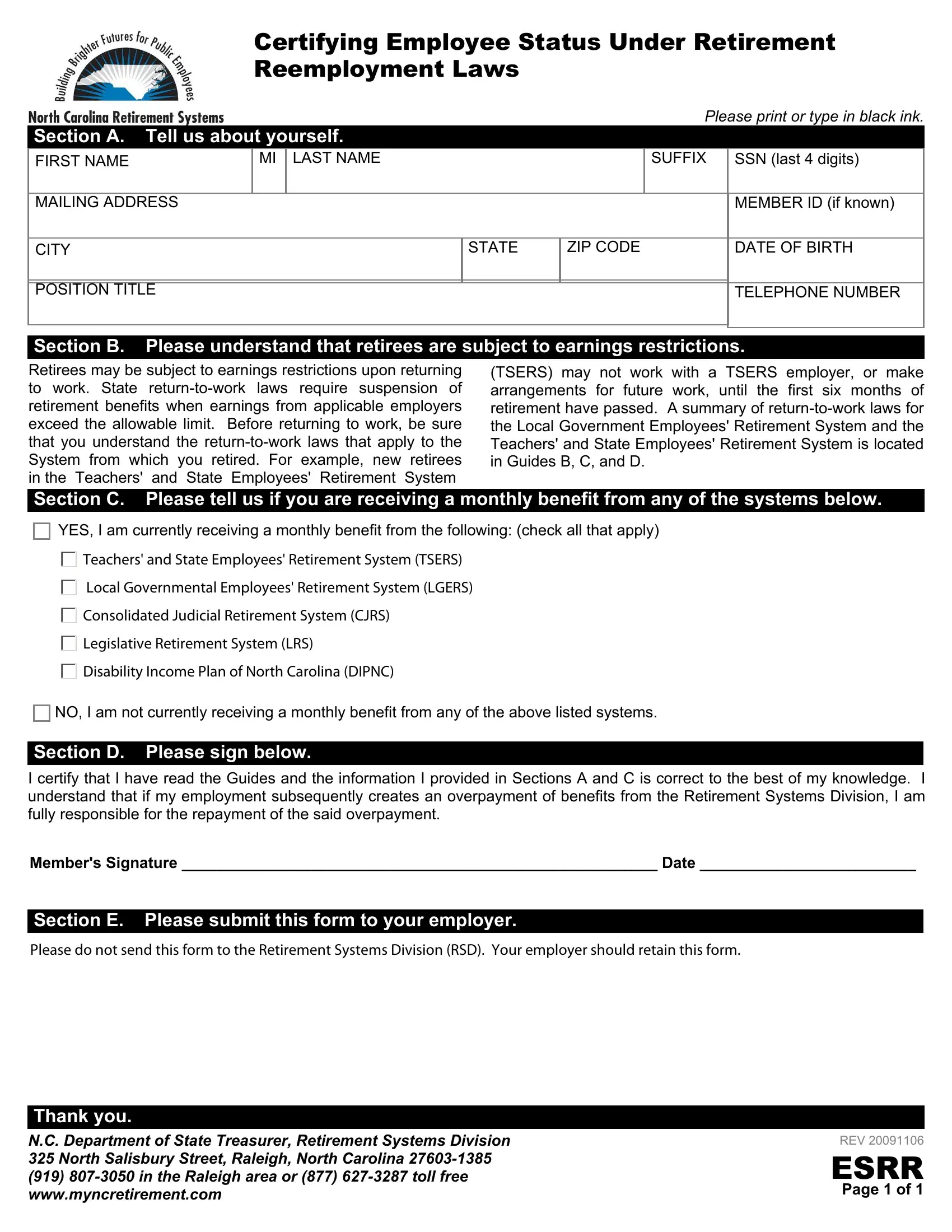

Working with PDF files online is certainly simple with our PDF editor. You can fill in North Carolina Form Esrr here painlessly. To make our tool better and more convenient to use, we consistently design new features, with our users' feedback in mind. If you are looking to get started, here is what it's going to take:

Step 1: Access the PDF form inside our editor by hitting the "Get Form Button" in the top part of this page.

Step 2: With our handy PDF editor, you are able to do more than simply fill in forms. Edit away and make your forms seem sublime with custom textual content put in, or adjust the file's original content to perfection - all supported by an ability to incorporate stunning graphics and sign it off.

Be mindful while filling out this form. Ensure that all necessary areas are filled out accurately.

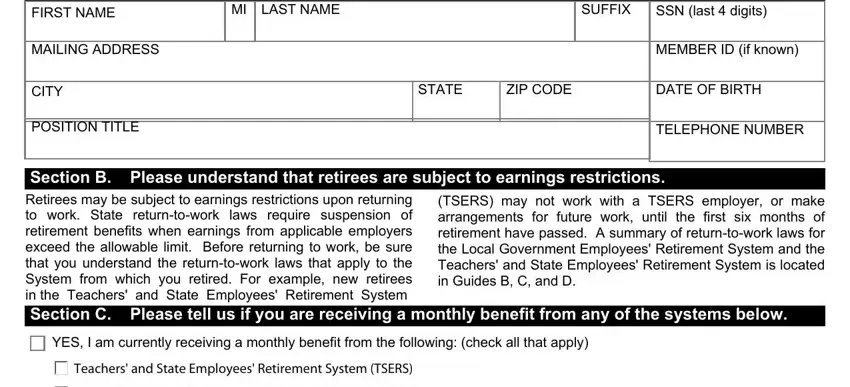

1. The North Carolina Form Esrr requires specific details to be entered. Be sure the following blank fields are completed:

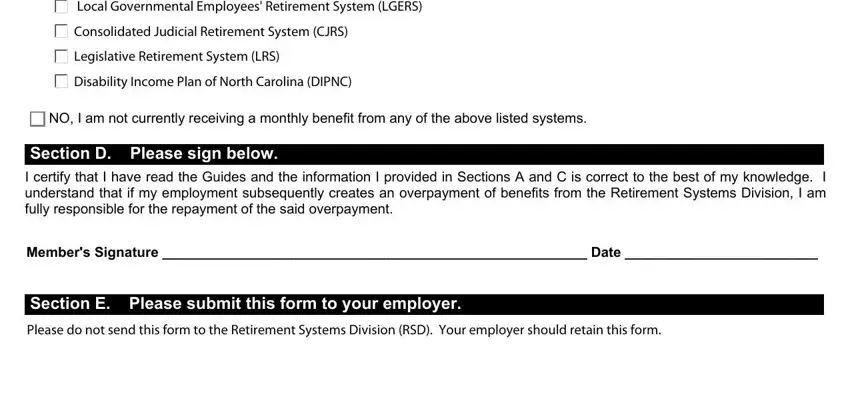

2. Soon after finishing the last section, go on to the next stage and fill out all required particulars in these fields - Local Governmental Employees, Consolidated Judicial Retirement, Legislative Retirement System LRS, Disability Income Plan of North, NO I am not currently receiving a, Section D Please sign below, I certify that I have read the, Members Signature Date, Section E Please submit this form, and Please do not send this form to.

It is possible to make errors when filling in the NO I am not currently receiving a, therefore make sure you look again before you decide to finalize the form.

Step 3: Make certain the information is correct and just click "Done" to continue further. After setting up a7-day free trial account here, you'll be able to download North Carolina Form Esrr or send it via email right off. The PDF form will also be easily accessible via your personal account menu with all of your changes. FormsPal is committed to the privacy of our users; we always make sure that all information handled by our system remains secure.