When working in the online PDF tool by FormsPal, you may fill in or alter pension person form here and now. Our tool is constantly developing to give the very best user experience attainable, and that's due to our commitment to continuous enhancement and listening closely to user opinions. All it takes is just a few easy steps:

Step 1: Click the "Get Form" button in the top part of this page to get into our PDF editor.

Step 2: With this state-of-the-art PDF editor, it is possible to do more than simply complete blank form fields. Express yourself and make your forms look great with customized text put in, or adjust the original input to excellence - all supported by the capability to insert just about any images and sign it off.

It is actually easy to complete the form using this practical tutorial! Here is what you need to do:

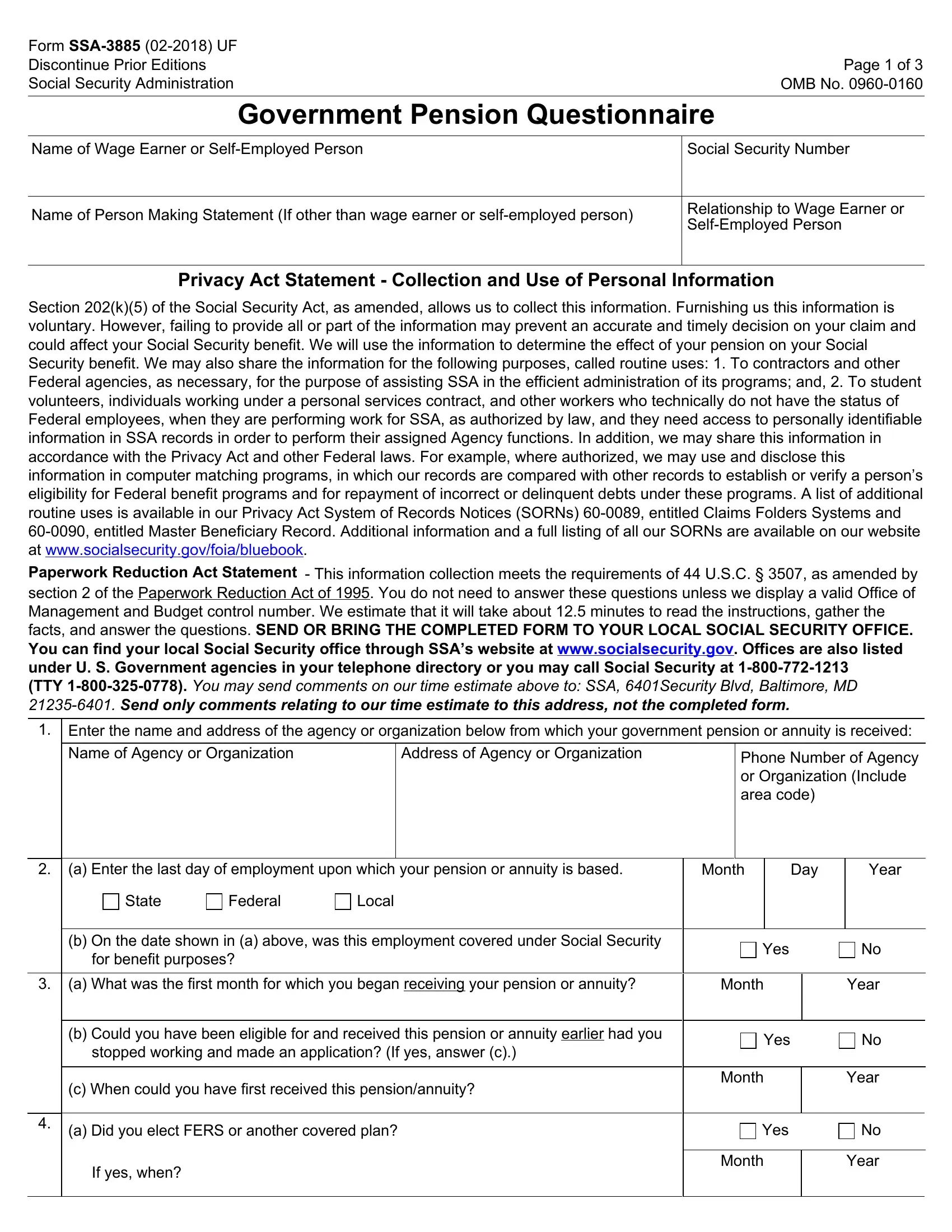

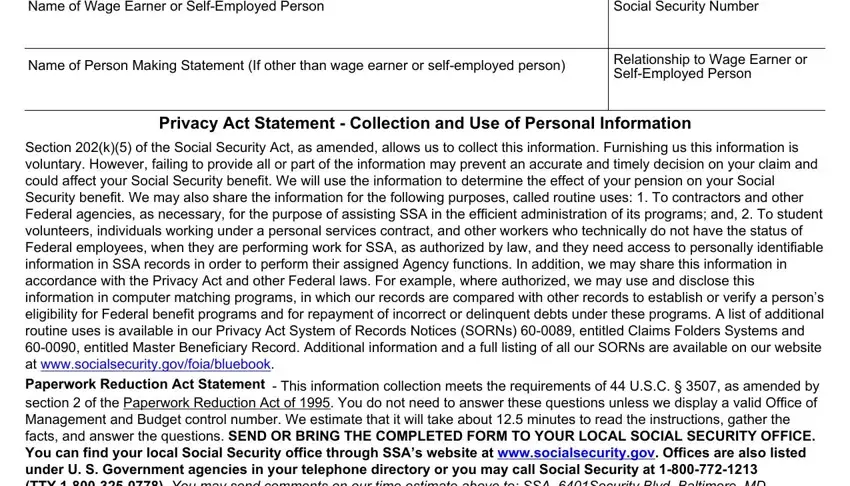

1. Whenever filling out the pension person form, ensure to complete all of the necessary blank fields within the corresponding form section. It will help hasten the work, allowing for your details to be handled without delay and appropriately.

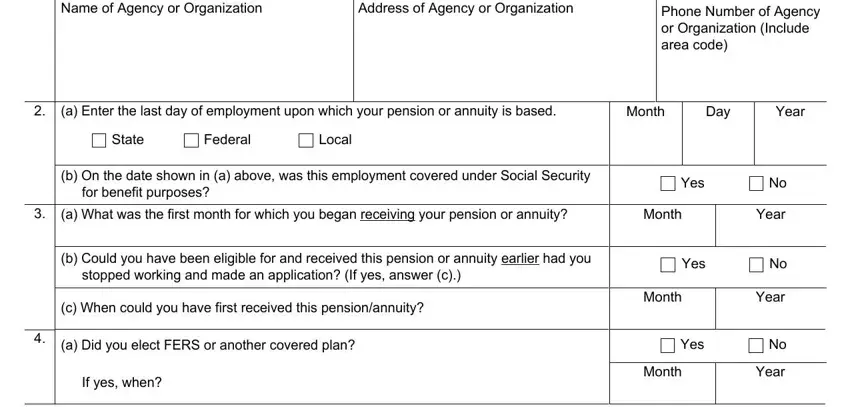

2. The next stage is to fill in these particular fields: Name of Agency or Organization, Address of Agency or Organization, Phone Number of Agency or, a Enter the last day of employment, Month, Day, Year, State, Federal, Local, b On the date shown in a above was, for benefit purposes, Yes, a What was the first month for, and Month.

Always be very attentive while filling out Yes and Month, because this is where most users make mistakes.

