Are you a contract professional seeking to better understand the process for awarding Standard Form 1153? This blog post is here to help. Here, we will provide an overview of what SF-1153 is, why it is important for contract management professionals, and some tips on how to make sure that your organization obtains the best value possible from this form. By reading through this article in full, you should have a more informed understanding of what SF-1153 entails and how it can benefit your contracts.

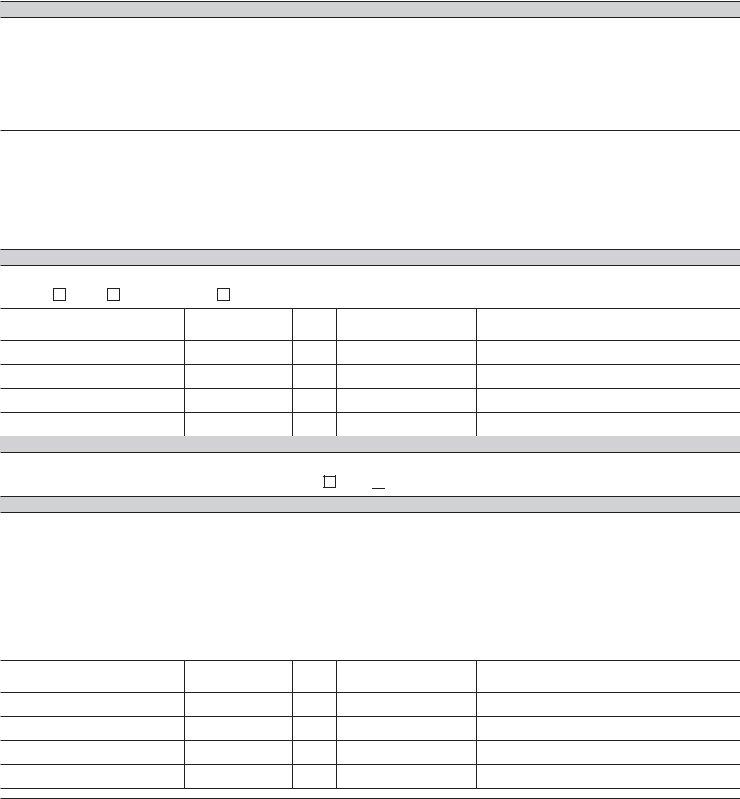

| Question | Answer |

|---|---|

| Form Name | Standard Form 1153 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | sf 1153 form, opm standard sf claim form, opm standard form 1153, 2011 form compensation |

CLAIM FOR COMPENSATION OF DECEASED CIVILIAN EMPLOYEE |

Form Approved |

|

OMB No. |

||

|

||

|

|

GENERAL INFORMATION

•Complete this form and send it to the Federal Government agency that employed the deceased at the time of his/her death. Contact that agency if you need help to complete this form.

•All Government checks in your possession, drawn to the order of the deceased in payment of “unpaid compensation,” should accompany this claim. All Government checks drawn to the order of the deceased for other purposes (such as veterans’ benefits, social security benefits, or Federal tax refunds) should be returned to the agency that sent it.

PART A

1. |

Name of deceased |

2. |

Social Security Number of deceased |

|

|

|

|

3. |

Last address of deceased (if known) |

4. |

Date of death |

|

|

|

|

5. Employing agency

INSTRUCTIONS

•If you are a designated beneficiary of the deceased, complete Parts B and G.

•If you are the widow or widower of the deceased, complete Parts B, C, and G.

•If you are not a designated beneficiary of the deceased but you are a relative or next of kin of the deceased, complete Parts D and G.

•If you are an executor or administrator of the deceased’s estate, complete Parts E and G.

•If you do not meet the criteria in Items 1 through 4, complete Parts F and G.

PART B

1. Is a Designation of Beneficiary for Unpaid Compensation (SF 1152) on file with the agency?

Yes No

If you need more room, write "See Attached" in Part B. On a blank sheet (the attachment), print your name, date of birth and social security number at the top. List the information required in Part B for each beneficiary. Sign the form and attachment having the same two people witness both of your signatures..

Full Name/Legal entity, e.g., Trust

Social Security

Number

Age

Relationship to deceased

Address

PART C

1. Do you certify that (1) you were married to the deceased and (2) to the best of your knowledge and belief the marriage

was not dissolved prior to his/her death? |

Yes |

No

PART D

1.List below the name, social security number, age, relationship, and address of:

(a)If no widow or widower survives, list each living child of the deceased and state whether natural, adopted, illegitimate or stepchild.

(b)If no child survives, list each living descendant of the deceased children.

(c)If no widow or widower, child or descendant of deceased children survive, list each surviving parent and state whether natural, step, foster, or adoptive parent.

(d)If none of the above survives, list the next of kin who may be capable of inheriting from the deceased (brothers, sisters, descendants of deceased brothers and sisters).

