Stock (Shares) Purchase Agreement Template

A stock purchase agreement is an agreement that indicates the transfer of ownership of stocks between two parties – the seller and buyer.

Shares are commonly sold when a business wishes to raise money or for some other agreed-upon compensation. When it comes to small business entities or startups, they might offer shares as a benefit for employees to attract talented specialists or to expand the business. The purchaser, in their turn, may expect to receive dividends on their investment.

This type of purchase agreement is used to record the important details of the transfer such as the number of shares, the price per share, the effective date of the sale, and gives both seller and buyer desired legal protection. Along with that, the agreement comprises specific terms and conditions that present the nature of the contractual agreement.

When the transaction is being closed, the seller has to transfer ownership of the stock certificates, while the buyer is obligated to pay the stock price mentioned in the document.

Read further to learn more about the specifics of a stock purchase agreement and how to create a decent document.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Should Be Included in a Stock Purchase Agreement?

There are certain key provisions that should be included in every stock purchase agreement. Among such provisions are:

Parties

The parties to a stock purchase are referred to as the seller and the purchaser. The seller in the agreement is commonly a business such as a corporation, limited liability company, or partnership. It might be either the company or stockholders in the company who sell stock to buyers.

Date of the transaction

A stock purchase agreement should specify in the opening recitals the date of the agreement. It should also include the names of the parties.

Number and price of the stock being sold

Further, the document should mention who issued the shares and how many of them are involved in the purchase and sale. As well as that, the dollar value of each of them and the class of stocks (common or preferred) should be specified.

Stock certificates

When the transaction comes to an end, the seller transfers the ownership of shares to the purchaser. It is the seller who is responsible for the endorsement of the certificates (it is the procedure of depositing paper stock certificates with a broker that helps ensure their safety against theft or loss). The seller is also responsible for paying any taxes for the transfer.

Amount and method of paying

A stock purchase agreement should include the provision about when and how the purchase price will be paid. Typically the buyer pays a certain percentage (deposit) first, and the remainder is being paid after the execution of the agreement.

Warranties by the seller

The purchaser should get warranties when purchasing stock certificates such as the warrant of the corporation being legally able to issue shares. As well as that, the purchaser would need a guarantee of the company being in good standing. A stock purchase agreement should also tell that the seller is the actual owner of the shares and has legal rights to sell them to the purchaser.

Warranties by both parties

The document should clearly state that both parties confirm that all information they were required to provide was disclosed and there are no stipulations on the part of both parties.

General terms and conditions

General provisions in a stock purchase agreement should include the statement that the contract is written in accordance with the state laws where the agreement is being executed.

Witnesses

Despite not being a legal requirement, the parties might want to ensure the presence of witnesses or involve a notary when signing the document. It is common in situations when parties don’t know each other or have reasons to think the other party might pull out of the agreement.

Share Purchase Agreement vs. Share Repurchase Agreement

A share repurchase agreement is a document that solidifies repurchasing of a company’s shares from its stockholders and putting them back in the name of the issuing entity. It is typical for established corporations that have enough funds to buy shares while still having money to cover their operating costs. When shares are redeemed and the ownership is returned to the company, there is commonly an increase in the value of the remaining stock.

A share purchase agreement allows transferring shares between individuals. The ownership of shares would be transferred between stockholders and persons wanting to purchase stock certificates of the company. The latter would not act as the party in the agreement.

How Is a Private Sale of Shares Held?

Stock can be bought in two ways – directly from the company with the use of a purchase agreement or online through an online stockbroker. It will depend on whether or not the company sells its shares publicly. Here, we will consider the procedure of buying shares of stock directly from a business.

Signing the letter of intent

First, the seller should get a stock purchase letter of intent from the purchaser who wants to buy a limited number of shares in the company. The letter should explain the proposed sale. The signing of the document signifies the seller’s consent to start negotiations with a particular purchaser.

To get a good letter of intent template, you can use one provided on our website.

Due diligence period

After the seller signs the letter of intent, the purchaser gets the right to get all the documents they need to be sure of the purchase. These might be financial reports, agreements, etc. The procedure is aimed at helping the buying party be sure that the seller represents their business truthfully.