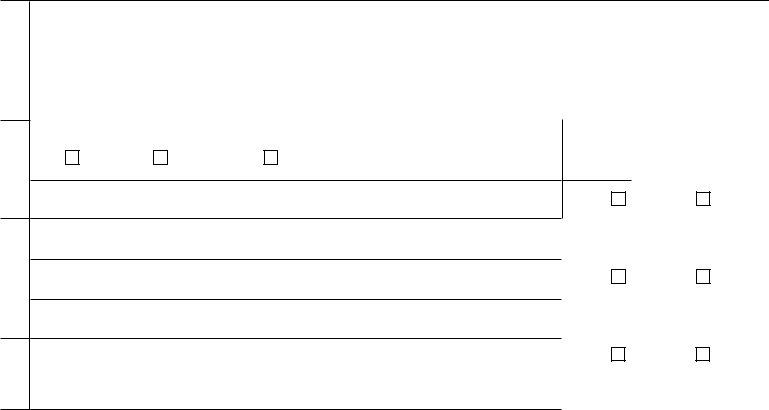

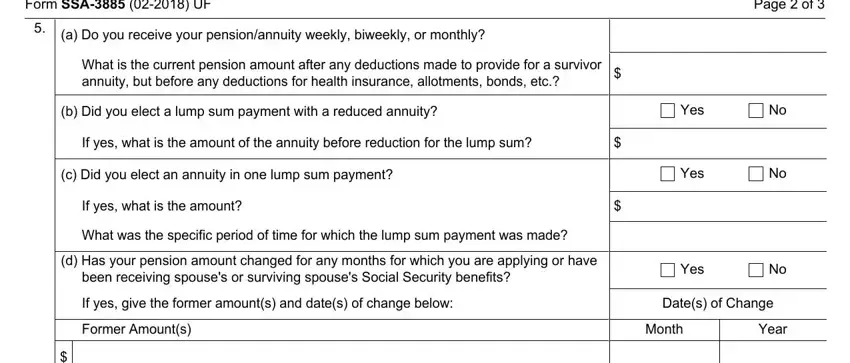

3. This next portion will be about Form SSA UF, Page of, a Do you receive your, What is the current pension amount, b Did you elect a lump sum payment, If yes what is the amount of the, c Did you elect an annuity in one, If yes what is the amount, What was the specific period of, d Has your pension amount changed, been receiving spouses or, If yes give the former amounts and, Former Amounts, Yes, and Yes - fill in each one of these empty form fields.

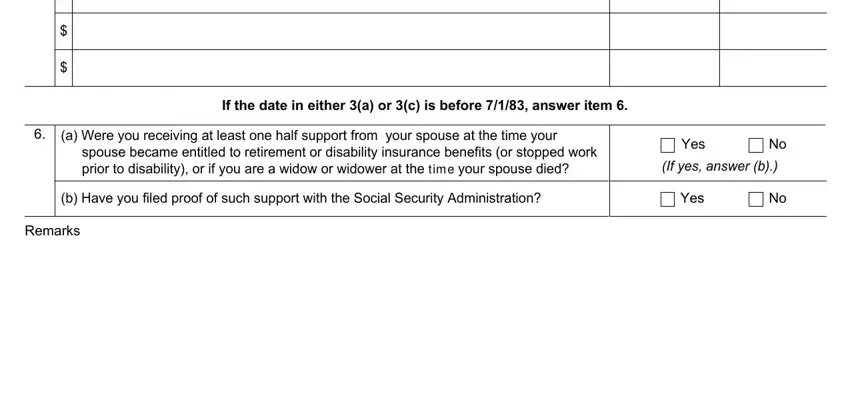

4. This section comes with these particular fields to focus on: If the date in either a or c is, a Were you receiving at least one, spouse became entitled to, Yes, If yes answer b, b Have you filed proof of such, Yes, and Remarks.

