If you intend to fill out uniform residential loan application for rural assistance, there's no need to download any software - just make use of our online PDF editor. To have our editor on the forefront of efficiency, we strive to put into operation user-oriented features and enhancements on a regular basis. We're routinely grateful for any feedback - play a vital role in remolding PDF editing. Getting underway is easy! All that you should do is stick to the following easy steps down below:

Step 1: Click on the "Get Form" button above on this page to open our PDF editor.

Step 2: The editor will allow you to modify PDF files in a variety of ways. Improve it by including customized text, adjust original content, and add a signature - all readily available!

This PDF doc requires some specific information; to guarantee accuracy, please consider the subsequent steps:

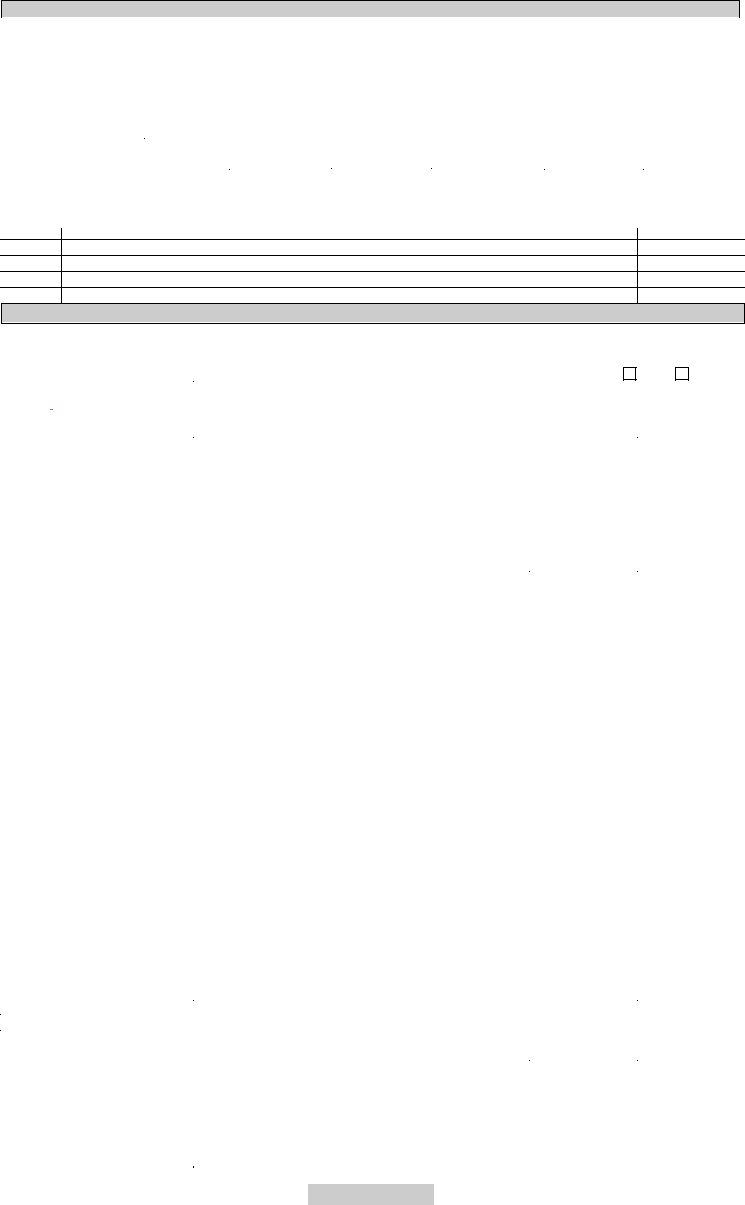

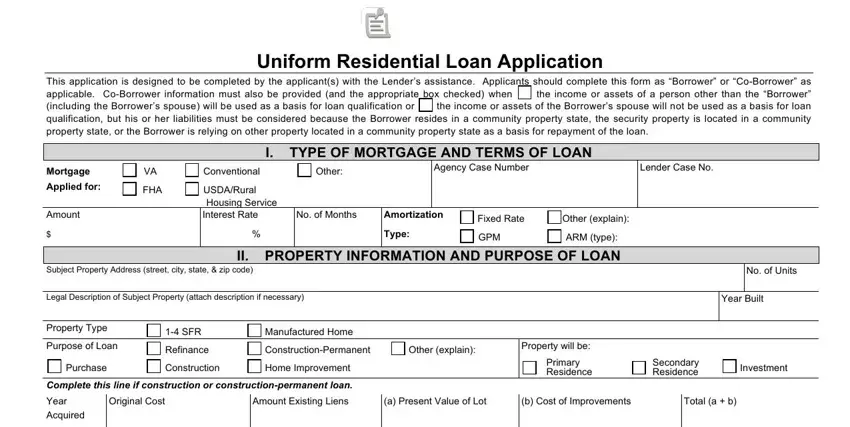

1. Whenever filling out the uniform residential loan application for rural assistance, make certain to include all of the necessary fields within the corresponding section. It will help speed up the work, allowing for your details to be handled efficiently and appropriately.

