form 532b can be completed without difficulty. Simply open FormsPal PDF editor to perform the job fast. To retain our editor on the forefront of efficiency, we work to adopt user-driven features and improvements on a regular basis. We're at all times grateful for any suggestions - join us in remolding how you work with PDF files. To get started on your journey, consider these easy steps:

Step 1: Simply press the "Get Form Button" at the top of this site to open our pdf editor. There you will find everything that is needed to work with your file.

Step 2: With the help of this advanced PDF editor, you are able to do more than simply fill out forms. Express yourself and make your forms look sublime with custom textual content added in, or fine-tune the file's original content to excellence - all that supported by an ability to add any type of images and sign the PDF off.

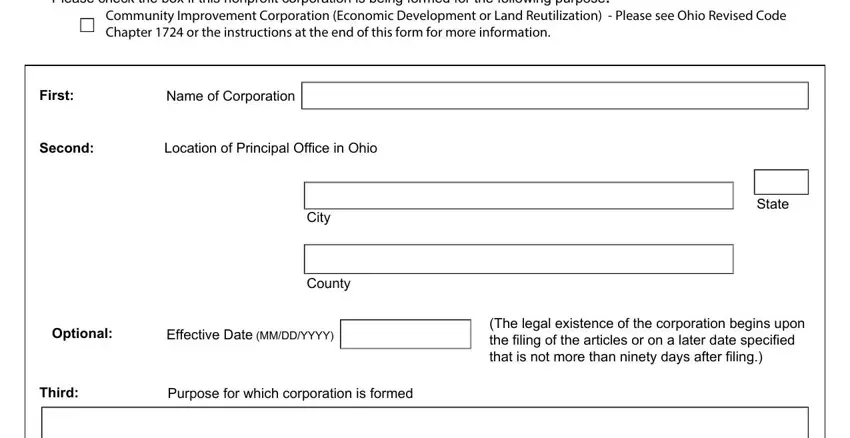

Filling out this form requires attentiveness. Make certain all required blanks are filled in properly.

