Handling PDF files online is definitely a breeze with our PDF tool. You can fill out Nyc 4S Ez Form here painlessly. To make our editor better and easier to use, we consistently come up with new features, with our users' feedback in mind. It just takes just a few easy steps:

Step 1: Just hit the "Get Form Button" in the top section of this page to start up our pdf editing tool. This way, you will find all that is needed to fill out your file.

Step 2: With the help of our handy PDF tool, you could do more than merely complete blanks. Express yourself and make your forms look sublime with customized textual content added, or modify the original content to perfection - all that comes along with the capability to insert your own graphics and sign the PDF off.

Filling out this PDF needs attention to detail. Make sure each field is done accurately.

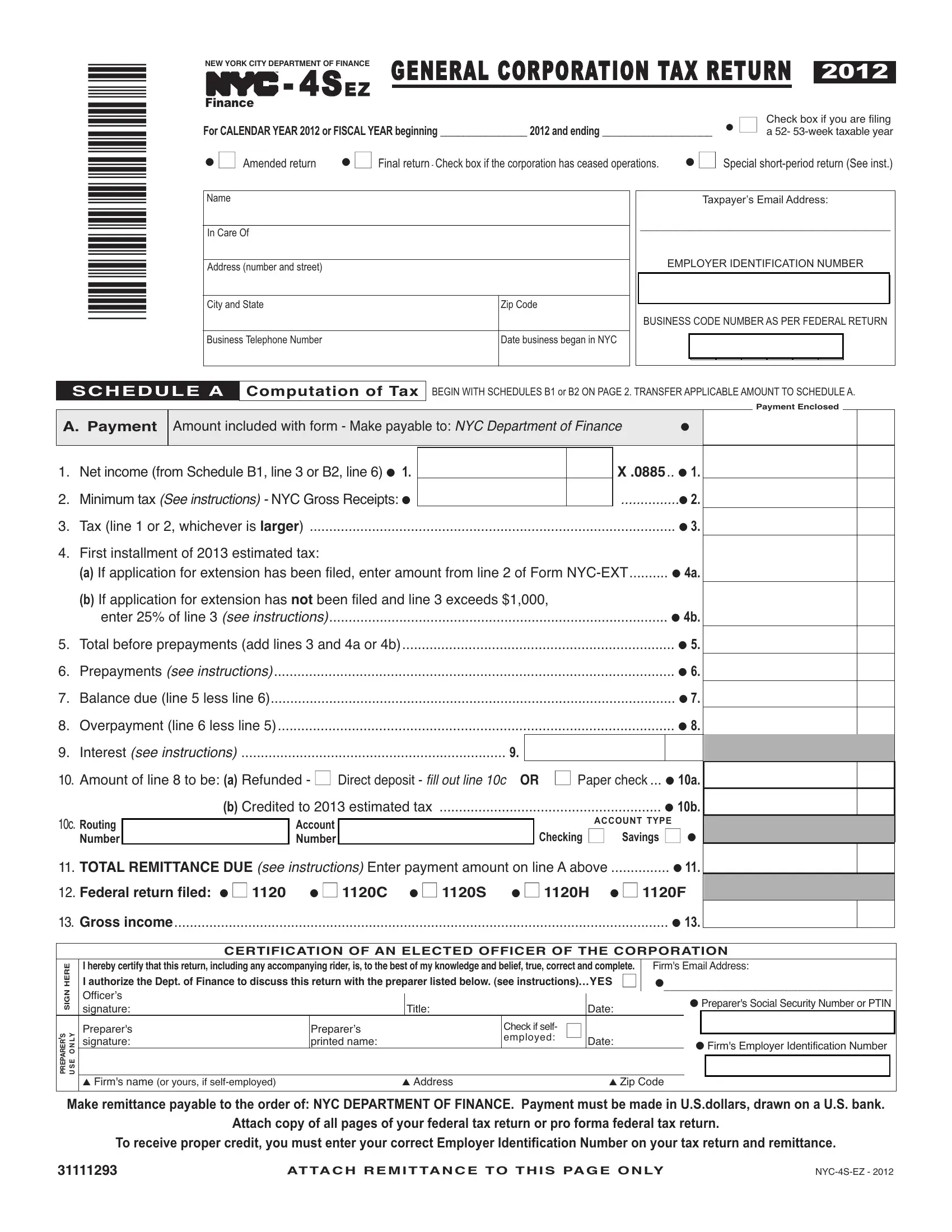

1. To start with, once filling out the Nyc 4S Ez Form, begin with the area that includes the next blanks:

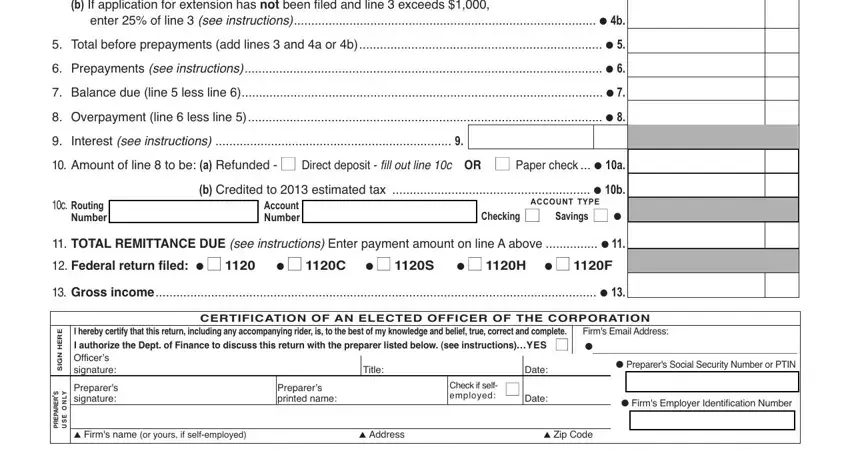

2. Once the last segment is completed, you should insert the essential details in b If application for extension has, enter of line seeinstructions b, Total before prepayments add, Prepayments seeinstructions, Balance due line less line, Overpayment line less line, Interest seeinstructions, Amount of line to be a Refunded, c Routing Number, Account Number, ACCOUNT TYPE, Checking Savings, b Credited to estimated tax b, TOTAL REMITTANCE DUE see, and C S so you're able to move forward to the 3rd stage.

