You are able to work with State Form 38337 effectively using our online PDF editor. Our expert team is always working to improve the tool and ensure it is much easier for people with its cutting-edge functions. Enjoy an ever-evolving experience now! It merely requires a couple of easy steps:

Step 1: Click on the "Get Form" button in the top area of this page to open our tool.

Step 2: With this advanced PDF tool, you may do more than just fill in blank fields. Edit away and make your documents look faultless with customized text put in, or fine-tune the original input to excellence - all that backed up by the capability to insert any photos and sign the document off.

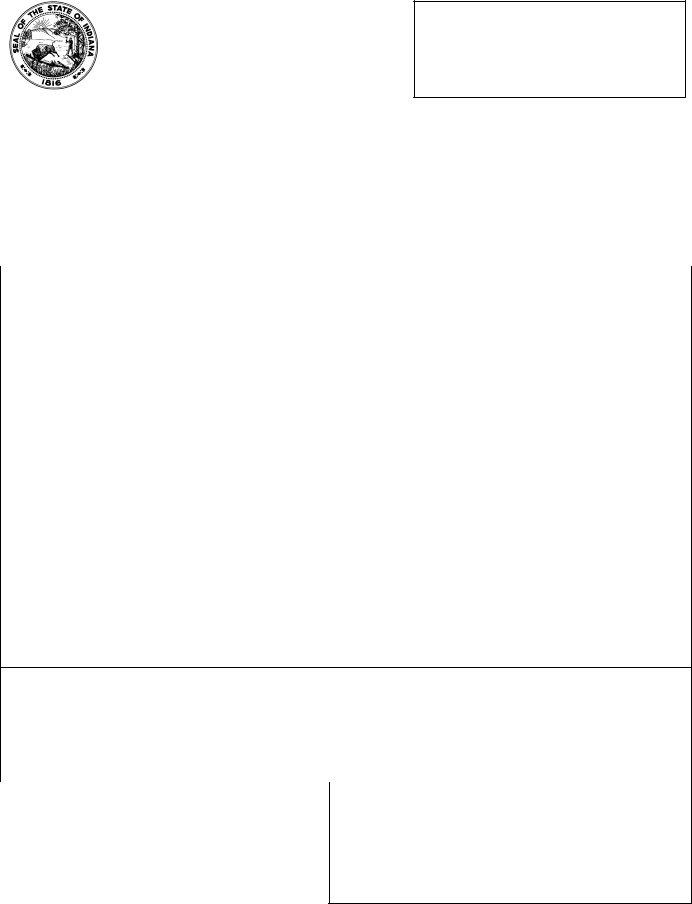

In an effort to finalize this document, be certain to provide the right information in every field:

1. Fill out your State Form 38337 with a group of necessary blanks. Collect all of the necessary information and ensure not a single thing forgotten!

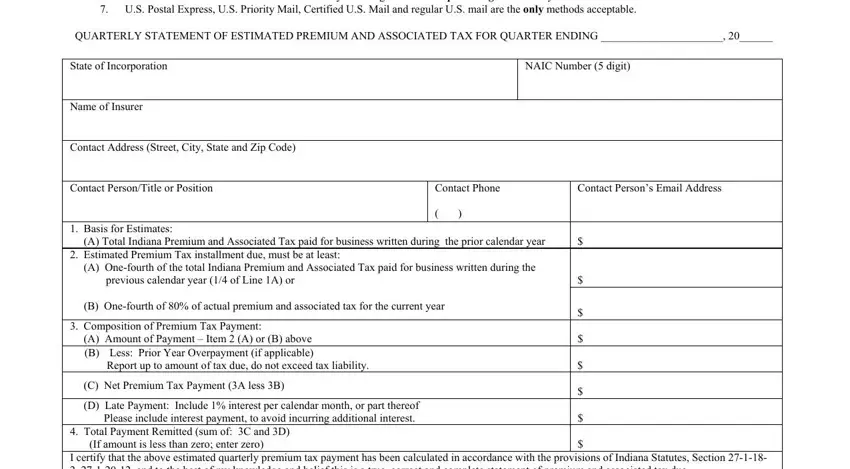

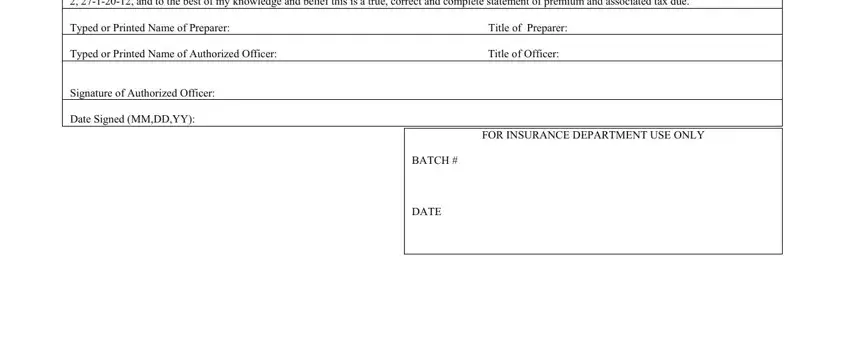

2. When this part is done, go to enter the relevant information in these: Total Payment Remitted sum of C, FOR INSURANCE DEPARTMENT USE ONLY, and BATCH DATE.

As for Total Payment Remitted sum of C and FOR INSURANCE DEPARTMENT USE ONLY, be certain you get them right in this current part. Those two are the most significant ones in this file.

Step 3: Soon after proofreading your entries, press "Done" and you're all set! Grab the State Form 38337 the instant you subscribe to a 7-day free trial. Readily access the form in your personal account, along with any edits and adjustments conveniently synced! We do not sell or share the information that you provide while filling out forms at our site.