You are able to fill out R-19026 effortlessly with the help of our PDFinity® PDF editor. In order to make our editor better and simpler to utilize, we continuously implement new features, bearing in mind suggestions from our users. By taking a couple of basic steps, it is possible to start your PDF journey:

Step 1: Access the PDF doc in our editor by pressing the "Get Form Button" at the top of this page.

Step 2: When you access the online editor, there'll be the form prepared to be filled out. In addition to filling in different blank fields, you may as well perform some other actions with the PDF, specifically writing custom text, editing the initial textual content, adding graphics, affixing your signature to the document, and much more.

It will be simple to complete the pdf with our practical tutorial! Here is what you want to do:

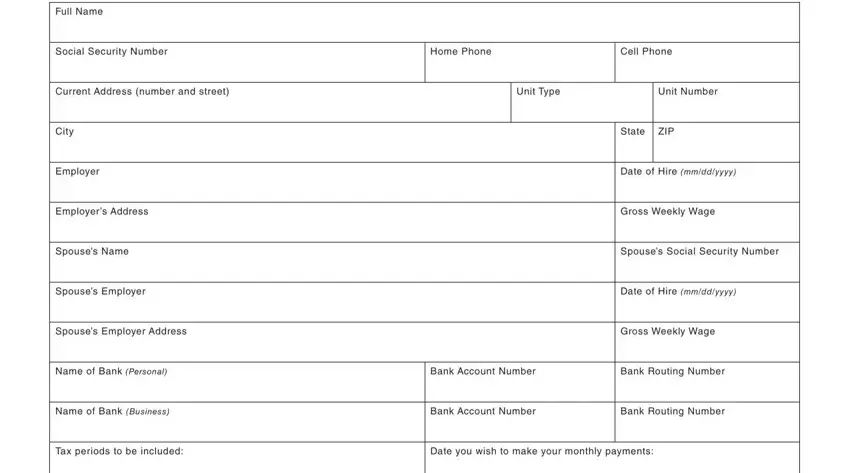

1. Begin filling out the R-19026 with a group of necessary blanks. Consider all of the information you need and ensure there is nothing neglected!

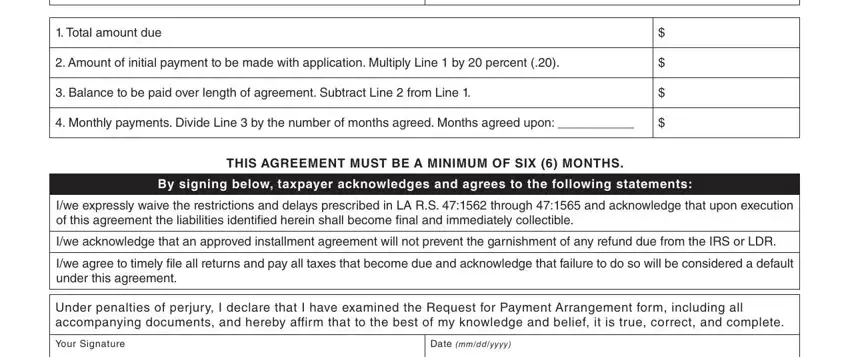

2. The next part is to complete the next few fields: Total amount due, Amount of initial payment to be, Balance to be paid over length of, Monthly payments Divide Line by, THIS AGREEMENT MUST BE A MINIMUM, By signing below taxpayer, Iwe expressly waive the, Iwe acknowledge that an approved, Iwe agree to timely file all, Under penalties of perjury I, Your Signature, and Date mmddyyyy.

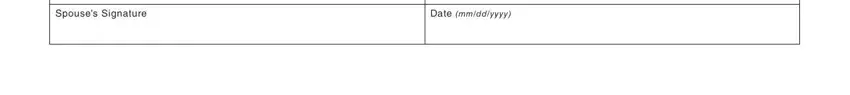

3. Completing Spouses Signature, and Date mmddyyyy is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

People generally make errors while filling out Spouses Signature in this section. Be sure you read twice whatever you enter here.

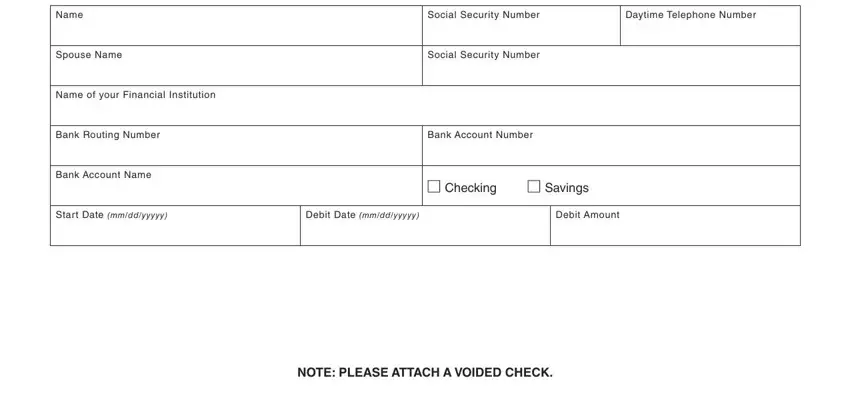

4. To go onward, this next step requires typing in a handful of empty form fields. These comprise of Name, Spouse Name, Name of your Financial Institution, Social Security Number, Daytime Telephone Number, Social Security Number, Bank Routing Number, Bank Account Number, Bank Account Name, Checking Savings, Start Date mmddyyyyy, Debit Date mmddyyyyy, Debit Amount, and NOTE PLEASE ATTACH A VOIDED CHECK, which are essential to continuing with this particular process.

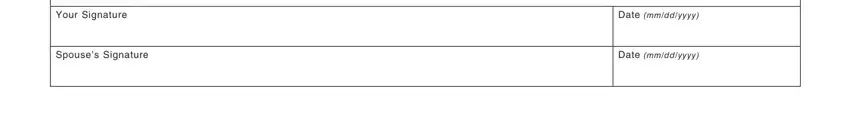

5. When you near the completion of this file, there are a couple more requirements that need to be met. In particular, Your Signature, Spouses Signature, Date mmddyyyy, and Date mmddyyyy should be filled out.

Step 3: Revise what you have entered into the form fields and hit the "Done" button. Acquire your R-19026 when you register here for a free trial. Conveniently view the pdf document inside your FormsPal account page, with any modifications and changes being all preserved! FormsPal is focused on the privacy of our users; we ensure that all information processed by our editor stays protected.