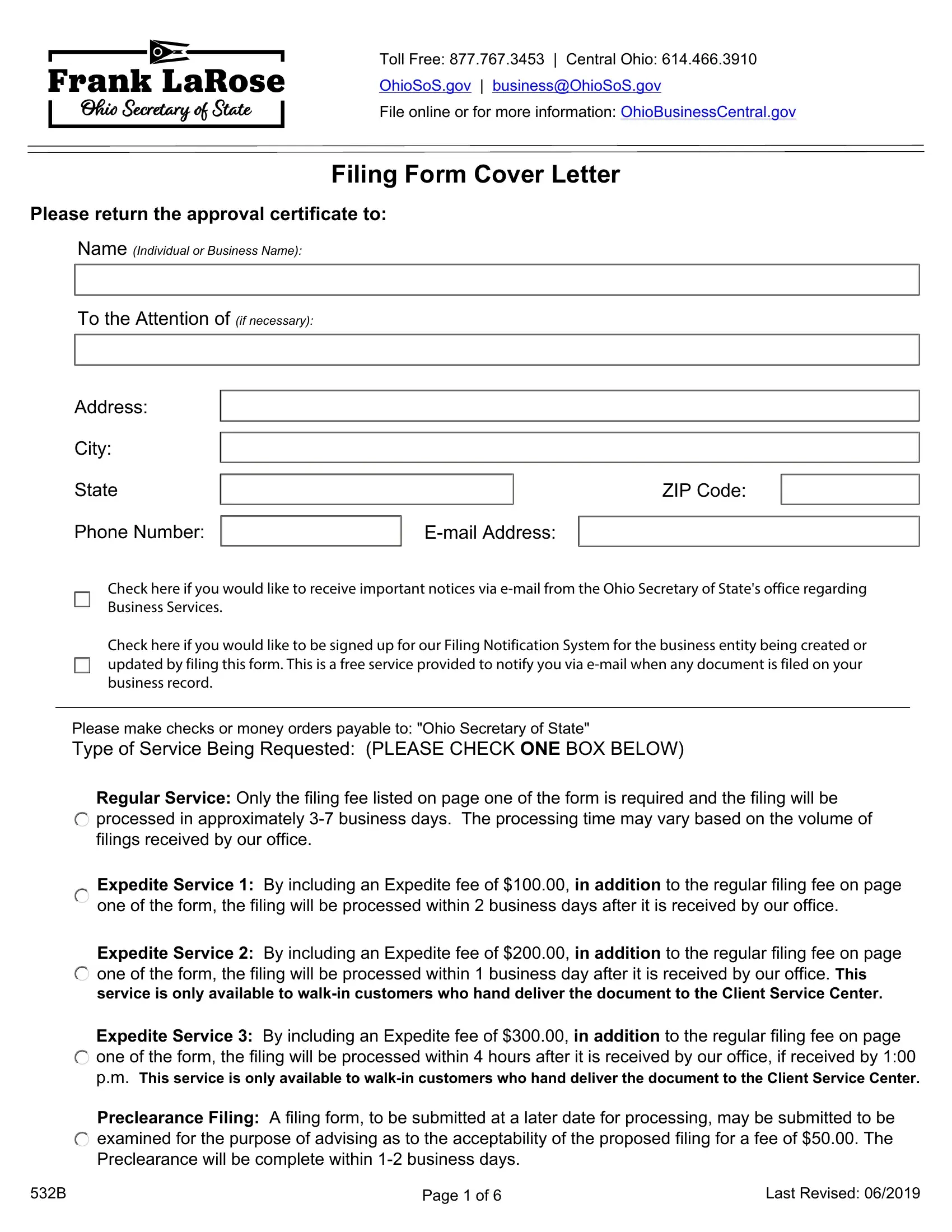

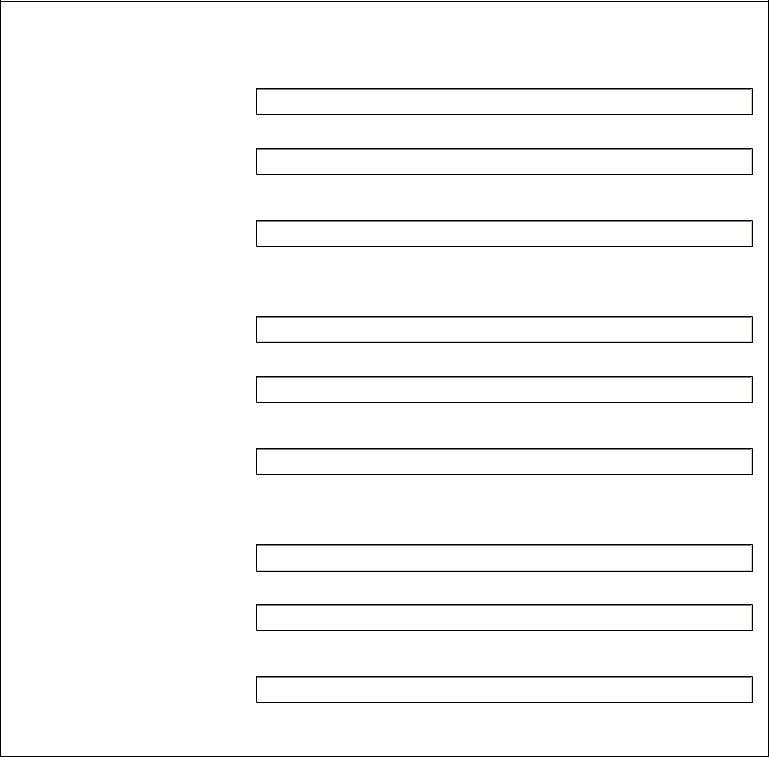

1. Begin completing the form 532b with a number of necessary fields. Gather all of the required information and make certain there's nothing omitted!

