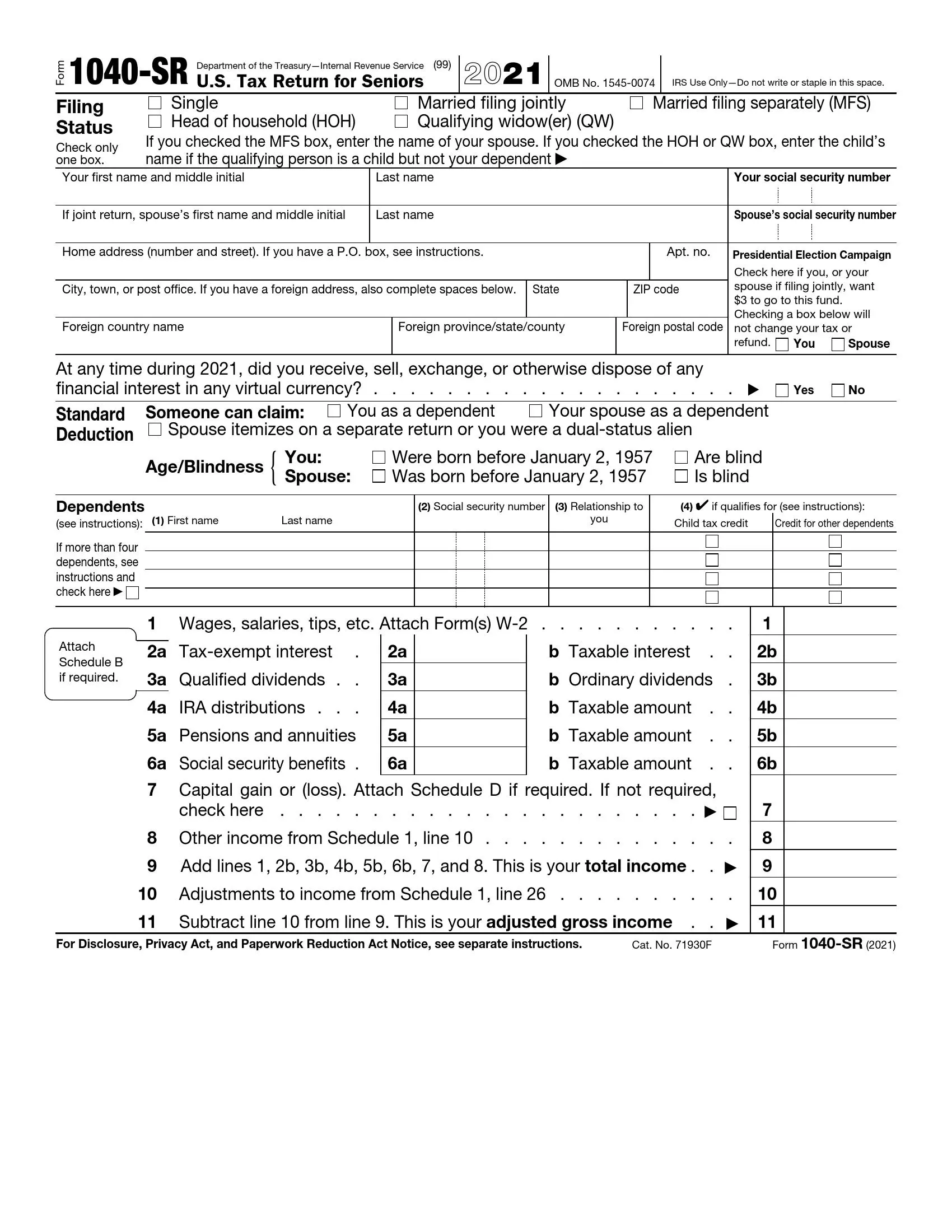

Form 1040-SR, titled “U.S. Tax Return for Seniors,” is a version of the standard Form 1040 designed specifically for taxpayers 65 or older. It offers a more readable format with larger print and a simpler layout, making it easier for seniors to view and understand. The form includes the same lines and schedules as the regular Form 1040, allowing seniors to report income, deductions, and credits in a format tailored to their needs. Additionally, Form 1040-SR includes a chart for calculating the standard deduction, which may be higher for seniors, depending on their filing status and whether they or their spouse are blind.

The purpose of Form 1040-SR is to provide seniors with an easier way to file their taxes while taking advantage of all the tax benefits available. By using this form, seniors can more easily cut through the complexities of tax preparation and ensure that they accurately report their income and deductions. This form was created to simplify the filing process and recognize older adults’ unique financial situations, helping them maintain financial independence and comply with tax laws without undue stress.

Other IRS Forms for Partnerships

Our online database comprises hundreds of various IRS forms. Check what other IRS forms you might need as an individual taxpayer.

How to Fill Out IRS Form 1040-SR

If you are eligible to file Form 1040-SR, you need to download an up-to-date template and furnish all requirements provided in the paper. To generate a valid PDF file, use our form-building software. We also inspire you to read the guide below and learn the tips on how to fill out the referenced form.

Complete the Heading

Select the applicable variant that defines your status. Choose from the following:

- Single

- Married (preparing the form jointly)

- Married (preparing the paper separately)

Here, you should also submit the spouse’s name.

- Head of household

- Qualifying widow(er)

For the last two options, the declarant needs to enter the child’s name if they are not a dependent.

