Are you overwhelmed by trying to understand the complexities of RPD 41072 Forms in 2021? This comprehensive blog post includes everything you need to know about the RPD form. From understanding its purpose and when it's applicable, to completing it accurately and securely, we will cover all aspects of this important but often confusing bureaucratic process. Keep reading for information that can help you make sure your RPD Form experience is as stream-lined and worry-free as possible.

| Question | Answer |

|---|---|

| Form Name | Rpd 41072 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | in.pinterest.com pin 843791680181677011https://api10.ilovepdf.com/v1/download ... |

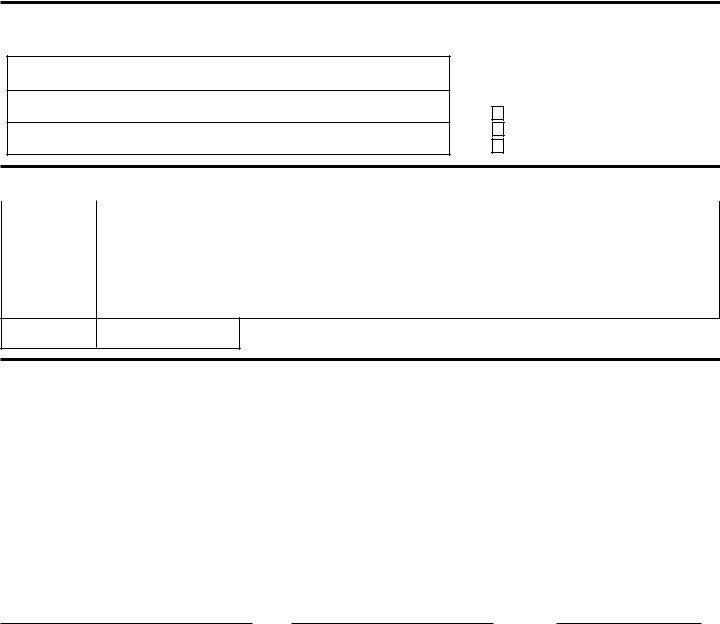

New Mexico Taxation and Revenue Department

ANNUAL SUMMARY OF WITHHOLDING TAX

Who Must Complete This Form: Employers, payers and gambling establishment operators who withhold a portion of New Mexico income tax from salaries or wages, from pension or annuity income, or from gambling winnings, may use Form

Form

or New Mexico Form

PART I. Business Information

PLEASE TYPE OR PRINT

NAME

STREET / BOX

CITY, STATE, ZIP

NMBTIN |

REPORTING YEAR |

|

|

FILING FREQUENCY (Check one)

Monthly

Quarterly

Semiannually

PART II. Schedule of New Mexico Income Tax Withheld and Reported (See instructions.)

MONTH |

AMOUNT |

MONTH |

AMOUNT |

MONTH |

AMOUNT |

|

1.January |

|

5.May |

|

9. |

September |

|

|

|

|

|

|

|

|

2.February |

|

6.June |

|

10. |

October |

|

|

|

|

|

|

|

|

3.March |

|

7.July |

|

11. November |

|

|

|

|

|

|

|

|

|

4.April |

|

8.August |

|

12. |

December |

|

|

|

|

|

|

|

|

TOTAL

(all columns)

PART III. Qualifying Information (See instructions.)

1. |

Enter the number of annual statements of withholding submitted. (Federal Forms |

|

|

2. |

Total New Mexico income tax withheld for the taxable year (as shown on Federal Forms |

|

|

$ |

|||

|

|||

3. |

Total New Mexico income tax withheld and reported during the reporting year |

$ |

|

|

|

|

|

4. |

Difference. Subtract line 3 from line 2. (See "Other Attachments" in instructions) |

$ |

|

|

|

|

PART IV. Taxpayer Declaration

I declare that I have examined this return and accompanying documents, and to the best of my knowledge and belief, they are true, correct and complete.

Signature: |

Title: |

Date: |

New Mexico Taxation and Revenue Department

ANNUAL SUMMARY OF WITHHOLDING TAX

Instructions

PART I. Business Information

Complete the information about your company and the re- porting year (e.g. 2021).

PART II. Schedule of New Mexico Income Tax Withheld and Reported

Enter the New Mexico income tax withheld and reported to the Taxation and Revenue Department on Forms

were withheld and not the month the tax was due. Enter the sum of all "AMOUNT" columns in the box marked "TOTAL".

Note: Form

2021 onging withholding tax is reported using

PART III. Qualifying Information

Reconcile the New Mexico income tax withheld and reported on Form

LINE 1. Enter the number of annual statements of with- holding submitted.

Enterthe number ofannualstatements ofwithholding submit- ted. (Federal Forms

LINE 2. Total New Mexico income tax withheld for the taxable year

Enter the total New Mexico income tax withheld for the tax- able year as shown on Federal Forms

LINE 3. Total New Mexico income tax withheld and re- ported during the reporting year

Enter the total New Mexico income tax withheld and reported on

LINE 4. Difference

Subtract line 3 from line 2 and enter the difference.

PART IV. Taxpayer Declaration

Sign and date the form. If applicable, prepare attachments and submit it to the Taxation and Revenue Department.

Other Attachments

Federal Forms

If you have or will be submitting the information returns to TRD through electronic or magnetic media (see Publication

If you file a wage and contribution report, ES903, to the New Mexico Workforce Solutions Department, or New Mexico

Form

If You Discover a Discrepancy

If you have underreported withholding on your CRS-

amended returns for the period(s) in which underreporting occurred and remit the difference.

Ifyouhaveoverpaidwithholdingonyourreturns,youmustsub- mit Form

returns for the period(s) in which overpayments occurred. No refund will be paid on the basis of this report alone.