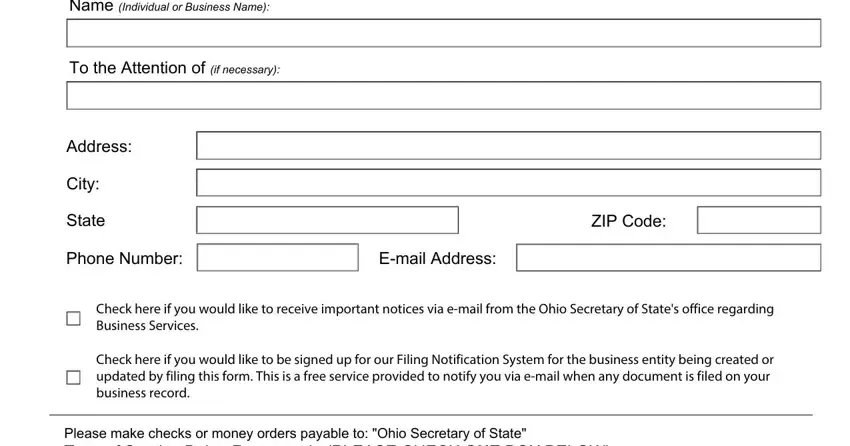

2. Now that this section is complete, you should insert the necessary particulars in Regular Service Only the filing, Expedite Service By including an, Expedite Service By including an, Expedite Service By including an, Preclearance Filing A filing form, Page of, and Last Revised so you're able to go to the 3rd part.

