The Greater Palm Harbor Area Chamber of Commerce

About Us

In September 1977, a group of 14 businessmen saw the need to establish one effective voice that could speak for the residents and businessmen of the Palm Harbor area. The Greater Palm Harbor Area Chamber of Commerce, Inc. was formed to serve the areas of Palm Harbor, Crystal Beach, Ozona, and East Lake. From this nucleus of 14 businessmen, our membership has grown to over 400 businesses.

Located in the heart of historic downtown Palm Harbor, the Palm Harbor Chamber is active in developing the entire community economically. We also serve as a link with local, state, and federal government. In July of 2001, we formed a partnership with the Palm Harbor Library and Pinellas County Economic Development to assist all the businesses in the greater Palm Harbor area. We host many events to promote business and the community. For membership information and/or a calendar of events, please feel free to browse this site by using the navigation menu above.

Today, the Palm Harbor Chamber of Commerce is still one of the most influential forces in local government and economic development. With dedicated, active members, the Chamber of Commerce is actively involved in the Palm Harbor Community and providing valuable resources to its members. The Chamber offers unprecedented benefits, discounts, and opportunities to make Palm Harbor businesses prosperous. The Palm Harbor Chamber of Commerce is excited to pave the way for a growing regional economy as we venture into the new millennium.

OUR MISSION STATEMENT:

To provide leadership to promote an active membership and support, educate and advocate for the community.

Our goal is to provide the community with all the necessary and valuable resources, including legal documents and templates. That’s how we can be sure that every our member is well-educated and legally protected.

