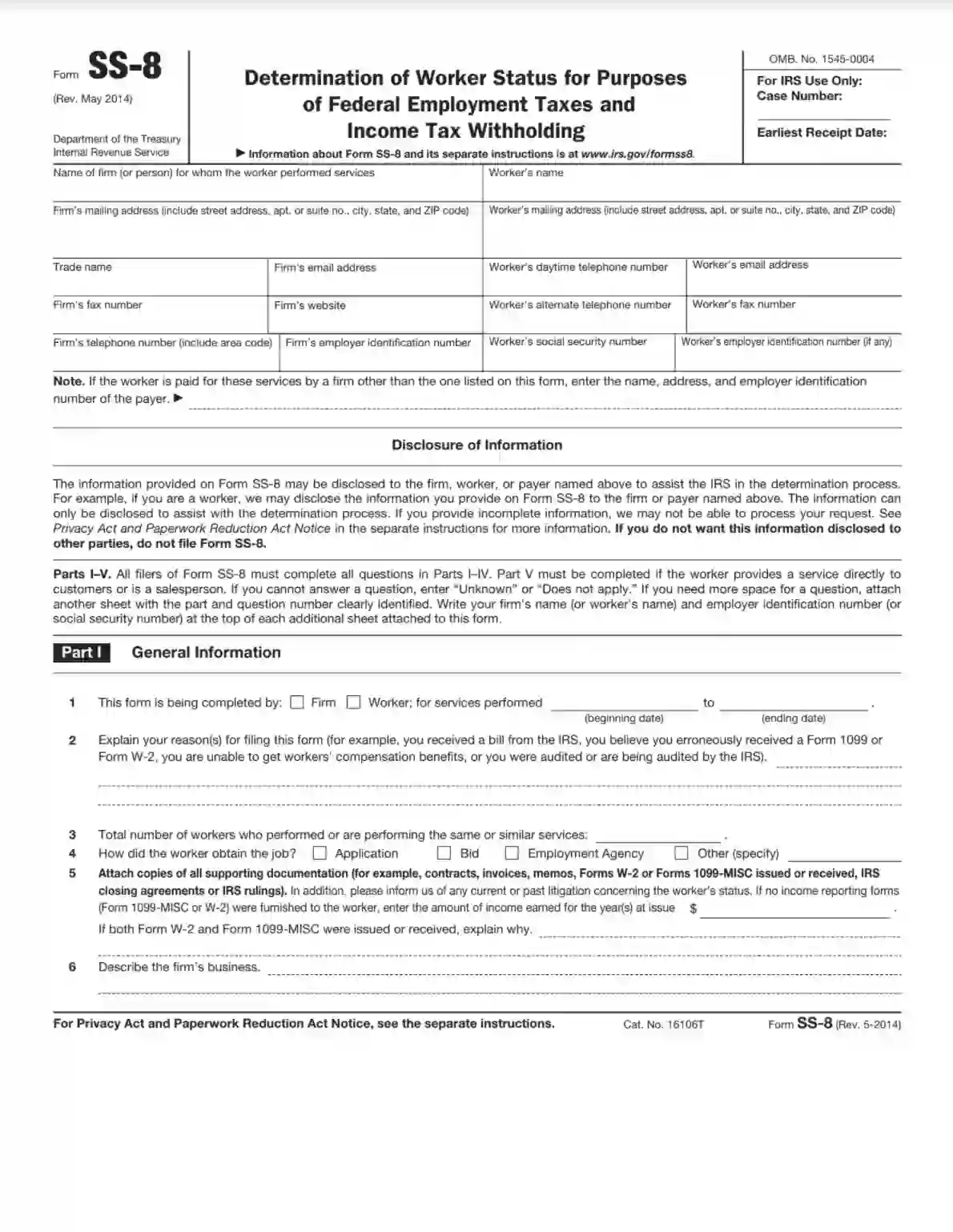

IRS Form SS-8 is a document businesses and workers use to request a determination from the IRS about a worker’s employment status and whether they should be classified as an employee or an independent contractor. This classification affects how workers are taxed and what documents they must file.

The purpose of Form SS-8 is to resolve questions about how a worker should be classified under common law rules. The distinction between employee and independent contractor is crucial because it determines the employer’s obligation to withhold income taxes and pay Social Security, Medicare, and unemployment taxes. Proper classification helps ensure that both the IRS and the worker receive the appropriate taxes due, and it helps workers receive the correct employment benefits and protections.

