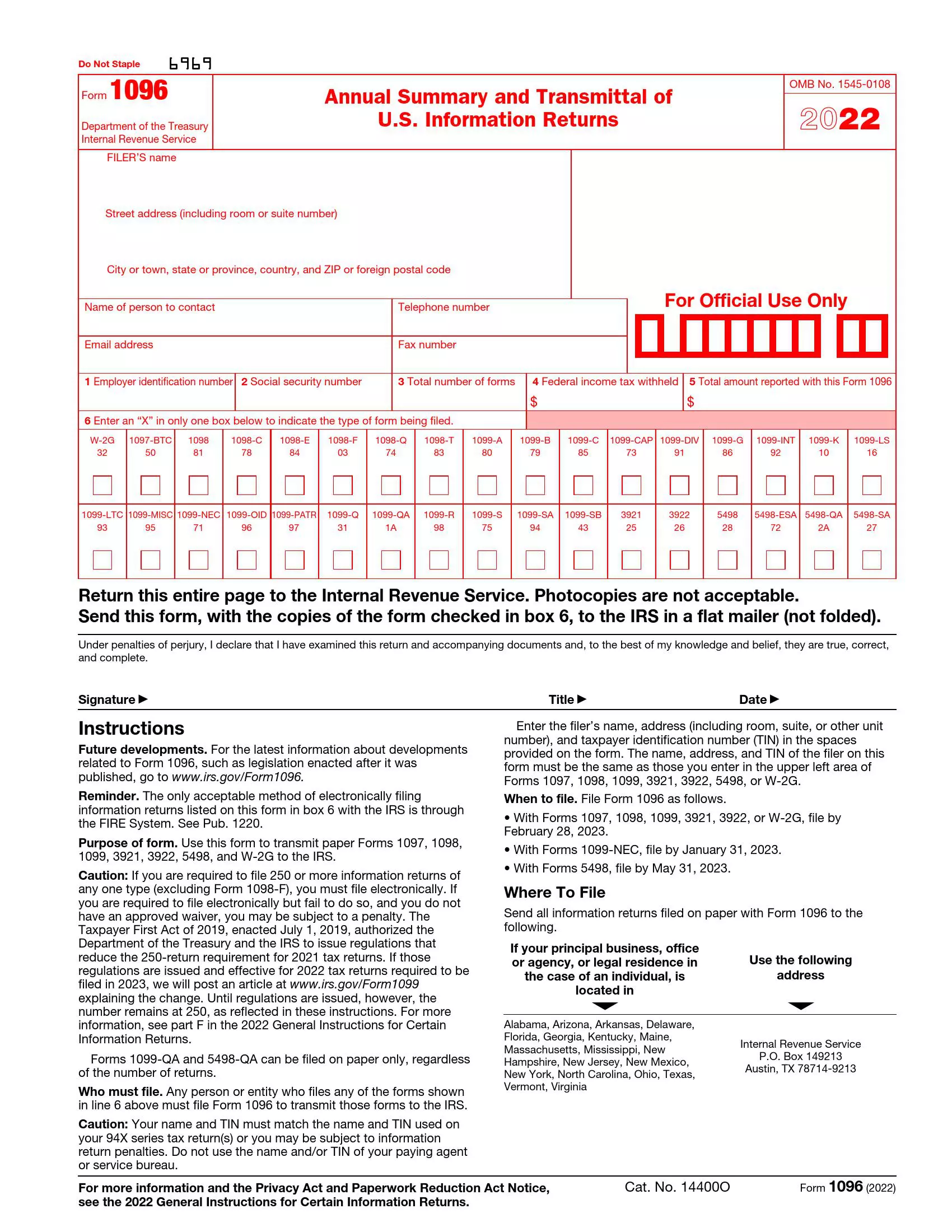

Form 1096 is a summary or transmittal form businesses and financial institutions use to submit information returns to the Internal Revenue Service (IRS). This form is not used for individual income tax purposes but as a cover sheet to compile and transmit forms like 1099, 1098, 5498, and W-2G to the IRS in paper format. It helps the IRS track and organize various types of non-employee compensation, financial distributions, and other specific financial transactions reported throughout the year. Key information required on Form 1096 include:

- The filer’s name, address, and Employer Identification Number (EIN),

- The total number of forms being transmitted with Form 1096,

- The total amount of federal income tax withheld,

- And the type of transmitted forms (such as 1099-MISC, 1099-INT).

