va schedule adj can be completed online without difficulty. Just use FormsPal PDF tool to finish the job in a timely fashion. We at FormsPal are committed to providing you the perfect experience with our tool by regularly releasing new features and improvements. With these updates, using our tool becomes better than ever! To get started on your journey, consider these basic steps:

Step 1: Open the PDF form inside our tool by hitting the "Get Form Button" in the top part of this page.

Step 2: After you start the tool, you will see the form all set to be completed. In addition to filling in different blanks, you may also perform other things with the form, specifically putting on any text, changing the original text, adding images, placing your signature to the document, and much more.

This PDF form will require you to enter specific information; in order to guarantee consistency, be sure to heed the next guidelines:

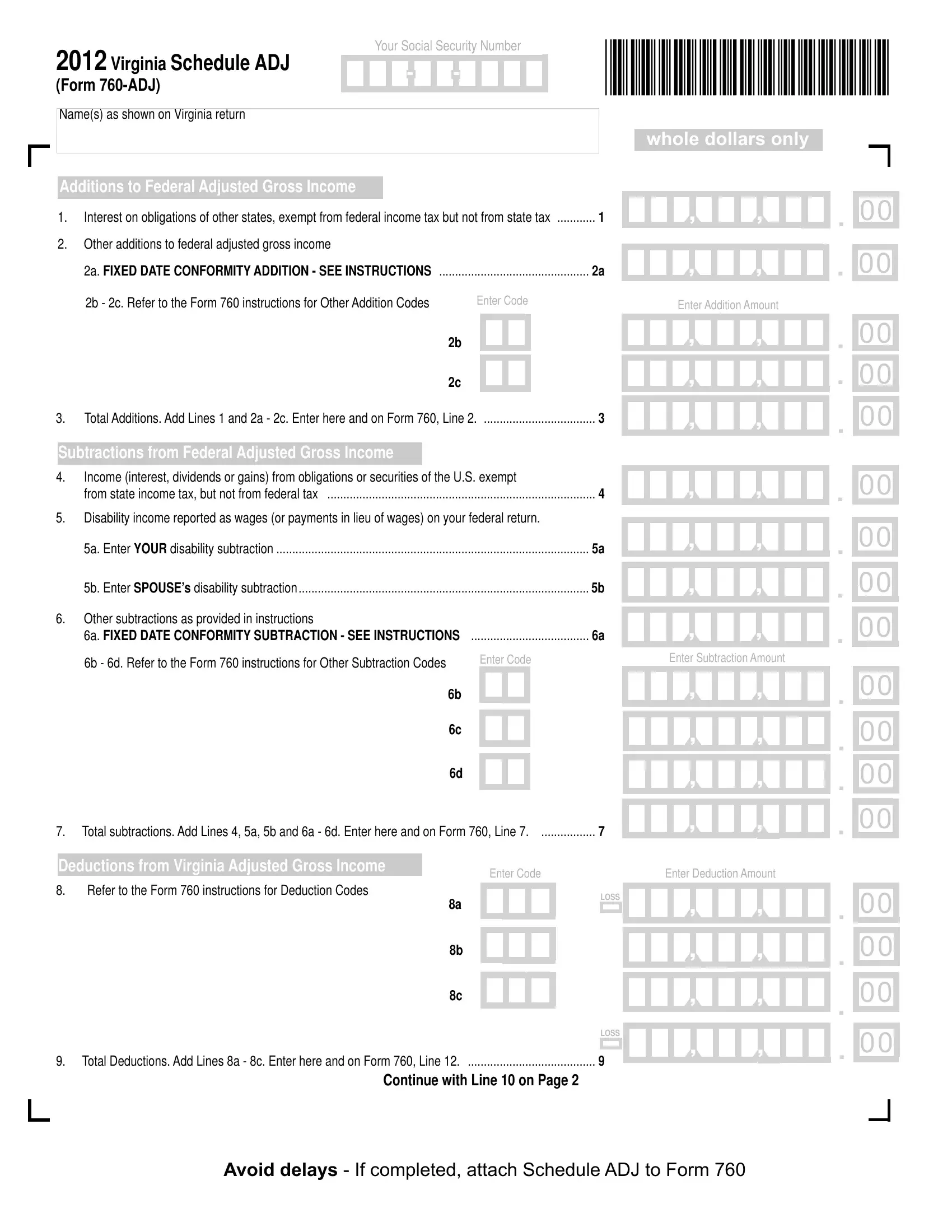

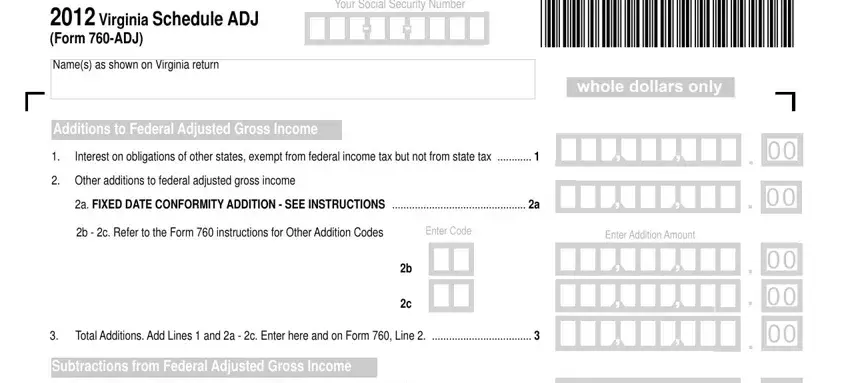

1. Fill out your va schedule adj with a group of essential blanks. Collect all the information you need and ensure absolutely nothing is overlooked!

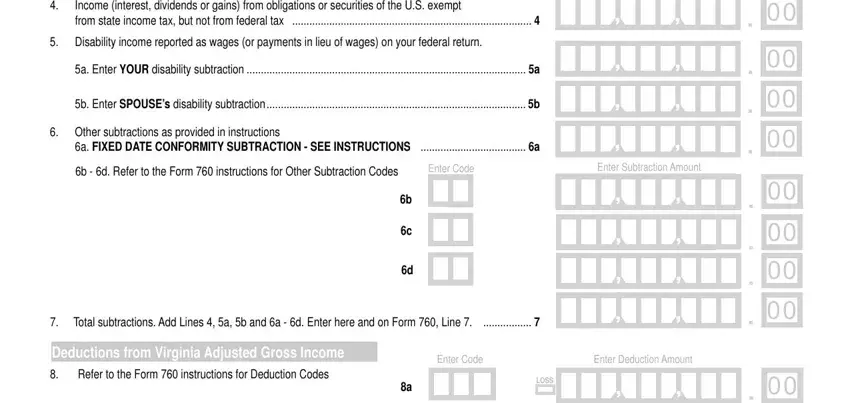

2. Your next stage is to fill in the following blanks: Income interest dividends or gains, Disability income reported as, a Enter YOUR disability, b Enter SPOUSEs disability, Other subtractions as provided in, a FIXED DATE CONFORMITY, b d Refer to the Form, Enter Code, Enter Subtraction Amount, Total subtractions Add Lines a b, Deductions from Virginia Adjusted, Refer to the Form instructions, Enter Code, Enter Deduction Amount, and LOSS.

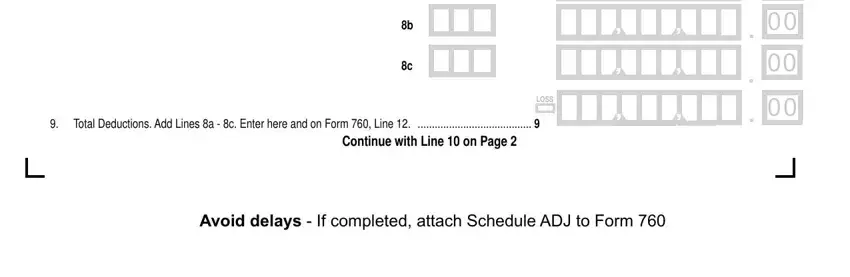

3. This next segment is pretty simple, LOSS, Total Deductions Add Lines a c, Continue with Line on Page, and Avoid delays If completed attach - all these form fields will need to be completed here.