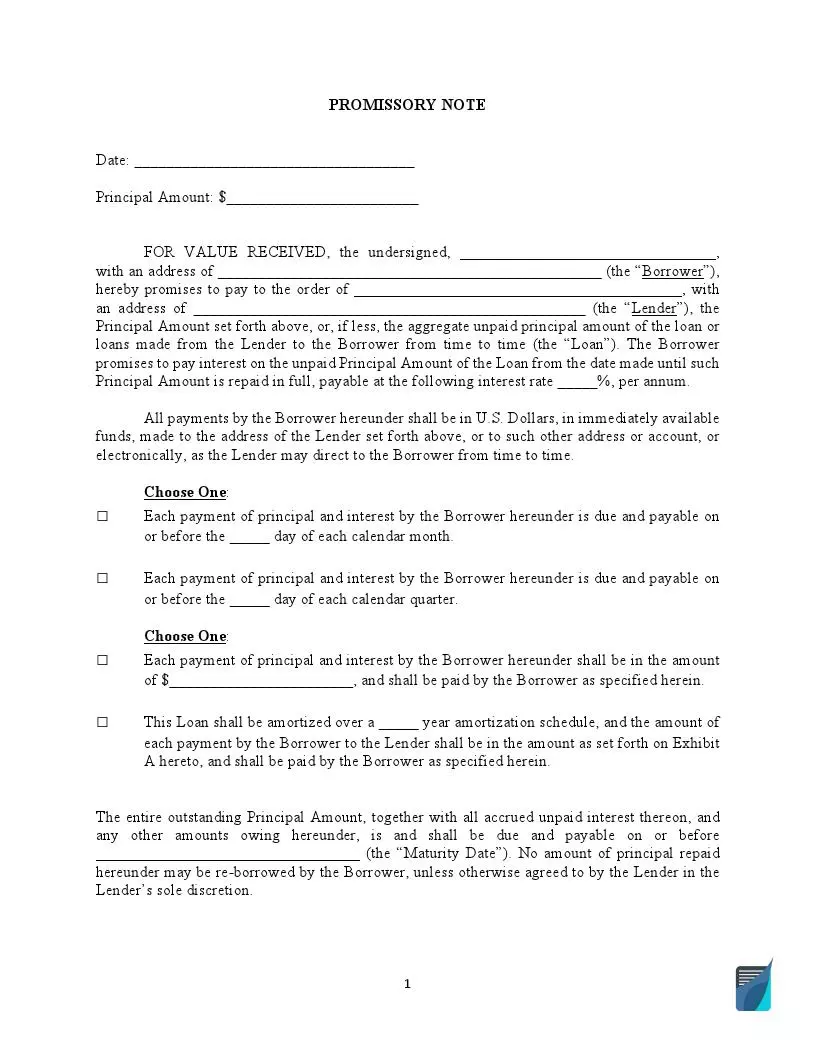

Promissory Note Templates

Among our legal documents, we would like to highlight a Promissory Note . It’s an agreement to pay back a loan and sometimes can be referred to as a loan agreement. A promissory note is often used by financial institutions, such as banks and credit unions, but can be a crucial legal tool for individuals as well. The document records all the details related to loans, including the amount borrowed, interest rate, and repayment schedule. It can also include certain collateral, any property or assets that ensure the loan will be repaid.

We highly recommend creating a Secured Promissory Note. This type of promissory note provides your loan with additional protection. In the secured note, you indicate the borrower’s property, known as collateral, which secures the loan. It means that if the borrower fails to pay back, the lender will get their property.

On the other hand, an Unsecured Promissory Note does not provide any remedy against failure to pay. So, if the borrower fails to repay the loan, the lender will have to file a lawsuit. This type of promissory note still might be the case, but it’s better to sign such a note between family members or close friends. Therefore, the lender can be sure that they will get their money back.

You can also use a Promissory Note for Car if you need a car loan. It works like any other promissory note but indicates the loan details related to motor vehicle purchase. Therefore, you will need to provide such information as buyer’s and seller’s contacts, the amount of the loan, payment method and schedule, interest rate, grace period (if any), certificate of title, and vehicle’s description (VIN, make, model, and year).

Promissory Note Templates by States

A quality promissory note should include the borrower’s and lender’s details, loan amount, interest rate, payment methods and schedule, when the loan must be repaid, and signatures of the parties. However, a promissory note should be created considering state laws since they may govern the essential components differently. It’s specifically relevant to interest rates. All states have their usury laws regulating the maximum amount of interest that can be charged on loans.

If you reside in the Golden State, you should take advantage of a Promissory Note California. The document may provide a clear structure for the repayment of any loan. California usury laws provide the maximum interest the lender can charge that is equal to 10%. This interest rate applies to family or personal loans. For other purposes, the lender can set a higher than 10% interest rate.

A Promissory Note Texas records all the relevant loan details between Texas residents. The document should be signed by both parties and preferably witnessed. According to the state usury laws, the lender can charge an interest rate of up to 18%. Using a Texas promissory note, you can loan money to a family member or close friends. In this case, you are recommended to charge little interest to avoid any conflicts.

In Florida, you are expected to prepare a Promissory Note Florida. You are free to create a secured or unsecured promissory note, but you are recommended to notarize the document in any case. Only the borrower must sign the document. The state usury laws set a general limit to 18% of the interest charged on loans, but if the loan is over $500,000, then the interest rate can be up to 25%.

Other state-specific forms you will find below:

- Alabama Promissory Note

- Arizona Promissory Note

- Promissory Note Colorado

- CT Promissory Note

- Promissory Note Template Georgia

- Promissory Note Illinois

- Indiana Promissory Note

- Iowa Promissory Note

- Kansas Promissory Note

- Kentucky Promissory Note Example

- Promissory Note Louisiana

- Promissory Note Maryland

- Promissory Note Massachusetts

- Promissory Note Template Michigan

- Promissory Note Minnesota

- Promissory Note Missouri

- Promissory Note Nevada

- New Jersey Promissory Note Sample

- Promissory Note New York

- NC Promissory Note

- Promissory Note Ohio

- Oregon Promissory Note

- SC Promissory Note

- Promissory Note Template Utah

- Promissory Note Template Virginia

- Promissory Note Washington State

- Promissory Note Wisconsin

Sample Promissory Note:

When the borrower pays the debt under the promissory note, the lender signs a Release of Promissory Note. This document proves that the repayment is made in full and releases the borrower from any liabilities and obligations stated in the note. A release of promissory note should be attached to the original document.

