Kansas Promissory Note Template

Sometimes we lend money to other people and without bothering about the conditions and terms of a refund. If you have loaned a significant sum to another individual, you might feel uncomfortable without evidence, such as a completed and signed Kansas promissory note.

Borrowers and lenders create a standard promissory note form in all American states. Whether you are in Kansas or any other part of the United States, there are irreplaceable details in the document. The parties’ personal information, the termination date, the lent amount, and other vital features are among them.

If you are the party that gives money, you are called a lender or a creditor. If you receive money, you are considered a borrower or a debtor.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Promissory notes in all states are divided into two types:

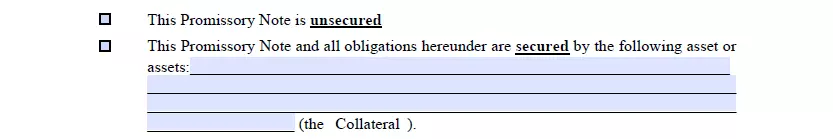

- Secured notes. These documents let the borrower guarantee the refund with valuable items. For instance, debtors can offer their car or apartment as compensation (depending upon the lent amount).

- Unsecured notes. These documents do not presume such a guarantee. Usually, people prefer this type when the agreement is between relatives, friends, or close people. Another case to complete this note is the small lent amount that does not worry a lender much.

Whether you complete a secured or unsecured promissory note, you still have to keep the structure, and the information you add is the same (apart from the tangible items provided in secured notes).

If the borrower cannot refund and the situation is questionable, the creditor can use the signed promissory note in court.

Kansas Usury Laws

Each state regulates usury in its own way. Chapter 16 of the Kansas Statutes incorporates provisions about money, usury, and contracts in Kansas.

According to Section 16-201, the legal interest rate in Kansas is 10%. The general usury limit is prescribed in Section 16-207. It should not exceed 15% in this state.

Kansas Promissory Note Form Details

| Document Name | Kansas Promissory Note Form |

| Other Name | KS Promissory Note |

| Max. Rate | 10% – legal rate of interest; 15% – general usury limit |

| Relevant Laws | Kansas Statute, Sections 16-201 and 16-207 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 28 |

| Available Formats | Adobe PDF |

Popular Local Promissory Note Forms

Whenever lending or borrowing money, consider creating a promissory note. It is a simple legally binding document widely used by businesses and individuals in many states. Listed here are the state-level promissory note templates our visitors read about most often.