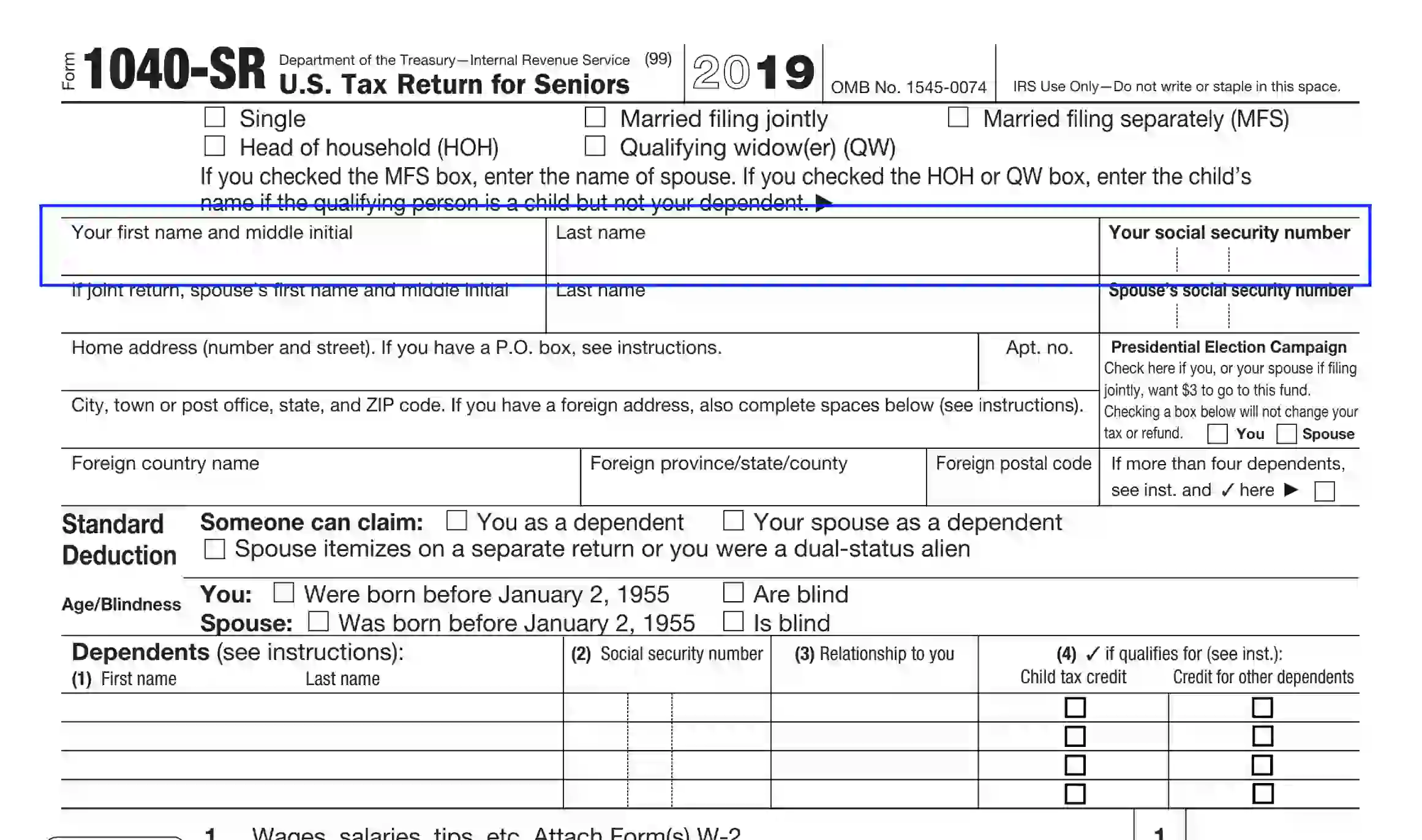

Introduce Yourself

Enter your first and last names and include the middle initial, if any. Also, you need to submit the social security number.