Full name

Social Security

Number

Age

Relationship to deceased

Address

U.S. Office of Personnel Management |

|

Standard Form 1153 |

CFR 178, Subpart B |

(continue on other side) |

Revised August 2011 |

NSN |

1153 |

|

|

|

All other previous editions are not usable |

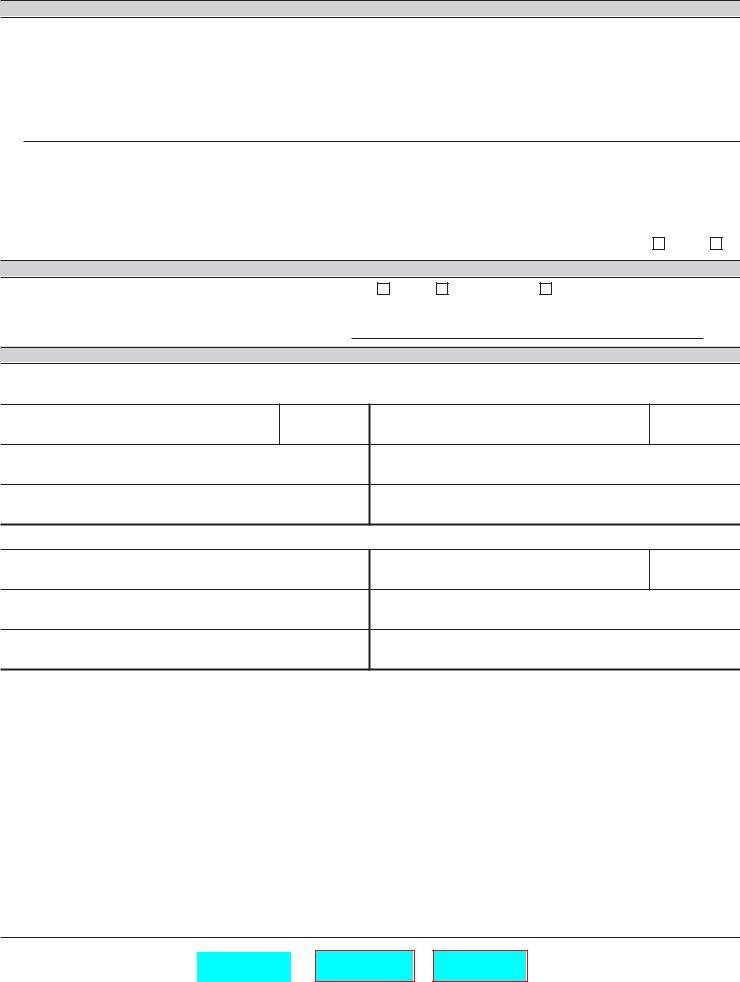

PART E

1.If none of the individuals listed in Parts B and D survives and an executor or administrator of the deceased’s estate has been appointed, the following statement should be completed.

I/we have been duly appointed |

|

of the estate of the deceased, as |

|

(Executor or Administrator) |

|

evidenced by certificate of appointment herewith, administration having been taken out in the interest of

(Name, address, and relationship of interested relative or creditor)

and such appointment is still in full force and effect.

NOTE: If making claim as the executor or administrator of the estate of the deceased, no witnesses are required, but a court certificate evidencing your appointment must be submitted.

2. If no administrator or executor of the deceased’s estate has been appointed, will one be appointed? Yes

No

PART F

1. Have funeral expenses of the deceased been paid? |

Yes |

No |

(If paid, receipted bill of the funeral director must be attached.) |

|

|

Whose money was used to pay the funeral expenses?

Don’t know

.

PART G

Fines, Penalties and Forfeitures are imposed by law for making false or fraudulent claims against the United States or making false statements in connection therewith.

Signature of claimant

Date

Signature of claimant

Date

Street address

Street address

City, State, and Zip Code

City, State, and Zip Code

Two Witnesses are Required

Signature of witness |

Date |

Signature of witness |

|

|

|

Date

Street address

Street address

City, State, and Zip Code

City, State, and Zip Code

Privacy Act and Public Burden Statement

Solicitation of this information is authorized by the Code of Federal Regulations, Part 178, Subpart B. The information you furnish will be used to determine the amount, validity, and the person(s) entitled to the unpaid compensation of a deceased Federal employee. The information may be shared and is subject to verification, via paper, electronic media, or through the use of computer matching programs to obtain information necessary for determination of entitlement under this program or to report income for tax purposes. It may also be shared and verified, as noted above, with law enforcement agencies when they are investigating a violation or potential violation of the civil or criminal law. Public Law

We think this form takes an average of 15 minutes per response to complete, including the time for reviewing instructions, getting the needed data, and reviewing the completed form. Send comments regarding our estimate or any other aspect of SF 1153, including suggestions for reducing completion time, to the Office of Personnel Management (OPM), Reports and Forms Officer, Paperwork Reduction

U.S. Office of Personnel Management CFR 178, Subpart B

Standard Form 1153 Revised Aug 2011