Handling PDF forms online is certainly quite easy with this PDF editor. Anyone can fill out Ohio Form Mf 2 here and try out various other options available. Our editor is constantly evolving to provide the best user experience achievable, and that is because of our resolve for continuous enhancement and listening closely to feedback from users. Getting underway is simple! All you need to do is take the following easy steps below:

Step 1: Click the "Get Form" button above. It will open our tool so that you can begin filling out your form.

Step 2: Once you launch the file editor, you will notice the document prepared to be completed. Other than filling out various blank fields, you may as well perform several other things with the PDF, that is writing custom words, changing the original text, adding graphics, placing your signature to the PDF, and much more.

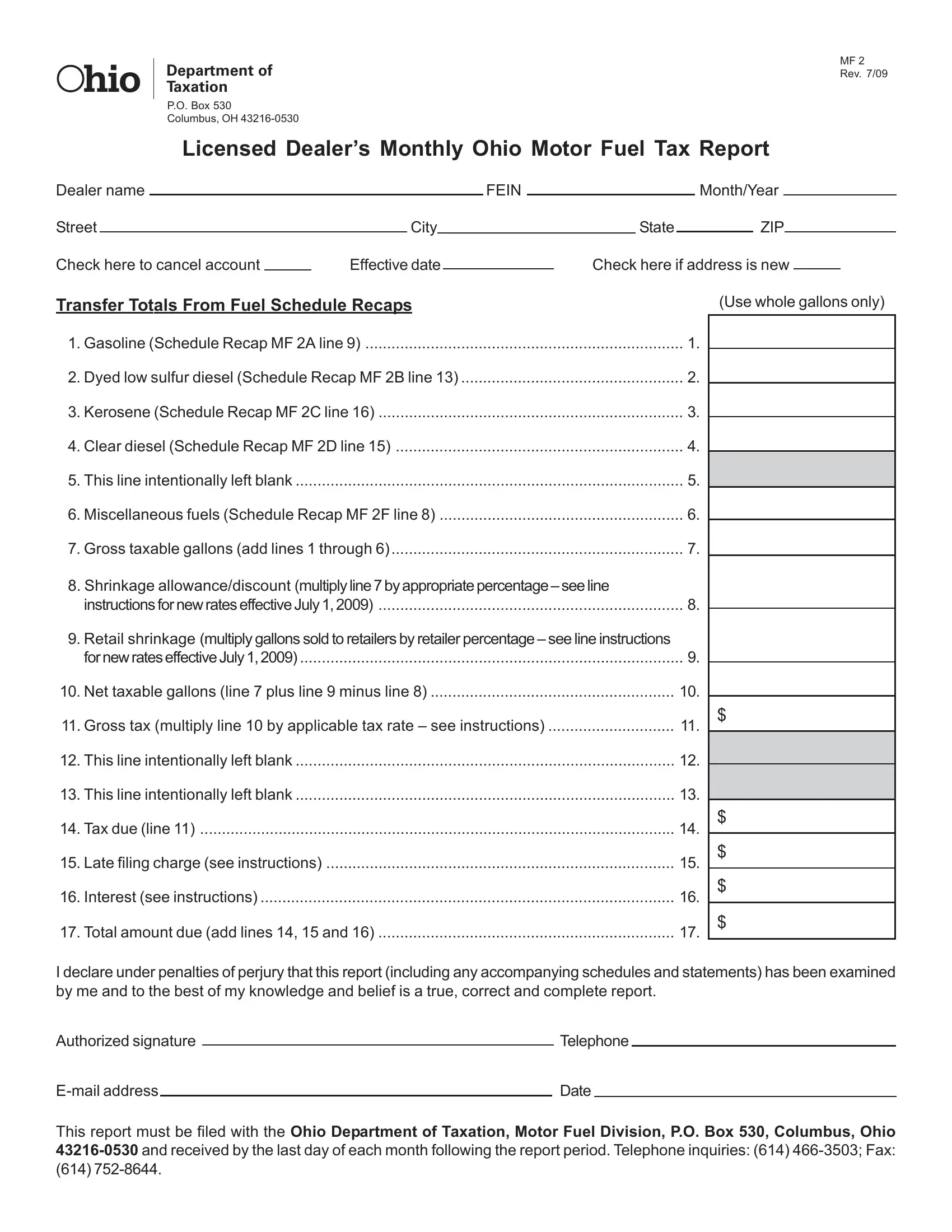

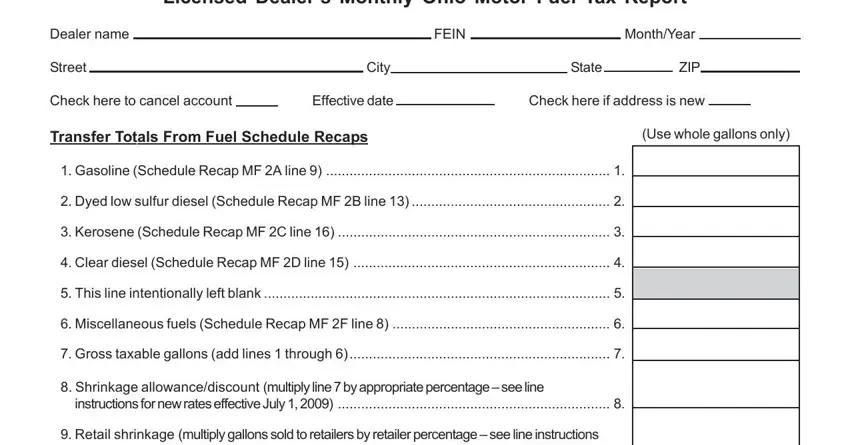

This document will require specific information; to guarantee correctness, please be sure to consider the suggestions down below:

1. Whenever submitting the Ohio Form Mf 2, be certain to complete all of the needed fields in the corresponding section. It will help to hasten the process, allowing for your details to be processed without delay and appropriately.