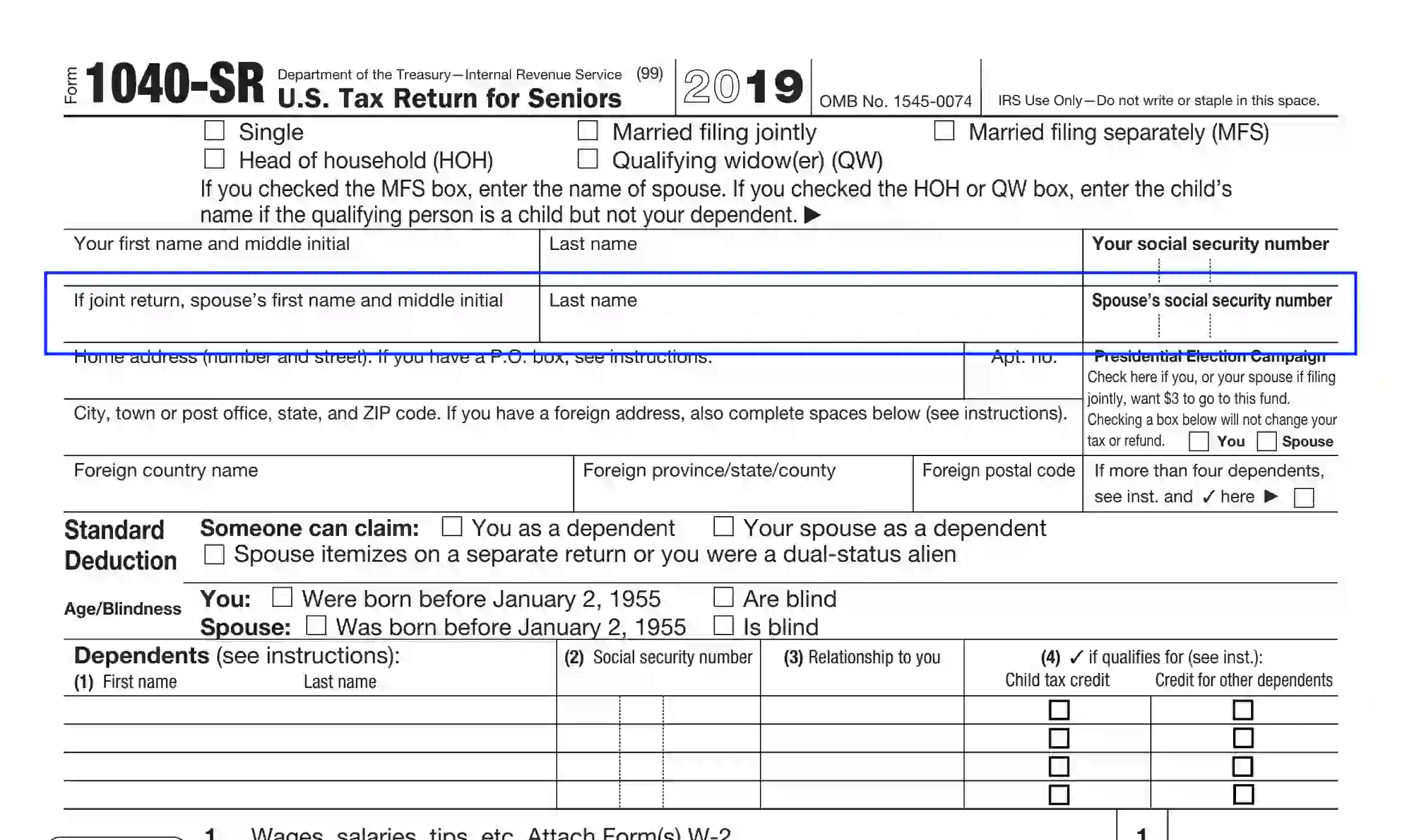

Introduce Your Spouse

If you decide to prepare the document jointly with the spouse, please include their name (first, last, and middle initial). Enter the SSN in the last box.

Specify the Living Address

In this section, the preparer should enter their living address details as follows:

- Apartment, unit, or room number

- Street, state, and ZIP for US residencies

Use the P. O. Box option only if the service does not deliver mail to your living location.

If your residency is situated in foreign territories, enter only the city name in the “City, town, or post office…” section. Also, you should indicate the foreign country name, province, and postal data.

Define Your Contribution to the Election Program

If you wish to participate in the Presidential Election Campaign, check the “Yes” box. Regardless of what you select, the tax amount won’t change. The contribution is distributed to support the candidates’ independence during the election programs. It is also invested in medical research programs.

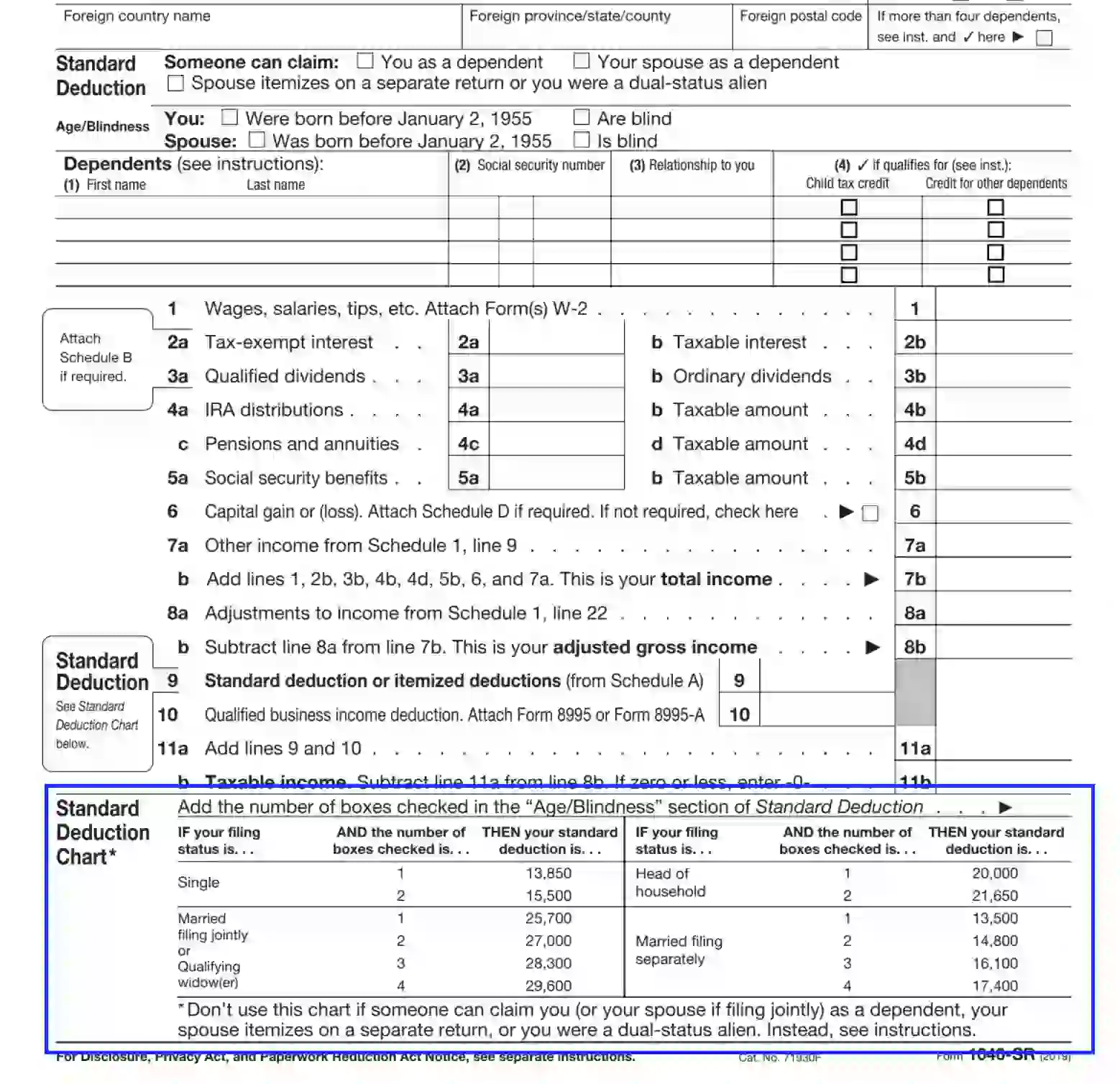

Revise and Complete the Standard Deduction Heading Section

Here, you need to select the appropriate alternative to clarify your deduction case:

- If another person can claim you or your spouse as a dependent in their tax return paperwork, choose the corresponding box.

- Dual-status alien option is appropriate if the declarant prepares the report jointly with their husband or wife who was a US citizen or alien resident during the tax period at issue.

- Age or blindness option is applicable if the declarant or their spouse was born prior to January 2, 1956. Also, this alternative should be chosen if the declarant became blind by the end of the tax period at issue. If the blindness was partial, you should provide verification from a licensed eye specialist stating the irreversible health changes or damages.

