Any time you want to fill out washington state reseller permit, you don't need to install any kind of applications - just use our PDF editor. FormsPal development team is constantly endeavoring to enhance the tool and help it become much easier for clients with its extensive functions. Take advantage of the current revolutionary opportunities, and discover a heap of new experiences! All it requires is a couple of easy steps:

Step 1: Access the PDF doc in our tool by hitting the "Get Form Button" at the top of this webpage.

Step 2: Once you access the tool, you'll see the document ready to be filled out. Other than filling out different blank fields, you can also do many other actions with the Document, namely adding any words, modifying the original textual content, adding images, placing your signature to the PDF, and much more.

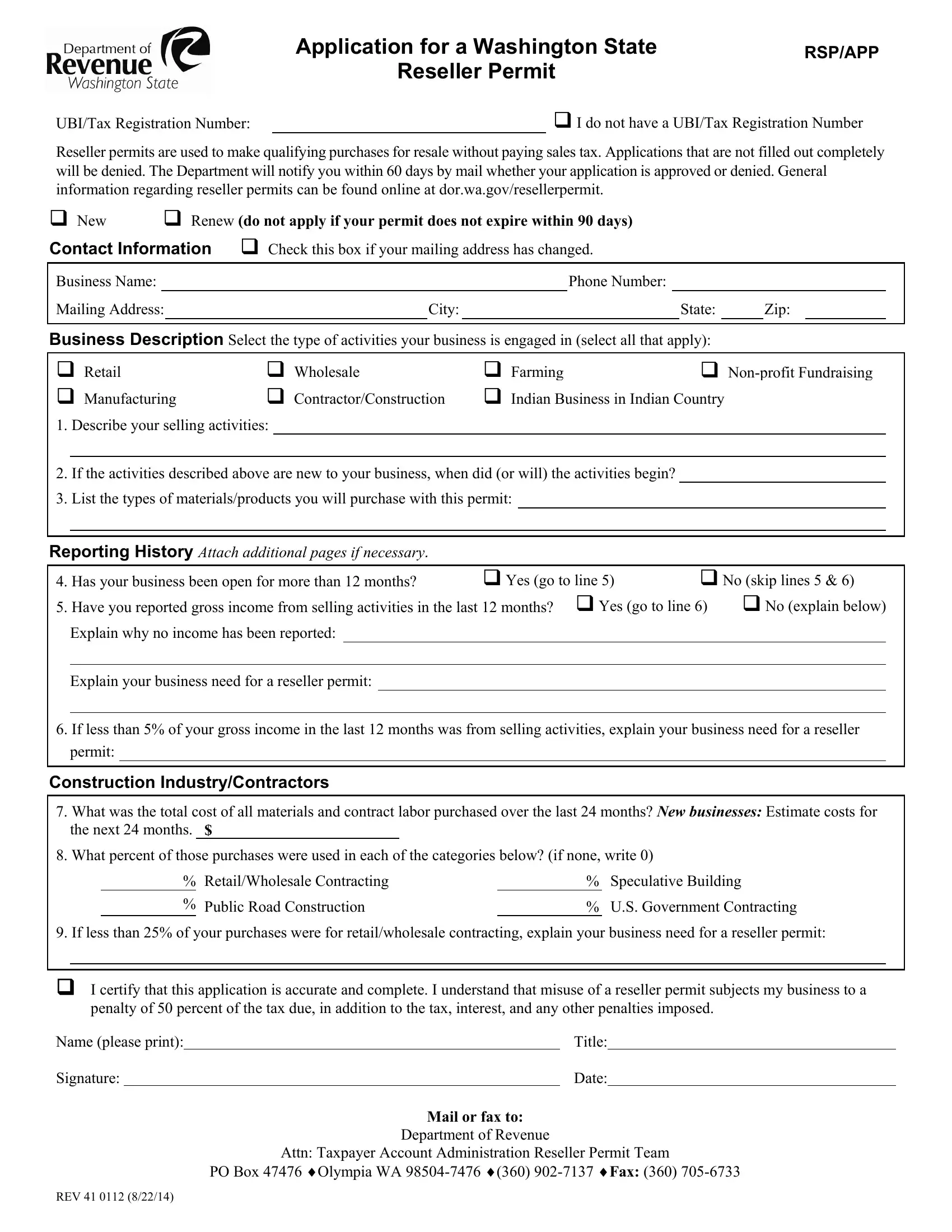

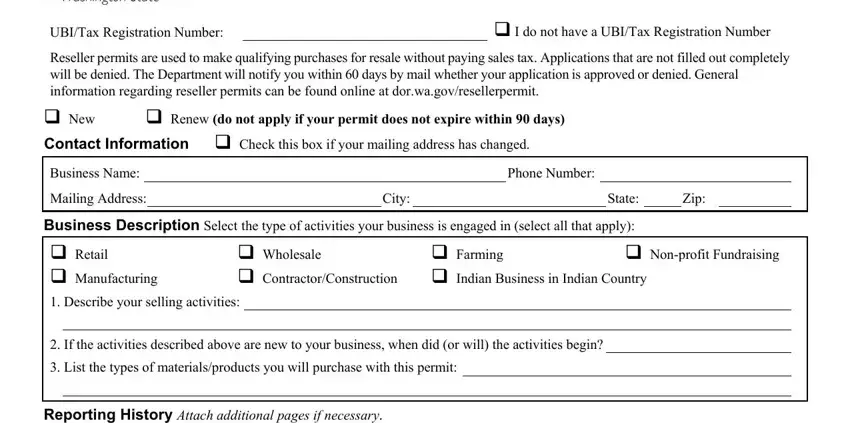

With regards to the blank fields of this precise document, here's what you should know:

1. For starters, while filling in the washington state reseller permit, start out with the area with the subsequent blank fields:

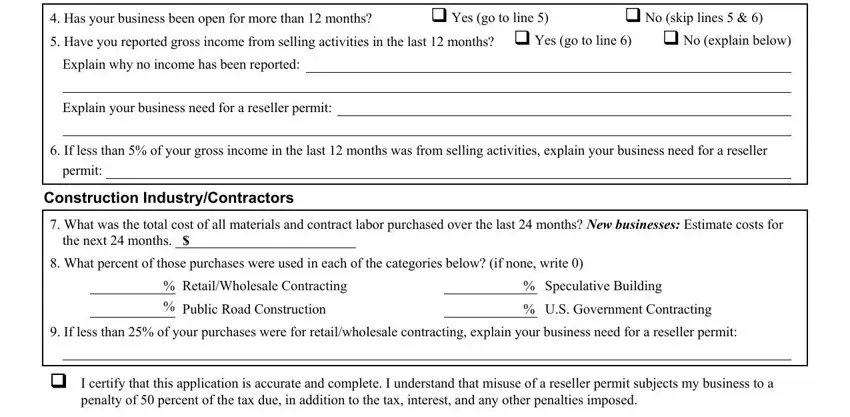