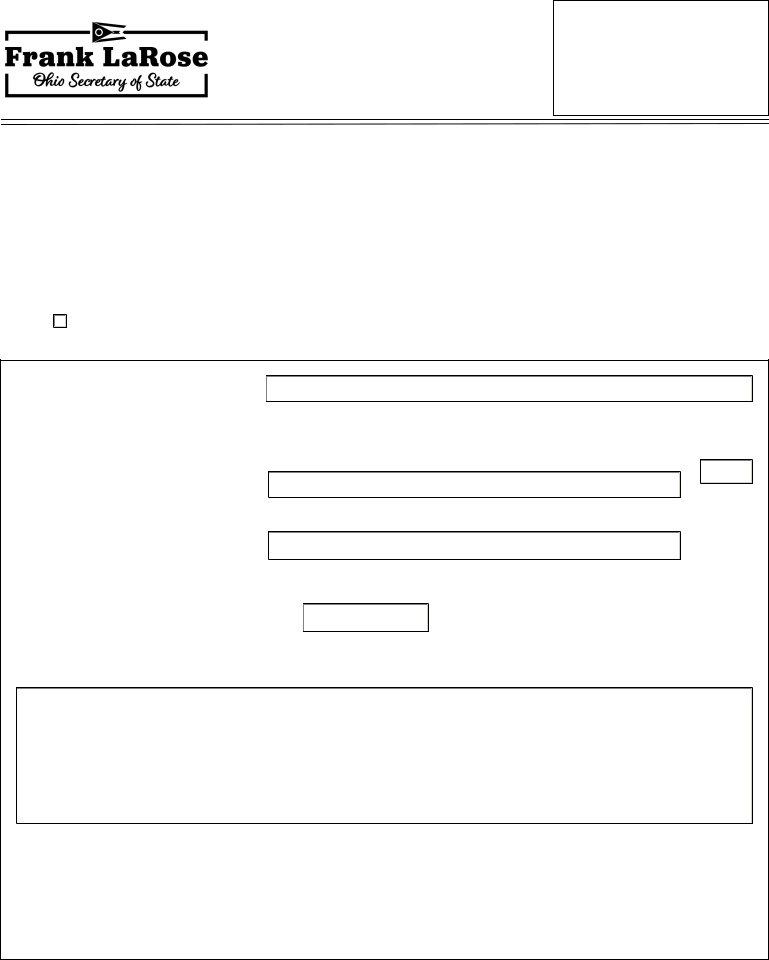

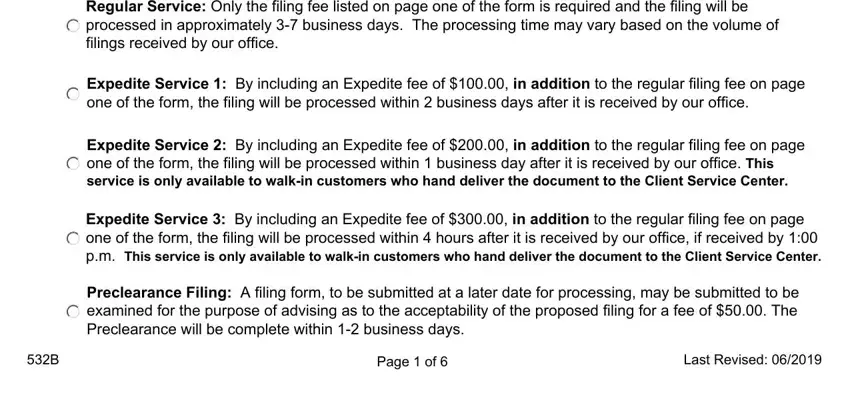

3. This next step will be focused on Please check the box if this, Community Improvement Corporation, First, Name of Corporation, Second, Location of Principal Office in, City, County, State, Optional, Effective Date MMDDYYYY, The legal existence of the, and Third Purpose for which - fill in every one of these fields.

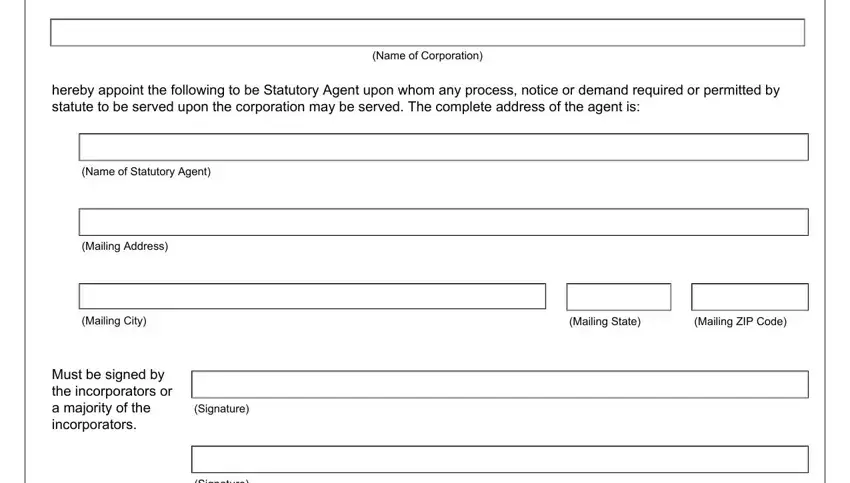

4. You're ready to proceed to this next segment! Here you will have all these hereby appoint the following to be, Name of Corporation, Name of Statutory Agent, Mailing Address, Mailing City, Mailing State, Mailing ZIP Code, Must be signed by the, Signature, and Signature fields to complete.

Be very attentive when filling out Signature and Mailing Address, because this is where most users make mistakes.

5. To wrap up your form, the last subsection features several additional fields. Entering Signature, The Undersigned, Name of Statutory Agent, Statutory agent for, Name of Corporation, Acceptance of Appointment, named herein as the, hereby acknowledges and accepts, Statutory Agent Signature, and Individual Agents Signature should wrap up everything and you'll be done in an instant!

Step 3: Soon after double-checking the form fields you have filled in, hit "Done" and you are all set! Create a free trial subscription at FormsPal and get instant access to form 532b - download or edit in your personal account page. FormsPal is committed to the personal privacy of our users; we always make sure that all personal data used in our system is kept secure.