If your spouse wishes to claim privileges separately, ensure to check the needed slot.

Revise the deduction table at the bottom of the page to learn the conditions and amounts of benefit.

Define the Dependents

In this part, the declarant should list a maximum of four dependents. Include the following data to complete the table:

- The dependent’s first and last name

- SSN

- How the dependent relates to you.

- If they qualify for the credit indicated (check the box if positive).

To find out if the dependent is qualifying to claim special conditions and benefits, see the IRS brochure on the service’s official web portal.

In case the number of dependents exceeds four, you are empowered to prepare an additional verification statement to submit the needed info.

Specify Your Revenue Details

In Units 1-11 (a, b), the declarant should submit their revenue, including the following:

- Both taxable and non-taxable income

- IRA profits

- Capital gains

- Social security privileges

- Wages

- Dividends

- Pensions

- Other revenue

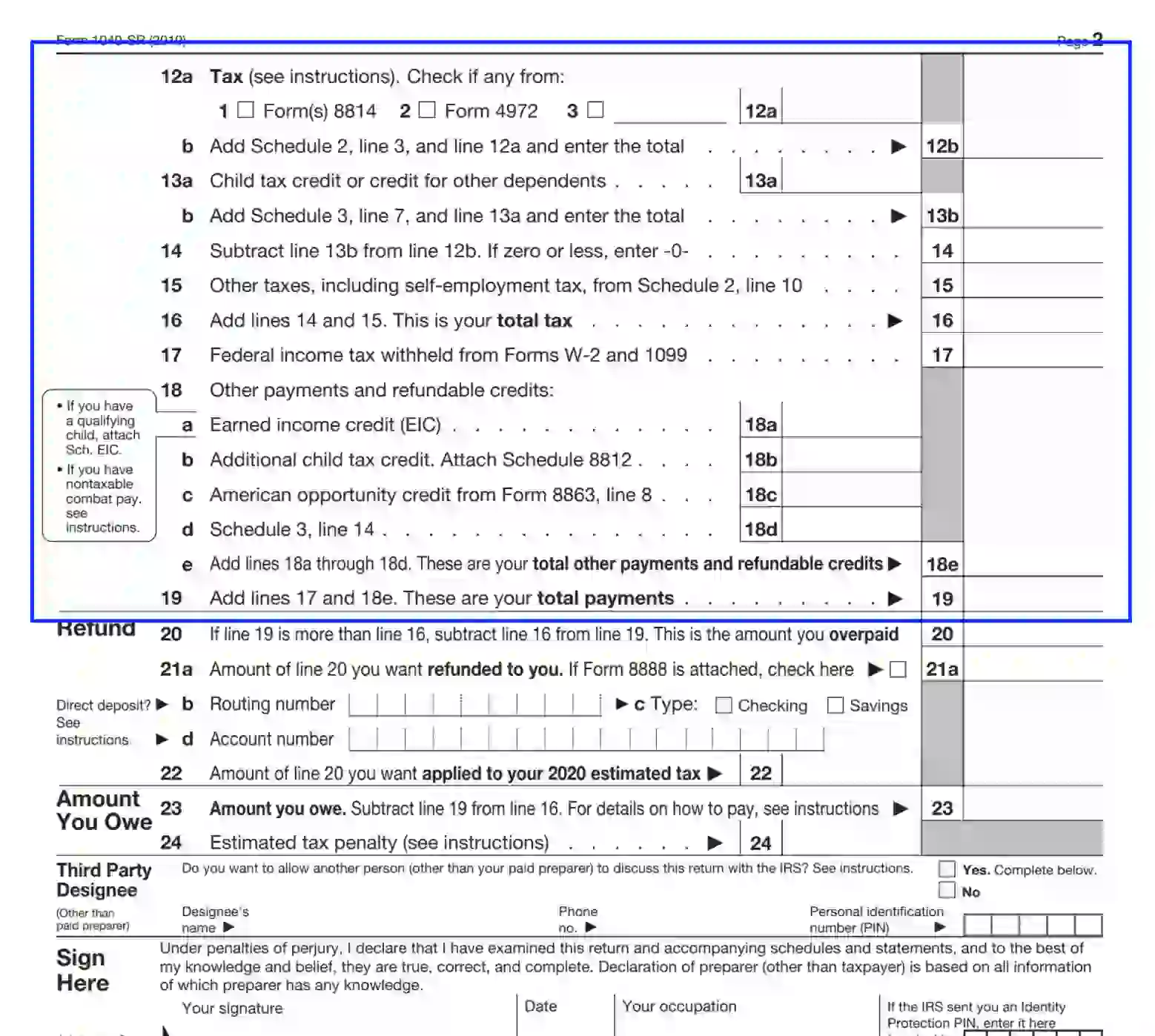

Describe the Taxation and Payments

Use Units 12 (a) through 19 to cover info related to the taxation conditions and other payments. Also, include any Schedules required to describe the needed statements.

