Are you looking to file Form 6E with the US Securities and Exchange Commission (SEC)? Whether you are a first-time filer of this form or already have experience, it’s important that every step in the process is done correctly. In this blog post, we will provide an overview of Form 6E and cover all the necessary details for getting started. We'll explain what information must be included on your filing and outline helpful tips to ensure your submission goes smoothly. Get ready to learn everything there is about preparing a successful official submission!

| Question | Answer |

|---|---|

| Form Name | Official Form 6E |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | fillable da form 31, da 31 pdf fillable, da form 31, da form 31 pdf fillable |

Official Form 6E (10/06)

In re |

, |

Case No. |

|

|

Debtor |

|

(if known) |

SCHEDULE E - CREDITORS HOLDING UNSECURED PRIORITY CLAIMS

A complete list of claims entitled to priority, listed separately by type of priority, is to be set forth on the sheets provided. Only holders of unsecured claims entitled to priority should be listed in this schedule. In the boxes provided on the attached sheets, state the name, mailing address, including zip code, and last four digits of the account number, if any, of all entities holding priority claims against the debtor or the property of the debtor, as of the date of the filing of the petition. Use a separate continuation sheet for each type of priority and label each with the type of priority.

The complete account number of any account the debtor has with the creditor is useful to the trustee and the creditor and may be provided if the debtor chooses to do so. If a minor child is a creditor, indicate that by stating “a minor child” and do not disclose the child’s name. See 11 U.S.C. §

112.If “a minor child” is stated, also include the name, address, and legal relationship to the minor child of a person described in Fed. R. Bankr. P. 1007(m).

If any entity other than a spouse in a joint case may be jointly liable on a claim, place an "X" in the column labeled "Codebtor," include the entity on the appropriate schedule of creditors, and complete Schedule

Report the total of claims listed on each sheet in the box labeled "Subtotals" on each sheet. Report the total of all claims listed on this Schedule E in the box labeled “Total” on the last sheet of the completed schedule. Report this total also on the Summary of Schedules.

Report the total of amounts entitled to priority listed on each sheet in the box labeled "Subtotals" on each sheet. Report the total of all amounts entitled to priority listed on this Schedule E in the box labeled “Totals” on the last sheet of the completed schedule. Individual debtors with primarily consumer debts who file a case under chapter 7 or 13 report this total also on the Statistical Summary of Certain Liabilities and Related Data.

Report the total of amounts not entitled to priority listed on each sheet in the box labeled “Subtotals” on each sheet. Report the total of all amounts not entitled to priority listed on this Schedule E in the box labeled “Totals” on the last sheet of the completed schedule. Individual debtors with primarily consumer debts who file a case under chapter 7 report this total also on the Statistical Summary of Certain Liabilities and Related Data.

Check this box if debtor has no creditors holding unsecured priority claims to report on this Schedule E.

TYPES OF PRIORITY CLAIMS (Check the appropriate box(es) below if claims in that category are listed on the attached sheets)

Domestic Support Obligations

Claims for domestic support that are owed to or recoverable by a spouse, former spouse, or child of the debtor, or the parent, legal guardian, or responsible relative of such a child, or a governmental unit to whom such a domestic support claim has been assigned to the extent provided in 11 U.S.C. § 507(a)(1).

Extensions of credit in an involuntary case

Claims arising in the ordinary course of the debtor's business or financial affairs after the commencement of the case but before the earlier of the appointment of a trustee or the order for relief. 11 U.S.C. § 507(a)(3).

Wages, salaries, and commissions

Wages, salaries, and commissions, including vacation, severance, and sick leave pay owing to employees and commissions owing to qualifying independent sales representatives up to $10,000* per person earned within 180 days immediately preceding the filing of the original petition, or the cessation of business, whichever occurred first, to the extent provided in 11 U.S.C. § 507(a)(4).

Contributions to employee benefit plans

Money owed to employee benefit plans for services rendered within 180 days immediately preceding the filing of the original petition, or the cessation of business, whichever occurred first, to the extent provided in 11 U.S.C. § 507(a)(5).

Official Form 6E (10/06) - Cont.

In re |

, |

Case No. |

|

|

Debtor |

|

(if known) |

Certain farmers and fishermen

Claims of certain farmers and fishermen, up to $4,925* per farmer or fisherman, against the debtor, as provided in 11 U.S.C. § 507(a)(6).

Deposits by individuals

Claims of individuals up to $2,225* for deposits for the purchase, lease, or rental of property or services for personal, family, or household use, that were not delivered or provided. 11 U.S.C. § 507(a)(7).