Signing the agreement

After checking the company’s documents, the parties craft a stock purchase agreement and sign it. The signing should be followed by the immediate closure of the sale with the money being exchanged for the company’s shares. After this, the purchaser can be considered a new legal owner of the stock certificates.

If you are concerned about including all of the details in a stock purchase agreement, make sure to use our online document builder. It will offer you to answer some questions regarding the stock certificates, the company that issued them, and the purchaser. In about 10 minutes, you will get a well-crafted agreement that will comprise all of the information that is required for such type of documents. Your stock purchase agreement will be easy to download and print.

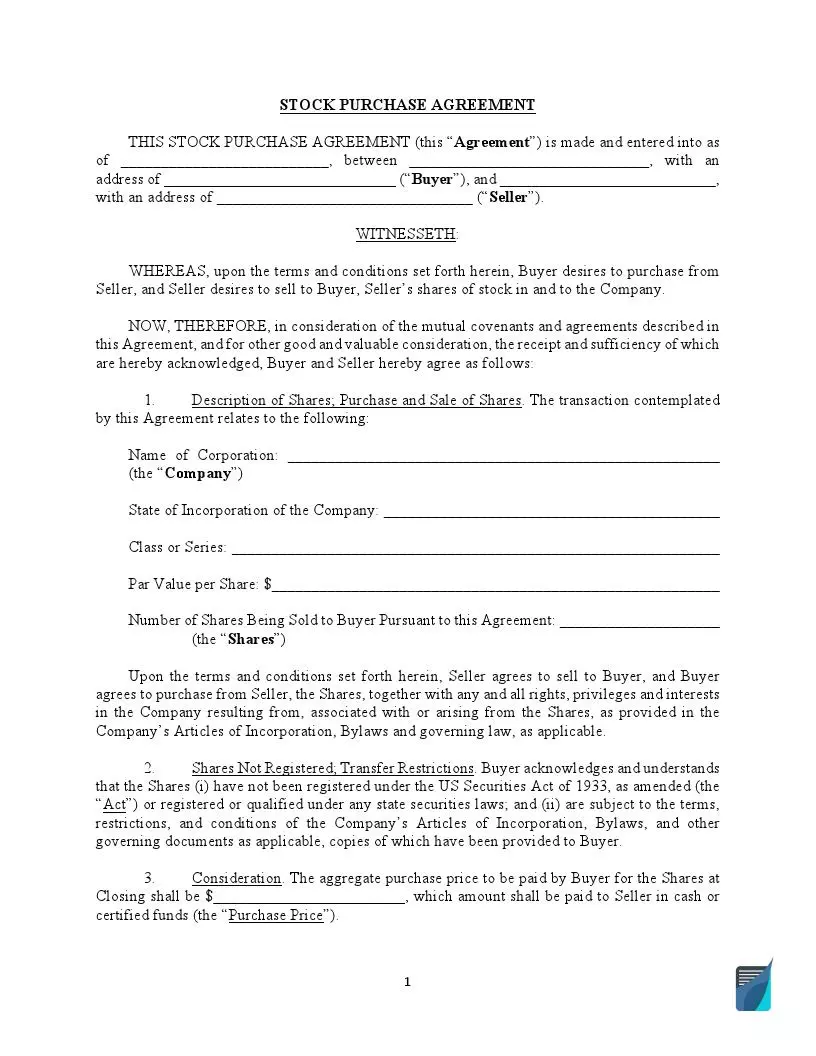

How to Fill out a Stock Purchase Agreement

A stock purchase agreement is typically an extensive document that is broken up into a variety of sections.

Step 1

The document should start with the names of the seller and purchaser entering into the agreement and their mailing addresses. It should also specify the date when it was created.

Step 2

Next, include the definitions – main terms that will be used in the document. This will help both the seller and buyer stay on the same page and don’t face any ambiguity regarding the definitions of the terms in the contract. The more definitions are provided in this section, the less likelihood is there that the seller and purchaser will face misunderstandings on the transaction-related matters.