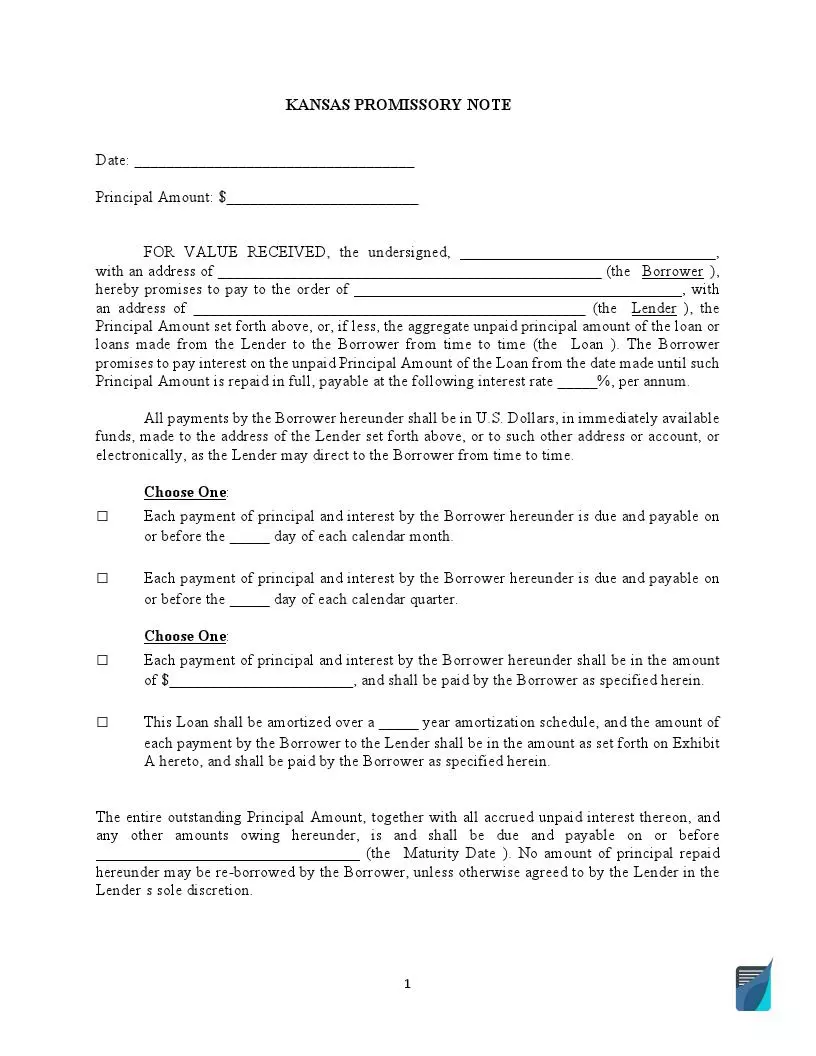

Filling Out the Kansas Promissory Note

Some people try to create legal forms by themselves and often make mistakes. To avoid such situations, you may check our brief guide for the Kansas promissory note template completion. With these simple steps, you can make the note correctly and without effort.

- Get the Template

To start the completion process, you should find the right template. Use our form-building software to generate the promissory note template for Kansas.

You have to print two copies, so both the debtor and the creditor can sign and save the paper for the future.

- Write the Date

When you have gotten the template, enter the date of completion on the top of the page.

- State the Borrowed Sum

Below the date, add the sum given to the debtor. It has to be written in US dollars.

- Name the Debtor and the Lender

Write the lender’s and the debtor’s names and addresses in suitable blank spaces.

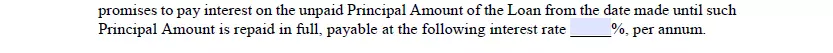

- Agree on the Interest Rate

Before signing the paper, the parties should discuss the rate of interest. Agree on it and write it in the relevant line.

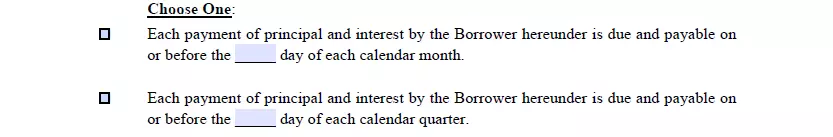

- Schedule the Payments

If the sum is significant, the borrower will probably return it piece by piece. You have to schedule the payments, including the dates and exact amount to repay. Choose the statements and add the information where needed.

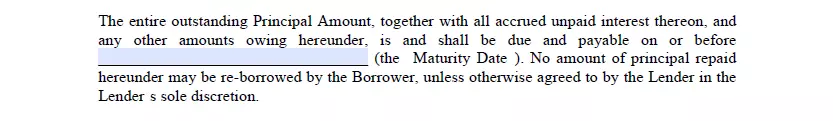

- Enter the Termination Date

The termination date (when the borrower completes the refund) in promissory notes is usually called the “maturity date.” Add it in the form.

- Choose the Form Type

You should indicate the promissory note type. If you choose a secured note, the borrower must include the items to replace cash in the “Collateral” line.

- Leave the Signatures

Both parties’ signatures at the end of the note will ensure the document’s validity. Keep the promissory note until the debt is covered. Notarizing this paper is not required; however, you can ask for the acknowledgment anyway.

Use our builder to personalize any form on our website to your preferences. Here’s a list of various other printable Kansas documents we offer.

Other Promissory Note Forms by State