How to Fill Out IRS Form SS-8

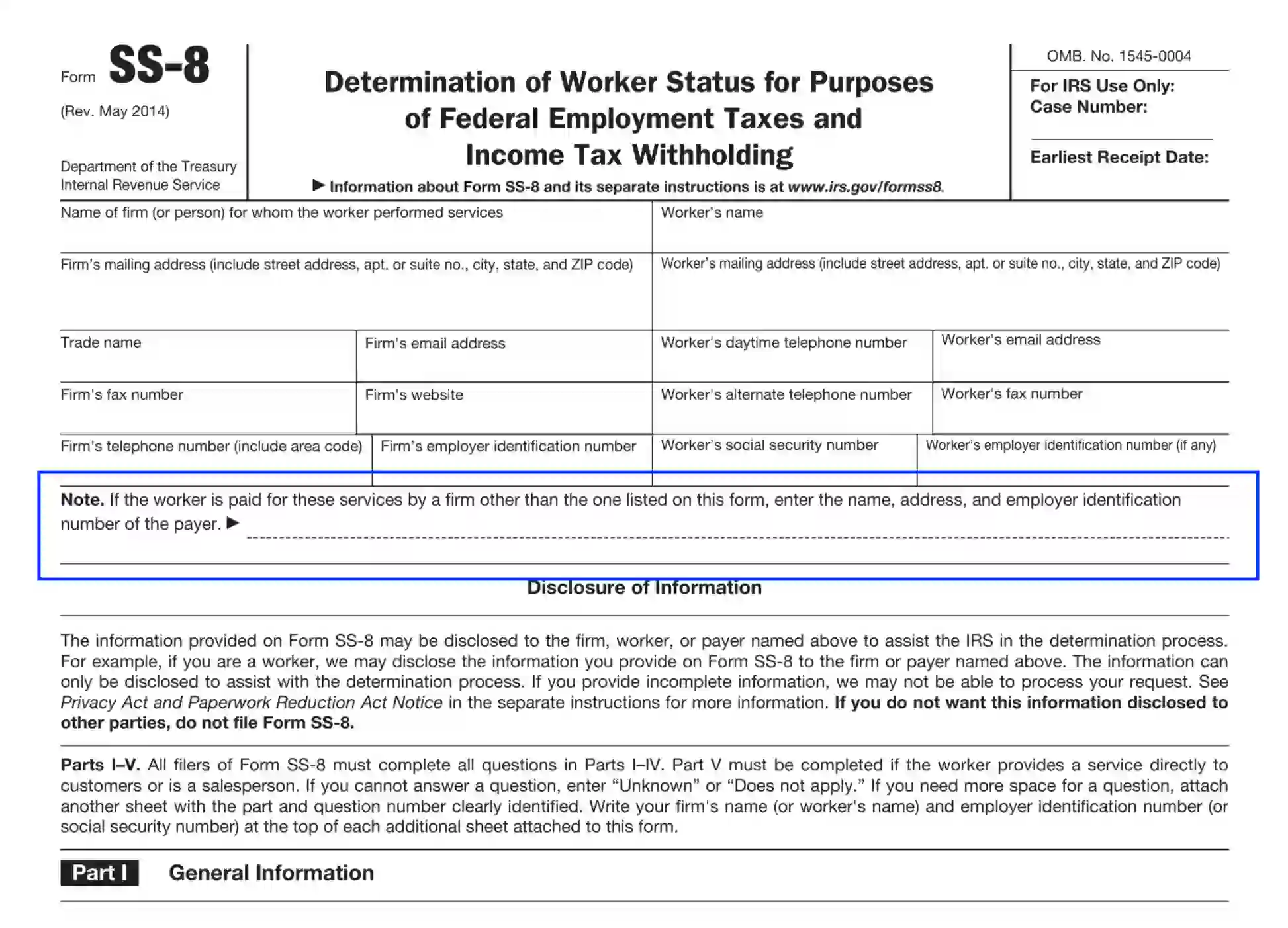

We encourage you to generate, complete and print out the inherent SS-8 template via our latest form-building software. The document contains a disclosure warning that states that any submitted info may be discussed with either participant. When completing the form, you consent to the terms of the disclosure policy. If you refuse to share the information, you mustn’t fill out the SS-8 template at all.

Before you proceed to fill out the document, learn about some definitions used in the referenced form:

- “Firm” relates to any individual or business entity that hired the worker to provide certain services. The definition covers the aspect that the worker has been paid directly or indirectly for the cooperation and services.

- “Worker” can both cover employees and independent contractors. Therefore, use the SS-8 disclosure to determine the worker’s status and settle the federal tax aspects.

The claimant is encouraged to provide thorough information to each question of Parts I through IV. Fill out Part V only if the worker renders direct services to the firm’s clients. If any statement is unclear, the preparer should insert “Doesn’t Apply” or “Unknown” to answer. You are allowed to use extra sheets if any explanation fails to fit the space of the unit.