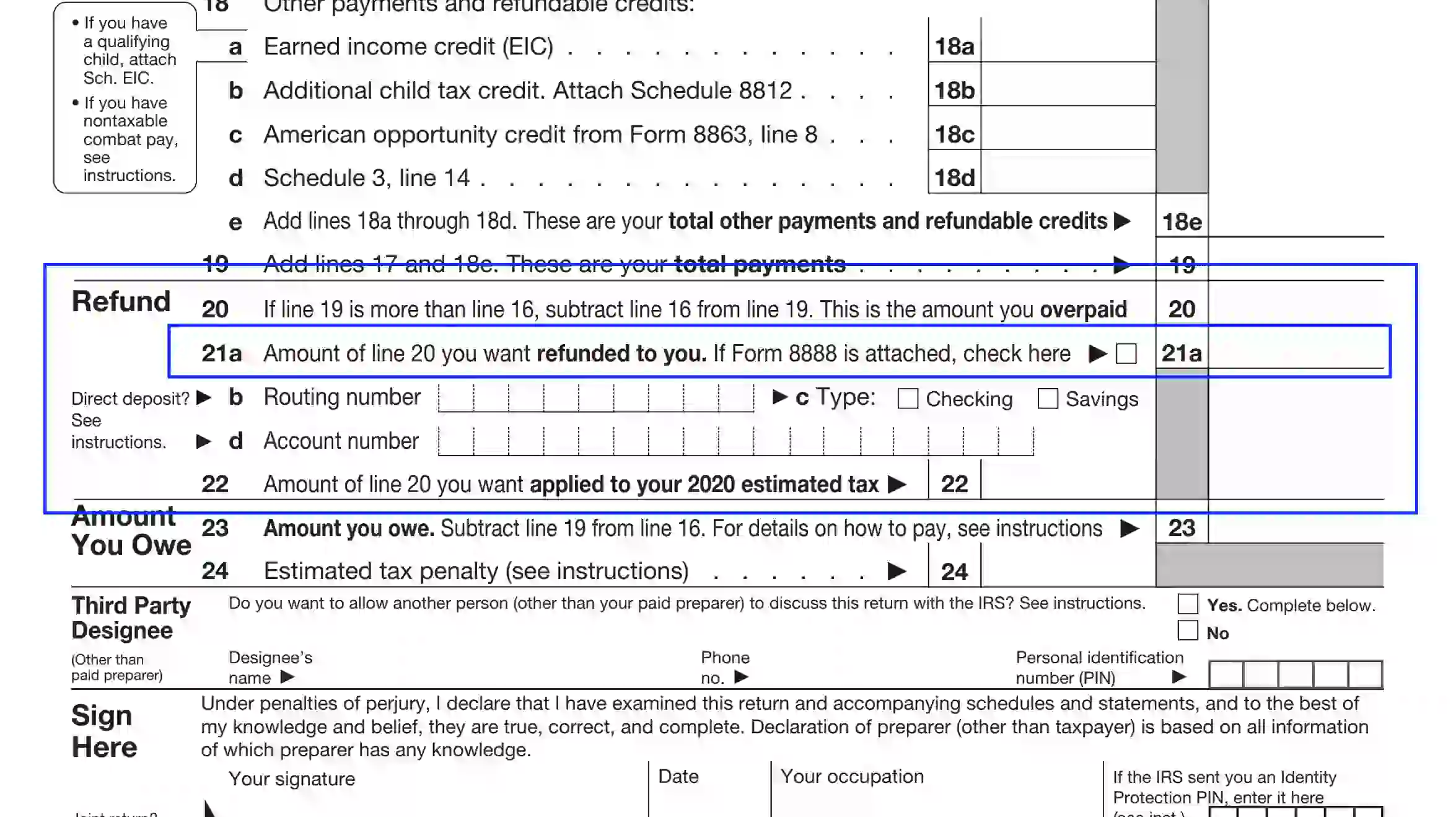

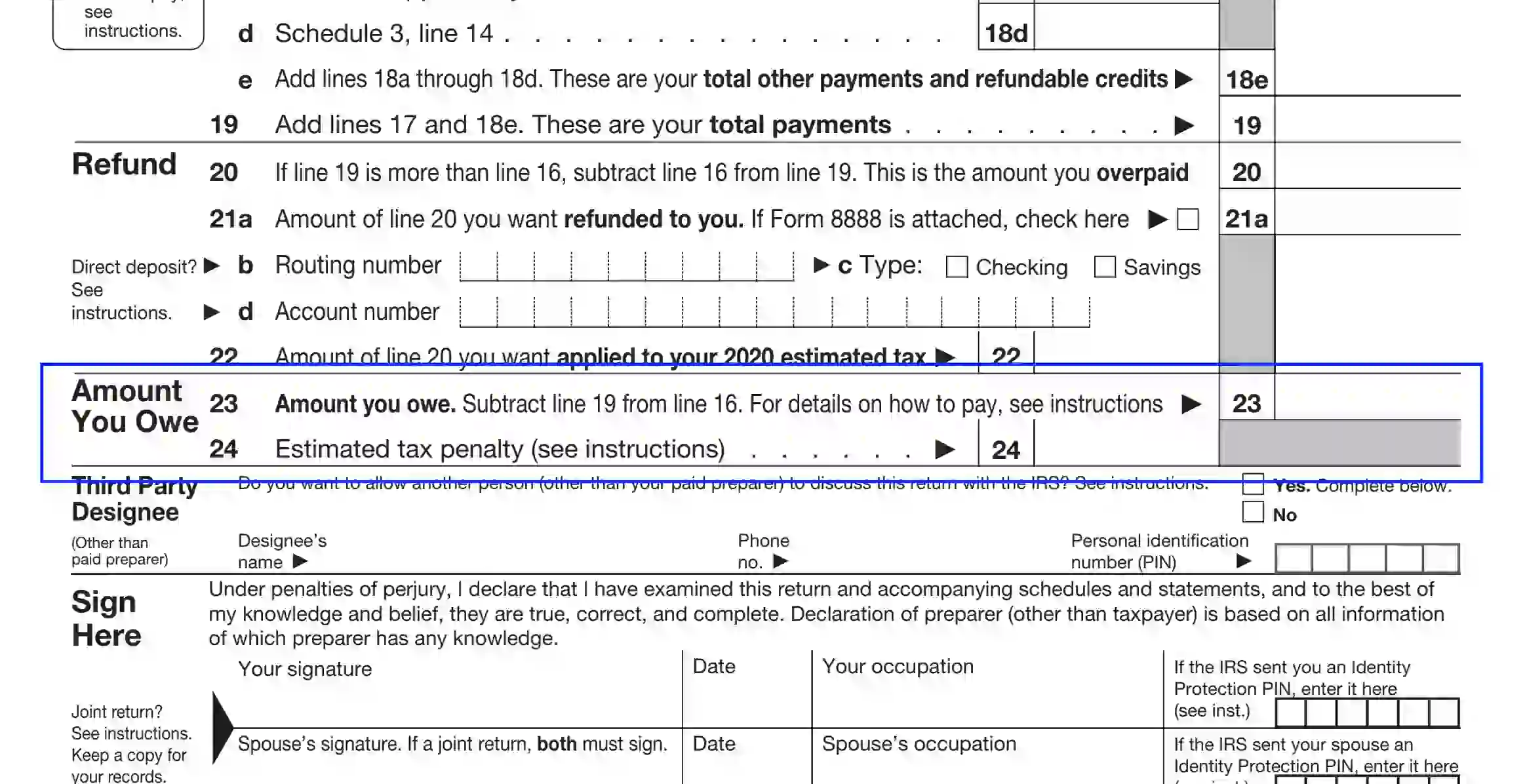

Compute the Refund Amounts

Units 20-22 are dedicated to explaining the refund amount that the declarant has overpaid (if any). Adjust the calculations and fill out the necessary info. Insert the refund amount you want to be paid in Unit 21 (a).