Form 1096 allows the IRS to efficiently process and record the multiple informational documents received from various sources, ensuring that data regarding payments and transactions are accurately captured and maintained. This process ensures compliance with U.S. tax laws and regulations concerning reporting various incomes and transactions.

Other IRS Forms for Self-employed

IRS forms are used for a variety of functions and to meet the demands of diverse taxpayer groups. If you haven’t yet discovered the right form for your purposes, take a look at some of the others.

How to Fill Out the 1096 Form

You can find the respective forms on the IRS official website. But please note that not all of these forms can be submitted electronically; most of them can only be submitted in writing and on paper.

The Revenue Service has renewed some of its compilation requirements and norms in 2021. We follow all the refreshments and try to keep up with the contemporary legislature, and you can check the relevant form template on our website as well. However, we have to warn you that you cannot download any electronic versions of the document and present them to the IRS, as all submitted versions must be scannable. The IRS uses their software, and a printed version will most likely not be scanned properly and will be recognized void. You, in turn, may be subject to a penalty for submitting an unlawful form, so be careful with all your filings. Thus, you can only preorder the relevant Form template that you can later fill out and file at the IRS office.

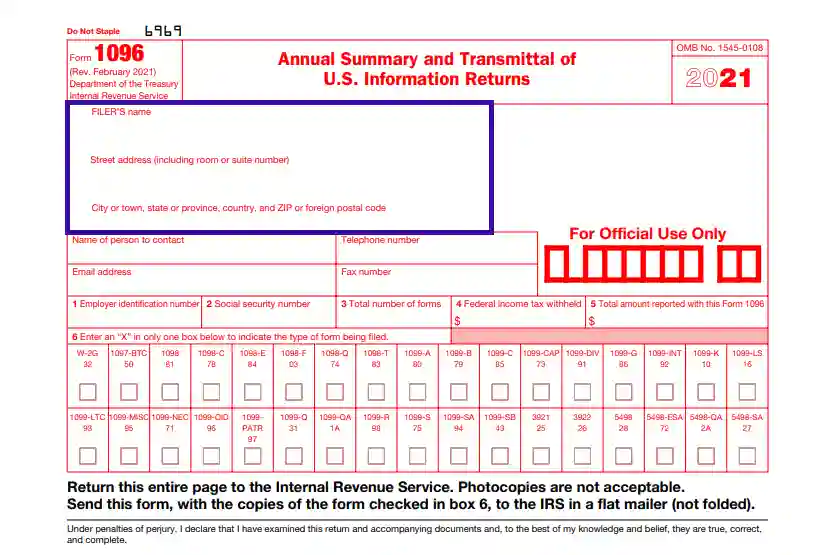

Enter the Filer’s Name and Address

You are the official Filer of the 1096 Form, so put your full legal name in the blank line and insert your mailing address in the line below, including street, room, or suite number, city/town, state, country, ZIP; use a foreign postal code for offices located abroad.

Provide Contact Info

You should appoint a person responsible for maintaining contact with the respective services if any questions occur. Insert the full name of that contact person, their daytime contact number, E-mail, and fax number into the relevant empty boxes.