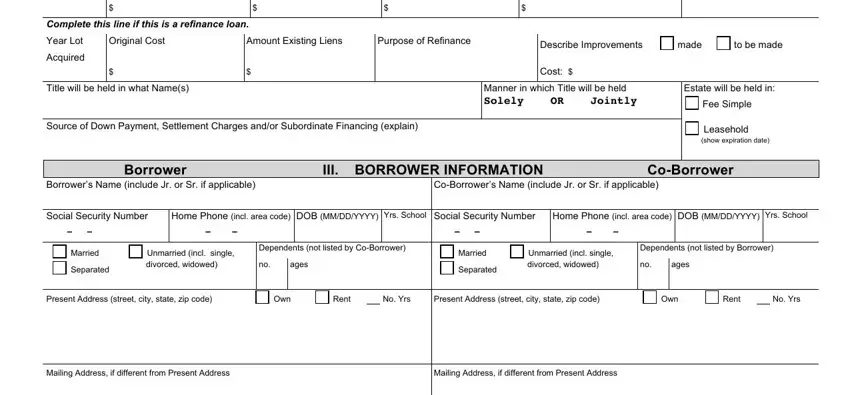

2. Once your current task is complete, take the next step – fill out all of these fields - Complete this line if this is a, Year Lot, Original Cost, Amount Existing Liens, Purpose of Refinance, Acquired, Title will be held in what Names, Source of Down Payment Settlement, Describe Improvements Cost, made, to be made, Manner in which Title will be held, Estate will be held in, Fee Simple, and Leasehold with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