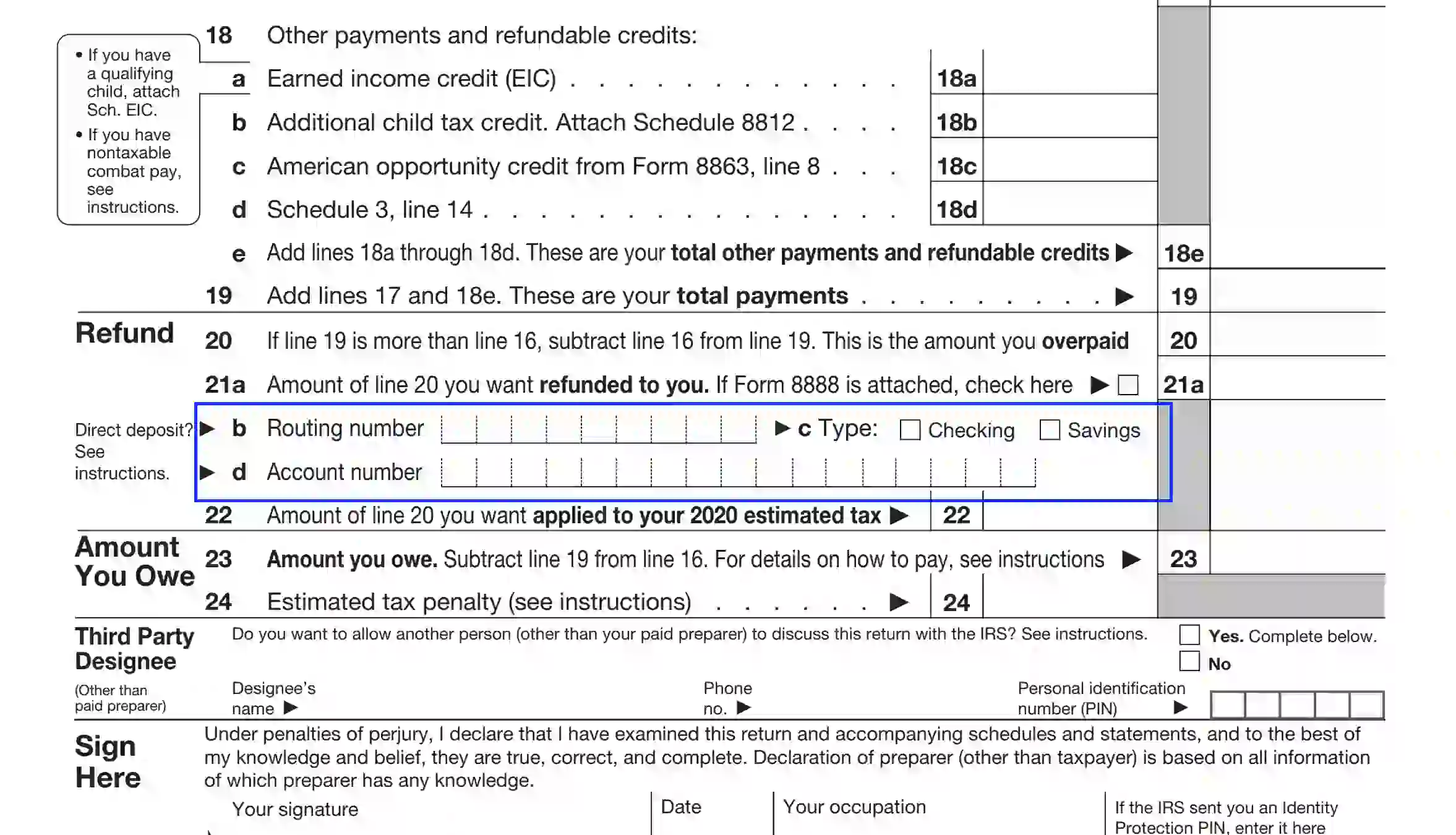

You can claim the refund via check or direct deposit. Using the second option, however, can be more preferable, as the repayments come faster and more secure. Also, you can distribute the refund among several accounts by completing Form 8888.

If you choose to get the refund by check or the direct deposit is declined due to some reason, you need to enter the routing and account number. Learn the valid data from your bank or financial organization. The routing number contains nine characters, while the account number can cover up to 17 digits.

