You could fill in social security correct effectively using our PDFinity® PDF editor. To make our tool better and simpler to use, we constantly design new features, with our users' feedback in mind. Getting underway is effortless! All you have to do is adhere to the following basic steps directly below:

Step 1: Access the PDF in our tool by clicking the "Get Form Button" above on this page.

Step 2: With this handy PDF tool, you're able to do more than merely fill in blanks. Try all of the functions and make your documents seem professional with custom textual content put in, or tweak the original input to excellence - all that accompanied by the capability to add stunning pictures and sign the PDF off.

It really is simple to fill out the form using out practical guide! Here is what you should do:

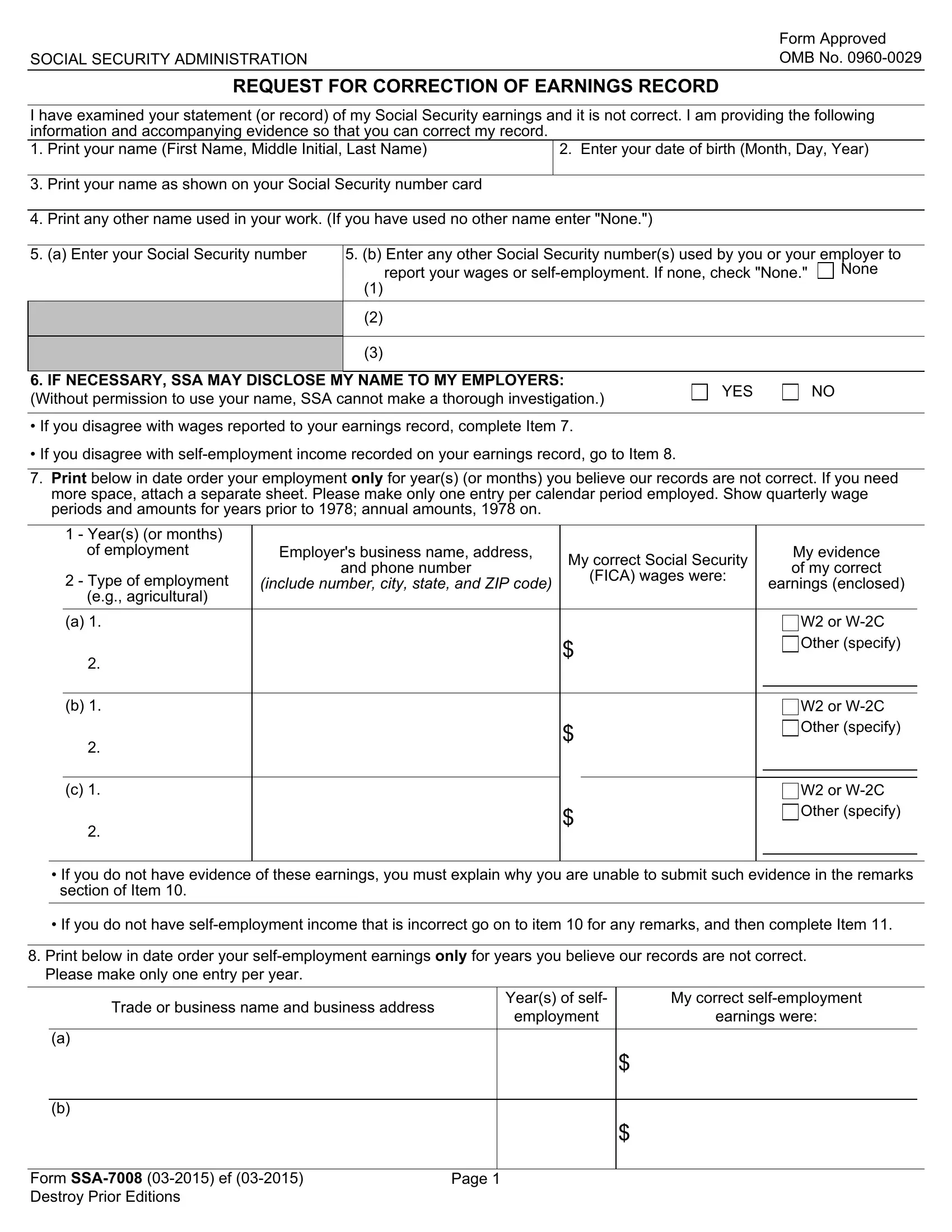

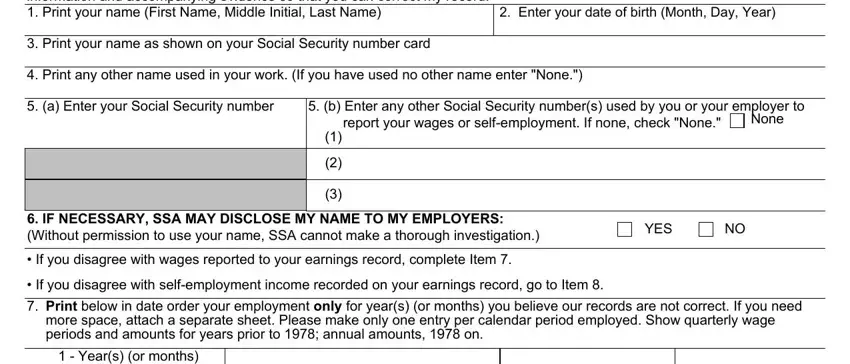

1. It is important to fill out the social security correct correctly, thus pay close attention while filling out the sections containing all these blanks:

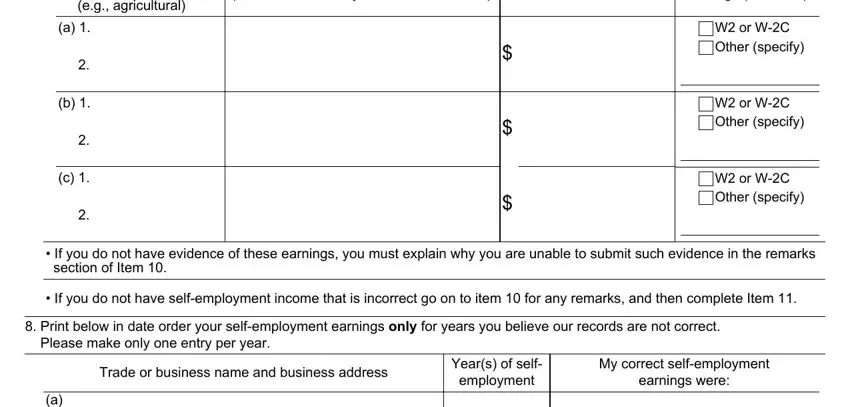

2. The subsequent part would be to fill out all of the following fields: Type of employment eg, include number city state and ZIP, earnings enclosed, W or WC Other specify, W or WC Other specify, W or WC Other specify, If you do not have evidence of, If you do not have selfemployment, Print below in date order your, Trade or business name and, Years of self, employment, My correct selfemployment, and earnings were.

Many people frequently make some mistakes while filling out Print below in date order your in this section. Remember to double-check everything you type in right here.

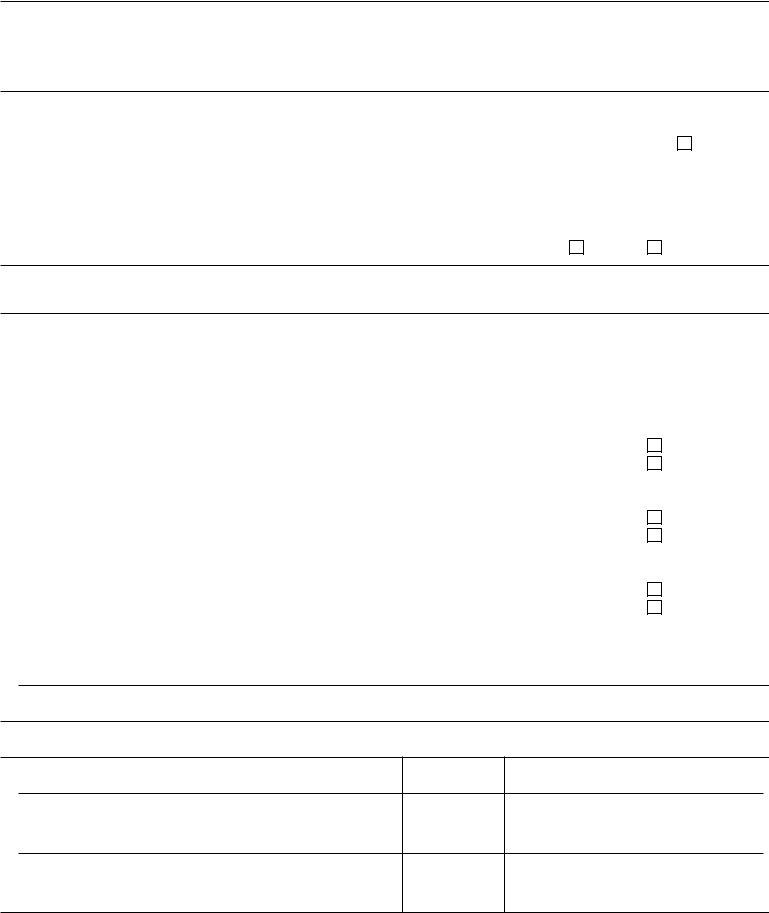

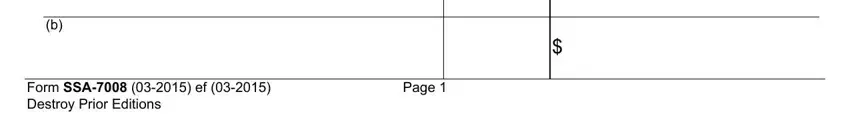

3. In this specific step, review Form SSA ef Destroy Prior, and Page. Each one of these have to be taken care of with utmost focus on detail.