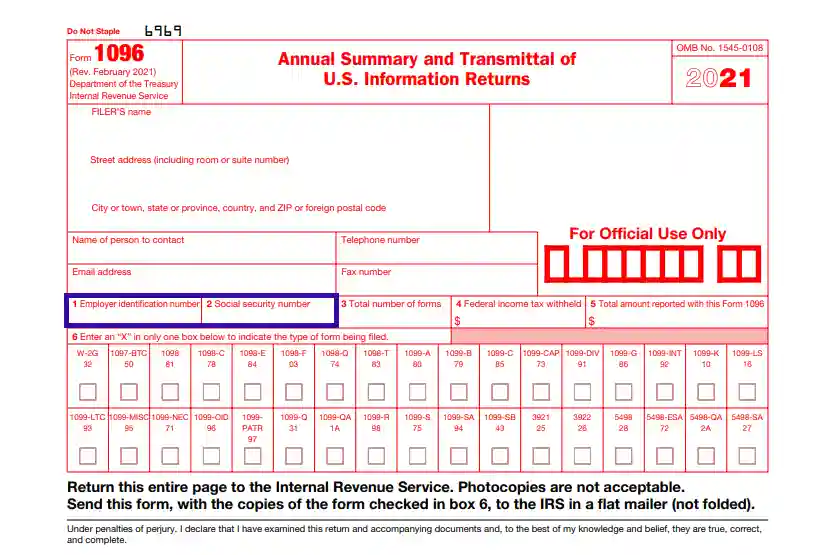

Insert the Taxpayer Information

There are two boxes in this form where you can enter your taxpayer’s information. In Boxes one and two, you should either enter an EIN or an SSN (but not both). Sure, there is a difference: if you are an individual not involved in any kind of business or trade, ensure to insert your SSN in the corresponding box. If you are a sole proprietor (or any other business representative), you should provide your EIN in the corresponding box. Mind that if you do not have an EIN for some reason, you should also provide your SSN. Pick either Box 1 or 2 and leave the other box empty.

Ensure to insert the same taxpayer identification number (or SSN) that you are using in the other accompanying form you are about to file with the Revenue Service.

Define the Total Number of Forms Covered

Here, you must enter the precise quantity of legal forms you are willing to transmit with this particular Form 1096. Usually, it is two. Please note that only the forms filled out accurately (copies, not pages) shall go on your total count; exclude all voided forms from the total amount.

People often ask how many copies of the 1096 Form one shall fill out and file with the IRS, which is a very important question, as this particular form is transmittal and this term always causes confusion amongst users. Finally, we have a clear answer: you should file as many 1096 Forms as you file accompanying IRS Forms. But there is another trick: if you have more than 250 filings on your hands that you personally have to prepare and file, you should send the documents out electronically. It is the only lawful reason for an electronic filing.

Enter Tax Amount Withheld and Reported

Here, you must enter the amount (in US dollars) of the federal income taxes that were withheld and reported to the respective authorities by the subject middleman. If you are submitting this form alongside Form 1098-T, 1099-A, or 1099-G, you must leave these boxes empty. In all other cases, you shall provide the exact amount in the correct box.

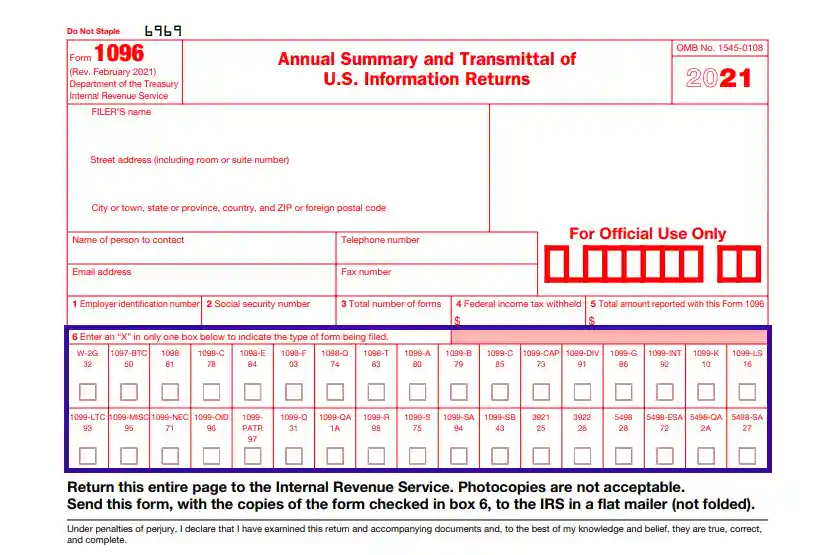

Mark the Form You Are Submitting Alongside

In Section 6, you will find a list of forms that you must submit only in combination with the 1096 IRS Form. Tick the box with the corresponding form’s name (note that you may only pick one for each information return transmittal form).

Form 1096 comes with a set of instructions regarding the rules and requirements for its completion and statements concerning the renewed legislature. We strongly advise you to get acquainted with those before you proceed to complete the forms.