Family (Friends) Personal Loan Agreement

Money lending can be a complicated affair, especially when the money is being lent to a loved one. A family loan agreement is a document used to record the terms of a loan between family members. This document can be used for close friends or family members. It clearly states the conditions on which the loan is given, the interest rate, and how and when the amount will be paid back.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What is a Family Loan Agreement?

A family loan agreement is a document that legally binds the borrower and lender to the terms and conditions of the loan. Lending money to family or friends can have the potential to spoil relationships. A loan agreement template can help in providing transparency and clarity between family members. This also gives a sense of surety to the lending party that the person borrowing the money will pay back the loan with interest.

What to Consider Before Borrowing from Family

One should consider many things before borrowing money from or lending money to a family member. Some of the things to be considered are discussed below.

Tax Matters

The lender must figure out the tax implications before lending money to a family member. For instance, if the interest charged by the lender is below the applicable federal rate, the Internal Revenue Service may consider the loan to be a gift and apply gift tax on the lender. To avoid this, the lender may set the rate equal to or slightly above the applicable federal rate.

Interest Rates

Interest rates applied on the loan must be in accordance with state and federal laws. For instance, each state sets a cap on the maximum interest rate that can be charged on a loan.

Alternatives

The individuals should also consider if there are other alternatives available. If a family member is in need of money, one of the options of helping him or her is by gifting the money to them. This means that the person will not be liable to pay back the money and the family member giving the money may have to pay gift tax depending on the amount of money gifted. Another alternative is that one can help a family member in getting a loan from a bank by co-signing the loan. This means that the co-signer may be liable to pay if the borrower defaults payment.

Pros and Cons of Using a Family Loan

The pros of using a family loan include:

Flexible Repayment Options

Family loans have more flexible repayment options as opposed to bank loans because of the nature of the relationship between the family members. It is also possible that a family member may allow delayed payments or even halt payments if the borrower is facing financial difficulty.

Lower Interest Rates

Family loans usually come with lower interest rates than bank loans. In some cases, the lending family member may not even charge interest from the borrower.

The cons of loaning money to family members include:

Lack of Security

Due to the personal nature of the relationship between the lender and the borrower, family loans are usually unsecured loans and it may be possible that the borrower fails to repay the loan. In that case, the lender can file a legal action or go through the small claims court.

Damaged Relationships

In case there is a dispute between the lender and borrower after giving a loan to a family member, it can put enormous strain on the relationship between them and can also cause tension in the whole family.

What Should Be Included in a Family Loan Agreement

Family Loan Agreements can be modified to meet the needs of the individuals but the general things to be included in a family loan agreement are:

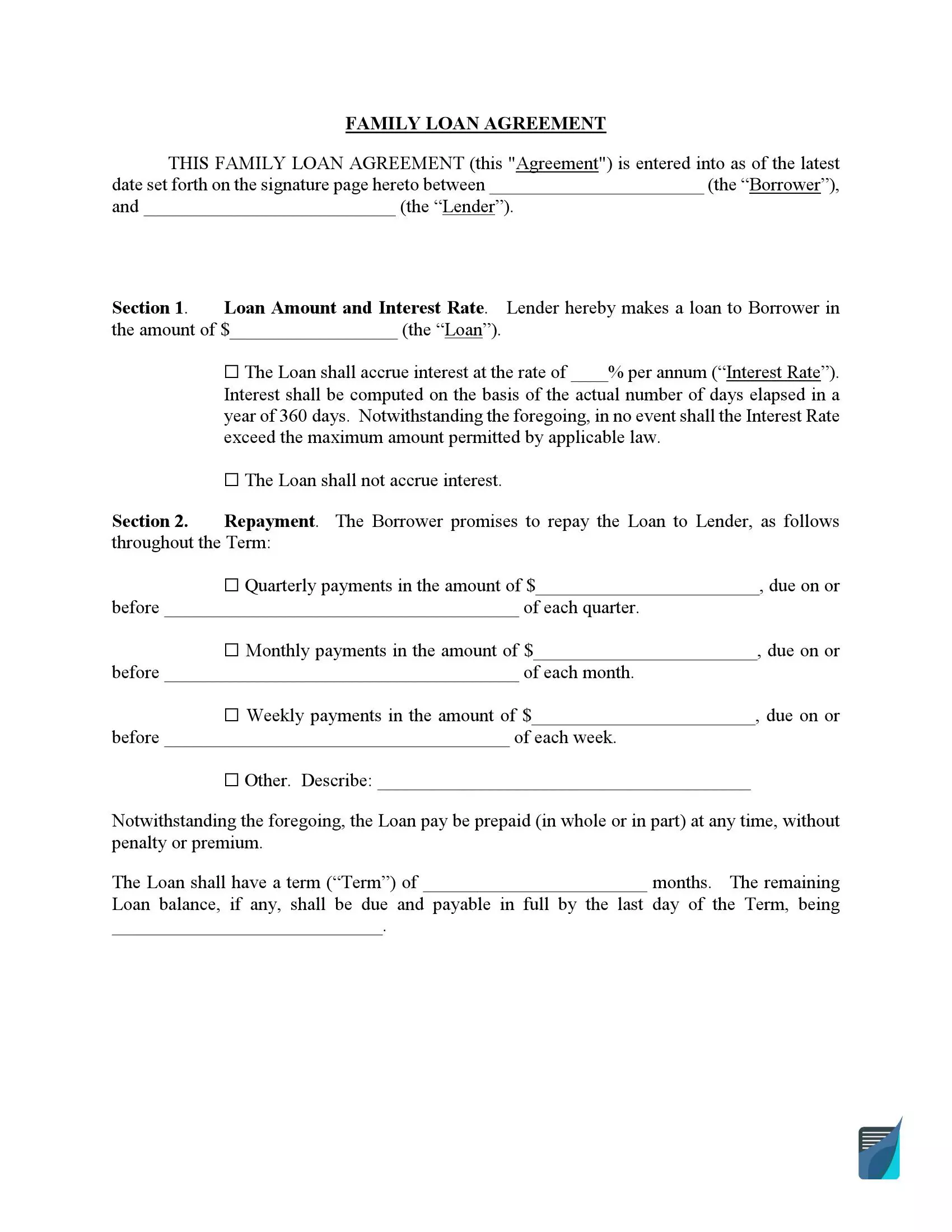

Date and Details of the Parties

At the beginning of the document, the date on which the document was signed must be mentioned. The agreement must then specify the details of the lender and borrower including their full names and addresses.

Family Relation

The agreement should also mention the relationship between the borrowing family member and the lending family member. For instance, if the parties are brothers, the document should mention that the borrower the lender’s brother.

Loan Amount

The agreement must specify the principal amount being loaned out by the lender to the borrower.

Interest Rate

The document should also mention the interest rate applicable to the loan. The rate should be less than the usury rate applicable in the borrower’s State. Usury rate is the cap set on the maximum amount of interest rate that can be charged by the lender. Usury rates are usually set by the State and may vary in each State. The family members also have the option to not apply any interest on the loan. The same should also be specified in the document.

Payment Schedule

The document should provide a schedule regarding when and how the money must be paid back by the borrower. This repayment schedule can include weekly installments, monthly installments, or payments at other intervals. The agreement should also provide the date on or by which the total principal and interest should be paid in full.

Late Fees

Late fees are usually applicable in case of a default in payment by the borrower. This may also include any other reasonable expenses incurred by the lender in case of default including attorneys’ fees and interest incurred.

Governing State

The document should also specify the governing law. The lending family member and the borrowing family member should mention which State’s laws are applicable on the loan agreement.

Witnesses

The agreement should be made and signed in the presence of two witnesses. These witnesses should act in an unbiased manner in case of a dispute. The agreement should also include the name and signatures of the witnesses.

Signature of the Parties

The loan agreement becomes a legally binding document when the borrower and the lender have signed it. After finalizing all other details of the loan, each party must sign the agreement.

Filling Out the Family Loan Agreement Template

FormsPal’s easy-to-use and understandable family loan agreement form can be completed by following these simple steps.

Specify the Loan Amount and the Date

Fill in the total amount of money borrowed by the borrower in words in the first blank space provided in the document’s first line. Mention the loan amount in numerics in the second blank space provided in the document’s first line. Mention the date and year in blank spaces provided in the second line of the form.

Mention the Details of the Lender and the Borrower

After filling in the amount and date, provide the details of each party in the next paragraph. Mention the borrower’s name, mailing address, city, and state, respectively, in the blank spaces provided before the term “Borrower.” Similarly, mention the lender’s name, mailing address, city, and state, respectively, in the blank spaces provided before the term “Lender.”

Fill in the Family Relation

In the blank space provided in the next line, mention the relationship between the borrower and the lender.

Choose the Payment Structure

Choose the loan repayment structure under Section II of the template. If the money is to be repaid in weekly installments, choose the first option and specify the date and year when the first weekly installment will be due and payable in the blank spaces provided in the first option itself. If the money is to be repaid in monthly installments, choose the second option and specify the date and year when the first monthly installment will de due and payable in the blank spaces provided in the second option.

In case the parties wish to adopt any other payment structure, choose the third option and specify how the money will be paid back in the blank space provided in the third option.

Specify the day, month, and year on which the total principal and interest shall be due and payable in the blank spaces provided in the last paragraph of Section II.

State the Interest Rate

If there is an interest rate applicable on a loan, choose the first option under Section III and specify the rate of interest in words and numerics, respectively, in the blank spaces provided in the first option. In case it is an interest-free loan, choose the second option under Section III.

Specify the Expenses in Case of Default

Specify the maximum usury rate in words and numerics in the first two blank spaces and the name of the State in which the rate is applicable in the third blank space provided under Section X on page 3 of the template. This is will be the maximum amount payable by the borrower for attorneys’ fees in case of a default.

Choose the Governing Law

Mention the name of the State under whose laws the agreement will be governed in the blank space provided under Section XI of the template.

Signature of the Parties

Once all the other details are finalized, the parties should sign the agreement on the last page. The borrower must affix his signature in the blank space provided in front of “Borrower’s Signature” and the lender must do so in the blank space provided in front of “Lender’s Signature.” Once the parties sign the agreement, it becomes a legal contract and binds them to the terms and conditions mentioned therein.

Signature of the Witnesses

The form should also be signed by two witnesses in the corresponding blank spaces provided on Page 3 at the end of the template.

FormsPal’s easy-to-use family loan agreement template can be downloaded for free.