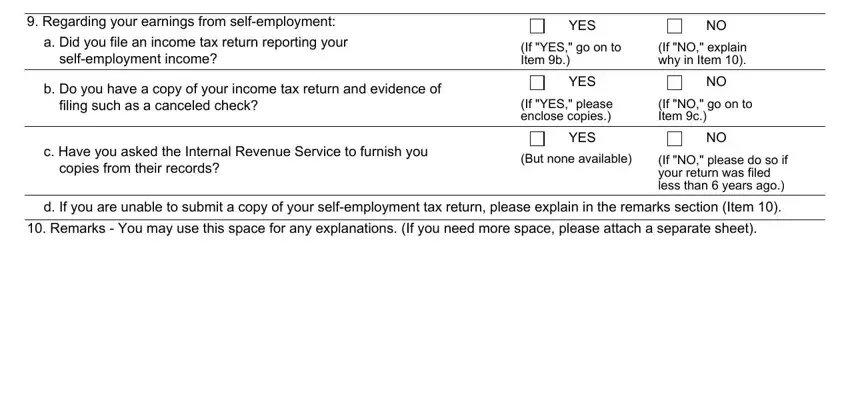

4. This next section requires some additional information. Ensure you complete all the necessary fields - Regarding your earnings from, a Did you file an income tax, b Do you have a copy of your, c Have you asked the Internal, YES, If YES go on to Item b, If NO explain why in Item, YES, If YES please enclose copies, If NO go on to Item c, YES, But none available, If NO please do so if your return, d If you are unable to submit a, and Remarks You may use this space - to proceed further in your process!

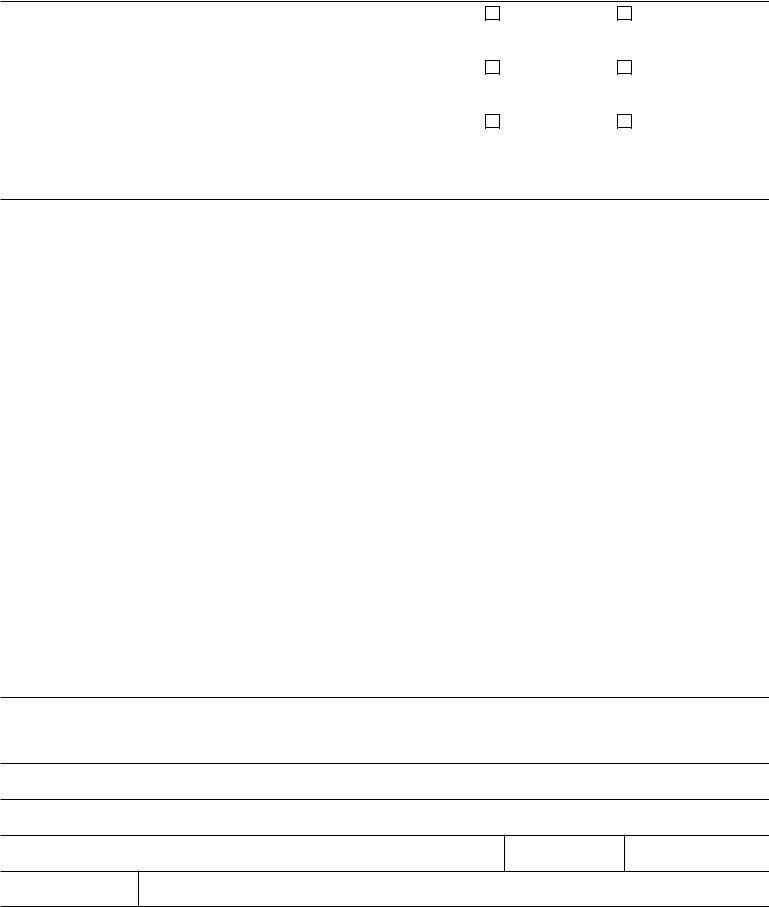

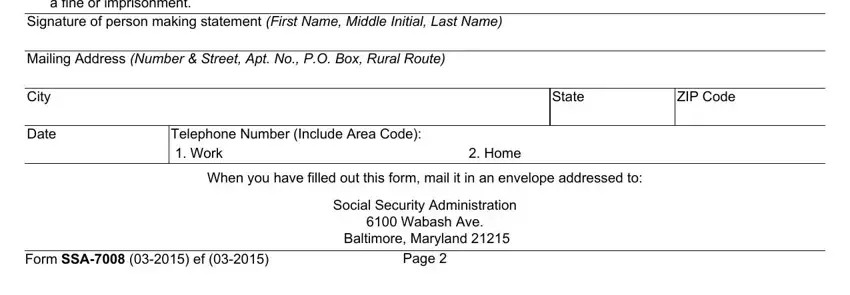

5. When you get close to the end of this document, you'll notice a few more points to undertake. Particularly, I declare under penalty of, Mailing Address Number Street Apt, City, Date, Telephone Number Include Area Code, Home, When you have filled out this form, State, ZIP Code, Form SSA ef, Page, Social Security Administration, Wabash Ave, and Baltimore Maryland must all be done.

Step 3: Immediately after taking one more look at the entries, click "Done" and you're done and dusted! Sign up with FormsPal right now and easily access social security correct, prepared for downloading. All changes you make are preserved , meaning you can change the form later on as needed. We do not share the information that you use while dealing with forms at our website.