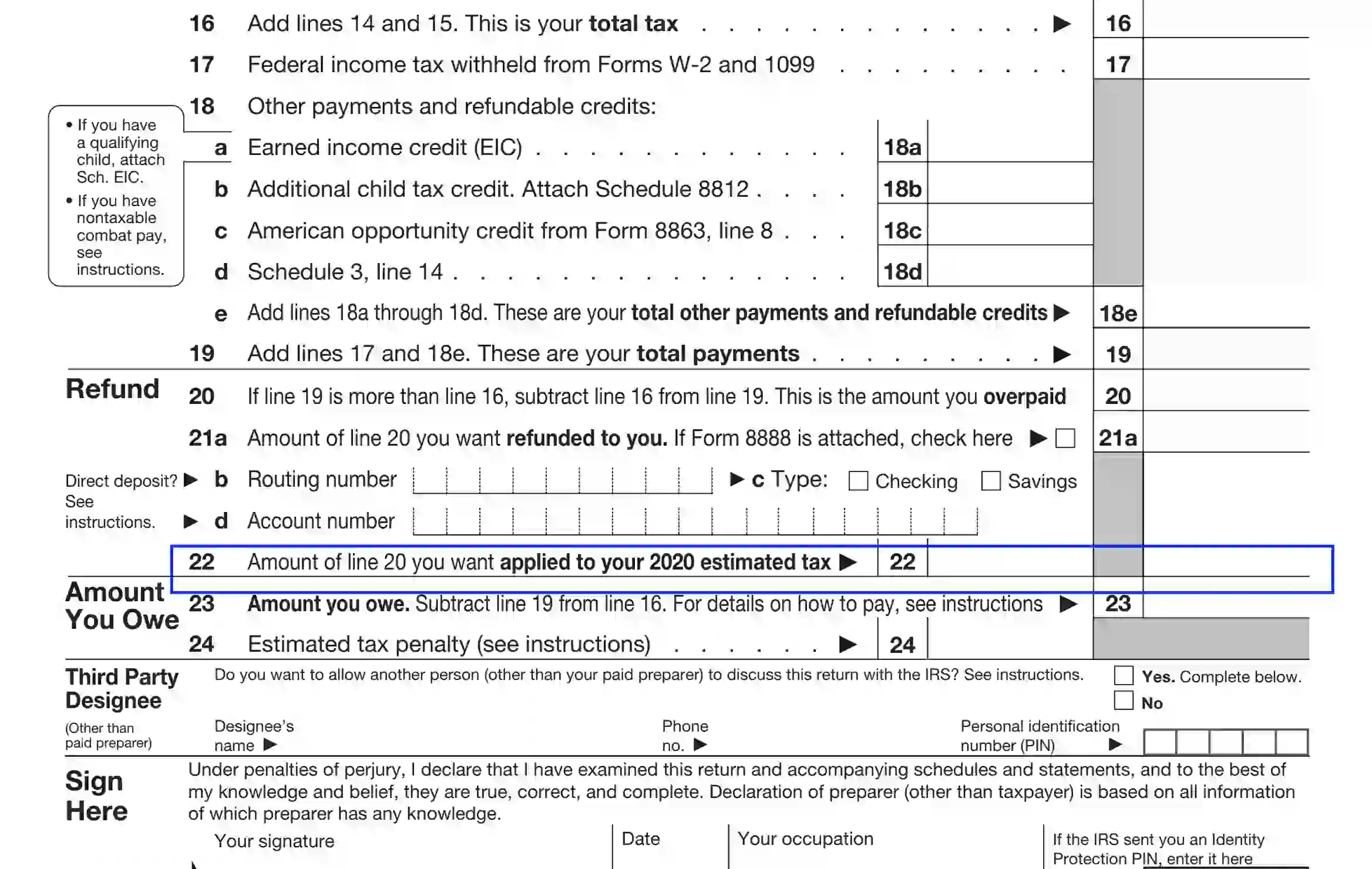

Specify If You Use Refunds to Cover Taxes

In Unit 22, the declarant should enter the refund amount (if there is any) they want to apply to cover the current year’s estimated tax.

Compute the Tax Liability

For lines 23-24, enter the amount you are liable to pay to cover the debt before the due date. Otherwise, you can become subject to penalties and fees.

The service offers several ways to transact payments: you are empowered to pay online, by check, money order, in cash, by phone, or via a mobile app. Detailed info on withdrawal methods can be found in the 1040-SR Instruction brochure provided by the service.