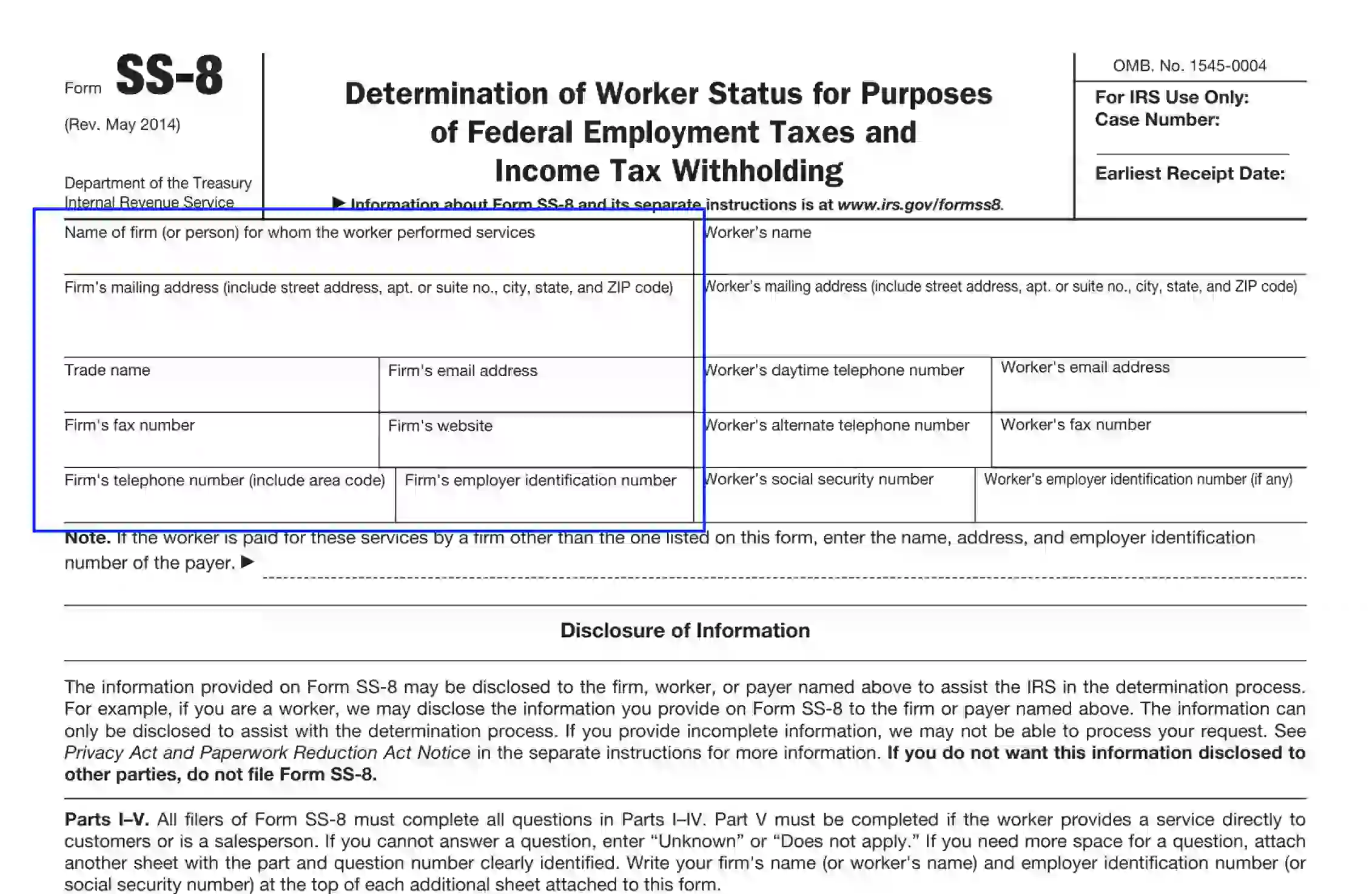

Define the Firm’s Details

Use the left part of the heading to identify the firm. Ensure to disclose the info as follows:

- Firm’s name — relying on the definition above, the preparer should enter the name of the entity or individual for whom the worker provided the services.

- Mailing address — enter the apartment (suite) number, street, city, state, and ZIP code details.

- Business or trade name that the firm uses to carry the activity.

- Contact info — enter the email address, phone number, fax number, and website (if any) in related boxes.

