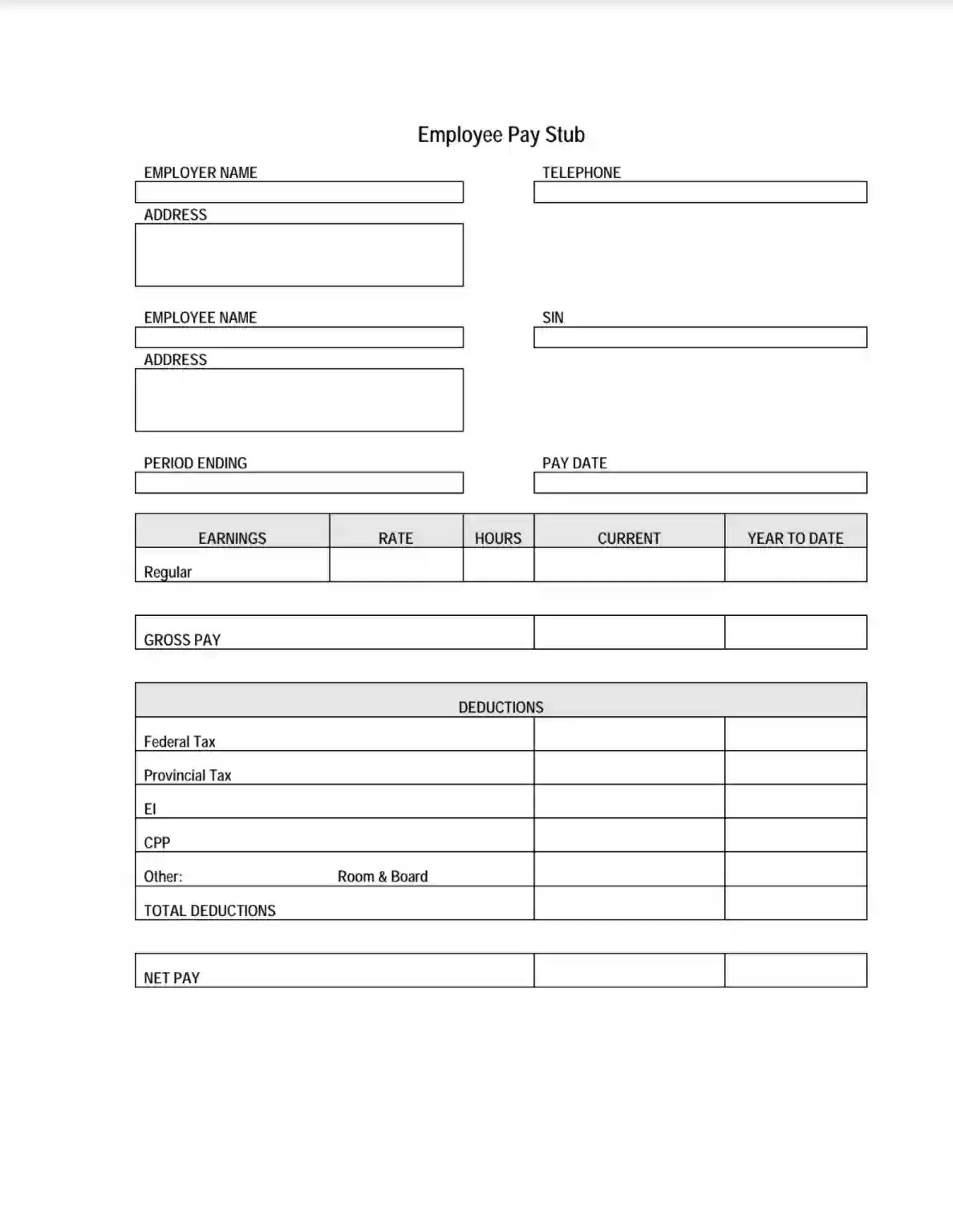

The Fillable Pay Stub is a digital document template employers use to provide employees with detailed information about their earnings and deductions for a specific pay period. This form includes sections for the employer’s and employee’s names and addresses, SIN, pay period ends, pay date, detailed earnings breakdowns by type, rates, and hours worked. It lists federal and provincial taxes, Employment Insurance (EI), Canada Pension Plan (CPP), and other deductions like room and board.

The form calculates gross pay, total deductions, and net pay, providing a clear picture of the employee’s take-home pay. This fillable pay stub ensures wage distribution transparency, allows for easy record-keeping, and helps employees understand exactly how their pay is calculated and what deductions are taken.

