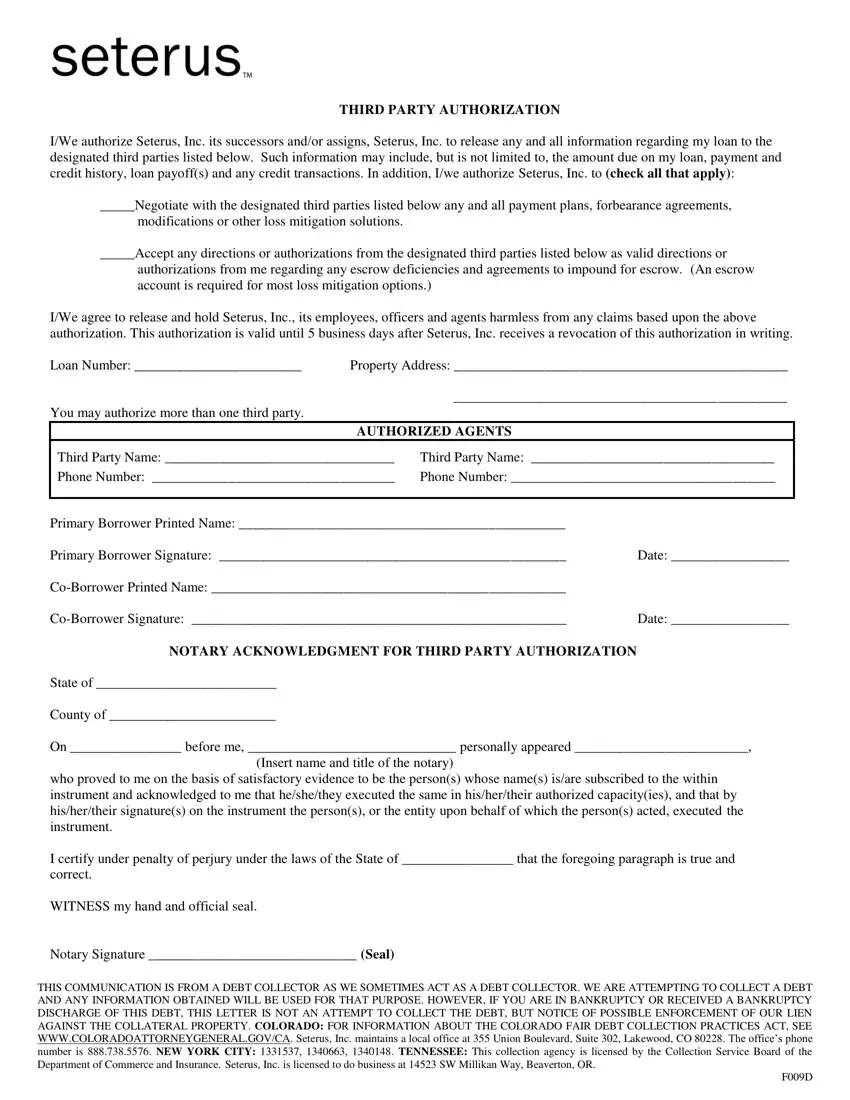

THIRD PARTY AUTHORIZATION

I/We authorize Seterus, Inc. its successors and/or assigns, Seterus, Inc. to release any and all information regarding my loan to the designated third parties listed below. Such information may include, but is not limited to, the amount due on my loan, payment and credit history, loan payoff(s) and any credit transactions. In addition, I/we authorize Seterus, Inc. to (check all that apply):

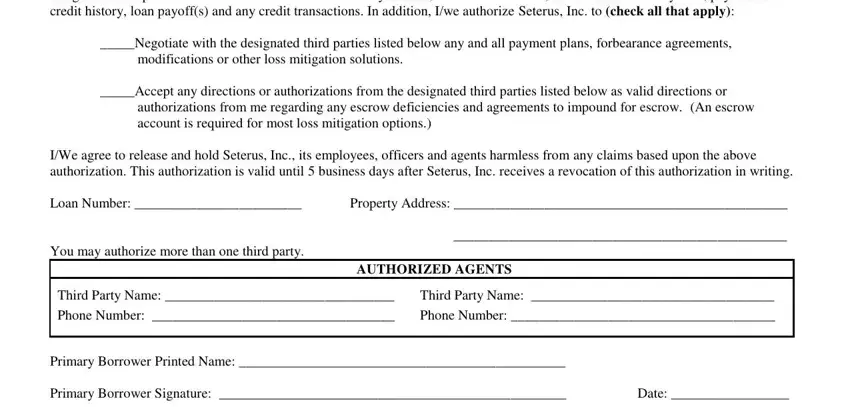

_____Negotiate with the designated third parties listed below any and all payment plans, forbearance agreements,

modifications or other loss mitigation solutions.