Chamber Menu

- About the Chamber

- Membership

- Welcome New Members

- Upper Pinellas Chamber Coalition

- Chamber Staff

- Board of Directors

- Committees & Task Forces

- Event Calendar

- Employment Opportunities

- Member Promotions

- Citrus Festival

- Scholarships

- Special Events

- Foundation

- CareerSource Pinellas

- Pay Here With PayPal

- 2016-2017 Honorary Mayor

- Advertising Opportunities 2016

- Community News

- Student of the Month

- 2016 Application for Business of the Year

Palm Harbor Menu

- About Palm Harbor

- Historical Palm Harbor

- Palm Harbor Facts

- Housing

- Palm Harbor Maps

- Sports & Recreation

- Parks

- Healthcare

- Worship

- Other Links

- Jolley Trolley

WHAT IS THE CHAMBER OF COMMERCE?

The Greater Palm Harbor Area Chamber of Commerce is a voluntary organization of business and professional men and women who have joined together for the purpose of promoting the civic and commercial progress of our community.

The area’s economic well-being is related directly to the caliber of work that is done by the Chamber. That is why our Chamber has a major impact on business, income and future growth of the area.

There are two primary functions of a chamber of commerce:

- It acts as a spokesman for the business and professional community and translates into action the group thinking of its members.

- It renders specific services of a type that an be most effectively rendered by a community organization both to its members and to the community as a whole.

OBJECTIVES OF THE CHAMBER

- To promote a better understanding of the nations private enterprise system.

- To coordinate the efforts of commerce, industry, and the professions in maintaining ans strengthening a sound and healthy business climate in the Greater Palm Harbor area.

- To sponsor aggressive programs of work and stimulate activities that will provide for full development and employment of our human and economic resources.

- To provide creative business leadership and effective coordination of all interested parties in solving community problems and in initiating constructive community action.

- To create broad understanding and appreciation of the great opportunities in our area and to promote the advantages and assets of our community with the area, in the state, and in the world.

- To maintain the internal and external capability to meet challenging conditions and challenges while remaining alert to the needs of its membership.

HOW IT OPERATES

The Board of Directors, the policy making body of the Greater Palm Harbor Area Chamber of Commerce, represents the business and professional leadership of the community. The Board consists of not less than 15 members; one third are elected each year for a three year term.

The Officers, elected by the Board, serve as the Executive Board and Finance committee & may handle business that occurs between Board meetings.

The President/CEO, the Chief Executive Officer is employed by the Board of Directors as an ex-officio Executive Board Member, and advisor to the president & all committees/task forces. The President/CEO supervises the chamber staff and is responsible for carrying out the chamber’s business programs in accordance with Board policies.

WHAT DOES OUR CHAMBER DO?

- Disseminates pamphlets, brochures, maps, & factual data.

- Displays members’ business cards and information and compiles a relocation inquiry list.

- Establishes a link with local, state, and federal governments representing a voice on legislative affairs, taxation, zoning, etc. – We represent our members in dealing with all units of government, protecting the interest of members ad the business community.

- Strives for civic improvements to meet the growing needs of the increased population, promoting civic development and civic pride.

- Involved in education in our area. We sponsor an Annual Teachers Appreciation Breakfast, Student of the Month Luncheons, Frank E. Weaner Scholarship, and End of Year School Awards.

- Works to educate the public that all their services and needs can be met within our geographical location.

- Provide and enhance cultural activities, including the Bill & Louise Hoskin Visual Arts Scholarship.

- Conducts a monthly Business Coffee Hour, After Hours Business Social, Trade Shows, and publishes a weekly e-newsletter.

HOW IS IT FINANCED?

The Greater Palm Harbor Area Chamber of Commerce, Inc. is financed primarily by the investments of its members. Special projects are also conducted throughout the year such as the Harbor Arts Festival in December, the Citrus Festival in April, and others. The maintenance of an adequate level of support from all business and professional interests in the community is essential to finance the programs that are vital to community growth and development.

WHY JOIN YOUR CHAMBER?

Your Chamber of Commerce is your salesperson, your voice and watchdog representing your interest in the political arena, promoting your interests by bringing visitors to our area, welcoming them and encouraging them to return, and providing you the opportunity to network and advertise your business. Support your Chamber of Commerce through membership and participation in the activities. We invite you to join one of our committees or task forces. It is important to all business and professional people, and others because it pays real dividends in the form of more business, better living conditions, and a more attractive and desirable community.