Application for Homestead Exemption - Page 2

Requirement for Homestead Exemption Applications

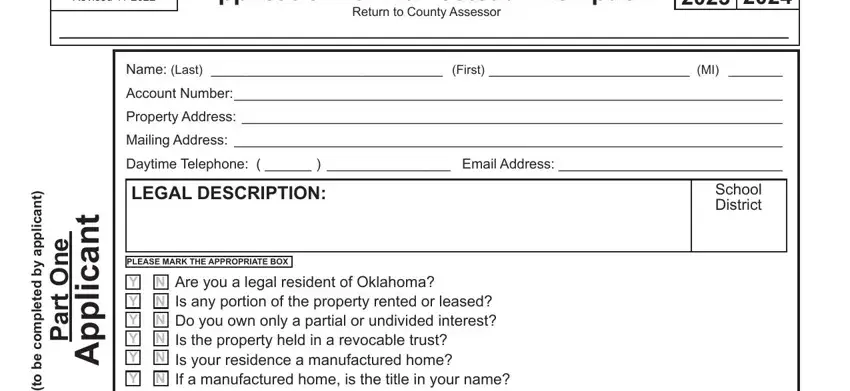

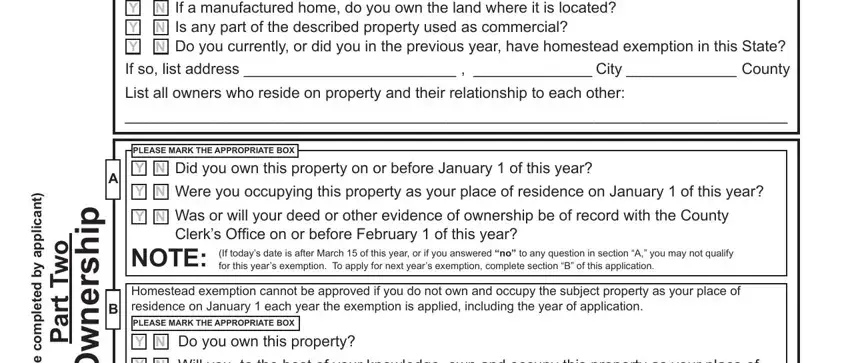

A.To receive a homestead exemption, a taxpayer shall be required to file an application with the county assessor. Such application may be filed at any time; provided, the county assessor shall, if such applicant otherwise qualifies, grant a homestead exemption for a tax year only if the application is filed on or before March 15 of such year or within thirty (30) days from and after receipt of notice of valuation increase. If an application for a homestead exemption is filed after March 15, the county assessor shall, if such applicant otherwise qualifies, grant the homestead exemption begin-

ning with the following tax year.

B.Any taxpayer who has been granted a homestead exemption and who continues to occupy such homestead property as a homestead, shall not be required to reapply for such homestead exemption.

C.Once granted, the homestead exemption shall remain in full force and effect for each succeeding year, so long as:

1.The record of actual property ownership is vested in the taxpayer;

2.The instrument of ownership is on record in the county clerk’s office;

3.The owner-taxpayer is in all other respects entitled by law to the homestead exemption; and

4.The taxpayer has no delinquent accounts appearing on the personal property tax lien docket in the county trea- surer’s office. On October 1st of each year, the county treasurer will provide a copy of the personal property tax

lien docket to the county assessor. Based upon the personal property tax lien docket, the county assessor shall act to cancel the homestead exemption of all property owners having delinquent personal property taxes. Such cancellation of the homestead exemption will become effective January 1 of the following year and will remain in effect for at least one (1) calendar year. However, such cancellation will not become effective January 1 of the following year if the taxpayer pays such delinquent personal property taxes prior to January 1. Cancellation of the

homestead exemption will require the county assessor to notify each taxpayer no later than January 1 of the next calendar year whose homestead is canceled and will require the taxpayer to re file an application for homestead

exemption by those dates so indicated in this section and the payment of all delinquent personal property taxes before the homestead can be reinstated.

D.Any purchaser or new owner of real property must file an application for homestead exemption as herein provided.

E.The application for homestead exemption shall be filed with the county assessor of the county in which the homestead is located. A taxpayer applying for homestead exemption shall not be required to appear before the county assessor in person to submit such application.

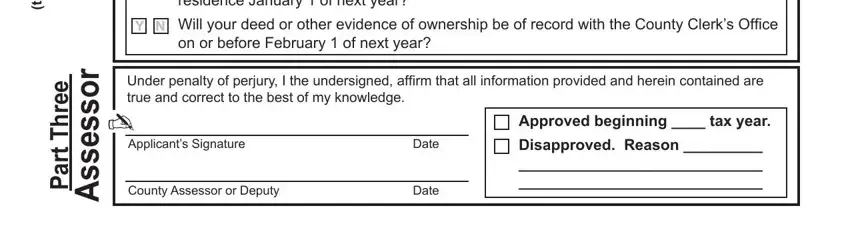

F.The property owner shall sign and swear to the truthfulness and correctness of the application’s contents. If the prop- erty owner is a minor or incompetent, the legal guardian shall sign and swear to the contents of the application.

G.The county assessor and duly appointed deputies are authorized and empowered to administer the required oaths.

H.The taxpayer shall notify the county assessor following any change in the use of property with homestead exemption thereon. The notice of change in homestead exemption status of property shall be in writing and may be filed with the

county assessor at any time on or before March 15 of the next following year after which such change occurs. The filing of a deed or other instrument evidencing a change of ownership or use shall constitute sufficient notice to the

county assessor.

I.Any single person of legal age married couple and their minor child or children, or the minor child or children of a deceased person, whether residing together or separated, or surviving spouse shall be allowed under this Code only one homestead exemption in the State of Oklahoma.

J.Any property owner who fails to give notice of change to the county assessor and permits the allowance of homestead exemption for any succeeding year where such homestead exemption is unlawful and improper shall owe the county treasurer:

1.An amount equal to twice the amount of the taxes lawfully due but not paid by reason of such unlawful and im- proper allowance of homestead exemption; and

2.The interest and penalty on such total sum as provided by statutes on delinquent ad valorem taxes. There shall be a lien on the property shall while such taxes are unpaid, but not for a period longer than that provided by stat- ute for other ad valorem tax liens.

K.Any person who has intentionally or knowingly permitted the unlawful and improper allowance of homestead exemp- tion shall forfeit the right to a homestead exemption on any property in this state for the two (2) succeeding years.

(Reference: Title 68, Section 2888; 2889; 2892 Oklahoma Statutes)