- Firm’s EIN

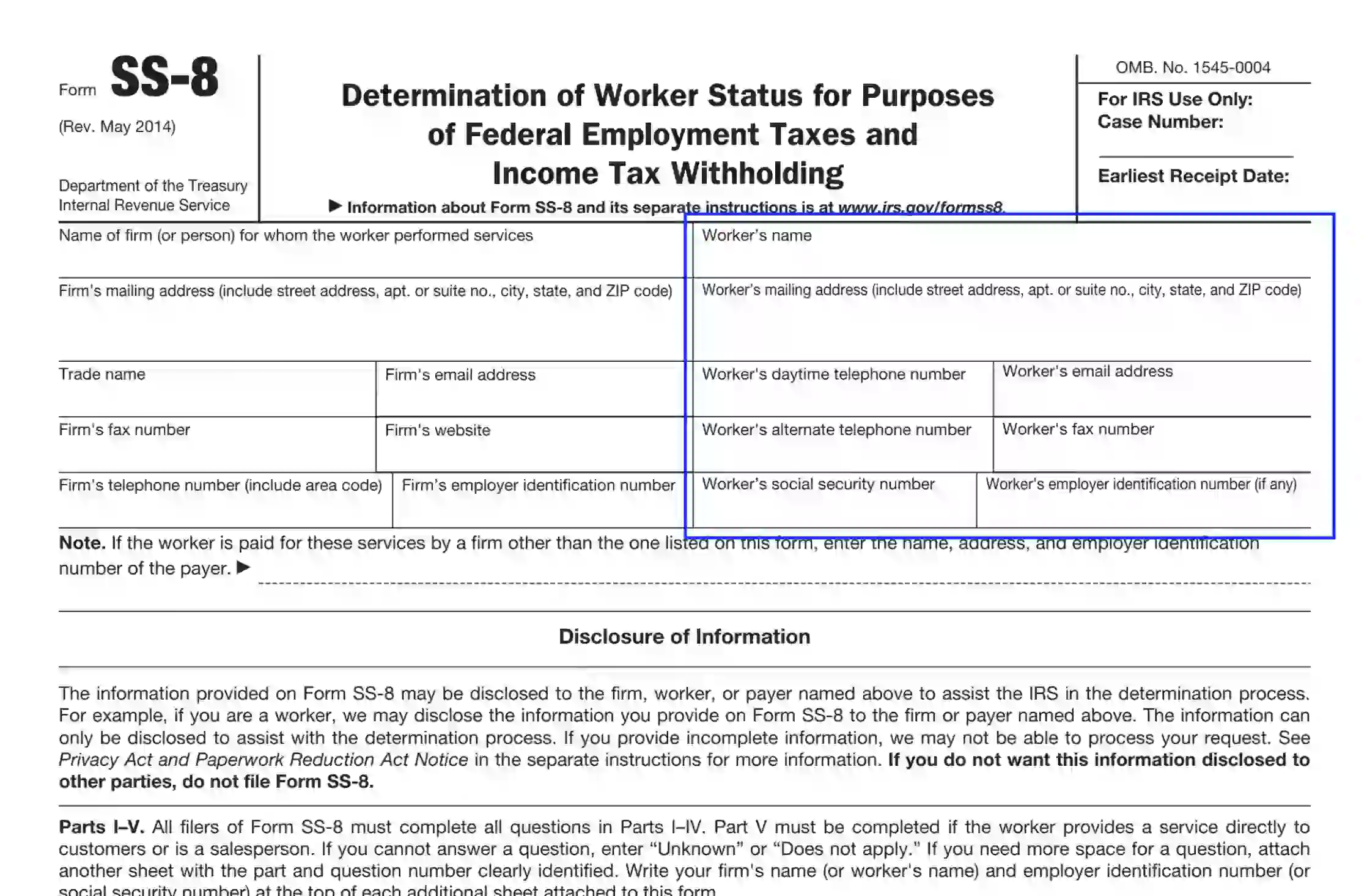

Identify the Worker

In the right part of the heading, the preparer needs to submit the worker’s info as required:

- Legal name

- Correspondence delivery address, including the apartment number, street, city, state, and ZIP data

- Business hours phone and alternate phone details

- Fax (if any)

- SSN

- If the worker has an EIN, enter the 9-digit number into the corresponding box. If absent, leave the slot blank.

Specify the Alternate Payer (If Any)

In case the worker is refunded by an individual or entity different than the one indicated in the heading section, disclose the payer’s name, mailing address, and tax ID number.