People generally make mistakes while filling out Account Number in this part. You need to read twice everything you type in right here.

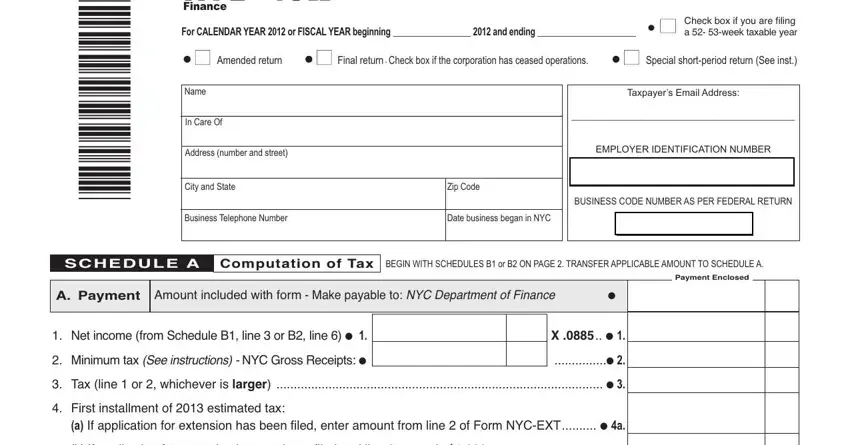

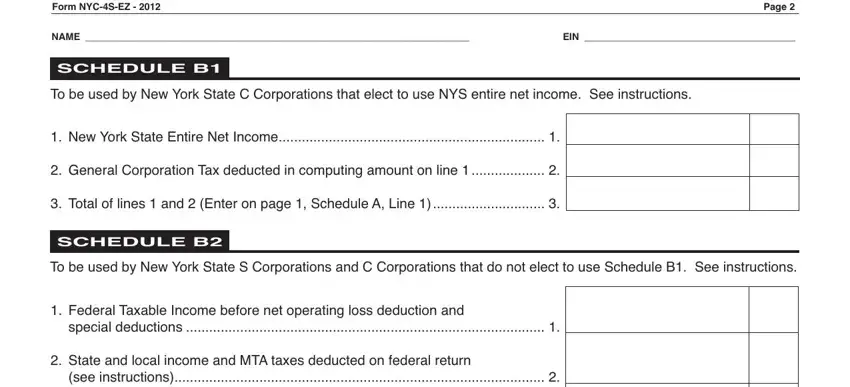

3. The following part will be about Form NYCSEZ, Page, NAME, EIN, SCHEDULE B, To be used by New York State C, New York State Entire Net Income, General Corporation Tax deducted, Total of lines and Enter on, SCHEDULE B, To be used by New York State S, Federal Taxable Income before net, special deductions, State and local income and MTA, and see instructions - type in every one of these blank fields.

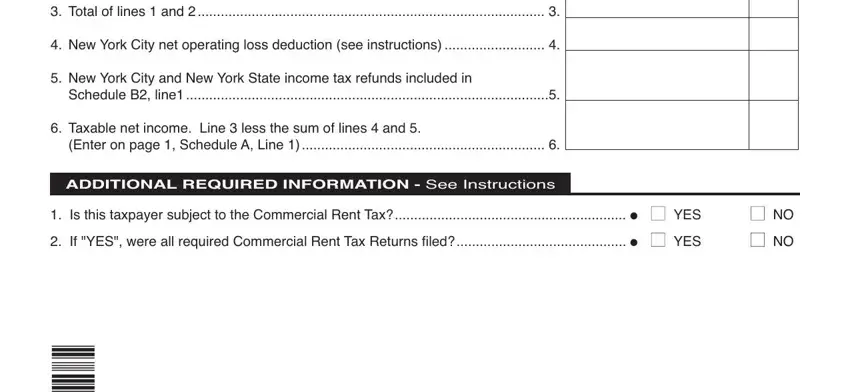

4. The form's fourth subsection arrives with these particular empty form fields to type in your details in: Total of lines and, New York City net operating loss, New York City and New York State, Schedule B line, Taxable net income Line less the, Enter on page Schedule A Line, ADDITIONAL REQUIRED INFORMATION, Is this taxpayer subject to the, and If YES were all required.

Step 3: After looking through your filled out blanks, press "Done" and you are all set! After getting a7-day free trial account at FormsPal, you'll be able to download Nyc 4S Ez Form or send it through email promptly. The PDF form will also be easily accessible from your personal account with all your modifications. When using FormsPal, you can easily complete documents without worrying about database breaches or records getting shared. Our protected platform makes sure that your personal information is kept safely.