Working with PDF files online is definitely a piece of cake with our PDF editor. Anyone can fill out 940 for 2021 here with no trouble. Our professional team is constantly working to enhance the tool and ensure it is even better for clients with its extensive functions. Bring your experience one stage further with constantly growing and fantastic opportunities we provide! For anyone who is looking to get going, this is what it requires:

Step 1: Click the "Get Form" button in the top area of this page to open our tool.

Step 2: This tool grants the capability to modify most PDF forms in a variety of ways. Enhance it with any text, correct what is already in the PDF, and include a signature - all close at hand!

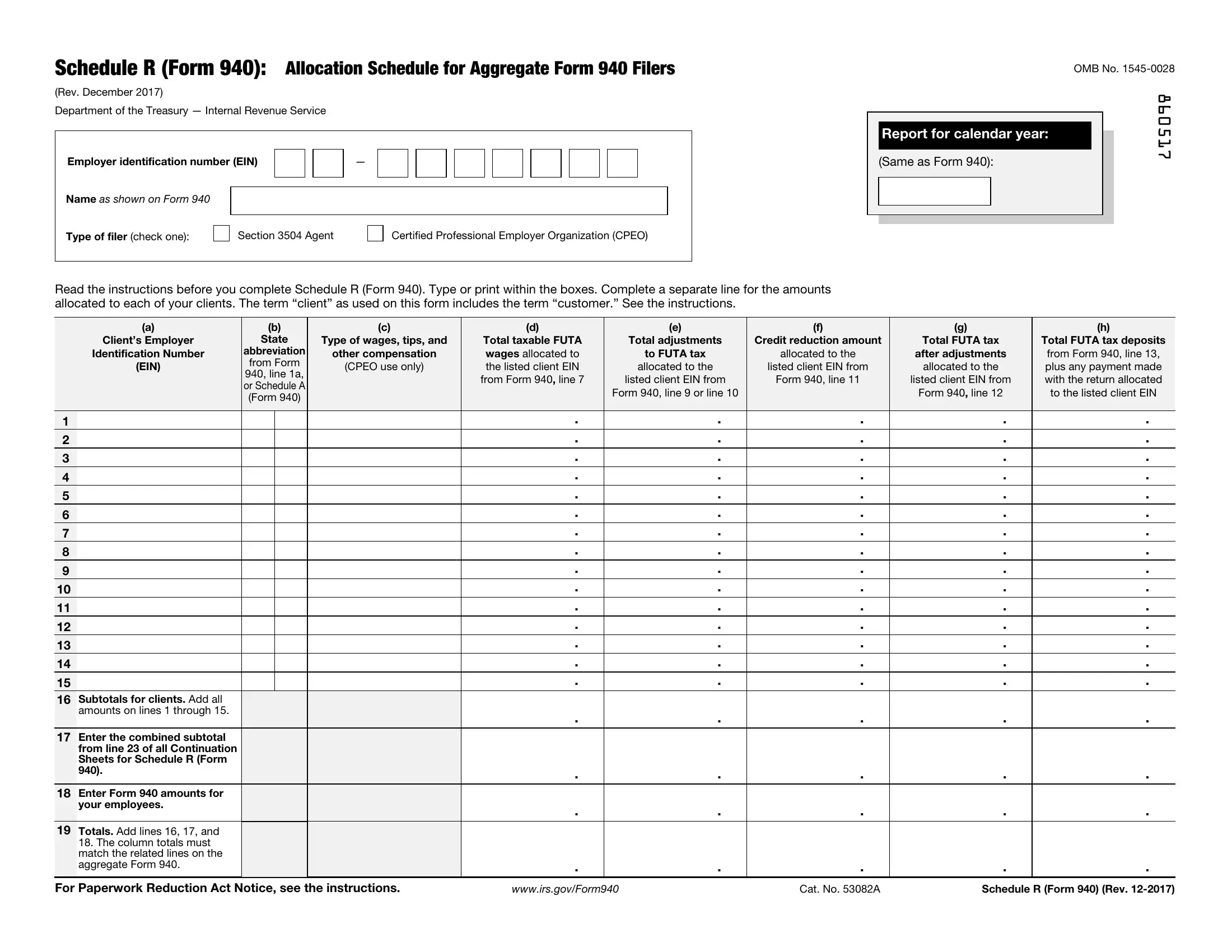

With regards to the blanks of this precise form, here is what you should do:

1. While filling out the 940 for 2021, be sure to incorporate all important blanks in its relevant form section. This will help hasten the work, which allows your details to be handled without delay and properly.