Taxes and Certain Other Debts Owed to Governmental Units

Taxes, customs duties, and penalties owing to federal, state, and local governmental units as set forth in 11 U.S.C. § 507(a)(8).

Commitments to Maintain the Capital of an Insured Depository Institution

Claims based on commitments to the FDIC, RTC, Director of the Office of Thrift Supervision, Comptroller of the Currency, or Board of Governors of the Federal Reserve System, or their predecessors or successors, to maintain the capital of an insured depository institution. 11 U.S.C. § 507 (a)(9).

Claims for Death or Personal Injury While Debtor Was Intoxicated

Claims for death or personal injury resulting from the operation of a motor vehicle or vessel while the debtor was intoxicated from using alcohol, a drug, or another substance. 11 U.S.C. § 507(a)(10).

*Amounts are subject to adjustment on April 1, 2007, and every three years thereafter with respect to cases commenced on or after the date of adjustment.

____ continuation sheets attached

Official Form 6E (10/06) - Cont. |

|

In re __________________________________________, |

Case No. _________________________________ |

Debtor |

(If known) |

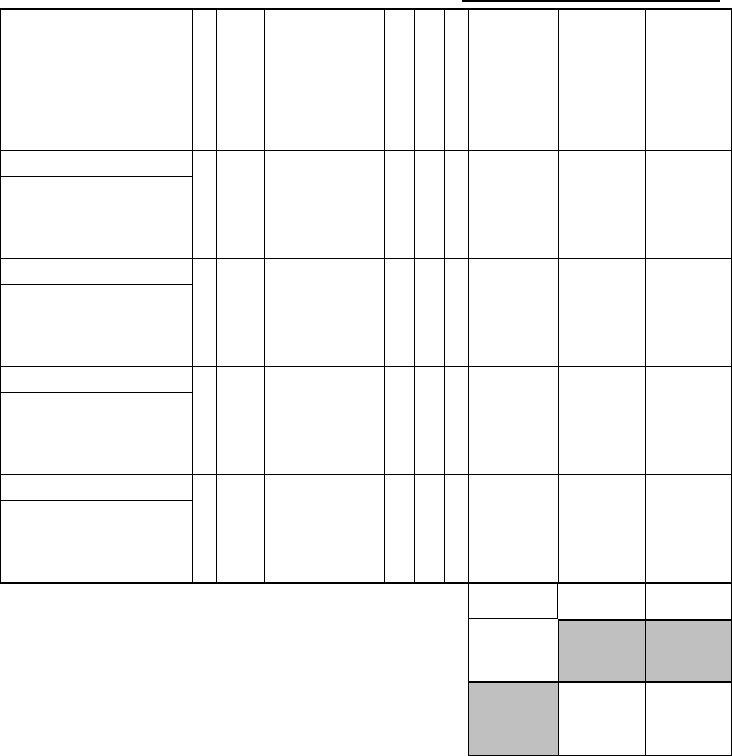

SCHEDULE E - CREDITORS HOLDING UNSECURED PRIORITY CLAIMS

CREDITOR’S NAME, MAILING ADDRESS INCLUDING ZIP CODE, AND ACCOUNT NUMBER

(SEE INSTRUCTIONS ABOVE.)

CODEBTOR |

HUSBAND, WIFE, |

JOINT, OR |

COMMUNITY |

(Continuation Sheet)

Type of Priority for Claims Listed on This Sheet

DATE CLAIM WAS |

CONTINGENT |

UNLIQUIDATED |

DISPUTED |

AMOUNT |

AMOUNT |

AMOUNT |

|

INCURRED AND |

OF |

ENTITLED |

NOT |

||||

|

|

|

|||||

CONSIDERATION |

|

|

|

CLAIM |

TO |

ENTITLED |

|

FOR CLAIM |

|

|

|

|

PRIORITY |

TO |

|

|

|

|

|

|

|

PRIORITY, IF |

|

|

|

|

|

|

|

ANY |

Account No.

Account No.

Account No.

Account No.

Sheet no. ___ of ___ continuation sheets attached to Schedule of Creditors Holding Priority Claims

Subtotals' $

(Totals of this page)

Total' $

(Use only on last page of the completed Schedule E. Report also on the Summary of Schedules.)

Totals'

(Use only on last page of the completed Schedule E. If applicable, report also on the Statistical Summary of Certain Liabilities and Related Data.)

$

$$