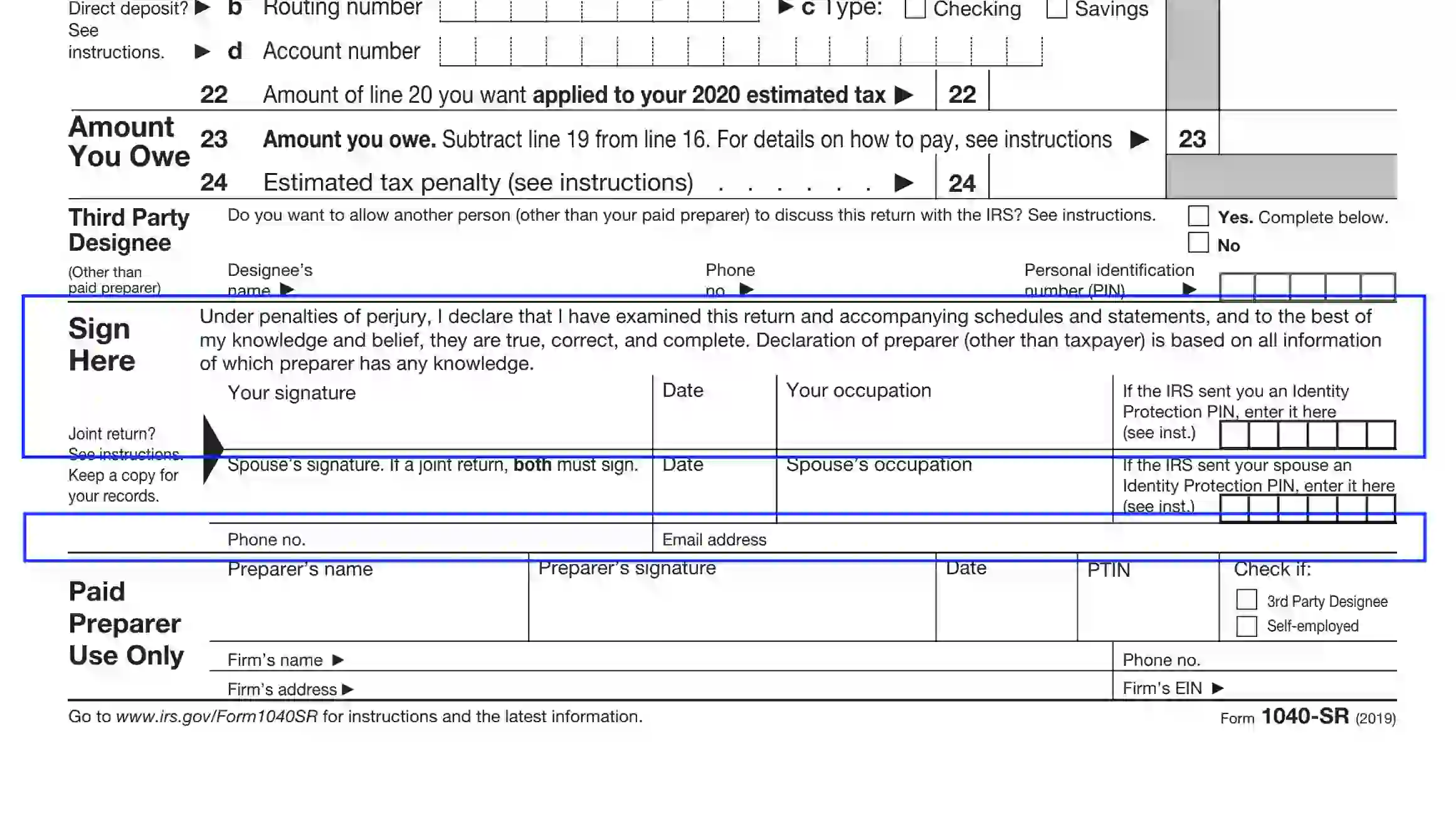

Designate Another Person to Discuss the Return

You can appoint a third-party individual to negotiate your return form with the IRS. If positive, tick the “Yes” box and ensure to provide the designee’s data:

- The agent’s name

- Contact phone number

- Personal ID number

Authorize the 1040-SR Report

Complete the form by appending the declarant’s signature and current date. Also, the preparer should enter their employment background and an Identity Protection PIN (if any). Below the spouse’s section, the declarant enters the email and contact phone number.

If the wife and husband fill out the form jointly, ensure that both spouses sign and date the form, providing the required info.

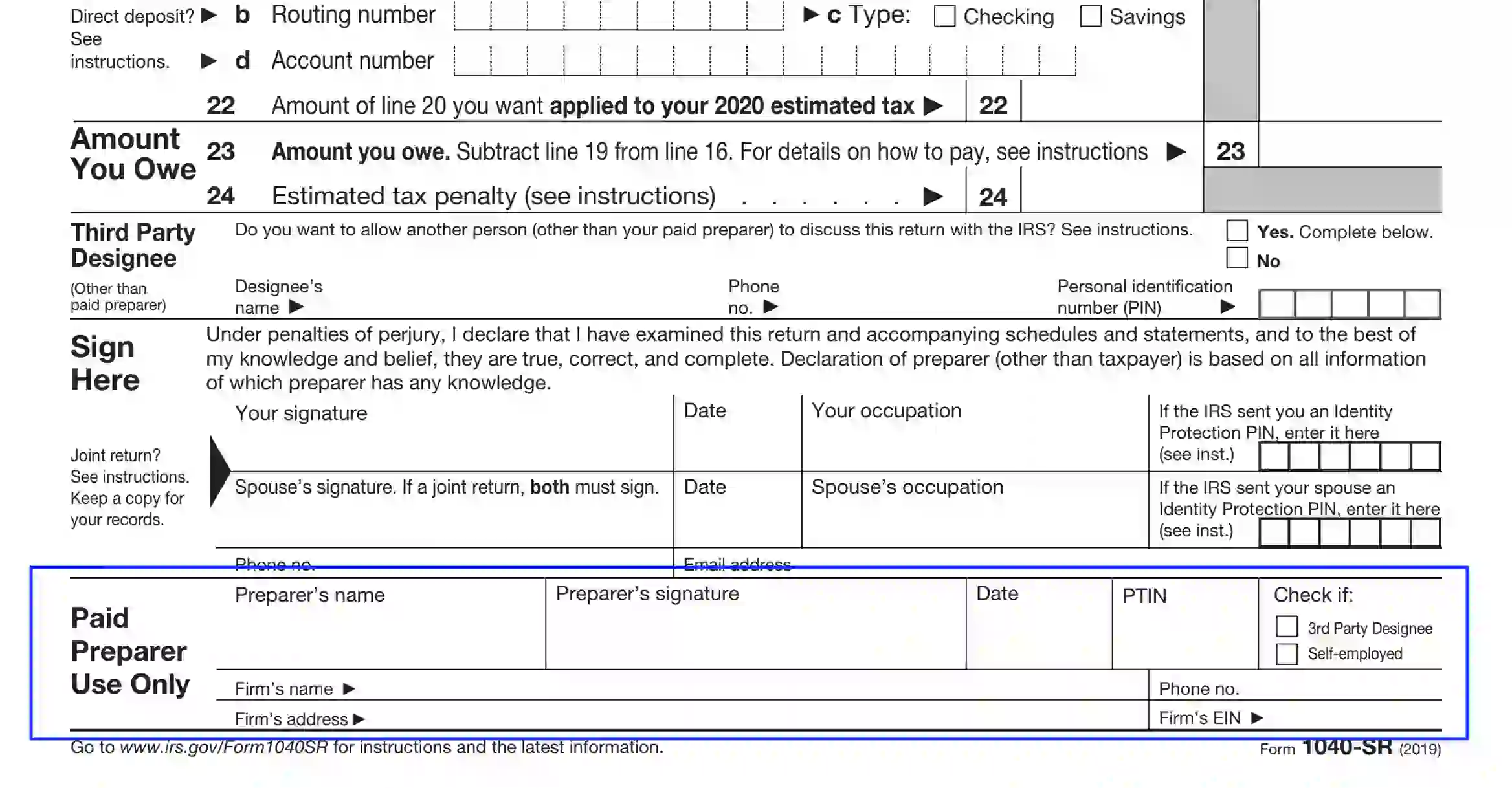

Introduce the Paid Preparer (If Applicable)

If the declarant wishes, they can hire a paid specialist (self-employed or some licensed firm’s representative) to prepare the form for the declarant. If you decide to select this option, make sure to introduce the preparer in the last bottom section of the form as follows:

- Preparer’s name

- PTIN

- If a company’s representative, enter the firm’s name, EIN, and contact details.

- Employment status — check if self-employed.

- The invited specialist must sign and date the document.

Also, if they are the appointed agent to discuss the respected form with the IRS on your behalf, make a corresponding guide-mark.