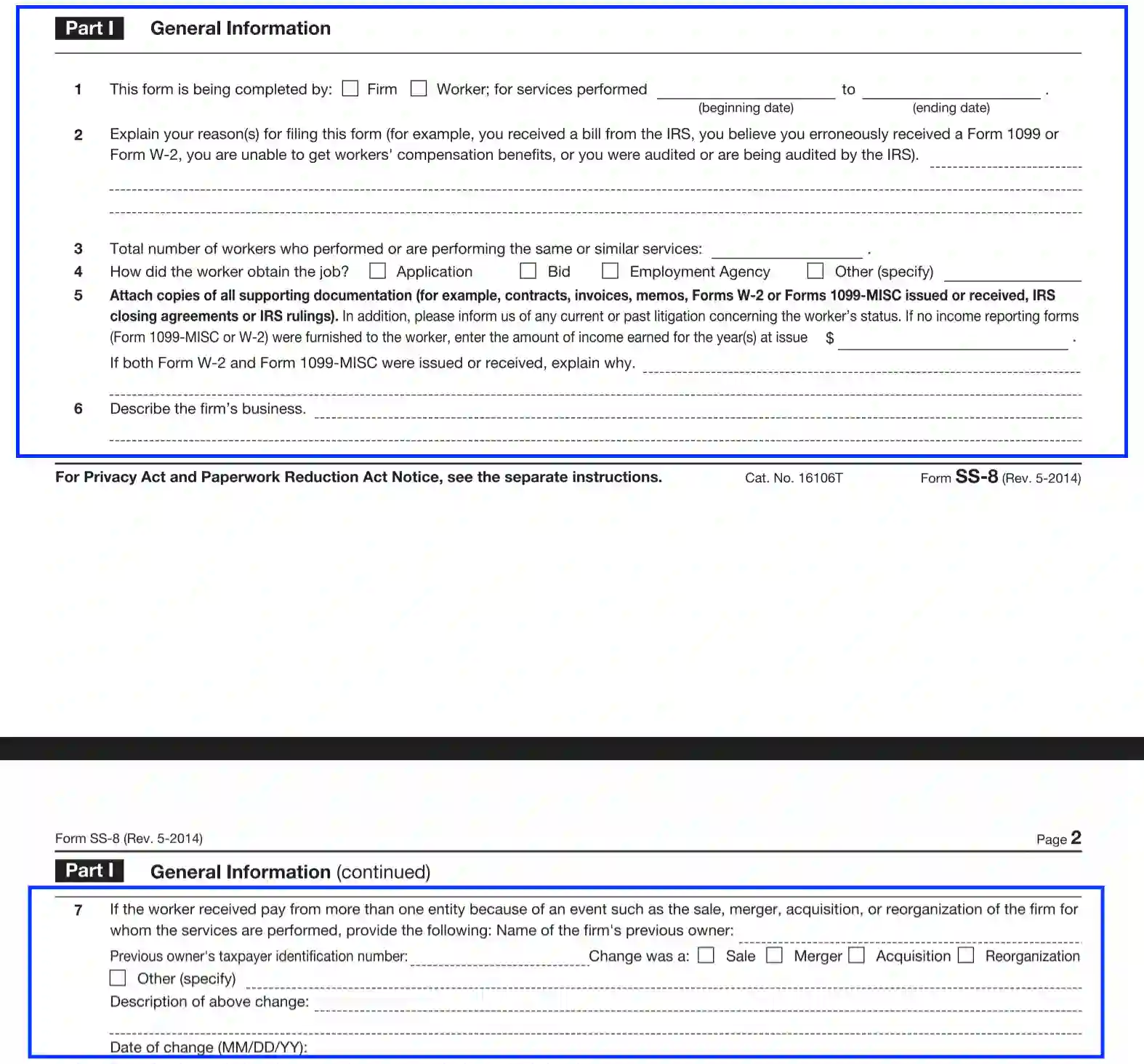

Specify the General Background

In Part I, the preparer should provide details regarding the general background of the applicant. Answer the questions 1 through 11, clarifying the following info:

- Determine the applicant — state if the request for the worker’s status determination is prepared either by the firm or the worker in Unit 1.

- In Unit 2, explain the reasons for preparing the document.

- List all workers who provide identical services in Unit 3.

- Use Unit 4 to clarify how the worker was hired.