It might be assumed that the definitions mentioned here are standard terms. However, reading through them thoroughly is a must-do, as they might drastically change the meaning of sections of the agreement depending on how they are defined in the Definitions section. The terms that require special attention are “liabilities”, “seller’s knowledge”, “material adverse effect”, etc.

Step 3

The provision that comes further should describe the business entity behind the shares, mentioning its name, mailing address, and formal business address.

As well as that, it should specify the purchase price per share, the number of shares, and their class or series.

Step 4

A piece of information that should go next is the total amount of money the buying party should pay to the seller, that is, the amount that will be expected from the purchaser on the closing date. The payment method that can be used should also be mentioned here. In addition, the section might specify whether any payments should be made to an escrow agent if one is involved.

It is typical to mention that the buying party first pays the percentage (deposit) within a certain time after signing of the agreement, and then pays the base purchase price at the finalization of the sale.

Step 5

Further, specify the closing date and place. The section should state the last day when the buyer can acquire the stock under the terms of the contract.

Step 6

The next thing to cover in the document should be the representations and warranties provided by the selling party. It should state that:

– the company issuing stock is a duly incorporated and validly existing business entity and is in good standing

– the seller has the authority to issue shares

– the seller is the sole record and beneficial owner of the shares of stock

– the execution of the agreement does not violate or conflict with the organizational documents of the company or local laws

– the execution of the agreement does not require any governmental permits before the closing

– there are no pending actions against the seller that question the validity of the agreement, etc.

Step 7

The next step is writing representations provided by the purchaser. In this section, the buying party should affirm that:

- they are not an issuer, affiliate, insider, or associate of the company

- they are not bound by any agreement that would prevent any transaction related to this contract;

- there are no pending actions the purchaser might know about that would materially affect this agreement.

Here should also be the statement that the purchaser will have sufficient funds that will be immediately available at the closing.

Step 8

The next provision should touch on the broker’s fees stating that the seller is responsible for paying them.

Step 9

A stock purchase agreement should include information about the actions before the closing date. The section is called Covenants and lists the actions the seller should cause the purchased business(es) to refrain from, for example, bringing change to the company’s capitalization, amending articles of incorporation or bylaws, etc.

Step 10

The document should have the section called Additional Agreements that should tell about the existing agreements related to access to information, confidentiality, insurance, etc.

Step 11

The next provision should include information regarding the employees in the purchased companies. It should list potential employee issues, such as bonuses and benefits.

Step 12

In the tax matters section, the document should state who is liable for paying taxes, filing tax returns, etc.

Step 13

The agreement apart from previous provisions should comprise the clause about the termination of the contract. It might happen due to mutual consent of the seller and buyer, by either of the parties if the closing did not take place due to failure of certain conditions, in case of the issuance of a certain governmental order, by either of the parties in case of breaching any of the other party’s covenants, etc.

Step 14

Stock purchase agreements should also contain the section called Closing Conditions. It should list actions that need to be taken or waived before the finalization occurs. It often includes the seller and buyer performing their pre-closing covenants and obtaining all necessary regulatory approvals.

Step 15

In the indemnification clause, it should be mentioned that after the closing, the seller indemnifies and holds harmless the purchaser, and the buying party should do the same regarding the seller. The section should cover the period of time during which claims cannot be brought, the use of escrow money for indemnification (if applicable), the method of calculating losses for recovery, etc. Also, the exceptions when the parties are released from this obligation should be outlined.

Step 16

As the next step, some general provisions should be included. Among the provisions the parties usually include in general provisions of a stock purchase agreement are:

– the survival clause (states that the representations and warranties of the parties are in effect within a certain period after the closing date)

– expenses (touches on who pays the transaction-related expenses)

– notices (has to tell how parties can communicate with each other regarding any agreement-related matters)

– severability (specifies that in case any term or provision of the agreement is invalid or illegal, all other conditions and provisions should remain in full effect)

– amendment (tells what should be done to change the agreement and whether it is possible)

– governing laws

Step 17

The last step is to include the signatures of the parties, that is, respective duly authorized officers of the companies.

On our webpage, you can find a free stock purchase agreement template in three formats – ODT, DOC and PDF. Just select the purchase agreement template you need and click on it to download the chosen agreement template format to your computer or portable device.