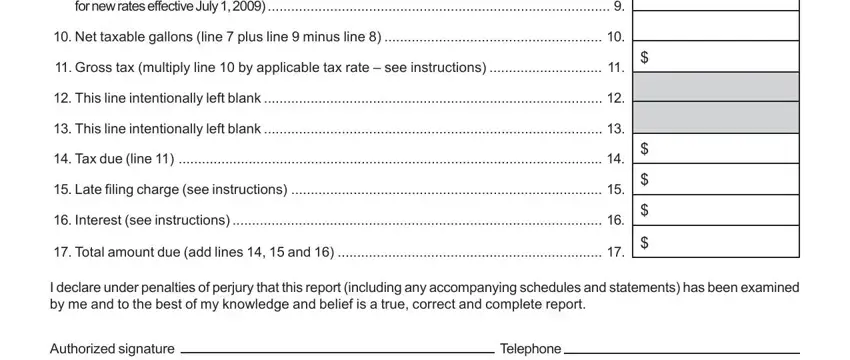

2. Once your current task is complete, take the next step – fill out all of these fields - for new rates effective July, Net taxable gallons line plus, Gross tax multiply line by, This line intentionally left, This line intentionally left, Tax due line, Late filing charge see, Interest see instructions, Total amount due add lines and, I declare under penalties of, Authorized signature, and Telephone with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Be really mindful while filling in Telephone and for new rates effective July, because this is the section in which many people make a few mistakes.

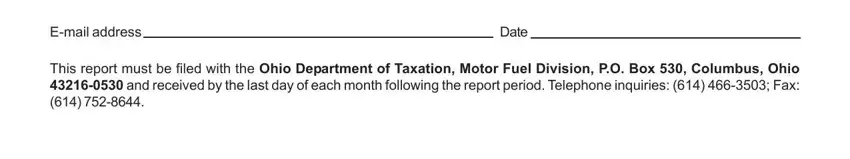

3. In this specific part, look at Email address, Date, and This report must be filed with the. All of these should be completed with highest awareness of detail.

Step 3: Once you have looked again at the information you filled in, click on "Done" to complete your document creation. Create a 7-day free trial account with us and obtain instant access to Ohio Form Mf 2 - download or edit from your personal cabinet. FormsPal guarantees your information confidentiality via a secure method that never saves or distributes any type of private information provided. You can relax knowing your docs are kept safe each time you use our tools!