- In Unit 5, specify the revenue amount the worker was refunded during the tax period at issue. Also, the preparer needs to attach related documentation and report forms, including contracts, agreements, invoice papers, W-2 (alternatively 1099-MISC) papers.

- The firm’s principal business activity is explained in Unit 6.

- In Unit 7, the preparer should state if the worker was refunded by the entity, which is subject to sale or other reorganization. If positive, specify the ownership transfer reasons, the date of adjustments, and submit the prior entity’s TIN.

- In Unit 8, the preparer should describe the service specifications they perform and enter the title.

- Explain your assumption if the worker appears to be either an independent contractor or an employee in Unit 9.

- In Unit 10, specify if the worker has provided other facilities than those related to the determination of the status request. If you answer positively, please, clarify the date and the difference of the service performed compared to the current duties. If you doubt, enter the “Not Applicable” variant.

- Explain if there exists an agreement authorized by both parties and attach a copy if applicable.

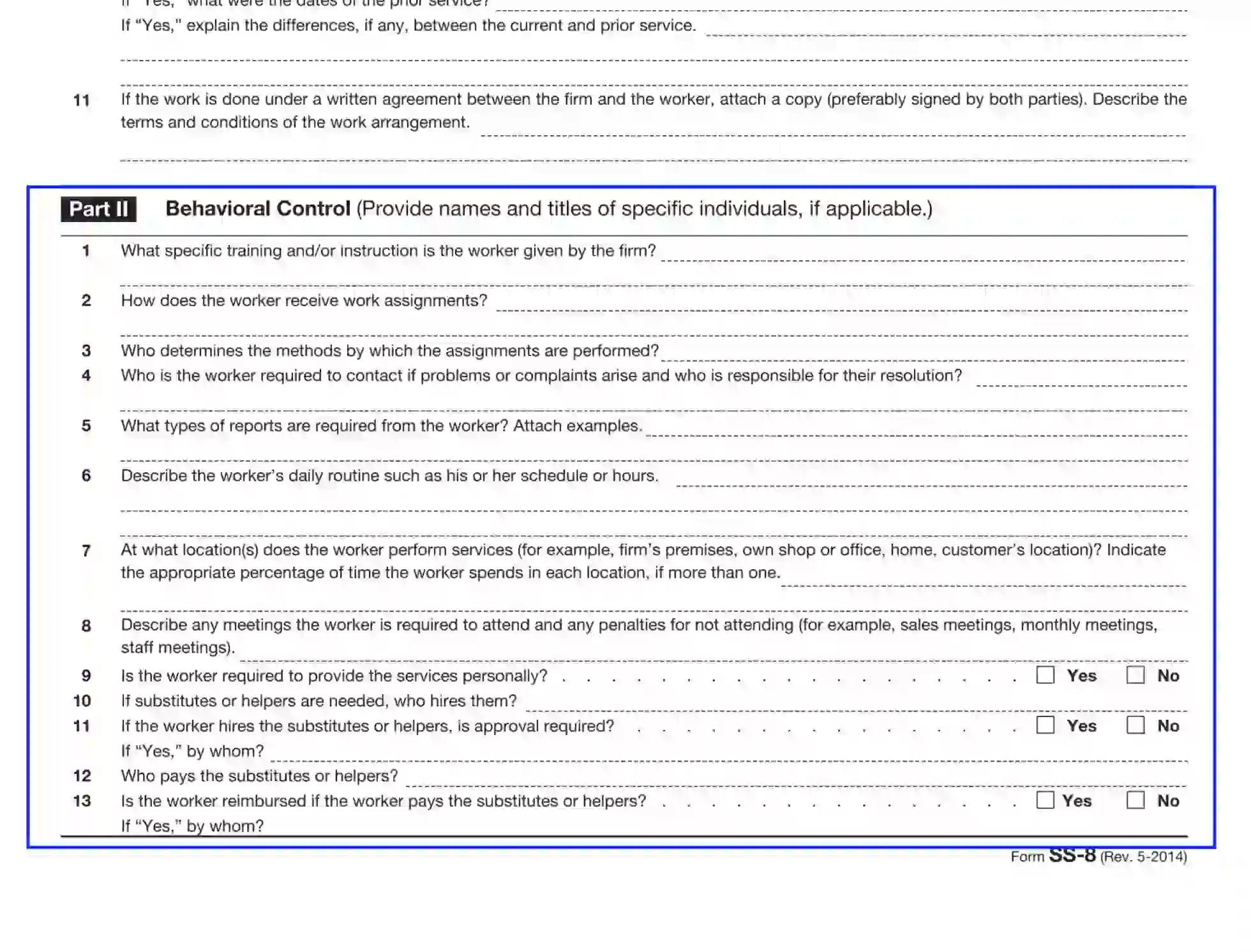

Complete Behavioral Control Section

Part II of the SS-8 document is dedicated to the determination of daily business routine aspects. Here, the preparer should enter data that reflect the following:

- Methods of work

- The manner the worker was instructed

- Required reports to complete

- Working schedule and meetings policy

- Existence of assistants and their compensation

- The manner of conducting the duties — checkbox “Yes” if the worker personally performed the services.

