IOU (I Owe You) Template

An IOU template or an I Owe You is a document used when one person borrows money from another. It is a legally binding document that records the debt owed by one person to another. It is not as formal a document as a promissory note, but it is still a legally binding document. An IOU is used between people who already have some ground to trust each other, for instance friends, family members, or business partners.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Is an IOU?

An IOU or an I Owe You is a legally binding document that serves as an acknowledgment of debt between two parties. It is a relatively informal document compared to a promissory note or loan agreement but can still be used to establish a legally binding relationship between the lending party and the borrowing party. People who don’t necessarily have a formal relationship, including friends and family, can use an IOU as a form of documentation or acknowledgment of debt.

When You Should Use an IOU?

You may need IOUs to record the terms of a loan. An IOU form serves the purpose for everyone involved as it specifies the amount of money borrowed and the terms of repayment. It can be used when you want to borrow or lend money from or to a person and want a written record of the loan.

It is like a less formal loan contract which states the amount you may owe to another individual. It can also be used when an IOU has been used in previous transactions with a person. You can also use it when you want to borrow money for an event. If you do not have enough money to pay for an item, you can give an IOU to the other party for the balance amount.

IOUs create a legal relationship between the two people involved and should be signed by the borrower and the lender. In some cases, the lending party and the borrowing party may also include a witness or a guarantor in the IOU form. In that case, the signatures of the witness or the guarantor are also required. Once the form is signed, it creates a legal relationship between everyone involved. There are free IOU templates available online that can be used in these situations.

Loan Agreement vs. IOU

Although the fundamental purpose for using both, a loan agreement and an IOU is to make an acknowledgment of debt, they are usually used in different scenarios. A loan contract is a much more detailed and formal document and is used when you want to borrow a substantial amount of money. It forms part of a more formal commercial transaction when a huge amount may be borrowed to buy a house or a car. A loan agreement template also contains more details regarding the terms of the transaction as compared to an IOU form.

Promissory Note vs. IOU

Promissory notes are also another way to make an acknowledgment of debt. They are a more formal document as compared to IOUs and contain more details regarding the terms of repayment and consequences of non-payment. It is also difficult to enforce an IOU in court unless it has been notarized. An IOU is usually a non-negotiable document and cannot be transferred from one person to another.

What Should Be Included in an IOU Form?

Although the details in an IOU form can vary from case to case, it is wise to include the following basic information in the IOU form to protect the interests of the lender and the borrower:

Debtor

It is important that the IOU mentions the full name of the debtor or the borrower and establishes a promise to pay back the money to the lender. The promise to pay is a fundamental ingredient of an IOU form and creates a legal relationship between the lender and the borrower.

Creditor

The form should also the full name of the creditor or lender. The promise to pay along with the contacts of the parties forms an acknowledgment of debt between the lender and the borrower.

Loan Amount

The form should specify the exact amount which has been given as a loan by the creditor to the debtor. The amount owed by the borrower to the lender should be clearly mentioned in words as well as in numbers.

Interest Rate

The form should also specify the interest rate, if any, applicable to the principal amount. The borrower is bound to pay back the principal amount along with the interest as mentioned in the IOU form.

Late Fees

It is up to the parties to include a late fees clause in the IOU form in case there is a delay in payment or default. This late fee can cover the expenses the lender may have to incur due to the delay in payment.

Repayment Terms

Like a loan contract or agreement, an IOU form can also contain repayment terms to maintain clarity between the parties. The parties can choose the amount of money and the time interval for each payment. For instance, the parties can choose between monthly, weekly, and quarterly payments.

Maturity Date

The maturity date or the due date is the day on which the entire principal amount along with the interest becomes due and payable. The borrower is required to pay the entire amount on or before the day of maturity.

Filling Out the IOU Template

FormsPal’s easy to use and understand IOU form can be completed by following these simple steps:

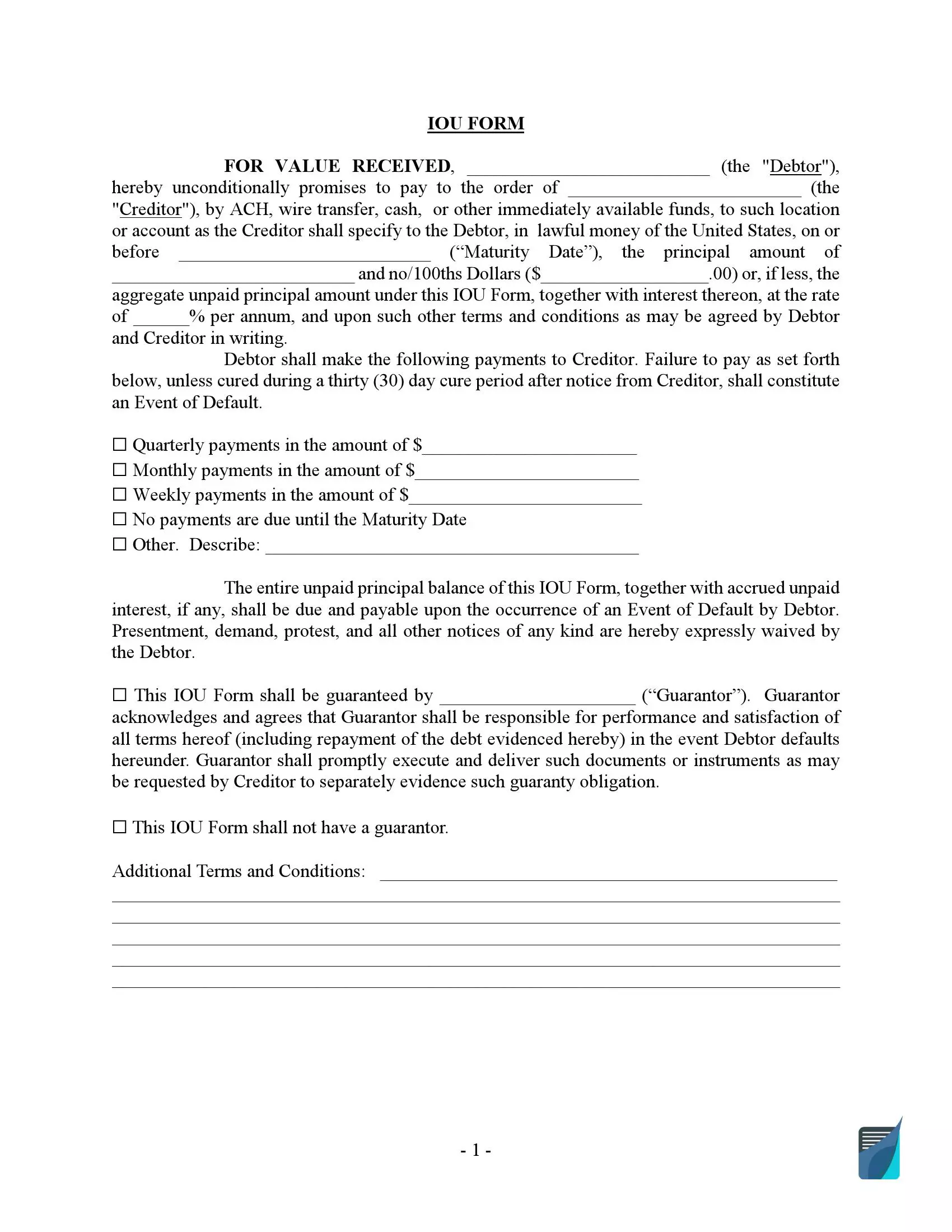

Mention the Details of the Borrower and the Lender

While filling out the form, mention the full name of the borrower in the blank space provided in the first line of the form before the term “Debtor”. Mention the name of the lender in the second blank space provided in the IOU form before the term “Creditor”.

Specify the Maturity Date

The next step is to specify the day on or before which the money shall be paid by the borrower to the lender. Mention the maturity date in the third blank space provided before the term “Maturity Date” in the first paragraph of the IOU form.

Fill in the Loan Amount and Interest Rate

The next step is to write down the principal amount borrowed in words and numbers in the fourth and fifth blank spaces, respectively, provided in the first paragraph of the IOU template. You can then mention the interest rate applicable on the loan amount in the last blank space in the first paragraph of the document.

Choose the Terms of Repayment

You can then choose the terms of repayment by selecting the time intervals for the repayment and the amount to be paid in each installment. The payments can be made quarterly, monthly, weekly, or in any other way as per the wishes of the borrower and the lender. For instance, if the borrower and the lender agree that a monthly payment of $100 will be made by the borrower, they can choose the option of for monthly payments and specify the amount of $100 in the corresponding blank space given in the document.

Provide the Name of the Guarantor

In the next part of the IOU form, if there is a guarantor who guarantees the performance of the terms of the IOU form, you can choose the first option. Mention the full name of the guarantor in the blank space provided before the term “Guarantor” in the first option. If there is no guarantor involved, you can choose the second option.

Stipulate any Additional Terms and Conditions Related to the Loan

If there are any additional terms and conditions related to the loan, they can be specified in blank spaces provided at the bottom of the first page of the IOU form.

Mention the Governing Law

Mention the governing law at the beginning of the second page of the document. Fill in the name of the state whose laws will govern the IOU form in the first blank space provided at the beginning of the second page.

Sign the Form

Once all of the information has been added, the debtor and creditor must sign the form and mention the month, day, and year in which the form is signed. The debtor’s and the creditor’s signature and print name must be affixed in the corresponding blank spaces provided towards the end of the IOU form.

If there is a guarantor, his or her signature and print name should also be filled in at the end of the IOU form. When you sign the form, it will create an acknowledgment of debt and a legal relationship between everyone involved.

You can download FormsPal’s easy-to-use IOU form for free.