Mutual Non-Disclosure Agreement

When working on sensitive projects that deal with confidential information, many companies and individuals will opt for a mutual non-disclosure agreement, also referred to as a mutual confidentiality agreement. These contracts are not uncommon as they are applicable in a number of scenarios where trade secrets or other proprietary information is exchanged between two businesses. According to Forbes, this nda agreement is appropriate in many instances and even helps build trust between the parties involved.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Mutual (2-Way) vs. Unilateral (1-Way) NDA

Mutual non-disclosure agreements are notable for the protection that they offer to both parties involved. When the two parties involved in creating a mutual non-disclosure agreement sign their document, both of them are afforded protection that the other party will not disclose any confidential information or release protected information to the public. Both parties are given the opportunity to add what information they want to be protected into the mutual non-disclosure agreement.

On the other hand, unilateral non-disclosure agreements are described as “one-way.” This non disclosure agreement template is often used in employment scenarios or when a contractor is hired. Because this kind of relationship is very different from that described in a mutual confidentiality agreement, the restrictions within the document are very different as well. Employees are often required to sign this agreement upon hiring to avoid product or trade secrets being leaked. Unilateral non-disclosure agreements are created to protect the secrets of the company or business hiring the other party. This means that the employee or independent contractor named in the document is forbidden from disclosing information about their employer if it is outlined in the NDA.

Sometimes, a mutual confidentiality agreement is easier to agree to than a unilateral NDA. LegalZoom claims that the peace of mind that it offers to all parties involved can make business deals easier.

When Should You Choose a Mutual NDA?

You may be unsure whether your situation requires a mutual non-disclosure agreement or not. If you plan on working closely with another party in a manner that will both receive and give sensitive information, you may need a mutual non-disclosure agreement to protect the interests of both parties.

For example, if two companies are looking to collaborate with each other, a mutual NDA will make sure that once the collaboration is over, neither party will use the information learned about their partner in a way that will benefit their former partner’s competitors.

Another common use of mutual NDAs is when a startup business looks for investors. The investors want some protection and the startup may have special trade practices or other confidential information that will give them an edge over the competition. A mutual NDA in this case allows the startup to be transparent with its investors without the risk of leaking information.

A mutual non-disclosure agreement is also important to use when selling a business. Sharing sensitive financial or marketing information with a party that is interested in buying your business is usually necessary to make a deal, but a mutual non-disclosure agreement will also ensure that if they back out of the deal, your private information will not be released.

When making a major business deal, the relationship between both parties has to be built on trust. A mutual NDA is the best way to make sure that both parties can address any confidentiality concerns and openly speak about relevant information.

Without a mutual non-disclosure agreement, the relationship between businesses can fall apart. Idea theft is a real concern in every industry, so refusal or hesitancy to sign a mutual NDA can appear to show ulterior motives in business deals. Not only this, but not all information within a business needs to be public, as the general populace may disagree with some business practices, especially if they do not understand them.

Other cases that often use mutual NDAs include the use of services from a business or individual that will have access to confidential or sensitive information or any other relationship that involves the exchange of proprietary information.

How to Create a Two-Way NDA

When creating your non-disclosure agreement, you must make sure that both entities involved in the contract are able to articulate and protect the information that they want to be protected. This requires consensus on what information will be protected, what parties are involved in this contract, and the penalty associated with the breach of the NDA.

Many mutual non-disclosure agreement forms are available online. Be careful when drawing up your NDA that it accurately compiles all of the information that you want to be represented.

Name the Parties

Before filling out the rest of the document, it is important to clearly state what parties this NDA applies to. Both entities need to be named correctly for the NDA to be as specific and accurate with its information as possible.

Name the Information

After dictating who the non-disclosure agreement applies to, the confidential information must be named in the NDA. There is a lot of freedom with this step, as the contract can simply state the information in broad terms (for example client lists or trade secrets, etc.) or it can specifically refer to individual pieces of information.

Depending on the nature of the business relationship that is created with the mutual confidentiality agreement, you may prefer to keep things vague to keep your competitors in the dark.

Create Duration

Your NDA may go on for years, months, or simply until a specific project is completed. Create a clear timeframe for the NDA to stay in effect. In the case of non-disclosure agreements that extend beyond the lifetime of the business or company relationship, it is common that both parties agree not to discuss anything covered by the non-disclosure agreement in the time following the relationship.

Breach of Contract

While nobody wants it to happen, occasionally, NDAs will be breached by one party or another. Every mutual non-disclosure agreement needs to have a clause that dictates what the penalty is for such a breach. This can range from the broader “equitable relief” (which just means that the breaching party must reimburse the other party for breached information) to a numerical dollar amount.