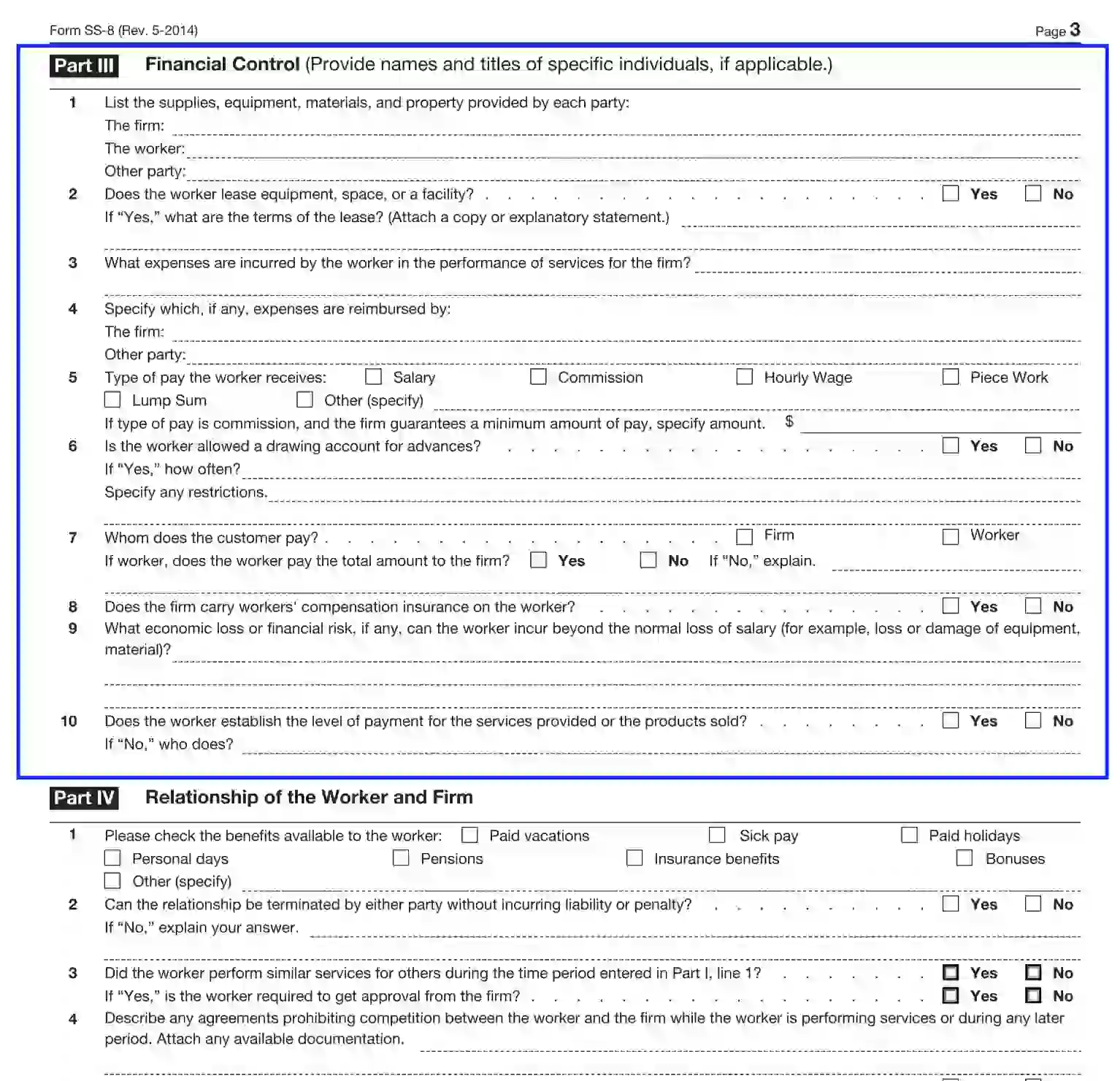

Submit the Financial Control Aspects

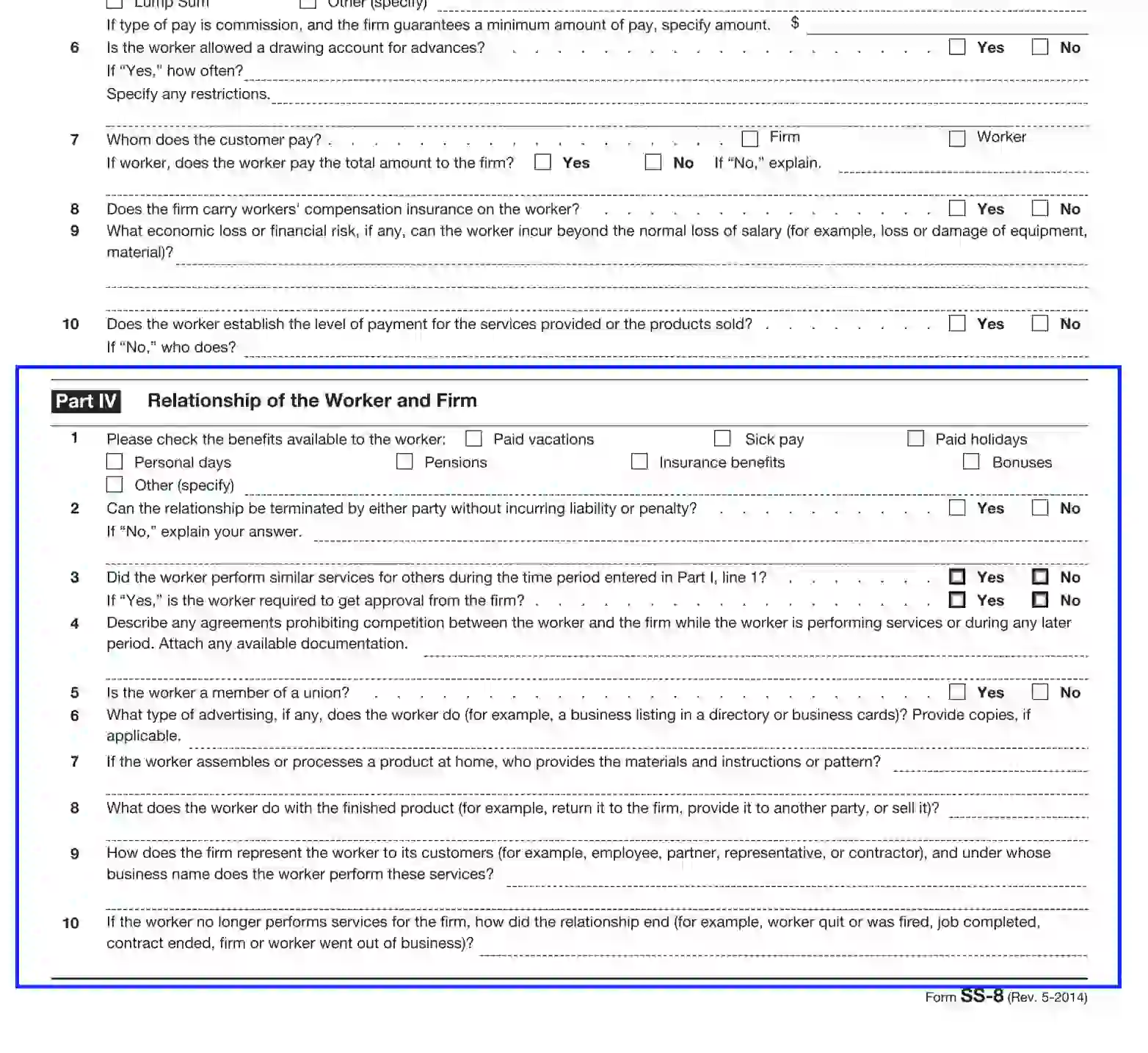

In Part III, the preparer needs to figure the financial aspects of the firm-worker relationships. You are encouraged to comment on statements 1 through 10, providing the name of certain individuals where possible. Enter the following aspects:

- Compensation for expenses

- Salary and other payments

- Spaces, equipment, and material at the worker’s disposal

- Lease business property

- If the worker received payments from the firm’s clients

- Compensation insurance and other guarantees the firm gets in case the worker damages anything

- If the worker defines the rate standard for the services performed

Describe the Parties’ Business Relationship

Use Part IV to define the relationship between the parties and disclose such aspects as:

- Benefits, liabilities, and penalties

- Exclusive services, exclusive rights to acquire the services performed by the worker, agreements, and any cases when the worker performed the aforementioned services to other firms

- Advertising

- Home office and homesourcing availability

- Finished product realization

- If no longer working, explain the details of how the parties separated.