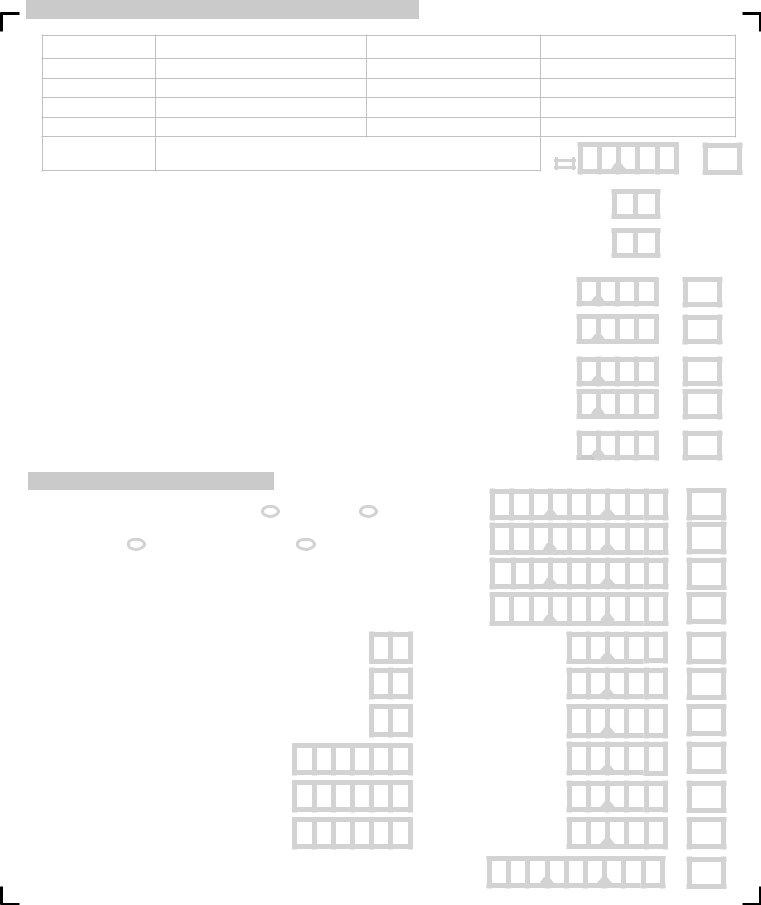

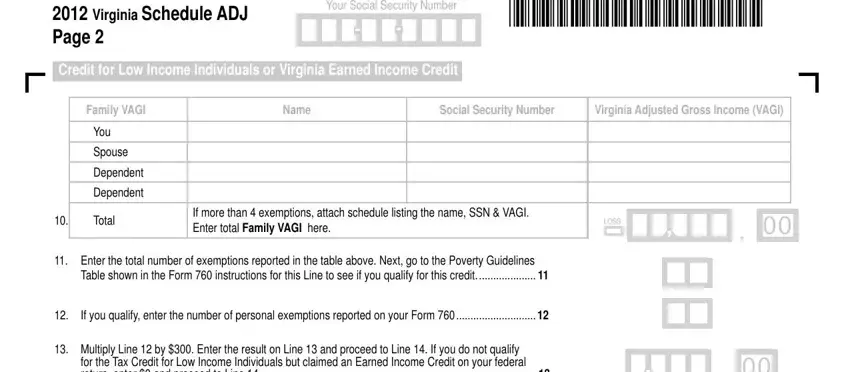

4. It's time to proceed to this next segment! Here you will have all of these Virginia Schedule ADJ Page, Your Social Security Number, Credit for Low Income Individuals, Family VAGI, Name, Social Security Number, Virginia Adjusted Gross Income VAGI, You, Spouse, Dependent, Dependent, Total, If more than exemptions attach, LOSS, and Enter the total number of fields to complete.

Concerning Total and You, be certain you review things in this section. Those two are thought to be the most important fields in this file.

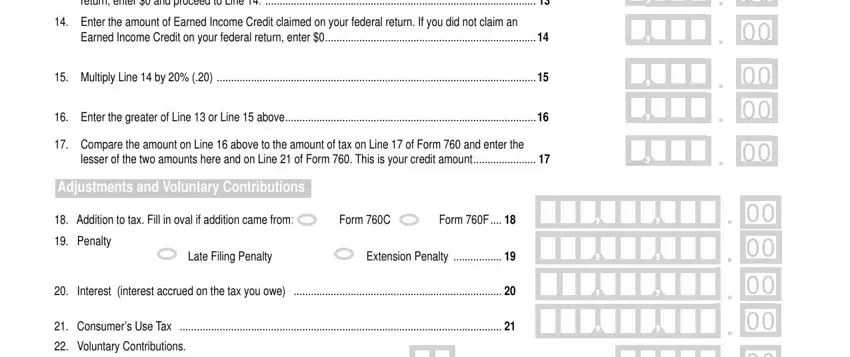

5. This very last notch to finalize this form is pivotal. Be sure you fill out the mandatory blank fields, which includes Multiply Line by Enter the, for the Tax Credit for Low Income, Enter the amount of Earned Income, Earned Income Credit on your, Multiply Line by, Enter the greater of Line or, Compare the amount on Line above, lesser of the two amounts here and, Adjustments and Voluntary, Addition to tax Fill in oval if, Form C Form F, Penalty, Late Filing Penalty Extension, Interest interest accrued on the, and Consumers Use Tax, before finalizing. Failing to do this may result in a flawed and probably unacceptable form!

Step 3: Ensure the information is right and then simply click "Done" to finish the project. Grab the va schedule adj when you sign up for a free trial. Conveniently get access to the document within your FormsPal cabinet, with any edits and changes being all preserved! We do not sell or share any information you provide whenever dealing with forms at our site.