Other Employment Forms

If you wish to check out more employment PDFs that you could edit and fill out here, the following are several of the forms searched often by our users. Additionally, keep in mind that you can upload, fill out, and edit any PDF document at FormsPal.

How to Fill out the Pay Stub Form

The most significant process in this whole story is the filling out of the payslip. An accountant or other financial specialist who deals with this issue must carefully and responsibly calculate the employee’s salary and provide a report. It is better to complete a settlement receipt in advance, counting all taxes, contributions, and bonuses.

Below is a step-by-step guide for filling out such documents. Do not rush into mathematical calculations because the correctness of the salary payment depends on it. If you have any misunderstandings or other difficulties, discuss everything with the employer and directly with the employee. Practice shows that if your business is small and does not offer many benefits to employees, pay stubs are uncomplicated and straightforward. Otherwise, the sheet contains several columns and rows for entering the amount.

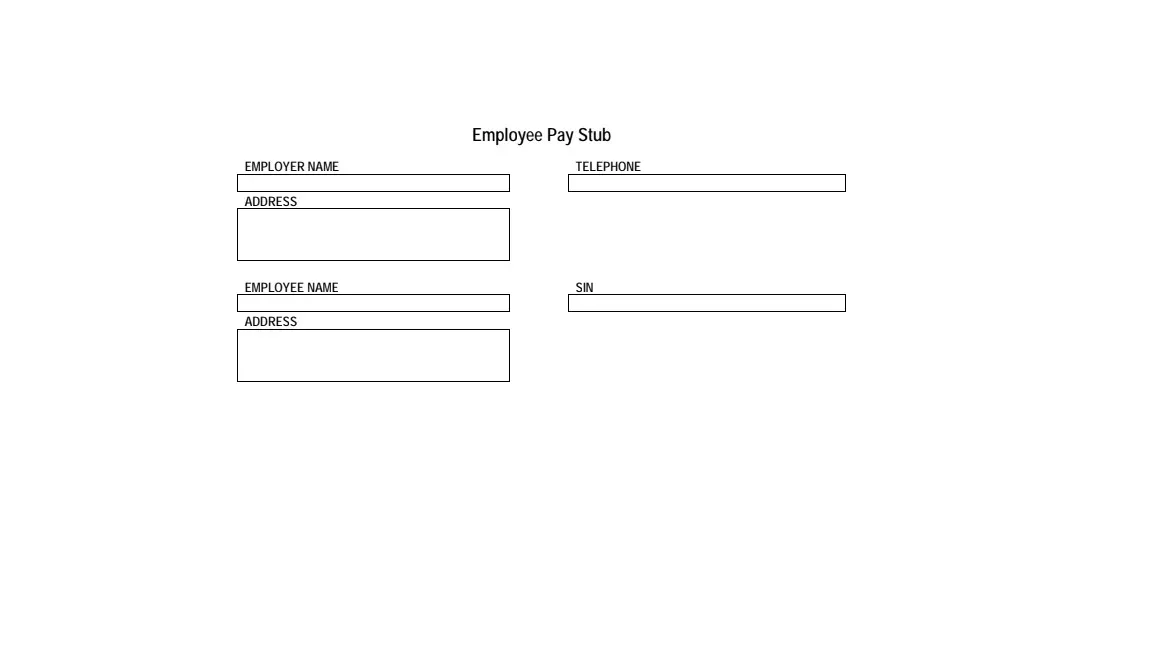

Complete the Employee’s Information

Like any other payment document, pay stubs request information about employees and your business. Enter their first name, last name, and current residential address. Don’t forget to include their social security number, as well as your company name and a valid phone number.