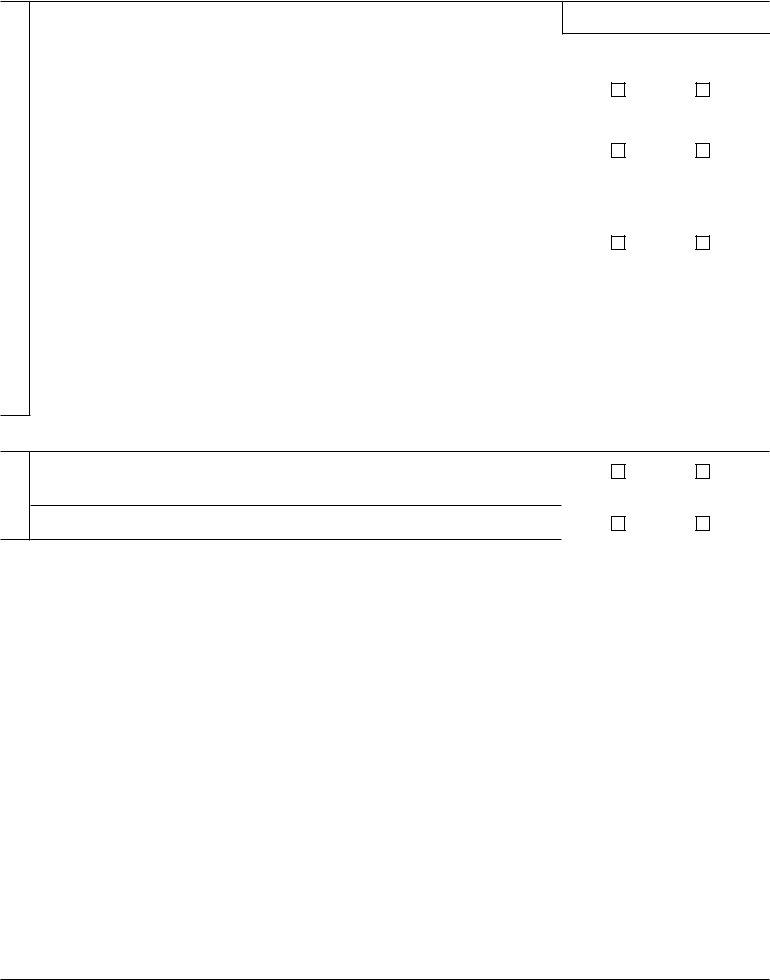

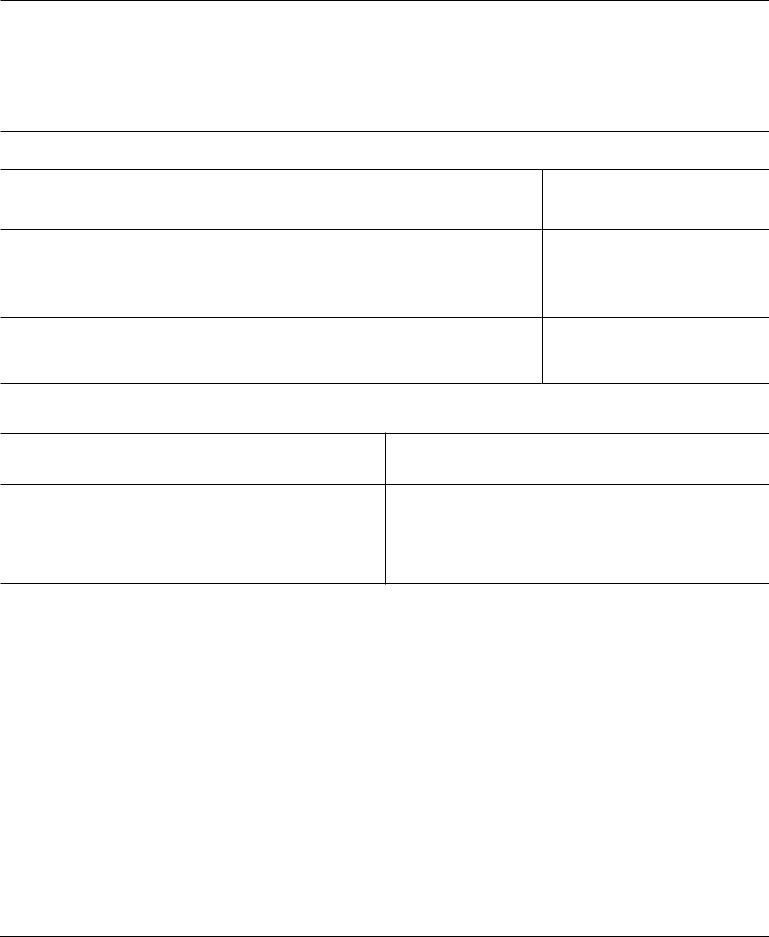

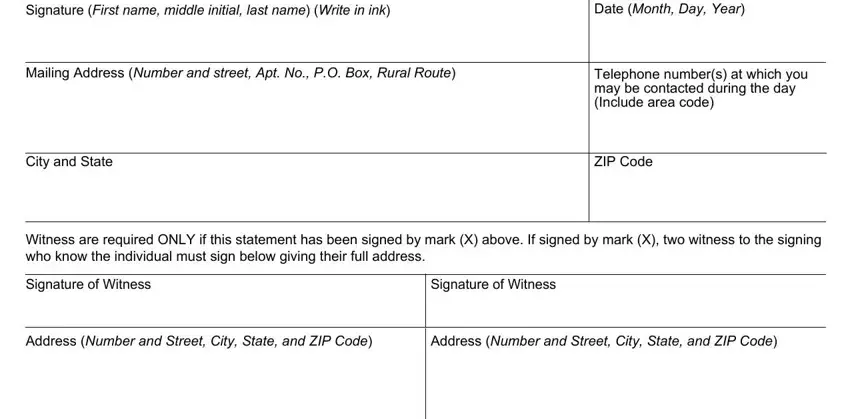

5. And finally, the following final subsection is what you'll want to wrap up prior to using the document. The blanks in question include the next: Signature First name middle, Date Month Day Year, Mailing Address Number and street, Telephone numbers at which you may, City and State, ZIP Code, Witness are required ONLY if this, Signature of Witness, Signature of Witness, Address Number and Street City, and Address Number and Street City.

Step 3: When you have looked once again at the information you filled in, click on "Done" to finalize your document generation. Right after starting a7-day free trial account here, it will be possible to download pension person form or email it immediately. The PDF form will also be accessible in your personal cabinet with your adjustments. At FormsPal.com, we aim to make sure all your details are stored protected.