Georgia Promissory Note Template

Lending money may lead to complications for the borrower due to the inability to refund. If a lender wants to oblige the borrower to pay the full amount by law, they should fill out and sign the Georgia promissory note.

Though such notes’ templates vary from state to state, the structure is similar. Each promissory note for personal loans reveals specific details like the borrower and lender’s personal information, the sum that the borrower was given (including the interest rate), the due date, and other essential details.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

One should choose wisely among the types of promissory notes. There are two of them:

- Secured Notes.

The form is “secured” because the borrower promises to give something out instead of the money (if they cannot cover the debt). For instance, in such notes, borrowers include an item for a refund, such as a car, an apartment, or other things depending on the borrowed sum.

- Unsecured Notes.

Sometimes, the lent sum is not much, or the borrower is someone you trust and who has proven that refunding on time is possible. In such a situation, you can fill out an unsecured promissory note.

Though the types differ, the structure and details are almost the same.

Georgia Usury Laws

Rules regarding usury and interest rate are different in each American state. Chapter 4 of Title 7 of the Georgia Code describes the norms of interest and usury within the state.

In particular, Section 7-4-2 of the Georgia Code outlines the interest rate for various sums. The standard rate is 7% per year unless the parties agree otherwise. Also, other conditions are described in the corresponding Code entries.

Georgia Promissory Note Form Details

| Document Name | Georgia Promissory Note Form |

| Other Name | GA Promissory Note |

| Max. Rate | 7% – if no written contract; 16% – if loan is below $3,000; 5% per month – if loan is above $3,000 |

| Relevant Laws | Georgia Code, Section 7-4-2 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

A promissory note (sometimes called just note) is considered a useful lending tool used regularly by both individuals and businesses throughout all states as a funds source and an alternative to banks. Find out more about the most popular states searched by our website users when it comes to promissory notes.

Filling Out the Georgia Promissory Note

Completing legal forms in the US can be a tricky endeavor. To improve your experience, we suggest reading our guidelines. They explain how to complete the Georgia promissory note template without difficulty.

- Download the Promissory Note Template

To succeed in completion, you will need the proper template of the note. Our form-building software is here to help. You may use it to download the required file.

- Indicate the Lent Sum

The first blank line in the promissory note template in Georgia is located on the right-hand side at the top of the page. You should write the exact sum that the borrower has obtained from the lender in US dollars.

- Name the Lender

In the first part, you have to name the one who has lent the money. Write their full name and address.

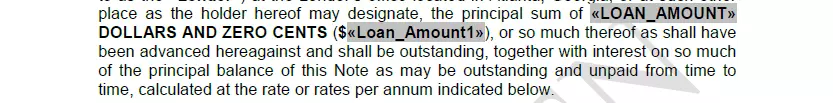

- Duplicate the Sum

You have to insert the lent sum again. It should be written in words first, then in numerals.

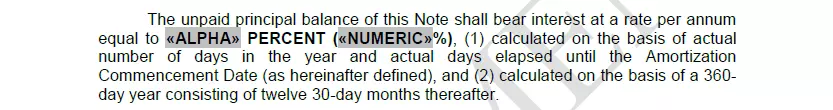

- Insert the Interest Rate

Parties should agree on the interest rate before signing the promissory note. You need to add the interest rate written in words and numbers in the second part of the template.

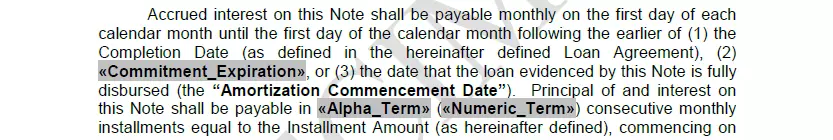

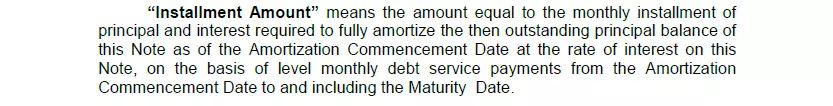

- Define the Schedule

The next section of the form is dedicated to the payments’ schedule. Define the due date and other details by filling out suitable lines.

- Read the Notice

You will see a detailed text that explains basic norms and terms tied to this note. Read them all carefully. Before signing the paper, you have to understand and acknowledge them.

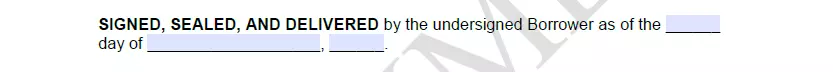

- Insert the Date

Below the text, insert the date of signing of the promissory note.

- Name the Borrower

Write the borrower’s full name. The borrower should sign the form.

- Ask an Attorney or a Notary to Sign

A borrower’s attorney or a notary has to sign the form to prove its validity.

Check out our document maker to personalize any template available on our site to your needs. Here is a range of other common Georgia forms we offer.

Other Promissory Note Forms by State