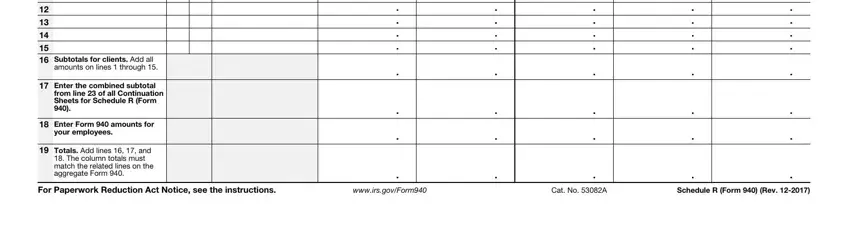

2. Immediately after this selection of blank fields is done, proceed to type in the suitable details in all these: Subtotals for clients Add all, Enter the combined subtotal, from line of all Continuation, Enter Form amounts for, your employees, Totals Add lines and, The column totals must match the, For Paperwork Reduction Act Notice, wwwirsgovForm, Cat No A, and Schedule R Form Rev.

Those who use this PDF frequently get some things incorrect when filling out your employees in this part. Make sure you read again whatever you enter right here.

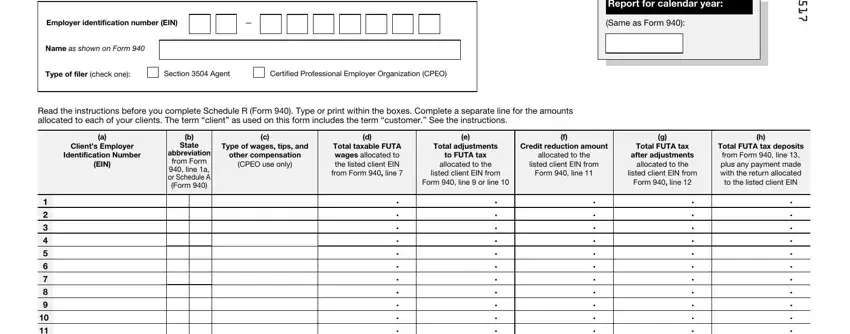

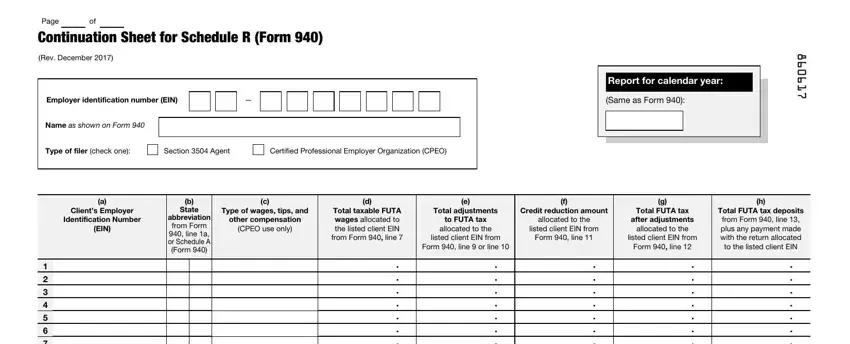

3. Your next part is usually straightforward - fill in all of the empty fields in Page Continuation Sheet for, Rev December, Employer identification number EIN, Name as shown on Form, Type of filer check one, Section Agent, Certified Professional Employer, Report for calendar year, Same as Form, Clients Employer, Identification Number, EIN, Type of wages tips and, other compensation, and CPEO use only in order to complete this part.

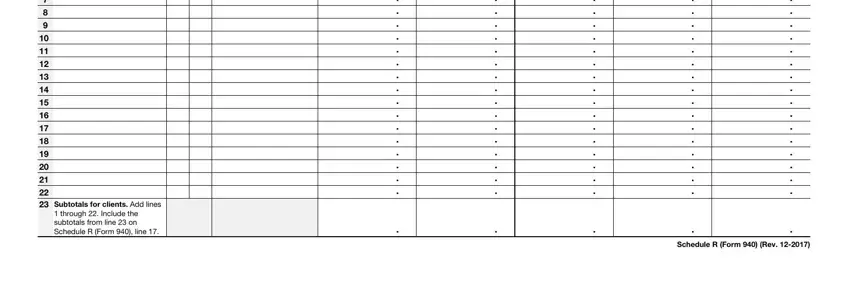

4. Filling out Subtotals for clients Add lines, through Include the subtotals, and Schedule R Form Rev is vital in this fourth stage - you should definitely don't rush and be attentive with every blank!

Step 3: Right after you have glanced through the information you given, just click "Done" to complete your FormsPal process. Sign up with us now and instantly gain access to 940 for 2021, available for download. Each change you make is handily kept , helping you to modify the pdf further if necessary. Here at FormsPal.com, we endeavor to make sure all your details are stored protected.