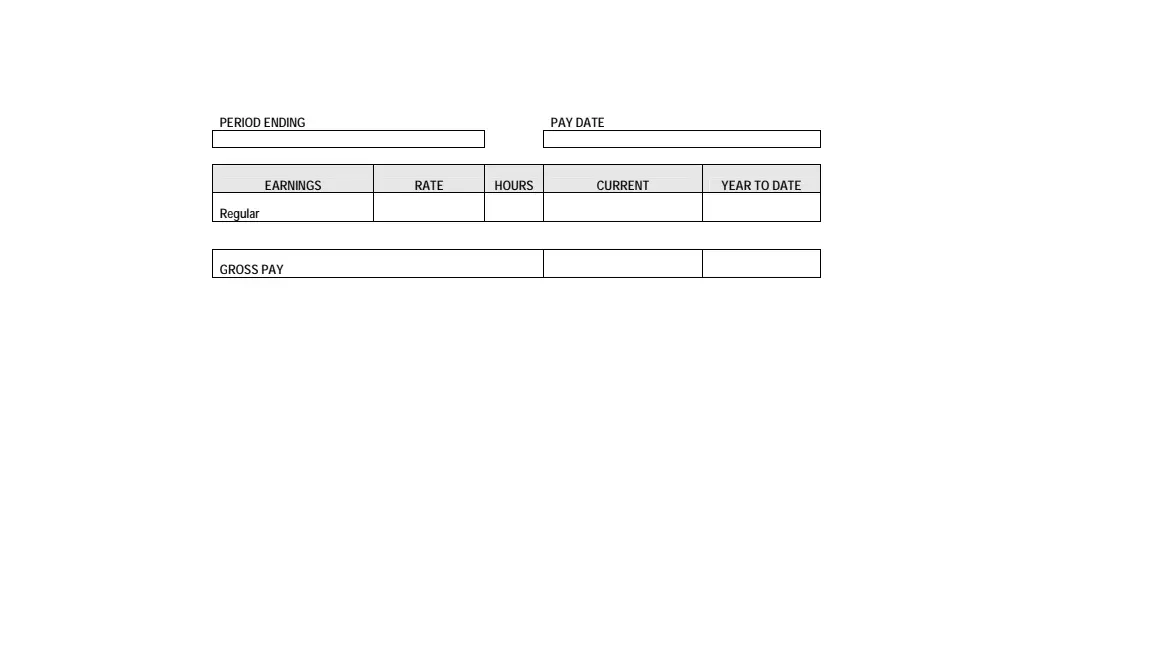

Enter the Payment Period

In such documents, you must specify the beginning of the billing period and the end. The accounting department issues pay stubs by the end of the payment for a month, six months, and a year. If an employee suddenly quits, the employer will have to pay quickly. However, knowing the information via pay stubs makes the process easier. Be sure to specify the hours worked, regular payments, and gross salary. In principle, these points are not so intricate. No difficulties should arise.

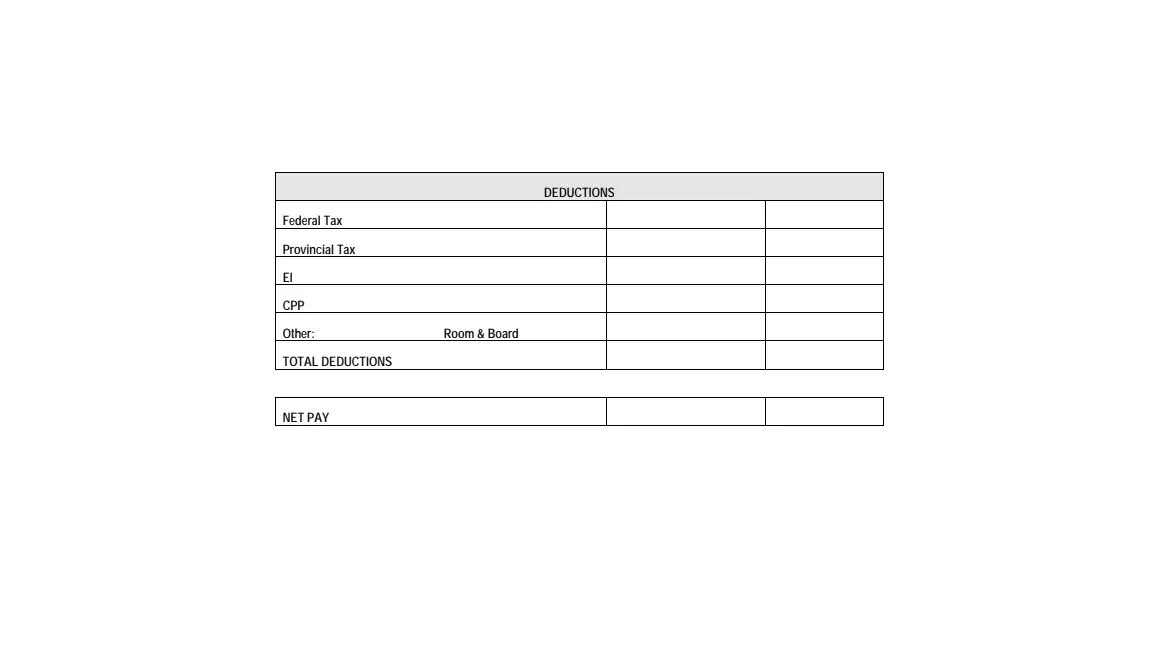

Specify All Deductions and Net Pay

As noted earlier, any pay sheet contains information about tax deductions and other deductions. Form this information array by counting each sum and combining it into the final one. If the company has a debt to the employee or vice versa, any related information must be entered in the pay stub.