How to Fill Out a Mutual NDA

One of the biggest reasons why people may shy away from a mutual NDA is because of the complexity of the document. When dealing with securities trading, careful steps must be taken to avoid violation of the law while creating a satisfactory NDA. Don’t worry! Follow these steps when filling out your agreement and the process becomes much clearer.

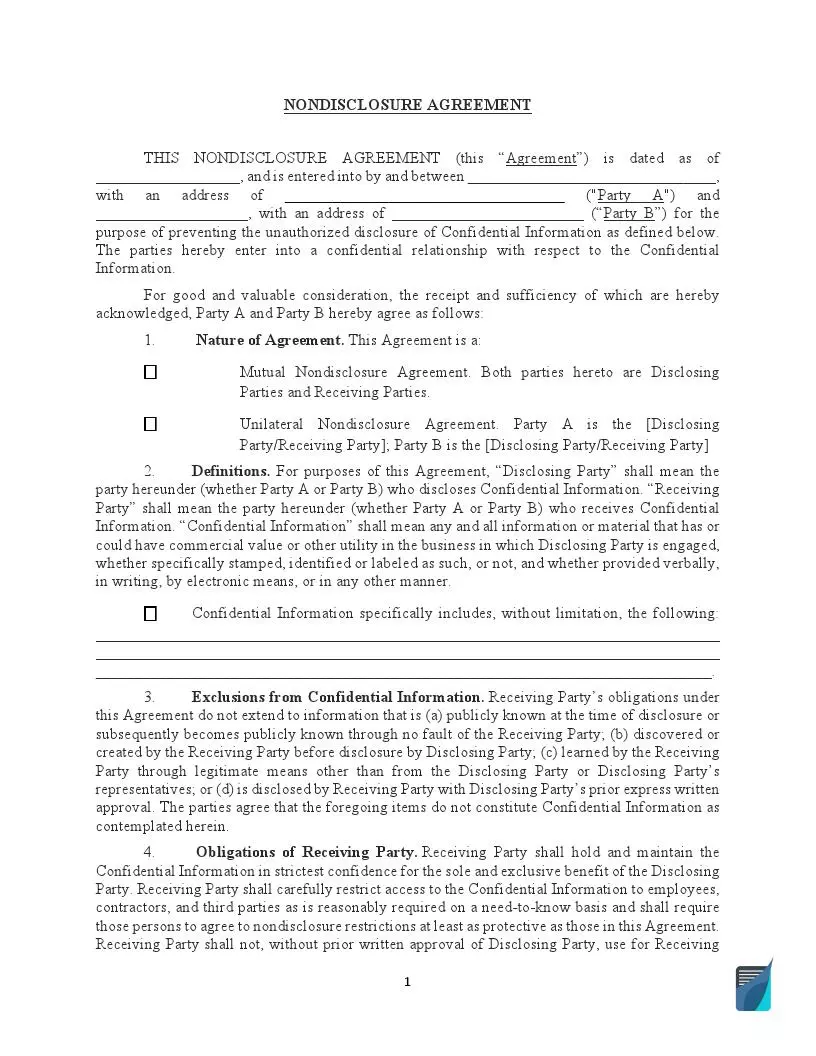

- Fill out the date at the beginning

- Name the two parties at the start of the contract. They will be referred to as Party A and Party B, so keep them straight. You will also supply the addresses of both entities to provide further clarification. These can be company addresses if desired.

- Acknowledge the purpose of the document. Express that this NDA is mutual and therefore not unilateral in nature.

- Supply confidential information. You will dictate exactly what information both parties want to be protected. The term “disclosing party” is used to refer to the party giving confidential information, and the term “receiving party” refers to the party that receives that confidential information. This is used to protect the disclosing party from the potential damage of the receiving party divulging any part of the information. In a mutual party, either party is both receiving party and disclosing party, protecting both parties from potential harm.

- Clarify exclusions. Not all information that is learned over the course of this business relationship is considered confidential, so making sure that these exclusions are laid out protects both members from an accidental breach of contract.

- Next, the obligations of the receiving party must be made clear. Again, both entities are receiving in the case of a mutual NDA, so the terms will apply to each business involved.

- Establish the time period for which the agreement will apply.

- Examine the rest of the general terms. This will include items such as the definition of the relationship between signees of the contract, severability clauses, definition of integration, and acknowledgment of the binding effect that the contract supplies.

- At this point, if the agreement and the terms within it are deemed acceptable to both parties, it is time to sign it.

Although they may appear daunting at first, a solid mutual NDA is often the best way to protect company interests and proprietary information when entering a partnership or joint venture with another entity.