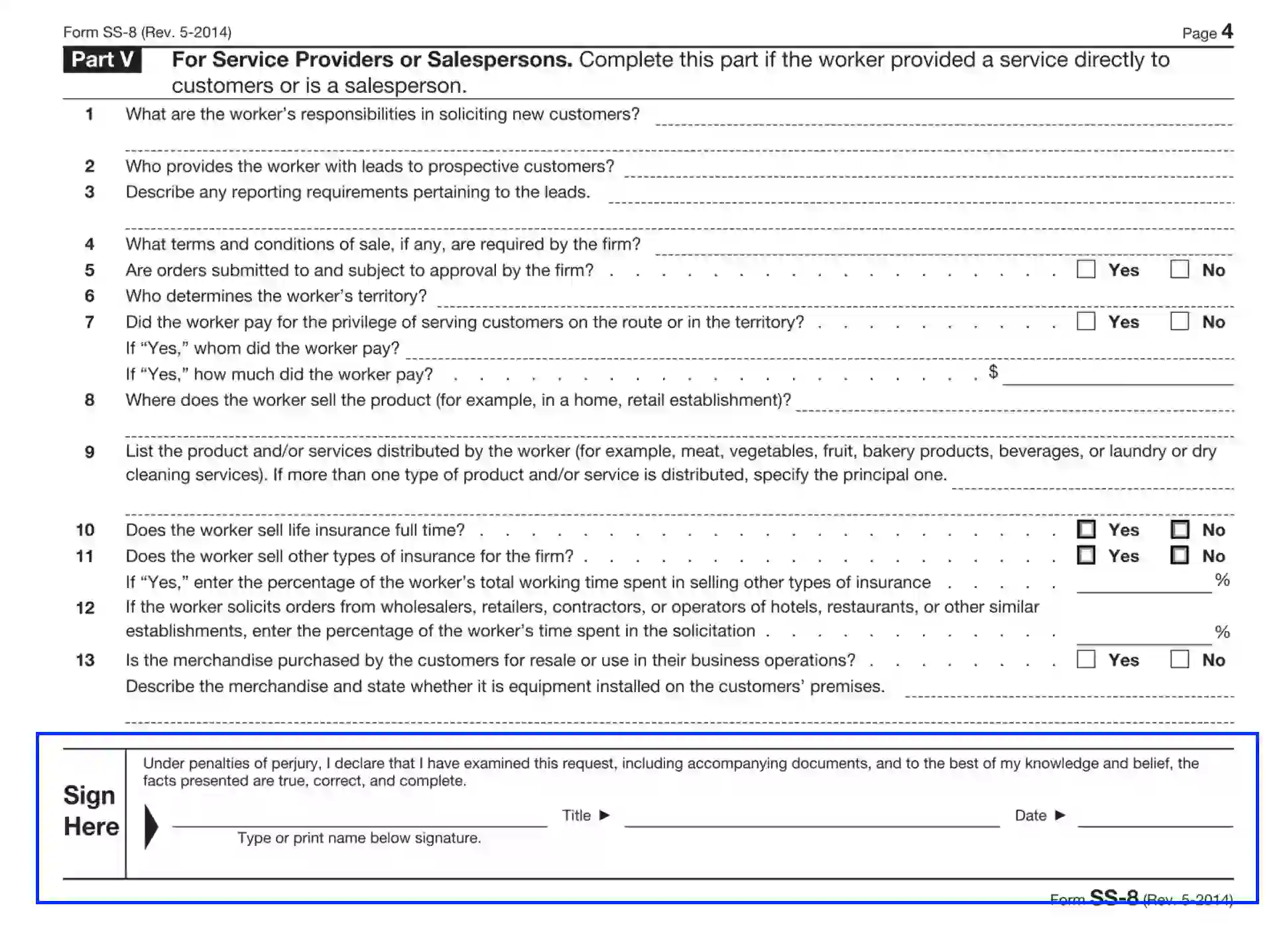

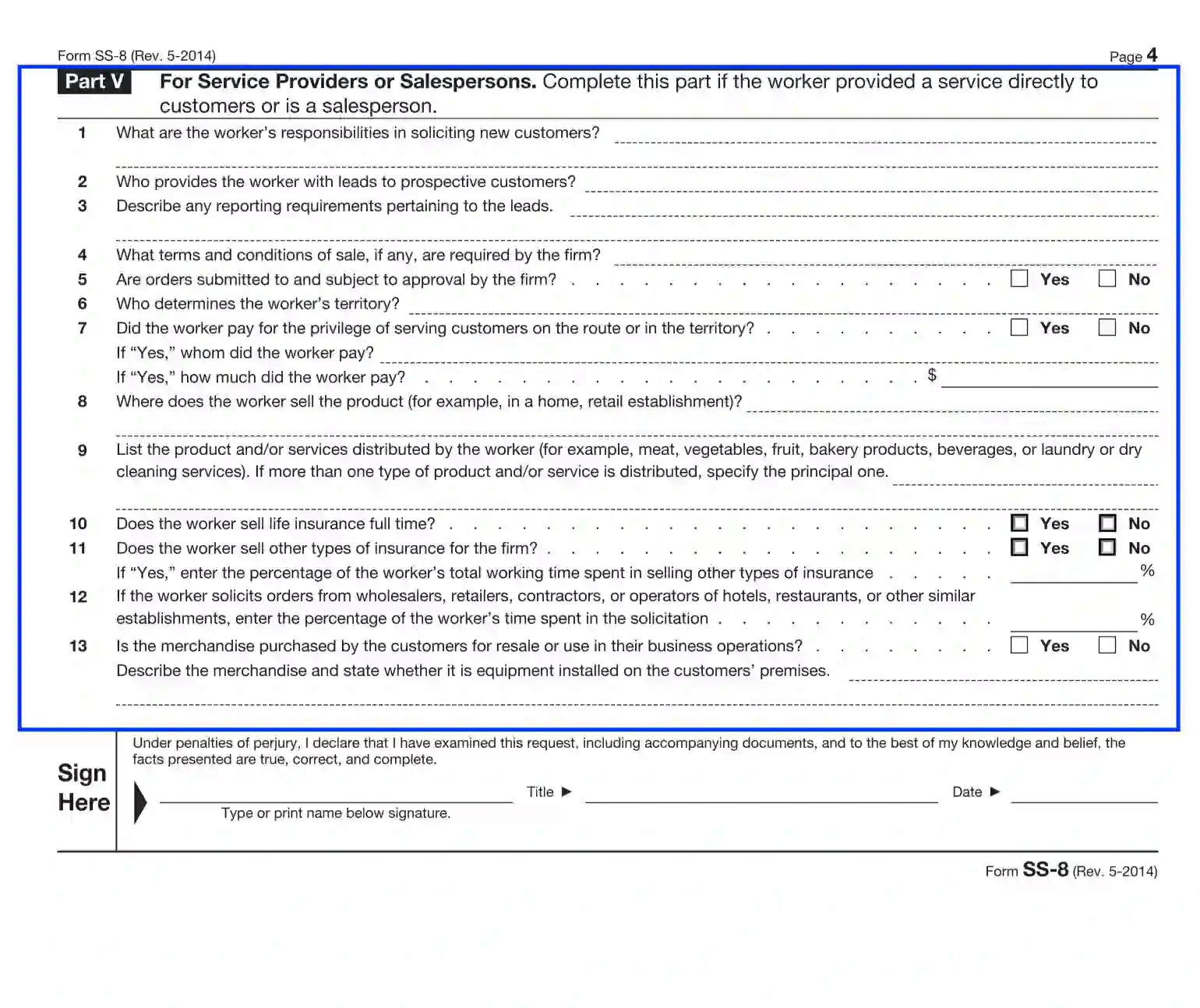

Complete Part V Questionnaire When Applicable

This section is filled out only if the worker performs the services directly to the firm’s clients or appears to be a salesperson. Disclose the below-listed ideas:

- Customers policy and duty requirements

- Trade terms stated by the firm

- Territories of sale

- Describe the product sold

- Provide details if the worker sells insurance products.

- Disclose if the worker negotiates with retailers and other third parties to order the product.

- Specify if the service includes resale, or the acquired products are used in production.

Authorize and File the Document

To authorize the form, the taxpayer should append their signature, print or type the legal name below it, define the preparer’s title, and place the current date when the form is being acknowledged. Note that all remarks applied in this section must be executed in handwriting, as stamped signatures are not accepted.

Once completed, the document should be delivered to the IRS, Form SS-8 Determination, P. O. Box 630, Stop 631, Holtsville, NY, 11742-0630.