_____Accept any directions or authorizations from the designated third parties listed below as valid directions or

authorizations from me regarding any escrow deficiencies and agreements to impound for escrow. (An escrow account is required for most loss mitigation options.)

I/We agree to release and hold Seterus, Inc., its employees, officers and agents harmless from any claims based upon the above authorization. This authorization is valid until 5 business days after Seterus, Inc. receives a revocation of this authorization in writing.

Loan Number: ________________________ |

Property Address: ________________________________________________ |

|

|

________________________________________________ |

You may authorize more than one third party. |

|

|

|

|

AUTHORIZED AGENTS |

|

Third Party Name: _________________________________ |

Third Party Name: ___________________________________ |

Phone Number: ___________________________________ |

Phone Number: ______________________________________ |

|

|

Primary Borrower Printed Name: _______________________________________________ |

|

Primary Borrower Signature: __________________________________________________ |

Date: _________________ |

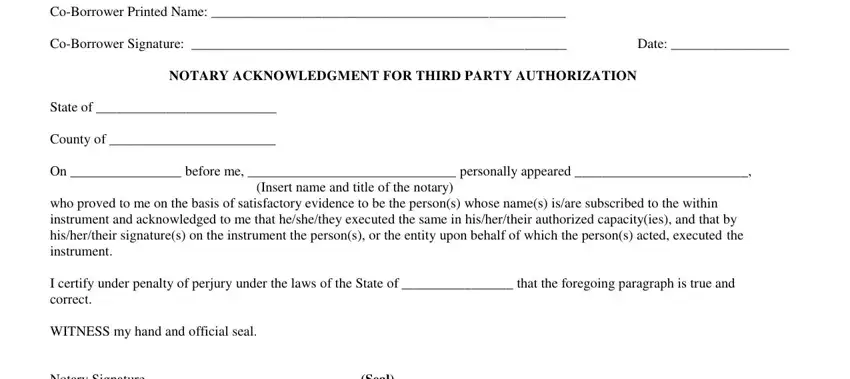

Co-Borrower Printed Name: ___________________________________________________ |

|

Co-Borrower Signature: ______________________________________________________ |

Date: _________________ |

NOTARY ACKNOWLEDGMENT FOR THIRD PARTY AUTHORIZATION State of __________________________

County of ________________________

On ________________ before me, ______________________________ personally appeared _________________________,

(Insert name and title of the notary)

who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under penalty of perjury under the laws of the State of ________________ that the foregoing paragraph is true and

correct.

WITNESS my hand and official seal.

Notary Signature ______________________________ (Seal)

THIS COMMUNICATION IS FROM A DEBT COLLECTOR AS WE SOMETIMES ACT AS A DEBT COLLECTOR. WE ARE ATTEMPTING TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. HOWEVER, IF YOU ARE IN BANKRUPTCY OR RECEIVED A BANKRUPTCY DISCHARGE OF THIS DEBT, THIS LETTER IS NOT AN ATTEMPT TO COLLECT THE DEBT, BUT NOTICE OF POSSIBLE ENFORCEMENT OF OUR LIEN AGAINST THE COLLATERAL PROPERTY. COLORADO: FOR INFORMATION ABOUT THE COLORADO FAIR DEBT COLLECTION PRACTICES ACT, SEE WWW.COLORADOATTORNEYGENERAL.GOV/CA. Seterus, Inc. maintains a local office at 355 Union Boulevard, Suite 302, Lakewood, CO 80228. The office’s phone number is 888.738.5576. NEW YORK CITY: 1331537, 1340663, 1340148. TENNESSEE: This collection agency is licensed by the Collection Service Board of the Department of Commerce and Insurance. Seterus, Inc. is licensed to do business at 14523 SW Millikan Way, Beaverton, OR.

F009D