2. Once the last array of fields is finished, you should put in the necessary specifics in Reporting History Attach, Has your business been open for, Explain why no income has been, Yes go to line, No skip lines, Explain your business need for a, If less than of your gross, permit, Construction IndustryContractors, What was the total cost of all, the next months, What percent of those purchases, RetailWholesale Contracting, Public Road Construction, and Speculative Building so that you can progress to the 3rd stage.

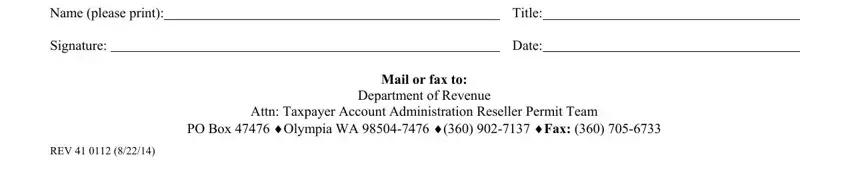

3. Your next stage is hassle-free - fill out all of the fields in Name please print, Signature, REV, Title, Date, Mail or fax to, Department of Revenue, Attn Taxpayer Account, and PO Box Olympia WA Fax to conclude this part.

People who work with this PDF often make errors while filling out REV in this section. Ensure you double-check whatever you enter here.

Step 3: Before moving forward, make sure that all form fields have been filled out the proper way. Once you are satisfied with it, click on “Done." Get hold of the washington state reseller permit after you sign up at FormsPal for a 7-day free trial. Easily get access to the pdf file from your FormsPal cabinet, with any modifications and adjustments being all saved! FormsPal guarantees your data privacy with a secure system that in no way saves or shares any type of personal data involved in the process. You can relax knowing your files are kept safe any time you work with our service!