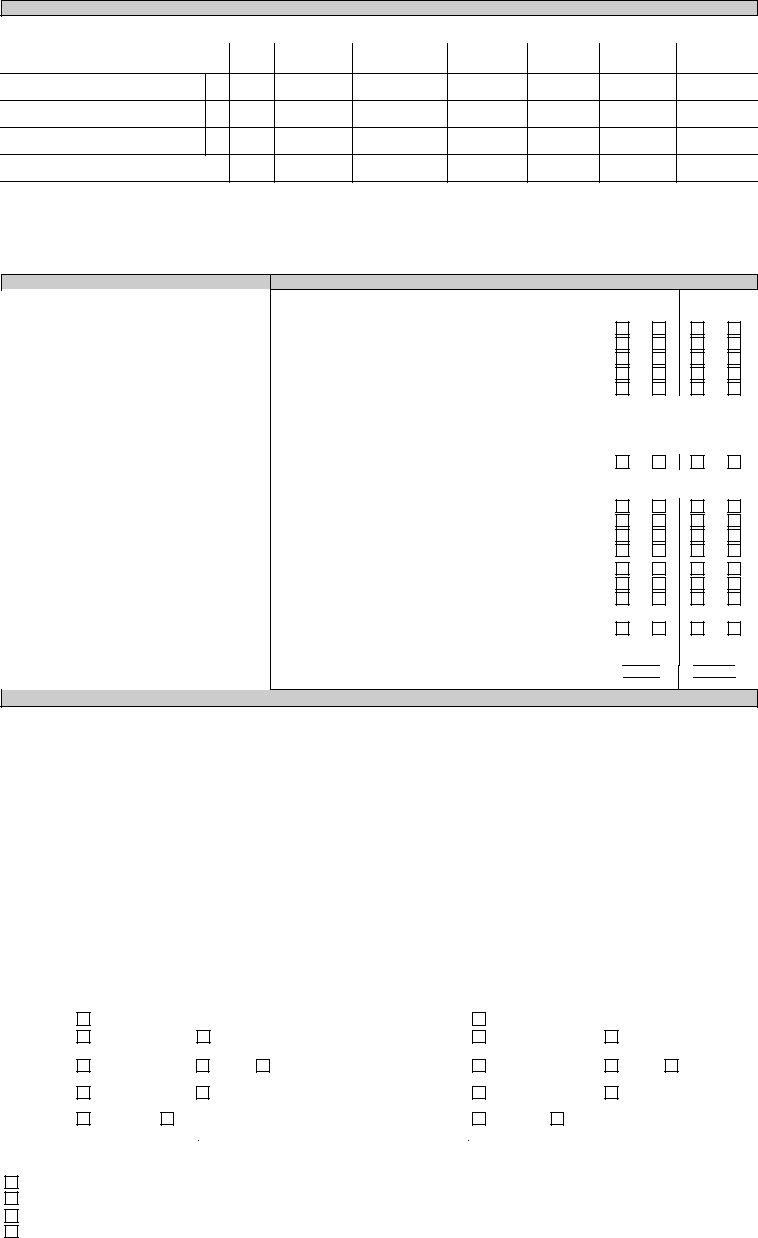

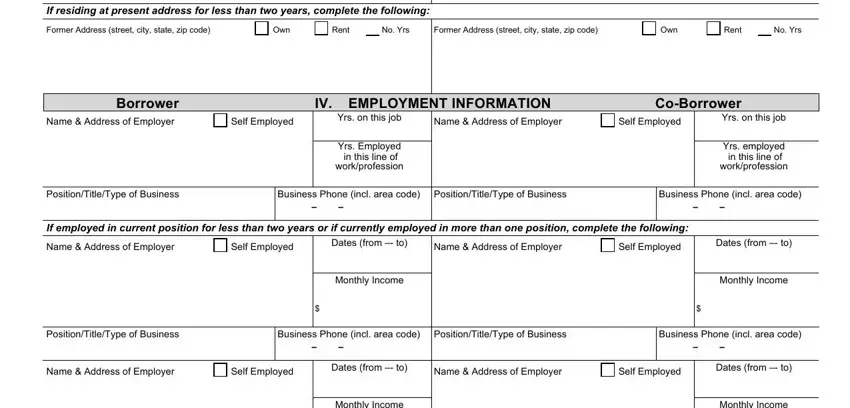

3. In this specific part, look at If residing at present address for, Former Address street city state, Own, Rent, No Yrs, Former Address street city state, Own, Rent, No Yrs, Borrower IV EMPLOYMENT INFORMATION, Name Address of Employer, Self Employed, Yrs on this job, Yrs Employed in this line of, and workprofession. Every one of these are required to be taken care of with highest accuracy.

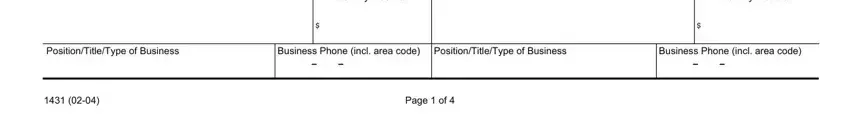

4. This next section requires some additional information. Ensure you complete all the necessary fields - Monthly Income, Monthly Income, PositionTitleType of Business, Business Phone incl area code, PositionTitleType of Business, Page of, and Business Phone incl area code - to proceed further in your process!

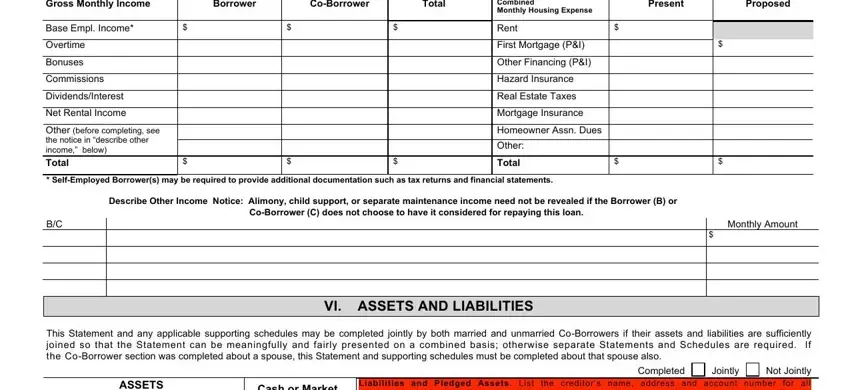

5. Since you draw near to the completion of your file, you will find a couple more points to do. In particular, Gross Monthly Income, V MONTHLY INCOME AND COMBINED, CoBorrower, Borrower, Total, Combined Monthly Housing Expense, Base Empl Income, Overtime, Bonuses, Commissions, DividendsInterest, Net Rental Income, Other before completing see the, Rent, and First Mortgage PI must be filled out.

Be really careful when completing Gross Monthly Income and Overtime, since this is the section where many people make errors.

Step 3: Soon after proofreading your filled out blanks, hit "Done" and you're good to go! Sign up with FormsPal right now and instantly use uniform residential loan application for rural assistance, all set for downloading. All modifications made by you are kept , which enables you to edit the file further as needed. We do not sell or share the details that you type in whenever working with documents at our website.